According to public reports, the 2024 China Automotive Chongqing Forum was held in Chongqing on June 8, 2024. In response to inquiries about whether Lantu Automobile and Dongfeng Motor Group Co., Ltd. (hereinafter referred to as Dongfeng Group) "started early but caught up late" in the field of new energy vehicles, Lantu Automobile CEO Lu Fang provided a detailed response.

Lu Fang first denied that Lantu Automobile and Dongfeng Group "caught up late," but rather "are still on the way to the market," and Dongfeng Group has empowered the development of China's new energy vehicle industry through its layout in this field.

Lu Fang also admitted that from a market performance perspective, Dongfeng Group is indeed not "ideal." "Our sales or image may not be as good as Ideal and other companies, and we have not yet achieved the results that the market truly expects."

Recently, several domestic new-energy vehicle companies have released their May sales figures. Among them, Ideal Auto delivered over 35,000 vehicles, starting to rebound after a low point. Other automakers like HarmonyOS, NIO, Zeekr, and Leapmotor followed closely, showing growth trends and good performance.

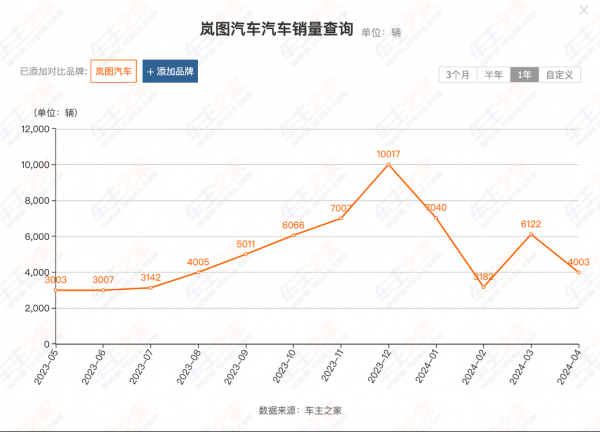

Lantu, which had previously shown strong momentum, has not performed well. Lantu's deliveries in January to May were 7,041, 3,182, 6,122, 4,003, and 4,521 vehicles, showing a downward trend.

Lantu's previous annual target was 100,000 vehicles, but the completion rate for the first five months is less than a quarter, putting greater pressure on the second half of the year. In the last month of 2023, Lantu achieved monthly sales of over 10,000 vehicles, reaching 10,017, but this year has not reached the same level in a single month.

Lantu cannot hide its anxiety.

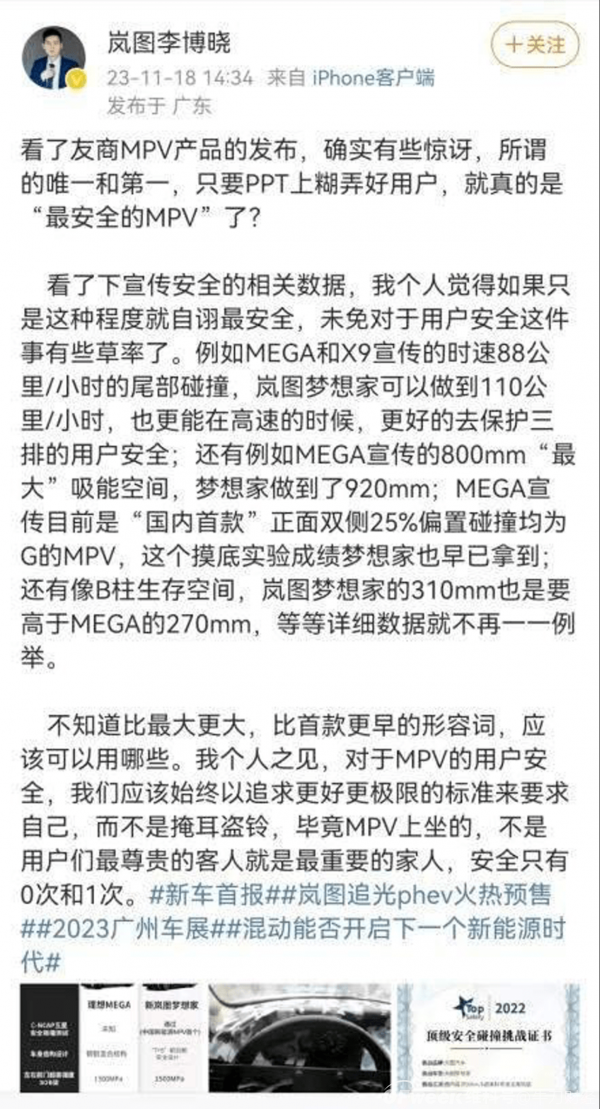

On November 18, 2023, Li Boxiao, the Assistant General Manager of Lantu, publicly questioned the safety of Ideal Auto's MPV products on social media, stating that as long as PPT is used to deceive users, they can be considered "the safest MPV." At the same time, he compared the relevant data of the two automakers' products and wrote, "For the safety of MPV users, we should always pursue better and more extreme standards, not burying our heads in the sand... After all, safety only requires 0 times or 1 time."

As the saying goes, competitors are rivals. Behind Lantu's executive bashing, there is a sense of urgency and lack of confidence.

This year, Ideal MEGA has encountered setbacks, but even so, Lantu, which once considered Ideal as its "imaginary enemy," has not seen an improvement in its own sales.

Lantu has always enjoyed good popularity due to its reliance on Dongfeng Motor, a leader in domestic cars. However, relying solely on popularity, Lantu still struggles to shake off issues like poor sales and severe losses, making its position in the new-energy vehicle industry increasingly awkward.

01 Sales Decline, What's Wrong with Lantu?

In May, based on sales figures, Lantu ranked 12th among new-energy vehicle companies and has basically experienced continuous declines in 2024. Lantu, which once showed strong momentum, has begun to encounter problems this year.

It should be noted that since May 2023, Lantu's deliveries have achieved a "seven-consecutive increase." In December, Lantu delivered 10,017 new vehicles, representing a month-on-month increase of 43% and setting a new sales record.

Compared to the high sales figures in the second half of last year, Lantu clearly suffered a setback in the first half of this year.

In the automotive market, there has always been an unwritten rule that automakers with sales exceeding 10,000 vehicles can be considered above average, otherwise, it is a luxury to survive for a long time.

At the same time, other new-energy vehicle companies are also seeing increasing sales. According to the latest data, Ideal Auto sold 35,020 vehicles in May, while Huawei's HarmonyOS series delivered 30,578 vehicles.

This year, Xiaomi Auto, a new entrant, has become the most dynamic new-energy vehicle company, selling 8,630 vehicles in May, ranking among the top 10.

In addition, new-energy vehicle brands with monthly sales exceeding 10,000 vehicles include NIO, Zeekr, Leapmotor, Deep Blue, Xiaopeng, and Nezha. NIO Auto has also emerged from its downturn, selling 10,055, 8,132, 11,866, 15,620, and 20,544 vehicles in the first five months of this year, respectively. Zeekr, as a rising star, has also seen its sales steadily increase since 2023, with monthly sales stabilizing at over 10,000 vehicles and selling 18,616 vehicles in May, starting to approach 20,000 vehicles.

In addition to sales issues, Lantu's financial situation is also not optimistic.

According to Tianyancha data, Lantu completed a Series A funding round of 4.55 billion yuan in November 2022, with a valuation of nearly 30 billion yuan. According to the financial information disclosed during the financing, Lantu generated revenues of 1.767 billion yuan and 1.887 billion yuan in 2021 and the first half of 2022, respectively, with net losses of 703 million yuan and 738 million yuan. In other words, in just one and a half years, Lantu has suffered losses exceeding 1.4 billion yuan. During the same period, Lantu sold a total of 12,467 new vehicles. Based on this estimate, Lantu loses over 1.1 million yuan for every new vehicle sold.

According to multiple media reports, in the first half of 2022, "Wei Xiaoli" lost 90,000 yuan, 60,000 yuan, and 23,000 yuan per vehicle sold, respectively. Although losses are common among new-energy vehicle companies, Lantu's losses are still prominent.

In addition, Lantu Automobile CEO Lu Fang said in an interview late last year: "Lantu is overall loss-making, but it has gross profit. Once the volume goes up, it will definitely be profitable. All Lantu cars have gross profit, it's just a matter of how much. Although the gross profit level is not far ahead in the industry, it is still relatively leading."

Lantu Automobile has not provided an answer to how much sales are needed to achieve profitability, but it can be foreseen that Lantu faces significant pressure in terms of sales if it wants to reverse its predicament.

Previously, Lantu CFO Shen Jun expressed Lantu's intention to make moves in the capital market in July 2023, stating, "If monthly sales can reach 10,000 vehicles, we will have the conditions for an IPO."

Unexpectedly, there has been a turn in sales, and based on this target, the IPO plan may not be ideal.

02 Always Lacking in High-End Appeal

In 2020, under the auspices of Dongfeng Group, Lantu emerged as a "high-end intelligent electric vehicle brand," aiming to leverage the advantages of traditional automakers while utilizing innovative products and concepts to become a leader among new-energy vehicle companies.

However, since Lantu entered the market more than three years ago, its product lineup has failed to meet consumers' expectations of "high-end" in terms of product strength.

As everyone knows, new-energy vehicle companies like "Wei Xiaoli" follow a high-end route. Media statistics on the prices of new vehicles released by NIO, Ideal, and Xiaopeng in 2023 show that Ideal's pricing range is 320,000 to 460,000 yuan, Xiaopeng Auto's pricing is 150,000 to 420,000 yuan, while NIO's pricing ranges from 300,000 to 660,000 yuan.

The guide prices of the two pure electric mid-to-large cars under Lantu's Zhuiguang series are 322,900 yuan and 385,900 yuan, respectively, while the newly launched Lantu Zhuiguang PHEV in December has a price range of 252,800 yuan to 358,800 yuan.

Compared horizontally, Lantu's pricing is not low.

However, despite its high price, Lantu's promotional selling points still mainly focus on traditional car aspects such as vehicle testing and body safety, while other high-end car brands emphasize intelligent features like intelligent assisted driving and convenient car usage, which Lantu rarely mentions. Most embarrassingly, Lantu's battery technology, which it boasts about and promotes heavily, has also suffered setbacks.

Previously, Lantu publicly promoted its independently developed high-safety battery PACK solution, claiming that it is the industry's first three-dimensional thermal insulation technology and achieved non-smoking, non-leakage, non-ignition, and non-explosion results in its unique battery safety testing experiments.

Not only does the battery itself have high safety, but the cloud-based battery management system can also predict and warn of faults such as smoking, ignition, and internal battery shorts in advance. In emergency situations, active power-off can be achieved within milliseconds through PDD emergency power-off to ensure the elimination of safety hazards.

However, Lantu's much-touted safe battery was exposed in an online video showing it catching fire.

In June 2022, Observer.com reported that a Lantu FREE caught fire and spontaneously combusted near a charging station. Fortunately, the fire was not large, mainly concentrated near the chassis, and was quickly extinguished by firefighters who arrived at the scene.

Subsequently, Lantu Automobile issued a statement explaining the accident, stating that at 16:28 on June 26, a case of a Lantu FREE vehicle catching fire occurred in Xiangyang, Hubei Province. After the accident, Lantu Automobile quickly established a special task force to rush to the scene to investigate and handle the situation. The accident did not cause any personnel or surrounding property damage, and the vehicle was partially damaged. Lantu Automobile will actively investigate the cause of the accident in collaboration with suppliers and will announce the results in detail as soon as possible.

This accident directly pulled Lantu down from the high-end pedestal. Although Lantu has good promotion, its new energy technology strength and product strength are obviously insufficient, making it difficult to truly establish a high-end brand image.

03 Frequent Leadership Changes, How Can Lantu Exit the Confusion Period?

As everyone knows, Dongfeng Group, which targets the下沉市场 (lower-tier markets), has relatively little high-end experience. Although Lantu is its own brand, the help it can receive is limited. Therefore, if Lantu Automobile wants to achieve a turnaround, it still needs to continuously explore on its own.

To this end, in the past two years, Lantu has frequently changed its leadership, seemingly seeking a shortcut to high-end positioning.

In March 2022, Lei Xin, the then Chief Brand Officer (CBO) of Lantu Automobile, was transferred, and Yu Fei, the former General Manager of Great Wall Motor's Ora brand marketing, took over; in June of the same year, Huang Weichong, the Senior Director of Lantu's brand operations, left, and Liu Zhanshu, who previously served as the Senior Director of User Development at Zeekr Motor, joined Lantu, primarily responsible for brand sales operations; in July 2022, CEO Lu Fang no longer concurrently served as Chief Technology Officer (CTO), and Wang Junjun took over.

However, for Lantu, changing leadership is only a temporary solution. The biggest issue with Lantu is that although the brand shouts about taking the high-end route, there are obvious shortcomings in product quality and after-sales service.

According to the China Automotive Quality Network, on January 11, 2023, a consumer complained that after the Lantu car they purchased malfunctioned on December 14, 2022, Lantu's after-sales service dragged on for 20 days without resolution. The after-sales service consistently requested customers to pay for on-site inspections, citing non-quality issues.

After being forced to agree to the inspection, the after-sales personnel demanded that the customer pay for repairs, citing improper vehicle maintenance. However, the quoted cost for after-sales repairs at Lantu was over 10,000 yuan. The vehicle had no human driving issues and the malfunction occurred while parked in a warehouse. Nevertheless, Lantu refused to provide after-sales service, citing non-quality issues,涉嫌欺诈消费者 (涉嫌 fraud against consumers), and violating the Automobile Three Guarantees Law. The consumer hoped that relevant departments would strictly investigate the matter, and that Lantu's after-sales service could promptly arrange for after-sales personnel to repair and resolve the vehicle malfunction.

Previously, Jipai Daily also reported that Lantu's after-sales maintenance store coverage is far inferior to other new-energy vehicle brands.

According to public data, as of the end of 2023, Lantu had 268 stores nationwide. In comparison, NIO Auto has established 99 NIO Houses and 303 NIO Spaces globally; Ideal Auto has 480 stores, including 337 retail centers and 143 showrooms distributed in 158 cities. Even Zeekr, founded in 2021, has accumulated over 392 offline stores, with an expected total of 520 by the end of the year.

However, although Lantu's high-end push has not been smooth, there are still plenty of opportunities as long as timely adjustments are made.

On the one hand, the high-end track chosen by Lantu has promising prospects.

According to statistics from the China Passenger Car Association, in the first half of 2023, China's luxury car retail sales increased by 11.8% year-on-year, continuing the continuous growth trend since 2020 and outpacing the overall passenger car market.

On the other hand, Lantu believes in long-termism and does not mind taking detours, making it more likely to succeed.

Lantu CEO Lu Fang said, "As a state-owned and central enterprise, we will make cautious promises and think twice before acting. In the long run, Lantu insists on long-termism."

Since its inception, Lantu has adhered to the principle of independent research and development and has worked with software developers and hardware manufacturers to achieve a unified interface and jointly build the Lantu ecosystem. At the same time, it insists on a multi-category product layout and enriches its core technology reserves, striving to firmly grasp key core technologies.

After all, Lantu has only been established for over three years and is still relatively young. With the support of Dongfeng, a giant automaker, Lantu has many advantages. And Lantu's growing sales seem to be proving that the lost Lantu has found the right direction and is working hard to catch up.