2026 Purchase Tax Exemption Policy Changes: The New Energy Vehicle Market Faces Tighter Constraints

![]() 10/23 2025

10/23 2025

![]() 617

617

Lead | Introduction

This year, during the 'Golden September and Silver October' sales peak, numerous automakers have rolled out new electric vehicle models. Beyond aiming to capture market share during this high-demand period, these launches are also influenced by anticipated adjustments in purchase tax and subsidy policies. A pressing question for consumers is whether they will still be eligible for subsidies when purchasing a vehicle in 2026. This uncertainty has been fueled by some 4S stores, which are spreading anxiety and, in some cases, even charging handling fees for processing cross-provincial subsidies.

Produced by | Heyan Yueche Studio

Written by | Cai Jialun

Edited by | He Zi

Full text: 2,106 characters

Reading time: 4 minutes

With just over two months remaining until 2026, both automakers and consumers are keenly awaiting the unveiling of next year's policies on new energy vehicles.

Recently, three departments, including the Ministry of Industry and Information Technology, issued the 'Announcement on Technical Requirements for New Energy Vehicle Products Eligible for Vehicle Purchase Tax Exemption and Reduction from 2026 to 2027.' This announcement further clarifies the technical criteria and direction of the 2026 purchase tax exemption policy for new energy vehicles.

According to the 'Announcement,' starting from January 1, 2026, the purchase tax exemption for new energy vehicles will undergo two significant changes. In terms of exemption magnitude, it will transition from full exemption to a 50% reduction, with a maximum tax reduction of 15,000 yuan per vehicle. Regarding eligibility, only models that comply with the two new national standards—'Fuel Consumption Limits for Passenger Cars' (GB19578-2024) and 'Energy Consumption Limits for Electric Vehicles Part 1: Passenger Cars' (GB36980.1-2025)—will qualify for the exemption.

Clearly, both market dynamics and policy trends suggest that the benefits from new energy vehicle policies will become increasingly scarce in 2026. So, what should consumers consider when purchasing new energy vehicles next year? Which models will be most impacted by these technical requirements?

Energy Efficiency Emerges as a Critical Factor

The two most impactful requirements in the new announcement concerning eligibility for new energy vehicle purchase tax exemptions are as follows:

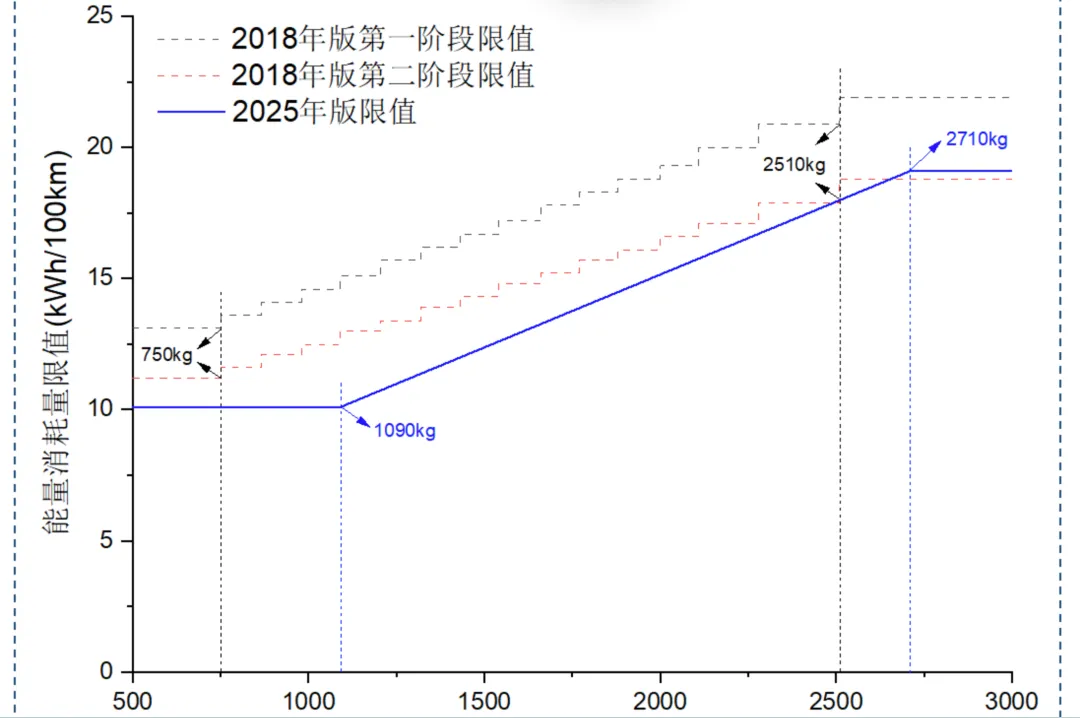

Firstly, the electricity consumption per 100 kilometers for pure electric passenger vehicles must not exceed the limits specified in 'Energy Consumption Limits for Electric Vehicles Part 1: Passenger Cars' (GB 36980.1—2025) for the corresponding vehicle type.

This implies that pure electric vehicles must enhance their energy efficiency. According to the new national standard GB 36980.1—2025, a 1.5-ton vehicle must save 1 kWh per 100 kilometers compared to previous standards, while A00-class compact cars are required to reduce electricity consumption by approximately 2 kWh. This imposes even stricter weight reduction requirements on large pure electric SUVs, such as the Li Auto i8 and NIO ES8.

Secondly, the all-electric range of plug-in hybrid (including extended-range) passenger vehicles under conditional equivalent all-electric range conditions must be no less than 100 kilometers. Compared to the fuel consumption limits specified in GB 19578—2024 for the corresponding vehicle type, passenger vehicles with a curb weight below 2,510 kg should have fuel consumption less than 70% of the limit; those with a curb weight of 2,510 kg or more should have fuel consumption less than 75% of the limit. Similarly, compared to the electricity consumption limits specified in GB 36980.1—2025, passenger vehicles with a curb weight below 2,510 kg should have electricity consumption less than 140% of the limit; those with a curb weight of 2,510 kg or more should have electricity consumption less than 145% of the limit.

This necessitates that plug-in hybrid vehicles double their range and reduce energy consumption. On one hand, it mandates that plug-in hybrid vehicles achieve a WLTC all-electric range exceeding 100 kilometers. On the other hand, it requires reductions in both fuel and electricity consumption, meaning automakers cannot simply rely on increasing battery size to qualify for tax reductions. Instead, they must strike a better balance between vehicle weight, fuel consumption, and electricity consumption.

The announcement regarding purchase tax exemptions for new energy vehicles from 2026 to 2027 marks a significant escalation in technical requirements. The core message is twofold: Firstly, it underscores that automakers should focus their technological advancements on energy efficiency and range in 2026. Secondly, the introduction of new national standards will compel low-tech new energy vehicles, such as those retrofitted from internal combustion engine vehicles and low-range plug-in hybrids, out of the market, steering the automotive industry towards efficient energy conservation upgrades.

Targeting Retrofitted Electric Vehicles and Volume-Driven Models

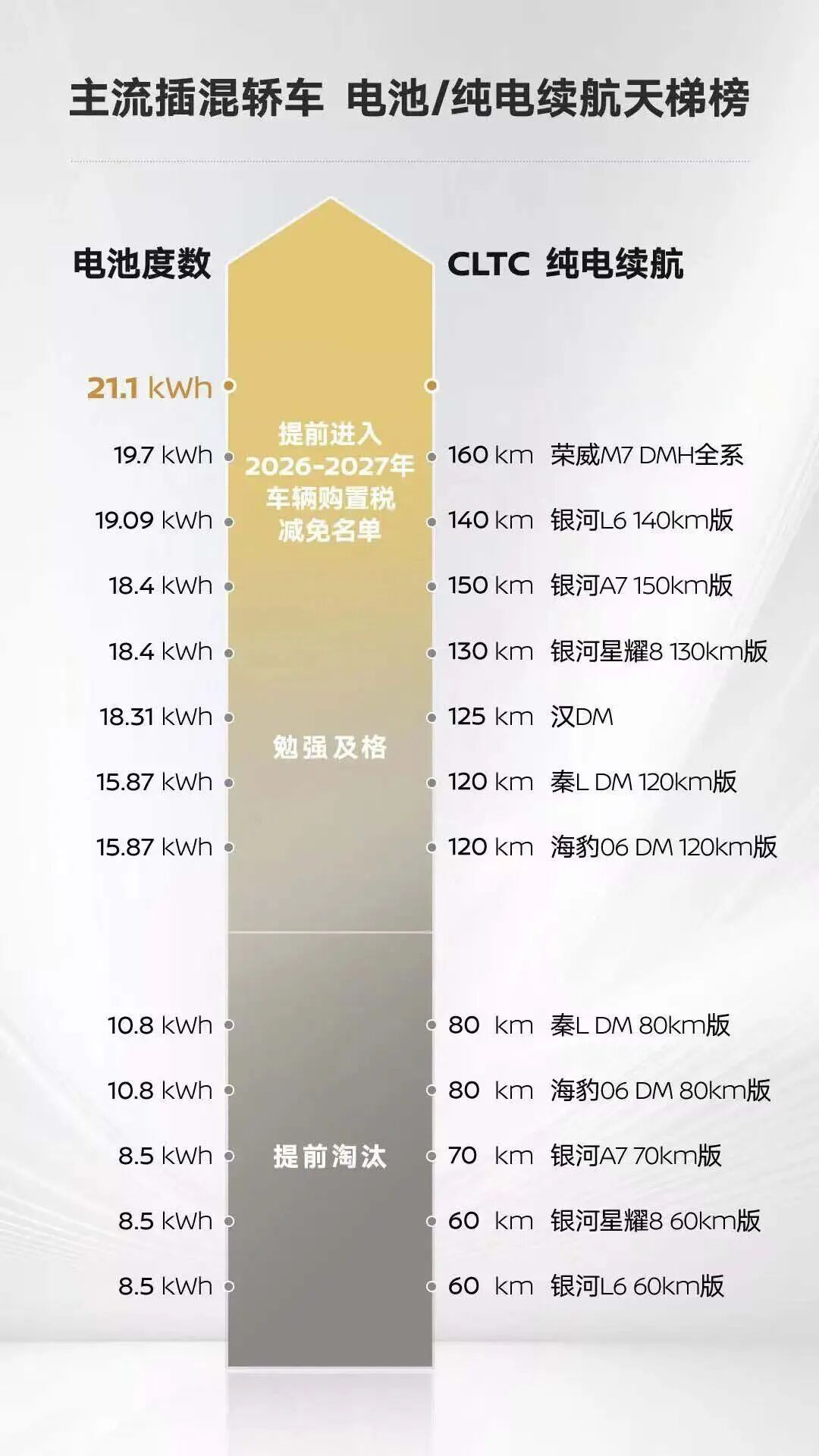

The confirmation of the new purchase tax exemption regulations implies that for currently mainstream pure electric models, achieving the technical standards does not necessitate drastic SKU reductions or technological leaps. Instead, adjustments in battery technology and vehicle lightweighting will suffice. However, for plug-in hybrid models, a phase of mass elimination or upgrades is on the horizon.

Models like the Haval XiaoLong MAX and Dongfeng Fengguang HaoHuan PHEV, which clearly exhibit a 'retrofitted electric' characteristic with WLTC ranges below 100 km, will fail to meet the new purchase tax exemption requirements.

Furthermore, small-battery plug-in hybrid models that remain popular in the market for volume sales, such as the BYD Qin PLUS/Seal 05 DM-i 55KM version, Qin L/Seal 06 DM-i 80KM version, Geely Galaxy A7, Xingyao 8, Wuling Xingguang, Haishi 06 DM-i, Song Pro DM-i, and Geely Galaxy M9 100KM version, will also be affected.

Whether these small-battery plug-in hybrid models are employed by automakers to lower listing prices or to provide more affordable options for entry-level consumers, with the increasing calls for 'de-escalation' and 'quality improvement' in China's new energy vehicle market, they no longer provide sufficient impetus for industry upgrades.

Therefore, for small-battery plug-in hybrid models that remain popular for volume sales, the latter half of the year may witness a rapid inventory clearance phase. Once 2026 arrives, these models will face market price and product value impacts if they cannot meet the purchase tax exemption criteria.

It is worth noting that BYD is swiftly adjusting its small-battery plug-in hybrid models. For instance, in September and October, it sequentially launched the Qin PLUS 128KM version, the 2026 Han DM-i with a full electric range of 245KM, and the BYD Qin L is set to introduce a long-range version at the end of October.

New Energy Vehicles Must Ascend Collectively

Starting from February this year, the market and policy direction of China's new energy vehicle industry have gradually shifted towards 'quality improvement and standard setting,' with standards becoming increasingly stringent.

In February, the Ministry of Industry and Information Technology and the State Administration for Market Regulation issued the 'Notice on Further Strengthening the Management of Intelligent Connected Vehicle Product Access, Recalls, and Software Online Upgrades.' In March, the Ministry of Industry and Information Technology released the new national battery standard 'Safety Requirements for Power Batteries Used in Electric Vehicles,' to be implemented from July 2026. In September, the Ministry of Industry and Information Technology solicited public opinions on the 'Safety Requirements for Combined Driving Assistance Systems in Intelligent Connected Vehicles' and the 'Safety Technical Requirements for Automobile Door Handles,' aiming to elevate L2-level intelligent driving and door handle safety to higher standards. October brought the 'Announcement on Technical Requirements for New Energy Vehicle Products Eligible for Vehicle Purchase Tax Exemption and Reduction from 2026 to 2027.'

Policy adjustments in the new energy vehicle industry have been more frequent in 2025 than in previous years. In 2026, technical requirements for new energy vehicles will become even stricter, and the 'benefits' consumers can derive from policies will diminish, if not vanish entirely. At the very least, the new purchase tax exemption regulations for 2026 will exclude a significant number of models.

Commentary

Consumers with sufficient budgets and urgent needs may consider purchasing new energy vehicles by the end of 2025. On one hand, they can still enjoy full purchase tax exemptions at this stage. On the other hand, if purchasing plug-in hybrid models with a range of less than 100 km, leading brands like BYD and Geely are likely to offer substantial discounts for inventory clearance. Of course, if local replacement subsidies are available, that would be ideal. For consumers in areas without replacement or scrappage subsidies, if their need is urgent, purchasing now will still allow them to benefit from full purchase tax exemptions. Consumers who are not price-sensitive but have high-quality requirements need not hesitate about whether to buy in the fourth quarter of this year or next year.

(This article is original to 'Heyan Yueche' and may not be reproduced without authorization.)