Porsche's 2025 Q3 Profit Plummets by 99%: Is the Electric Vehicle Era a Bane? Unveiling the Truth Behind Porsche's 'Pivot Back to Fuel Cars'

![]() 10/27 2025

10/27 2025

![]() 673

673

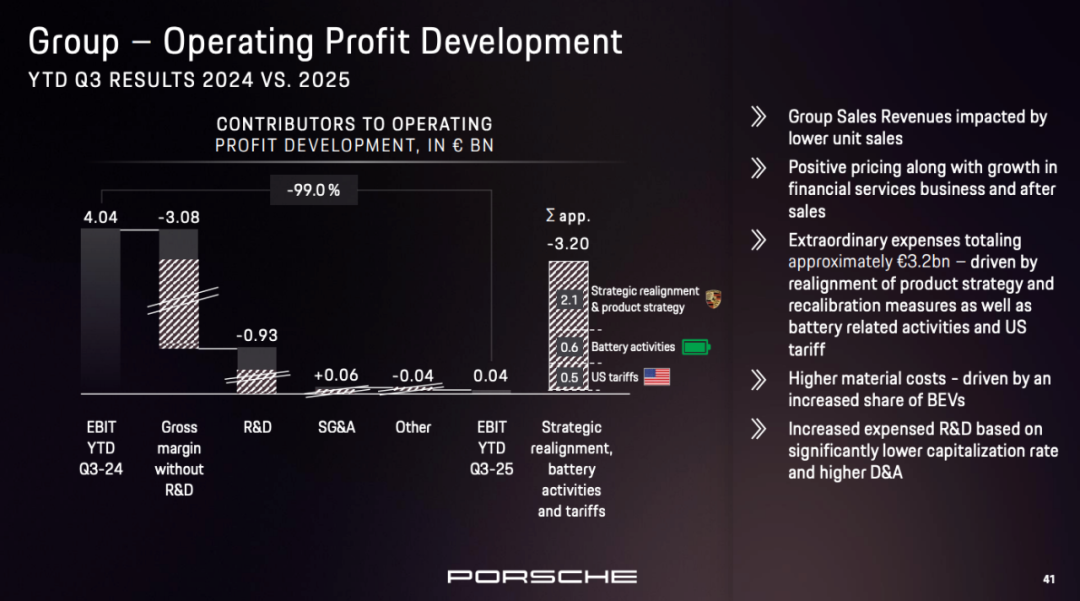

According to Porsche's third-quarter financial data for fiscal year 2025, the operating profit of the Porsche Group has taken a staggering nosedive, plummeting by 99.0%.

Specifically, the group's operating profit has plummeted from €4.035 billion in the first nine months of 2024 to a mere €40 million in the corresponding period of 2025, marking a staggering profit decline of -99.0%.

So, what exactly triggered Porsche's 2025 Q3 profit to plummet by such a massive margin? Can Porsche still maintain its global luster as it once did?

On the surface, strategic adjustments and associated special expenses emerge as the primary culprits.

According to the financial report released by Porsche, this sharp profit decline can be attributed to substantial special expenses incurred due to the company's strategic adjustments and recalibration efforts.

The main reason behind Porsche's profit erosion lies in its reversal of the electric vehicle (EV) strategy and the subsequent restructuring costs. Previously, Porsche had enthusiastically embraced electric vehicle projects like Mission R, emphasizing full electrification, high performance, and efficiency. However, in September, citing insufficient growth in demand for high-performance electric vehicles, Porsche decided to change its course.

Pivot Back to Fuel Cars: No longer insisting on an 80% pure electric vehicle penetration rate by 2030, Porsche is now extending the lifespan of internal combustion engines and hybrid models, postponing some new electric vehicle platforms, and refocusing investments on hybrid vehicles, performance-oriented internal combustion engine vehicles, and software.

This strategic pivot has resulted in significant negative impacts on operating profit from special expenses related to the restructuring. According to the financial report, these special expenses amount to approximately €3.2 billion.

These special expenses encompass:

- Strategic adjustments and product strategy reorganization: Approximately €2.1 billion. This includes the decision that a higher-tier SUV than the Cayenne will not initially feature a pure electric version, and the new electric vehicle platform planned for launch in 2030 will undergo reconsideration.

- Battery-related activities: Approximately €500 million. Porsche has canceled its independent internal battery production through its Cellforce subsidiary.

- U.S. tariffs: Approximately €600 million.

These loss expenses, stemming from strategic restructuring, are duly recorded in Porsche's 2025 Q3 financial report, leading to the 99% profit plunge.

From a data perspective, there are telltale signs in sales volume and revenue.

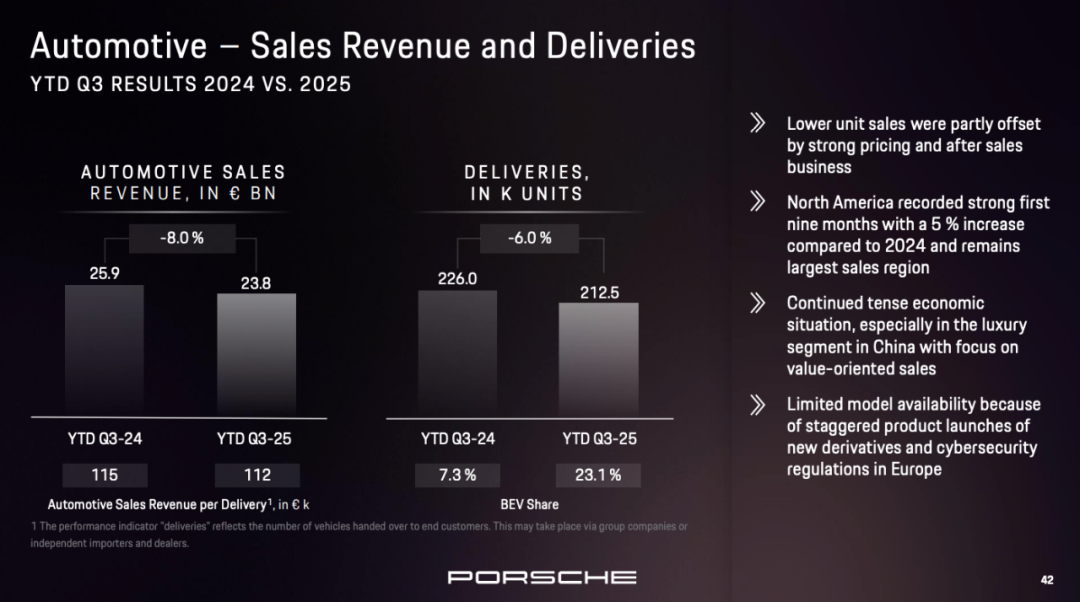

Porsche's global vehicle deliveries in the first three quarters of 2025 stood at 212,500 units, compared to 226,000 units in the same period in 2024, representing a 6% year-on-year decrease.

Automotive sales revenue in the first three quarters of 2025 was €23.8 billion, with an average selling price of €112,000 per vehicle. In contrast, revenue in the same period in 2024 was €25.9 billion, with an average selling price of €115,000 per vehicle. Thus, revenue decreased by 8% year-on-year, while the average selling price per vehicle dropped by €3,000.

Specifically, examining the pure electric vehicle penetration rate, Porsche's pure electric penetration rate soared to 23% in the first three quarters of 2025, a significant leap from 7.3% in 2024. It appears that electric vehicles have become a thorn in Porsche's side, as increased sales of electric vehicles have coincided with a decline in overall Porsche sales and average selling prices.

If I were the CEO, I might be compelled to conclude that electric vehicles are not a viable path forward.

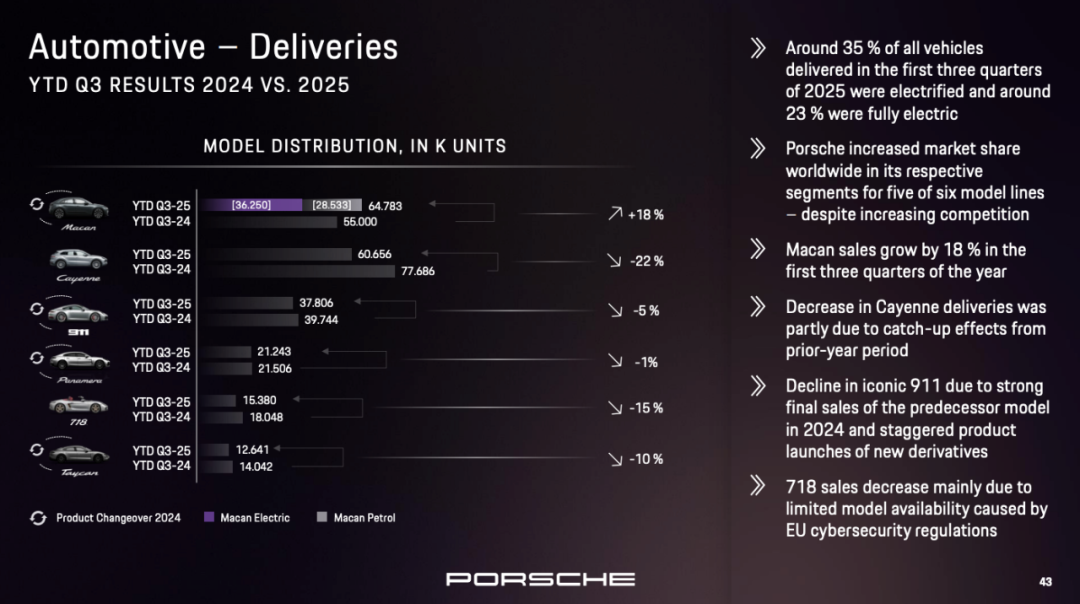

Porsche's global main models consist of six, with sales of five models declining year-on-year, except for the Macan, which witnessed an 18% increase in sales. However, those familiar with Porsche will recognize that the year-on-year increase in Macan sales is attributable to its refresh at the beginning of 2025, as new models generally receive more advertising and promotion.

The sales figures for these models unequivocally indicate that Porsche is facing significant challenges in selling its vehicles.

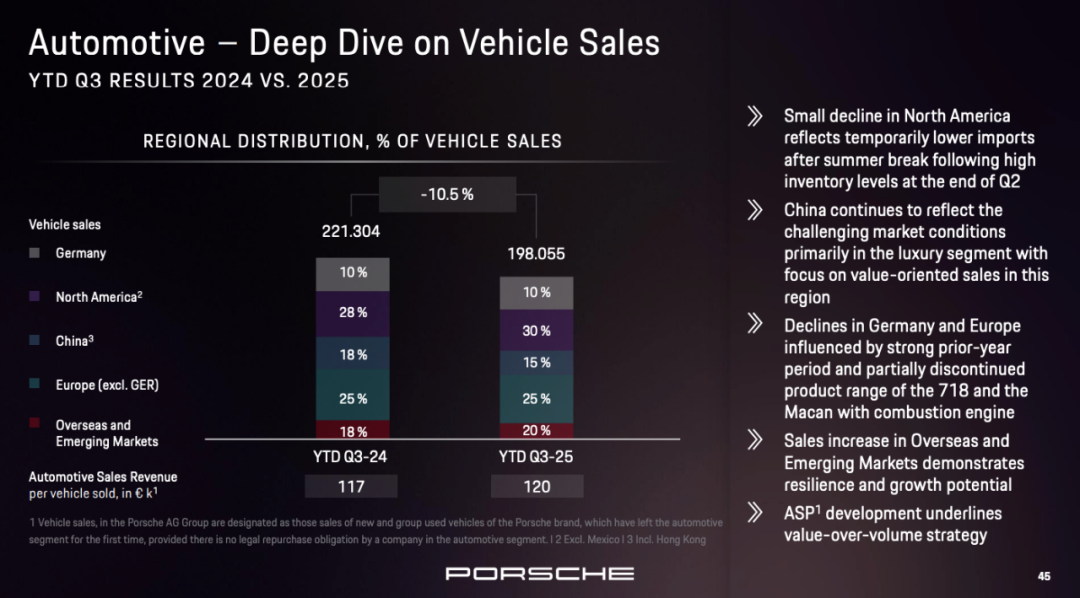

Now, let's delve into Porsche's sales data for the first three quarters of 2025 across several major markets:

- North America: Remains Porsche's primary sales market, with 30% of sales coming from the region in the first three quarters of 2025. Moreover, deliveries increased by 5% year-on-year to 64,400 units.

- Chinese Market: The sales share in the Chinese market decreased from 24% to 19%. Sales in China for the first three quarters were 32,200 units, a year-on-year decrease of approximately one-fourth.

- Other Overseas Markets: Furthermore, Porsche's market share in other overseas markets, excluding its main markets, has increased, highlighting pressure in the main markets and a focus on cultivating new overseas markets.

Overall, the Chinese market has had the most profound impact on Porsche's vehicle sales.

Behind the Scenes: The Chinese market is in decline, and there is no viable market for high-end electric vehicles.

China was once Porsche's top market but is currently experiencing a severe downturn. Of course, the luxury car market is not just Porsche; European luxury cars like Land Rover are also facing a downturn. Accurately speaking, the collapse of China's luxury market has significantly hit demand.

In addition, models like Huawei's Luxeed and BYD's Yangwang are redefining luxury and sportiness in a different way, compelling Porsche to implement a 'value-oriented sales' strategy in China.

The existence of a high-end market for electric vehicles is also questionable.

While there is demand for electric vehicles in the Chinese market, consumers in the luxury high-end market where Porsche operates are not flocking to purchase top-tier electric vehicles. The penetration rate of high-end electric vehicles (a niche market exclusive to BEVs) has been slower than initially anticipated.

Finally, although Porsche's overall sales volume and turnover have only decreased slightly (around -6%), the models that are actually selling well tend to have lower profit margins, while sales of high-end, high-performance models that typically generate the highest profits have declined.

In the end, Porsche has no production base in the United States and is therefore particularly vulnerable to tariffs. The current U.S. tariff rate is 15%, compared to the previous 2.5% tariff on passenger vehicles from Europe to the United States, thus negatively impacting Porsche's operating profit.

In Conclusion

Perhaps, the era of consumers has changed, and those who once adored Porsche have aged. Porsche's mechanical high-performance sports cars have become akin to luxury watches like Patek Philippe, Rolex, and IWC in the automotive industry.

Alternatively, the era of the automotive industry has also undergone a transformation. With the end of global division of labor, the era when commodities like automobiles, which have a significant impact on regional economies, could achieve high sales and profits through imports alone has come to an end.

Nevertheless, Porsche's strategic shift is commendable, as the company is seeking new opportunities to redefine the luxury high-performance automotive market.

Reference Articles and Images

Porsche 2025 Q3 Financial Report PPT - Porsche

*Unauthorized reproduction and excerpting are strictly prohibited-*