55 Chinese consumers jointly reported Apple, demanding zero-commission access to third-party payment and app stores

![]() 10/23 2025

10/23 2025

![]() 506

506

Author: Chang Yuan

Editor: Key Focus Editor

On October 20th, a 'Complaint Letter Regarding Apple Inc.'s Abuse of Market Dominance,' jointly signed by 55 Chinese consumers, was submitted to China's State Administration for Market Regulation.

Represented by Wang Qiongfei and Tian Junwei, the complaint accuses Apple Inc. of abusing its market dominance in China, engaging in a series of monopolistic practices including forced transactions, tie-in sales, anti-steering clauses, and charging 'unfairly high prices,' severely infringing upon the legitimate rights and interests of Chinese consumers.

The core appeal (demand) of the complaint is to request the State Administration for Market Regulation to initiate an investigation into Apple's illegal activities, order it to cease infringements, and open up third-party payment channels and third-party app stores to Chinese consumers.

Core Demand: Zero-Commission Access to Third-Party Payment and App Stores

According to the complaint, the 55 Chinese consumers' reporting requests are divided into two main parts: first, to request an investigation and prosecution, and second, to request corrective measures.

Regarding the request for investigation and prosecution, the complainants demand that regulatory authorities recognize three main types of abuse of market dominance by Apple Inc.:

Restricted Transactions and Tie-in Sales: Forcing Chinese consumers to only purchase digital goods and services within iOS apps through Apple's IAP (In-App Purchase) system. Additionally, prohibiting developers from steering consumers towards payment methods outside of IAP through anti-steering clauses.

Restricted Transactions: Forcing Chinese consumers to only obtain iOS apps through the Apple App Store.

Unfairly High Prices: Forcing Chinese consumers to bear a commission of up to 30% when using IAP, constituting an unfairly high price.

Regarding the request for corrective measures, the complainants put forward three specific demands:

Open Up Third-Party Payment: Order Apple Inc. to open up third-party payment channels outside of IAP to Chinese consumers. The complaint specifically requests that developers be allowed to steer consumers to any third-party platform or payment channel to complete purchases through external links, buttons, H5 pages, etc., and that Apple Inc. waive any form or amount of commission on these third-party payments.

Open Up Third-Party App Channels: Order Apple Inc. to open up channels for obtaining iOS apps outside of the App Store to Chinese consumers, including but not limited to third-party app stores and web-based sideloading. Similarly, the complainants demand that Apple waive any form or amount of commission, technical service fees, etc., on these channels.

Reduce Commission: Order Apple Inc. to lower its commission rate for in-app digital goods transactions, with the rate not exceeding the most favorable proportion in other countries and regions worldwide.

Accusation of 'National Discrimination' by Apple: China Subject to the Strictest Policies Globally

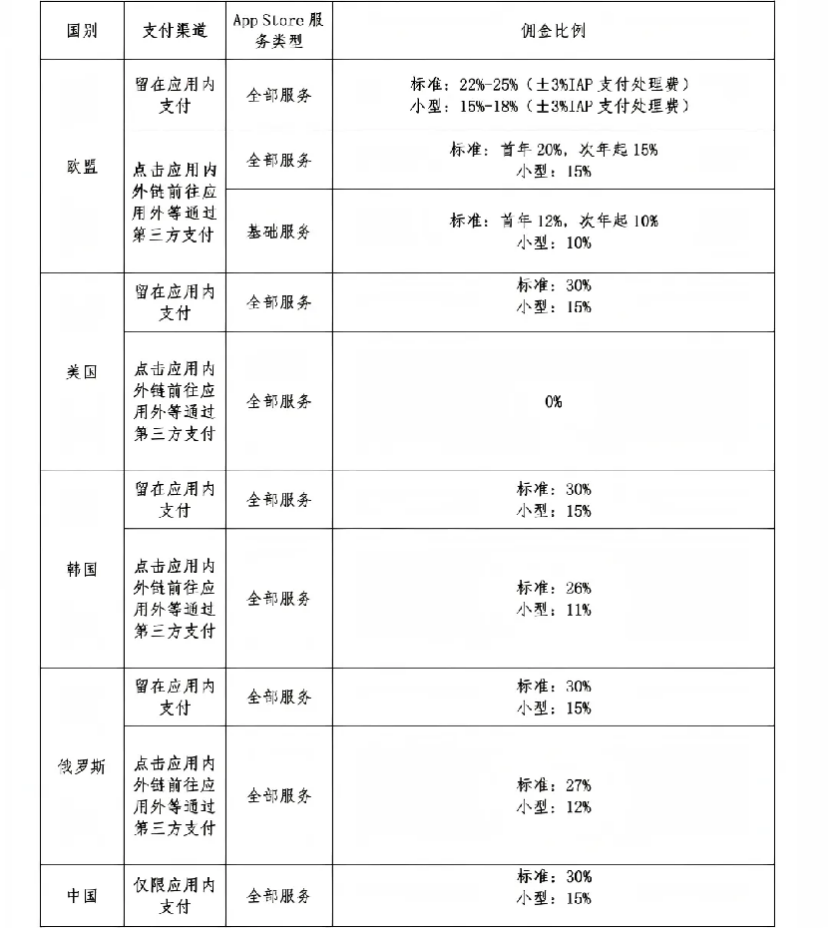

The first core factual argument in the complaint is that Chinese consumers are suffering from national discrimination by Apple Inc. The complainants found that compared to the European and American markets, Chinese consumers are still blocked by Apple from using third-party payment channels and third-party app stores, forced to bear an 'Apple tax' of up to 30%.

The complaint cites recent developments in the United States and the European Union as a contrast:

United States: On April 30, 2025, a recent ruling by the Federal Court for the Northern District of California ordered Apple to provide payment channel options for American consumers. The ruling allows consumers to click on built-in links, buttons, H5 pages, etc., within apps to jump to third-party platforms and use any third-party payment tools for purchases, with Apple Inc. not bearing any form or amount of commission.

European Union: After being fined €500 million by the EU, Apple substantially relaxed its third-party payment channels in the EU on June 26, 2025. EU consumers are similarly allowed to jump to third-party platforms and use third-party payment tools, with commissions adopting a tiered model, where the commission for third-party payment channels is as low as 12% in the first year and drops to 10% in the second year.

The complainants emphasize that Apple has not proactively extended the low (zero) commission models in the Americas and Europe to China. As Apple's third-largest market globally, China is still subject to the strictest Apple regulations: apps can only be downloaded through the App Store, digital goods can only be purchased through IAP, and consumers must bear a 30% commission burden.

Furthermore, the anti-steering clauses that Apple has abandoned in multiple countries including the United States and the EU remain in effect in China. This means Chinese developers are prohibited from steering consumers towards payment channels outside of IAP. The comparison table in the complaint also shows that the Chinese market is limited to in-app payments only, with a standard commission rate of 30%.

Accusation of Chinese Consumers Bearing the Heaviest 'Apple Tax' Burden Globally

The second core factual argument in the complaint is that Chinese consumers bear an extremely heavy 'Apple tax' burden, with their relative burden exceeding that of consumers in the Americas and Europe, and the total amount may soon surpass that of these regions.

Citing publicly reported data, the complaint states that in 2024, Chinese consumers paid $6.44 billion in 'Apple taxes,' second only to the $14.8 billion paid by American consumers and exceeding the $4.8 billion paid by European consumers.

The complaint then calculates the proportion of 'Apple taxes' in each market's revenue to illustrate the relative burden on Chinese consumers. Based on fiscal year 2024 revenue data (China: $64.65 billion, United States: $169.26 billion, Europe: $104.8 billion), the complainants calculate that the 'Apple tax' accounts for 10% of revenue in China, 8.8% in the United States, and only 4.6% in Europe.

The complaint points out: For every $10 Apple earns in China, $1 comes from the Apple tax, whereas in Europe it is less than $0.50. The relative burden of the 'Apple tax' on Chinese consumers has already surpassed that in the Americas and Europe.

The complaint also cites predictions from Chinese media stating that due to the implementation of zero (low) fee rates for third-party payments in the Americas and Europe, the total amount of 'Apple taxes' collected there will continue to decline. Assuming a 3:7 ratio of IAP to third-party payment usage by developers in the Americas and Europe, it is predicted that by 2026, the total 'Apple tax' in the United States will drop to $6.3 billion and in the EU to $7.1 billion. At that time, the 'Apple tax' paid by Chinese consumers may become the highest globally at $8.1 billion, exceeding that of the United States by $1.8 billion and Europe by $1 billion.

Global Legal Actions Against Apple's Monopolistic Practices

The complaint points out that following the lead of the Americas and Europe, more than 10 countries including Japan, South Korea, the United Kingdom, India, Spain, Turkey, Brazil, Russia, Australia, and Colombia have taken various legal actions against Apple Inc.'s monopolistic practices.

The complaint lists several recent cases:

Japan, as Apple's fourth-largest market globally, the Japan Fair Trade Commission announced on July 29 that it will force Apple to open up third-party transaction modes such as external links and third-party app acquisition channels before December 18 of this year.

On August 12, the Federal Court of Australia ruled that Apple Inc. abused its market dominance in the fields of iOS app distribution and in-app payments, pointing out that its prohibition of sideloading and alternative payment methods restricts competition.

Russia's newly revised Consumer Rights Protection Law took effect on September 1, requiring that smart hardware such as iPhones sold in Russia must allow third-party payment channels and third-party app distribution channels.

Colombia: The Superintendency of Industry and Commerce announced in late August that it would launch an antitrust investigation to assess whether Apple restricts alternative app stores and payment methods.

The complaint concludes by stating that the unfairly high prices charged by Apple Inc. for excessive commissions result in the 'Apple tax' cost ultimately being borne by Chinese consumers, damaging their legitimate rights and interests.

Below is the specific content of the 'Complaint Letter Regarding Apple Inc.'s Abuse of Market Dominance'

Recipient: State Administration for Market Regulation, EMS Tracking Number: 1259324178701

Complainants: Wang Qiongfei, Tian Junwei, and 53 other Chinese iPhone/iPad consumers (hereinafter referred to as 'Chinese Consumers')

Respondent: Apple Inc., with its registered office at One Apple Park Way, Cupertino, CA 95014, U.S.A.

Reporting Requests:

1. Initiate an investigation and prosecution into the following illegal activities of Apple Inc. that constitute abuse of market dominance:

(1) Forcing Chinese consumers to purchase digital goods and services within iOS apps through Apple's IAP (In-App Purchase) system and prohibiting developers from steering consumers towards payment methods outside of Apple's IAP through anti-steering clauses, which constitute restricted transactions and tie-in sales;

(2) Forcing Chinese consumers to only obtain iOS apps through the Apple App Store, which constitutes restricted transactions;

(3) Forcing Chinese consumers to bear a commission of up to 30% when purchasing digital goods and services within iOS apps through Apple's IAP, which constitutes an unfairly high price.

2. Order Apple Inc. to:

(1) Open up third-party payment channels outside of IAP to Chinese consumers, such as allowing developers to steer consumers to any third-party platform and directly purchase digital goods and services through any third-party payment channel via external links, buttons, H5 pages, etc., and waive any form or amount of commission on these third-party payments outside of IAP;

(2) Open up channels for obtaining iOS apps outside of the Apple App Store to Chinese consumers, including but not limited to third-party app stores and web-based sideloading, etc., and waive any form or amount of commission, technical service fees, etc., on these third-party app acquisition channels outside of the Apple App Store;

(3) Lower the commission rate for transactions involving digital goods and services within Apple apps, which must be lower than the most favorable rate in other countries and regions worldwide.

Factual Explanation:

The complainants found that compared to consumers in the Americas and Europe, Chinese consumers are still blocked by Apple from using third-party payment channels for digital goods and services outside of IAP and from using third-party app stores/websites outside of the App Store to acquire apps. They are deprived of the right to choose payment channels and app acquisition channels and are forced to bear an Apple tax burden of up to 30%, which is significantly higher than in the Americas and Europe. Specifically:

I. Due to Apple's monopolistic practices, Chinese consumers are deprived of the right to choose payment channels and app acquisition compared to consumers in the Americas and Europe

The complainants found that on April 30, 2025, a recent ruling by the Federal Court for the Northern District of California completely broke Apple's monopoly on the IAP payment channel. The ruling ordered Apple to provide payment channel options for American consumers, allowing them to click on built-in links, buttons, H5 pages, etc., within iOS apps to jump to any third-party platform and directly use any third-party payment tool to purchase digital goods and services, without bearing any form or amount of commission. After being fined €500 million by the EU, on June 26, 2025, Apple substantially relaxed its third-party payment channels in the EU, similarly allowing EU consumers to jump to any third-party platform via websites, etc., and directly complete purchases through any third-party payment tool, with commissions adopting a tiered model, where the commission for third-party payment channels is as low as 12% in the first year and drops to 10% in the second year.

The complainants noticed that Apple has not proactively extended the low (zero) commission models for third-party payments in the Americas and Europe to China, constituting national discrimination against Chinese consumers. As Apple's third-largest market globally, China is still subject to the strictest Apple regulations: apps can only be downloaded, installed, updated, and used through the Apple App Store; digital goods and services within apps can only be purchased through IAP; and consumers must bear a 30% Apple tax burden.

Furthermore, Apple prohibits Chinese developers from steering consumers towards third-party platforms or third-party payment channels outside of Apple's IAP to complete transactions through anti-steering clauses. Due to Apple's aforementioned monopolistic practices, Chinese consumers cannot autonomously choose other app acquisition channels, nor can they directly use third-party payment systems within Apple's iOS apps. They are not even allowed to jump to external platforms via external links to complete purchases. Compared to consumers in the Americas and Europe, they have been deprived of the right to autonomously choose payment channels at the very least.

(Comparison of Apple's payment channels and commission policies, compiled based on information from Apple's developer website)

II. Due to Apple's monopolistic practices, the proportion and relative burden of the 'Apple tax' borne by Chinese consumers have far exceeded those in the Americas and Europe, and the total amount may soon surpass these regions

Chinese consumers are still bearing a 30% Apple tax on in-app payments, significantly higher than the zero rate for third-party payment channels in the United States and three times the corresponding minimum rate in the EU. Moreover, the relative burden of the 'Apple tax' on Chinese consumers has significantly exceeded that in the Americas and Europe. If not intervened in a timely manner, the total amount may surpass these regions.

Public reports show that in 2024, Chinese consumers paid $6.44 billion in 'Apple taxes,' second only to the $14.8 billion paid by American consumers and exceeding the $4.8 billion paid by European consumers, who constitute Apple's second-largest market. In fiscal year 2024, Apple's revenue in the Chinese market was $64.65 billion, in the United States it was $169.26 billion, and in Europe it was $104.8 billion. Based on these figures, the complainants calculate that the 'Apple tax' accounted for 10% of revenue in China, 8.8% in the United States, and only 4.6% in Europe in 2024. This means that for every $10 Apple earns in China, $1 comes from the Apple tax, whereas in the United States it is $0.88 and in Europe it is less than $0.50. The relative burden of the 'Apple tax' on Chinese consumers has already surpassed that in the Americas and Europe.

Meanwhile, with the implementation of zero (low) fee rates for third-party payments in the Americas and Europe, the total amount of 'Apple taxes' paid by consumers there will continue to decline. Chinese media predict that assuming a 3:7 ratio of IAP to third-party payment usage by developers in the Americas and Europe, the total 'Apple tax' paid in the United States and the EU will be $6.3 billion and $7.1 billion respectively in 2026. Chinese consumers may then become the largest contributors to the 'Apple tax' globally at $8.1 billion, exceeding that of the United States by $1.8 billion and Europe by $1 billion.

III. More than 10 overseas countries, including Japan and Australia, are also taking various legal actions against Apple's monopolistic practices

Multiple overseas countries, including Japan, South Korea, the United Kingdom, India, Spain, Turkey, Brazil, Russia, Australia, and Colombia, are following the lead of the Americas and Europe in demanding that Apple open up and lower commissions.

Among them, Japan is about to become the first Asian market to be exempt from Apple's discrimination. On July 29, the Japan Fair Trade Commission announced that it will force Apple to open up third-party transaction modes such as external links and third-party app acquisition channels before December 18 of this year. Japan is Apple's fourth-largest revenue market globally, second only to China.

On August 12, the Federal Court of Australia ruled that Apple Inc. abused its market dominance in the fields of iOS app distribution and in-app payments, pointing out that its prohibition of sideloading apps and alternative payment methods restricts competition.

In late August, the Superintendence of Industry and Commerce (SIC) of Colombia announced the launch of an antitrust investigation into Apple, assessing whether Apple restricts other app stores and alternative distribution channels, as well as whether it prevents developers from using other more favorable payment methods.

On September 1, the newly revised Consumer Rights Protection Law of the Russian Federation officially took effect in Russia. This law breaks through Apple's closed system, requiring that smart hardware such as iPhones sold in Russia must allow third-party payment channels and third-party app distribution channels.

Explanation of Reasons:

I. The relevant market involved in this case is the intelligent terminal application transaction platform under the iOS system in the region of the People's Republic of China, excluding Hong Kong, Macau, and Taiwan.

According to the relevant provisions of China's Anti-Monopoly Law and the Guidelines on the Definition of Relevant Markets issued by the Anti-Monopoly Committee under the State Council, the relevant market refers to the scope of goods and geographical areas in which operators compete for specific goods or services (collectively referred to as goods) within a certain period. The definition of a relevant market typically requires the delineation of a relevant commodity market and a relevant geographical market. The relevant commodity market is a market composed of a group or category of goods that, based on factors such as the characteristics, uses, and prices of the goods, are considered by demanders to have a relatively close substitutability. The relevant geographical market refers to the geographic area where demanders obtain goods with relatively close substitutability.

(I) Relevant Commodity Market

1. Analysis Using Demand Substitution Analysis Method

According to the Interpretation of the Supreme People's Court on Several Issues Concerning the Application of Law in the Trial of Civil Dispute Cases Involving Monopolies (hereinafter referred to as the 'Interpretation'), the relevant commodity market can be determined based on the demand substitution analysis method. Demand substitution determines the degree of substitution between different goods from the perspective of demanders based on factors such as demanders' needs for the functional uses of the goods, recognition of quality, acceptance of price, and ease of acquisition. In principle, from the perspective of demanders, the higher the degree of substitution between goods, the stronger the competitive relationship, and the more likely they are to belong to the same relevant market. Therefore, the core lies in examining whether there is obvious substitutability between the objects.

2. Full Consideration Must Be Given to the Particularity of Mobile Internet Products Involved in This Case

Considering that the services in dispute in this case have emerged and grown in the era of mobile internet, the analysis should be based on the usage scenarios, operational costs, and product business models of demanders in mobile internet practices. Disregarding these specific circumstances and discussing 'substitution' does not conform to the principle of seeking truth from facts.

Specifically, the demand substitution analysis method generally requires consideration of factors such as demanders' needs for the characteristics, functions, and uses of the goods, recognition of quality, acceptance of price, and ease of acquisition. In the era of mobile internet, the core corresponding to the aforementioned 'ease of acquisition' is precisely 'switching costs' and 'inconvenience.' Given the closed nature of the iOS system, users of iPhones/tablets equipped with the iOS system have certain subjective preferences and habits, and objectively, they cannot achieve quick and convenient switching between the iOS system and the Android system. iOS apps also cannot be distributed and acquired on other app transaction platforms. At the same time, in-app transaction conversions typically require demanders to use methods other than in-app IAP payments (such as purchasing with an additional Android phone, purchasing on the official website using a browser on the phone, etc.), which significantly increases the operational steps and costs for demanders to acquire services. Choosing other app distribution and download channels even requires directly replacing hardware devices. The group that can switch is limited. Therefore, the degree of substitution of app distribution and payments achieved through other app distribution or payment methods for app transactions distributed or concluded on the Apple App Store is not high. Thus, the relevant commodity market in this case is the 'intelligent terminal application transaction platform under the iOS system.'

(II) Relevant Geographical Market

Regarding the definition of the relevant geographical market in this case, the alleged monopolistic behavior of Apple and the competitive relationships embodied by relevant competitors all occur in the region of the People's Republic of China, excluding Hong Kong, Macau, and Taiwan. Therefore, the relevant geographical market should be defined as the region of the People's Republic of China, excluding Hong Kong, Macau, and Taiwan.

II. Apple Inc. Holds an Absolute Dominant Market Position in the Relevant Market of This Case

Apple Inc. is the sole operator of the intelligent terminal application transaction platform under the iOS system in the region of the People's Republic of China, excluding Hong Kong, Macau, and Taiwan. Other operators are unable to enter this platform. Therefore, Apple Inc. obviously holds a 100% dominant market position in this market. The Shanghai Intellectual Property Court, in the monopoly case filed by Jin against Apple Inc., also recognized that Apple Inc. holds a dominant market position in the market for intelligent terminal application transaction platforms under the iOS system in the region of the People's Republic of China, excluding Hong Kong, Macau, and Taiwan.

III. Apple Inc. Engages in Restrictive Trading and Tying Practices, Significantly Limiting Chinese Consumers' Right to Choose

(I) Apple Inc. Prohibits Consumers from Acquiring iOS Apps Through Channels Other Than the App Store on the Intelligent Terminal Application Transaction Platform Under the iOS System, Implementing Restrictive Trading Practices

Apple Inc., in its intelligent terminal application transaction platform under the iOS system where it holds an absolute monopoly, prohibits consumers from acquiring iOS apps through any channels other than the App Store. This is equivalent to refusing consumers the ability to complete iOS app downloads in other environments and forcing market entities to only use the App Store promoted by Apple Inc. for acquiring and using iOS apps.

(II) Apple Inc. Further Leverages Its Monopoly Position to Implement Restrictive Trading and Tying Practices for In-App Transactions on iOS

In all in-app transactions on the Android system, payment institutions can freely and directly negotiate business with app developers, independently promote their own payment systems, and set rights and obligations. However, Apple Inc. mandates that Chinese consumers can only purchase in-app digital goods and services through IAP, preventing consumers from using independent and direct services provided by third-party payment institutions. In fact, Apple does not restrict the use of IAP only in physical goods app transactions on platforms like Taobao or in digital goods and services transactions in many countries and regions worldwide. This precisely proves that Apple Inc.'s mandate for Chinese consumers to only use IAP in digital goods and services transactions is unreasonable and constitutes restrictive trading. At the same time, Apple Inc. mandates that Chinese consumers can only accept the service combination of the Apple App Store and IAP for iOS app acquisition and digital goods and services transactions, which is unreasonable and constitutes tying.

(III) Through Anti-Steering Provisions, Apple Prohibits Chinese iOS Developers from Informing and Guiding Chinese Consumers to Try Third-Party Payment Channels Other Than IAP, Providing Assistance for Restrictive Trading and Tying Practices, and Further Excluding and Limiting Market Competition

Currently, Apple Inc. has abandoned 'anti-steering provisions' in the United States, the European Union, and other countries, allowing developers to inform and guide consumers to complete purchases through third-party payment channels other than Apple IAP by installing elements such as external links and buttons within apps. Furthermore, starting from April 30th of this year, Apple has waived commissions on third-party payment channels in the United States. However, in China, Apple still prohibits developers from informing and guiding consumers to use third-party payment channels through anti-steering provisions, which clearly constitutes a restrictive competitive behavior that provides assistance for restrictive trading and tying practices.

(IV) Apple Inc.'s Restrictive Trading and Tying Practices Damage the Legitimate Rights and Interests of Chinese Consumers

Apple Inc.'s restrictive trading and tying practices damage the legitimate rights and interests of Chinese consumers, including their right to choose payment channels and app acquisition, as well as their right to fair trading. This not only prevents consumers from downloading desired apps from diverse iOS app acquisition channels but also restricts a wide variety of payment institutions from directly cooperating with iOS developers. It simultaneously limits the opportunities for developers and consumers to use third-party payment channels. Restrictive trading and tying practices also force Chinese consumers to accept more expensive transaction channel costs, namely the up-to-30% Apple tax.

IV. Apple Inc. Engages in Unfairly High-Priced Practices, Causing Severe Exploitation of Chinese Consumers

According to the Anti-Monopoly Law of the People's Republic of China and its interpretations, to determine whether an operator has engaged in unfairly high-priced practices, two factors can be considered: 'whether the price at which the operator sells or purchases goods to trading counterparts is significantly higher or lower than the price at which other operators sell or purchase the same or comparable goods under the same or similar market conditions' and 'whether the price at which the operator sells or purchases goods to trading counterparts is significantly higher or lower than the price at which the operator sells or purchases the same or comparable goods in other geographical markets under the same or similar market conditions.' Whether compared to domestic Android app stores under the same or similar market transaction conditions or to foreign Apple App Stores under the same or similar market transaction conditions, Apple Inc. obviously mandates the collection of higher commission ratios.

(I) Under Domestic Equivalent Market Conditions, Apple App Store Commissions Are Significantly Higher Than Those of Android App Stores

Under domestic equivalent market conditions, i.e., in non-co-publishing scenarios, the Apple App Store mandates the collection of commissions up to 30%, while Android app stores do not charge any commission fees.

It should be emphasized that in the rules of Android app stores, there are two policy scenarios for app software: co-publishing and non-co-publishing. In the co-publishing scenario, Android phone manufacturers provide various value-added services, and Android app developers can choose different distribution channels and freely decide whether to participate in co-publishing. However, Apple app developers not only lack the option to acquire co-publishing services but also do not have the right to voluntarily choose other channels for distribution. Therefore, Android app stores under the co-publishing policy scenario and the Apple App Store belong to different market conditions and are not comparable. Only under non-co-publishing scenarios do the Apple App Store and Android app stores meet the criteria for 'the same or comparable goods under the same or similar market conditions' under anti-monopoly law. In this scenario, the Apple App Store charges commissions up to 30%, which is significantly higher than the free Android app stores.

(II) Under Foreign Equivalent Market Conditions in the EU, the US, and Other Regions, Apple App Store Commissions in China Are Significantly Excessive

In countries and regions such as the European Union and the United States, Apple has already opened up third-party payment channels outside of apps, correspondingly reducing the Apple tax ratio. Among them, the commission for third-party payment channels in the United States is zero, and the minimum in the European Union is 12% for the first year, decreasing to 10% in the following year. In in-app purchase scenarios, the standard commission ratio in the European Union is up to 25%, while China still maintains the globally highest standard ratio of 30%. This falls under the category of 'significantly higher than the price of the same or comparable goods under the same or similar market conditions in other regions' in anti-monopoly law, constituting unfairly high pricing.

According to the price transmission mechanism, Apple Inc.'s unfairly high-priced practice of charging excessive commissions results in the Apple tax cost ultimately being borne by Chinese consumers, damaging their legitimate rights and interests.

In summary, Apple Inc. holds a dominant market position in the intelligent terminal application transaction platform under the iOS system in the region of the People's Republic of China, excluding Hong Kong, Macau, and Taiwan. It engages in restrictive trading and tying practices, as well as unfairly high-priced practices. These behaviors do not have legitimate reasons and have resulted in the exclusion and limitation of market competition. Furthermore, these behaviors have severely infringed upon the legitimate interests of Chinese consumers.