August Sales Review of New Energy Vehicles: Leapmotor B01 and Nissan N7 Surpass 10,000 Units, While Many Models Lag Below 1,000 Units

![]() 09/12 2025

09/12 2025

![]() 517

517

Against the backdrop of the new energy vehicle penetration rate soaring past 55.2%, the automotive market in August 2025 exhibited a stark divergence. Several new models, such as the Chery Fengyun A9L, Nissan N7, and Leapmotor B01, successfully made it into the '10,000-unit club'. However, numerous other models faced significant market setbacks. Here's a detailed analysis of the new energy vehicle market's performance this month.

Joint Venture Brands: Few Breakthroughs Amidst Widespread Stagnation

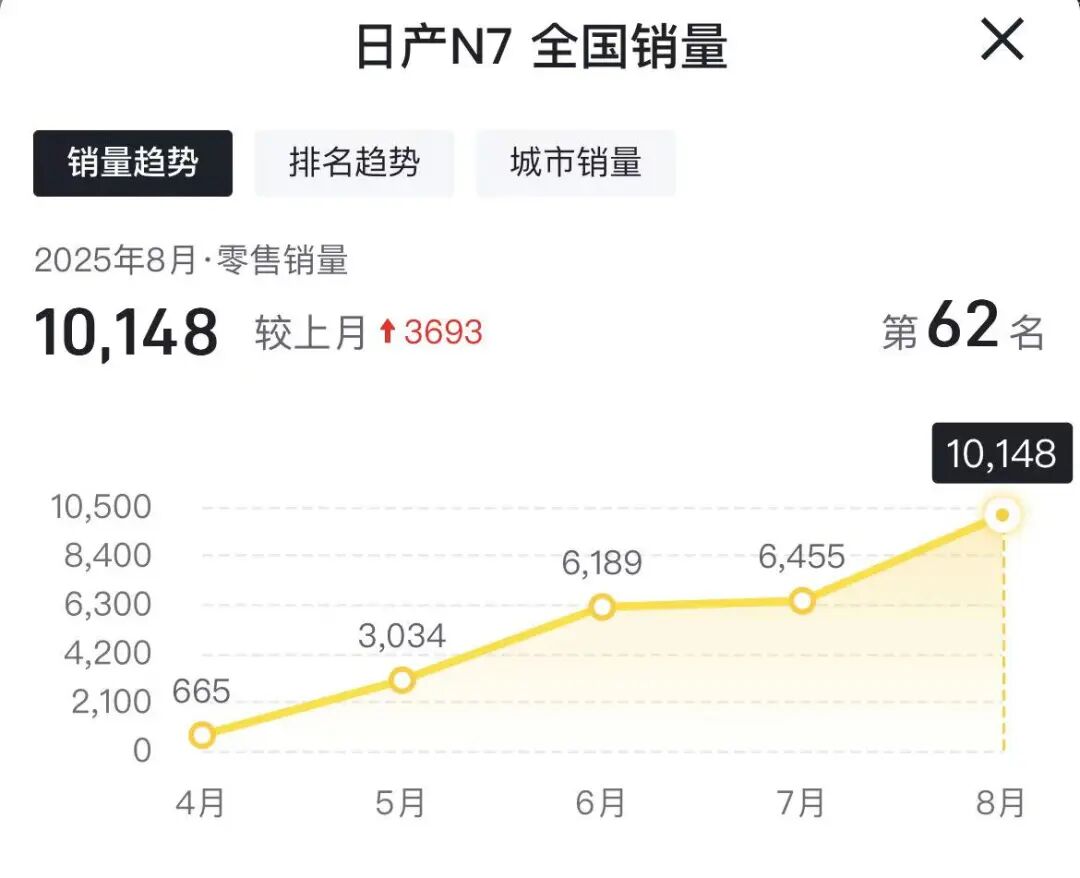

The joint venture new energy vehicle sector showcased significant polarization in August. The Dongfeng Nissan N7 emerged as a standout performer, with August sales reaching 10,148 units, marking a 57% month-on-month increase. Not only did it set a record as the first joint venture pure electric model to exceed 10,000 units in a single month, but its cumulative deliveries of 26,491 units also signaled a sustained upward trajectory. Priced between 119,900 and 144,900 yuan, this pure electric sedan successfully broke the sales curse that has long plagued joint venture new energy models.

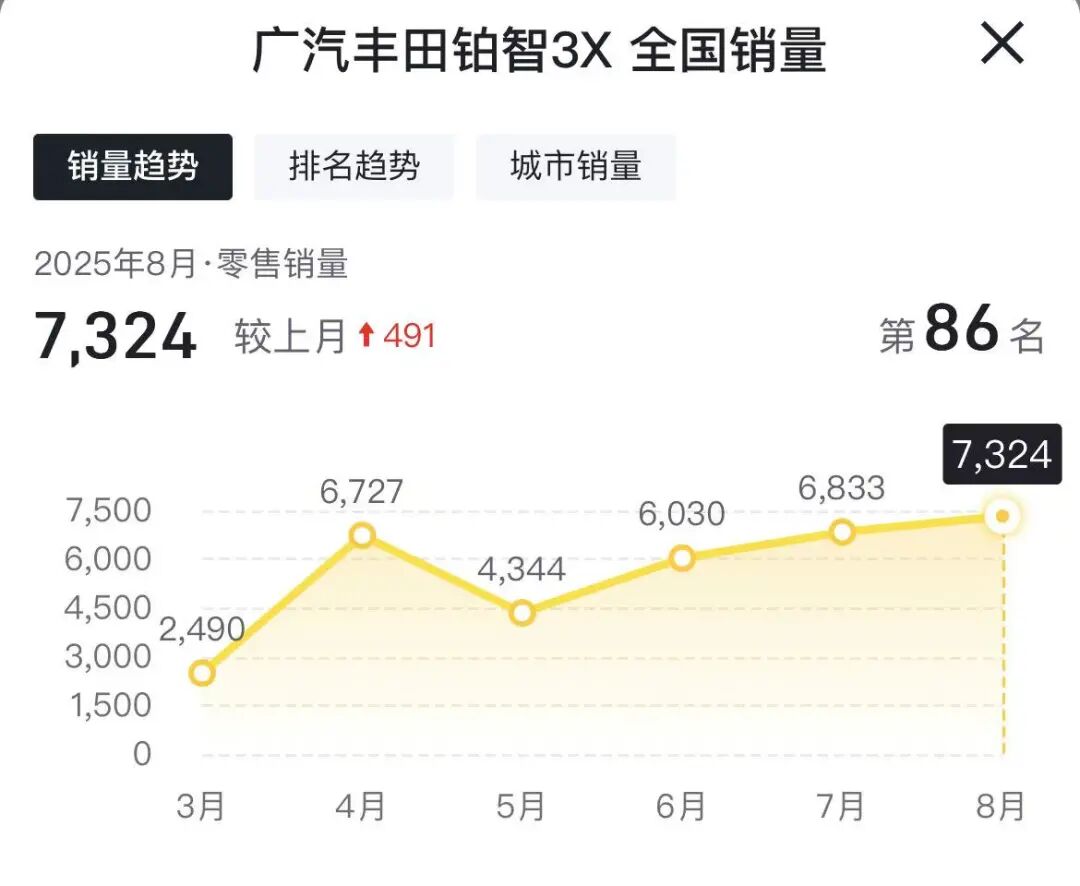

The GAC Toyota bZ4X also delivered a solid performance, with August sales reaching 7,324 units, just shy of the 10,000-unit mark. Launched in March, this model's starting price of 109,800 yuan undercut the pricing of other joint venture pure electric vehicles. With 25 intelligent driving assistance system features, its order backlog extended until June, highlighting its strong market potential.

However, the FAW Toyota bZ5, also from the Toyota family, paled in comparison, with August sales of only 2,017 units, creating a stark contrast with the bZ4X.

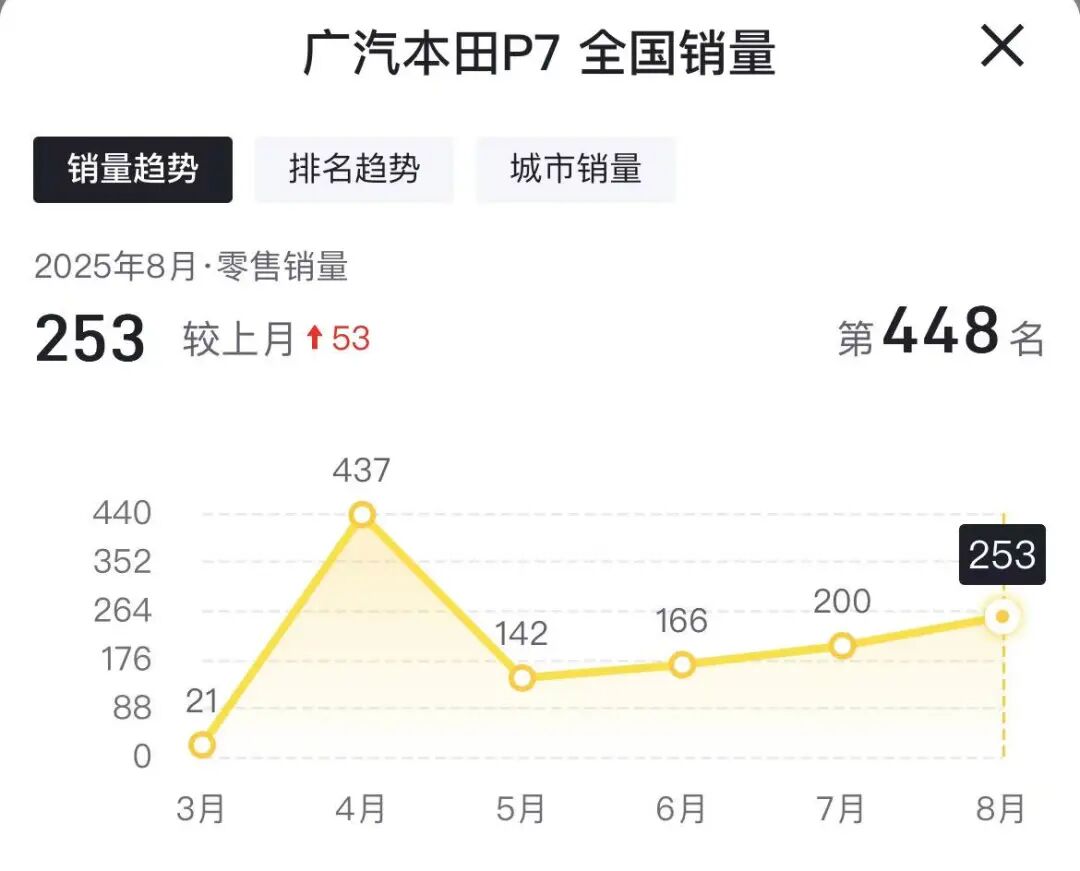

Even more disheartening was the performance of Honda's new energy models. The GAC Honda P7 and Dongfeng Honda S7 recorded August sales of 253 and 64 units, respectively, both falling far short of 500 units and virtually disappearing from a market with rising new energy vehicle penetration.

Domestic Brands: Dual-Track Growth from New Forces and Traditional Automakers

Unlike the polarized performance of joint venture brands, domestic new energy vehicle models exhibited strong momentum overall in August. The Chery Fengyun A9L quickly gained traction after its July launch, with August sales surpassing 10,000 units to reach 10,243 units, becoming a key growth driver for Chery in the new energy sector.

Leapmotor continued its explosive growth trajectory in 2025, with overall brand sales exceeding 50,000 units in August. This secured the top spot among new forces for five consecutive months and led in exports with 24,980 cumulative units. The Leapmotor B01, launched in June, performed exceptionally well, with August sales reaching 10,171 units and achieving 10,000-unit deliveries in just 37 days. Notably, over 40% of this model's buyers were female, and 80% opted for the 650km long-range version, precisely meeting the demands of young consumers.

NIO's volume brand, LEC, also made an impression with its second model, the L90. This mid-to-large SUV, launched on July 31, leveraged a starting price of 279,900 yuan and technological advantages like a 900V full-domain high-voltage architecture to achieve August sales of 10,575 units, becoming NIO's first model to exceed 10,000 monthly sales. Unlike the lackluster performance of its first model, the L60, the L90's success stemmed from resource synergies following NIO's dual-brand channel merger. Market Warning: Some Domestic Models Struggle with Sales

Not all domestic brands have been able to capitalize on market growth. Two new models from FAW PenTeng, the Yueyi 03 and Yueyi 07, recorded August sales of 3,063 and 396 units, respectively. The Yueyi 03 saw a slight decline from June's 3,358 units, failing to sustain its growth momentum.

The Hongqi brand faces even greater challenges in its new energy transition. Despite overall brand sales exceeding 40,000 units in August, its Tiangong series new energy models continued to underperform: the Tiangong 06 sold 480 units, the Tiangong 05 around 259 units, and the Tiangong 08 only 145 units, totaling less than 1,000 units. This creates a stark contrast with the brand's overall growth. As the core of Hongqi's new energy strategy, the Tiangong series' failure to gain market traction reflects the difficulties traditional luxury brands face in their electrification transitions.

That concludes the performance review of popular new energy models in August. Which model left the strongest impression on you this month? Feel free to share your thoughts in the comments section.