Cross-Year Purchase Tax Subsidies Gain Traction as Auto Companies Make a Year-End Sprint!

![]() 10/27 2025

10/27 2025

![]() 613

613

Recently, automotive brands like Xiaomi Auto, Shenlan Auto, and Li Auto have successively issued announcements. They promise that consumers placing orders before specified dates will be eligible for the same purchase tax benefits as this year, even if their vehicle deliveries are delayed until 2026. These subsidy policies are mainly implemented through deductions from the final payment or cash subsidies, with the maximum subsidy amount reaching 15,000 yuan.

The national policy for purchase tax exemptions on new energy vehicles has reached a pivotal juncture. Full exemptions will be in effect from 2024 to 2025, while a 50% reduction will be applied from 2026 to 2027. This policy shift has made the fourth quarter of this year a 'golden window period' for consumers to enjoy full tax exemptions, prompting auto companies to launch 'purchase tax subsidy' programs.

Models such as the Li Auto i6 and Zeekr 9X have their order deadlines set for October 31, while the Seres 2026 M7's cutoff date is November 3. Shenlan and Xiaomi's order lock-in periods extend until the end of November. This timing not only creates a sense of sales urgency but also provides auto companies with ample time to process orders.

The End of the 10-Year Tax Exemption Policy

The new energy vehicle purchase tax exemption policy, which has been in place since 2014, is set to undergo a phased adjustment in the Chinese auto market after a decade of widespread benefits. According to the policy, new energy vehicles purchased between January 1, 2024, and December 31, 2025, will continue to be exempt from vehicle purchase tax, with a maximum exemption of 30,000 yuan per new energy passenger vehicle. From January 1, 2026, to December 31, 2027, the purchase tax policy will shift to a 50% reduction, with a maximum tax reduction of 15,000 yuan per new energy passenger vehicle.

The policy changes are not only reflected in the extent of tax reductions but, more significantly, in the raising of technical thresholds. Starting from 2026, only vehicle models that meet the two new national standards, the 'Passenger Car Fuel Consumption Limits' and the 'Electric Vehicle Energy Consumption Limits,' will qualify for tax reduction policies.

This implies that some technologically outdated vehicle models will no longer enjoy purchase tax benefits, potentially increasing consumer purchasing costs. For instance, a new energy vehicle priced at 300,000 yuan is currently fully exempt from purchase tax, but after 2026, a purchase tax of 15,000 yuan will be applicable.

Three departments, including the Ministry of Industry and Information Technology, have frequently issued announcements regarding adjustments to the technical requirements for preferential policies on vehicle purchase tax and vehicle and vessel tax for new energy vehicles. Some vehicle models will not qualify for tax benefits if they fail to meet the standards. In essence, the energy consumption standards for pure electric vehicles have been raised, and the threshold for pure electric range has been tightened for plug-in hybrid vehicles (including extended-range models). Plug-in hybrid vehicles are now required to have a pure electric range of over 100 kilometers. Moreover, under full battery and full fuel conditions, the electricity consumption of plug-in hybrid vehicles is 40%-45% higher than that of pure electric vehicles, compared to the previous 35% in the old regulations. Only vehicles meeting these standards will be eligible for tax reductions.

Policy adjustments are accelerating the survival of the fittest in the new energy vehicle industry. 'Backward production capacities' that rely on low technology and low prices for competition will be phased out of the market due to their inability to enjoy preferential policies, driving the industry to shift from 'scale competition' to 'technology competition.'

Subsidies Become a Competitive Edge

Following the release of signals regarding policy adjustments, there have been noticeable reactions in the market and among consumers. Auto companies have significantly stepped up their actions. On one hand, there has been a flurry of new model launches in the second half of this year, leveraging the policy dividend window to drive order growth and strive to meet previously set annual sales targets. In September 2025, the Chinese auto market witnessed the most intense 'wave of new model launches' in history, with over 70 new models hitting the market simultaneously, covering multiple segments from economy to luxury and from pure electric to fuel-powered vehicles, forming a comprehensive competitive landscape. According to reports from several authoritative media outlets, the number of new model launches in the Chinese auto market in September 2025 reached a record high.

The surge in orders for some popular models has led to extended delivery periods, but the cross-year changes in purchase tax have also brought new issues to these orders. Therefore, purchase tax difference subsidies have become a mainstream move among auto companies.

NIO has stated that if consumers complete their order lock-in now and delivery is delayed until next year due to manufacturer reasons, they can use a purchase tax difference subsidy voucher to reduce the vehicle price, with a maximum deduction of 15,000 yuan. Additionally, products from Xiaomi, Seres, Zeekr, IM Motors, Li Auto, and Shenlan have also introduced similar programs.

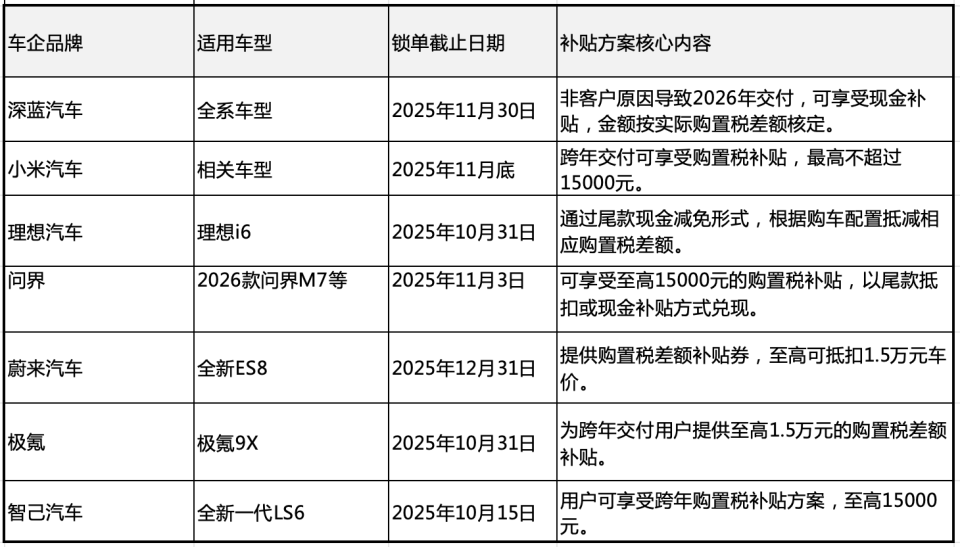

The following is a table of subsidy programs from some auto companies

For consumers, the remaining time in 2025 represents a golden window period for purchasing new energy vehicles. Consumers can not only enjoy the existing full purchase tax exemption benefits but also secure subsidy guarantees provided by auto companies.

When selecting vehicle models, priority should be given to those that comply with the new technical requirements for 2026, ensuring that even if delivery issues span into the next year, they can still enjoy the 50% tax reduction policy.

During the critical period of year-end sales volume push, purchase tax subsidies have evolved from a 'bonus point' to a key 'competitive edge.' After leading brands have introduced similar policies, other brands are likely to follow suit and launch their respective subsidy programs to avoid losing potential orders and maintain market competitiveness.

Before the end of November this year will be the last opportunity for consumers to lock in purchase tax benefits. As the policy window period gradually closes, auto companies' 'guarantee' commitments will become a key lever for driving year-end sales. For consumers with genuine car purchasing plans, it is advisable to seize this wave of subsidy benefits. In addition to the brands already announced, closely monitor the dynamics of other brands you are interested in. Furthermore, while subsidies are attractive, car purchasing decisions should still be based on product strength, actual needs, and long-term value. Be sure to carefully read the subsidy terms to ensure they cover cross-year delivery situations caused by non-personal factors such as production capacity.

Public Opinion on Vehicles

Overall, the fourth quarter of 2025 has become the final window period for full purchase tax exemptions on new energy vehicles. The clear policy shift by the national government and the 'subsidy guarantee' strategies of auto companies have jointly created a unique market opportunity.

For consumers, current decisions need to balance short-term benefits with long-term value. Purchasing a vehicle before the end of 2025 not only allows consumers to lock in purchase tax reductions of up to 15,000 yuan but also enables them to enjoy various subsidies and discounts offered by auto companies striving for sales volume, making it an excellent opportunity to make a purchase.