Countdown to Purchase Tax Exemption for New Energy Vehicles: The Final Stretch!

![]() 10/27 2025

10/27 2025

![]() 648

648

Which car manufacturer provides the most robust warranty?

The policy granting new energy vehicles (NEVs) an exemption from purchase tax, initiated in September 2014 and extended multiple times, is now nearing its conclusion.

On October 9, the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Taxation Administration jointly issued the "Announcement on Technical Requirements for New Energy Vehicles Eligible for Purchase Tax Reductions and Exemptions from 2026 to 2027" (hereinafter referred to as the "Announcement"). This announcement adjusts the technical criteria for battery electric passenger vehicles and plug-in (including extended-range) hybrid passenger vehicles.

The essence of the "Announcement" is to elevate the technical benchmarks for NEV purchase tax reductions and exemptions in the upcoming year. However, significant attention and discourse have centered around another announcement released as early as June 2023, which stated that "NEVs purchased between January 1, 2026, and December 31, 2027, will see a 50% reduction in vehicle purchase tax."

Consumers have swiftly realized that in just over two months, the NEV purchase tax will transition from "exemption" to a "50% reduction," with the tax exemption cap per NEV passenger vehicle dropping from "no more than 30,000 yuan" to "no more than 15,000 yuan in tax reductions per vehicle."

The potential price difference of up to 15,000 yuan due to the shift from "exemption" to "reduction," coupled with the fourth quarter being a pivotal period for achieving annual sales targets, has reignited a "warranty battle" among automakers. In this battle, automakers are "covering the cost difference for users caused by the reduction in purchase tax incentives."

Industry data suggests that purchase tax reductions alone could propel year-on-year NEV sales growth in the fourth quarter to exceed 50%. Meanwhile, beyond guaranteeing purchase tax differences, some automakers are swiftly introducing limited-time price protections, delivery commitments, and other marketing strategies to further incentivize consumers to place orders promptly.

The sense of urgency extends beyond consumers. Previously, multiple companies announced through various channels that they would achieve profitability in the fourth quarter of this year. New energy vehicle startups are nearing a profitability turning point this year, further amplifying the uncertainty surrounding automakers' participation in this "warranty battle," with market competition intensifying even more.

The "Warranty Battle"

The news that the NEV purchase tax exemption policy, in effect for over a decade, will conclude in 2025 is not novel. However, prior to this, market attention was largely consumed by ever-evolving price wars, technological advancements in intelligent driving, and breakthroughs in driving range, causing this information to be largely overlooked until the "Announcement" was released.

On June 19, 2023, the Ministry of Finance, the State Taxation Administration, and the Ministry of Industry and Information Technology issued the "Announcement on the Continuation and Optimization of Purchase Tax Reduction and Exemption Policies for New Energy Vehicles." This explicitly stated that "NEVs purchased between January 1, 2026, and December 31, 2027, will be subject to a 50% reduction in vehicle purchase tax, with tax reductions per NEV passenger vehicle not exceeding 15,000 yuan." It also clarified that "the purchase date will be determined based on the issuance date of valid documents such as the unified invoice for motor vehicle sales or the customs duty payment certificate."

Now, with just over two months remaining until the implementation of the aforementioned announcement, local consumer subsidies for NEVs are also being phased out, with many regions adopting "limited quota, first-come, first-served" subsidy policies.

Under the combined influence of multiple factors, experts predict a surge in advanced consumption in the NEV market during the fourth quarter.

The battle for the terminal market has already commenced: some brands have announced warranty subsidy schemes for their new or popular models before and after the National Day holiday.

On September 21, NIO unveiled the "All-New ES8 Secure Ordering Scheme": orders for the all-new NIO ES8 completed by December 31, 2025 (inclusive), will receive one purchase tax difference subsidy coupon per order. If, due to NIO's reasons, orders placed in 2025 require invoicing and delivery in 2026, users can utilize the subsidy coupon to offset the vehicle price (up to 15,000 yuan).

Image source: NIO

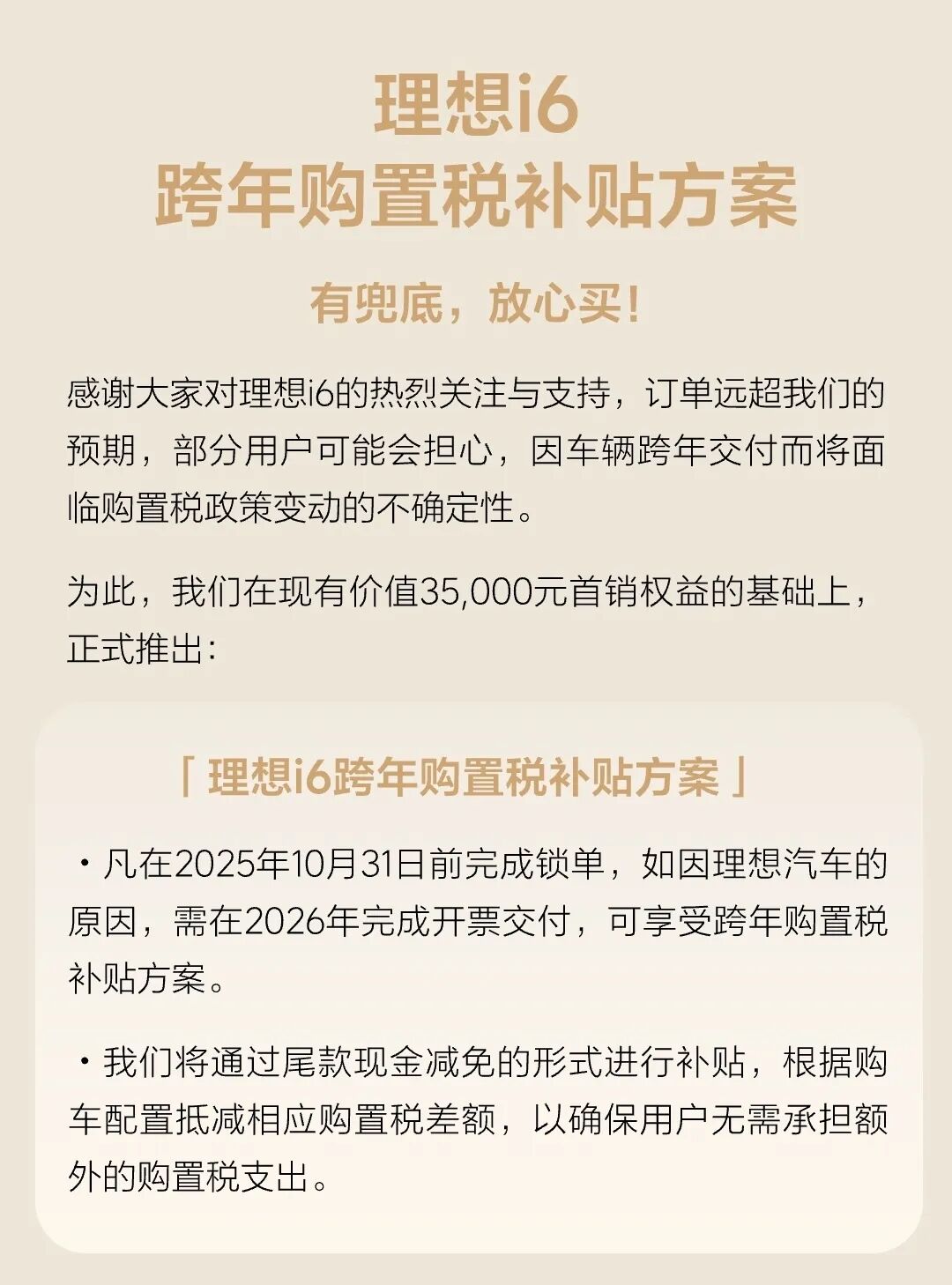

On September 30, Li Auto introduced the "Li L6 Cross-Year Purchase Tax Subsidy Scheme": for orders completed by October 31, 2025, if, due to Li Auto's reasons, invoicing and delivery are required in 2026, users can benefit from the cross-year purchase tax subsidy scheme. Subsidies will be provided as cash reductions from the final payment, with the purchase tax difference offset according to the vehicle configuration.

Image source: Li Auto

IM Motors followed suit on October 2, launching the "All-New Generation IM LS6 Cross-Year Purchase Tax Subsidy Scheme": for orders completed by October 15, 2025 (inclusive), if, due to IM Motors' reasons, invoicing and delivery are required in 2026, users can avail of the cross-year purchase tax subsidy scheme, with subsidies up to 15,000 yuan.

Additionally, Zeekr announced that it will provide purchase tax difference subsidies of up to 15,000 yuan for Zeekr 9X users who place orders before October 31 and cannot be invoiced in 2025. Huawei's AITO M7 and Luxgen S800 have also introduced similar subsidy schemes, both offering subsidies of up to 15,000 yuan for orders placed before November 3, with options for cash subsidies or final payment deductions.

Clearly, regarding this "warranty battle" over purchase tax subsidies, both new energy brands and traditional automakers exhibit significantly less enthusiasm compared to their collective participation in the previous price war, which lasted over two years. More brands are opting to adopt a wait-and-see approach during this critical fourth quarter, which marks a profitability turning point for new energy brands. Especially since next year, automakers will confront not only the issue of consumer purchasing expenditure differences due to purchase tax policy changes but also higher technical thresholds following policy adjustments.

Technological Upgrades

The most notable alterations in the "Announcement" encompass not only the adjustment of the pure electric driving range requirement for plug-in (including extended-range) hybrid passenger vehicles from the previous 43 kilometers to no less than 100 kilometers under conditional equivalent all-electric range but also the automatic transfer of models already listed in the "Tax Reduction and Exemption Catalog" by December 31, 2025, and meeting the technical requirements of this announcement to the 2026 Phase 1 "Tax Reduction and Exemption Catalog." Models failing to meet the requirements will be removed from the "Tax Reduction and Exemption Catalog."

From the industry's perspective, this adjustment imposes stricter energy consumption requirements on certain models subject to a 50% purchase tax reduction starting January 1, 2026, aiding in the elimination of outdated production capacity and fostering overall technological advancements in NEVs.

Taking plug-in hybrid models as an illustration, the threshold for their pure electric driving range has been substantially raised from 43 kilometers to 100 kilometers. The most affected are models priced below 100,000 yuan that have been on the market for several years and still dominate mainstream sales. Several top-selling models on the market feature low-end versions or even entire lineups with pure electric ranges concentrated between 43 and 90 kilometers. This implies that while other NEVs grapple with the potential 15,000 yuan increase in purchasing costs due to changes in the purchase tax exemption policy in just over two months, these models will directly forfeit their purchase tax exemption eligibility due to technical shortcomings.

Consequently, some analysts believe that to mitigate pressure and the impact of purchase tax policy changes, some plug-in hybrid models with pure electric ranges below 100 kilometers will witness a wave of price reductions and promotions in the near future.

In recent years, plug-in hybrids have emerged as one of the mainstream powertrains in the NEV market. Data from the China Passenger Car Association reveals that from January to September, plug-in hybrid models accounted for approximately 28% of total NEV sales. Multiple automaker executives have stated that in the future, pure fuel vehicles, hybrid vehicles, and battery electric vehicles will form a tripartite balance. Plug-in hybrids dominate the hybrid vehicle segment, especially in recent years, transitioning from initially relying on mid-to-low-end models for volume to now "blooming" across all price ranges.

Cui Dongshu, Secretary-General of the China Passenger Car Association, stated that China's plug-in hybrid technology has undergone three generations of evolution, progressing from the initial "fuel-to-electric" conversion stage to the "native hybrid" era. The first generation of plug-in hybrids (2010-2015) aimed to "meet policy requirements," with pure electric ranges below 50 kilometers and jerky power switching. The second generation (2016-2020) achieved "performance breakthroughs," surpassing fuel-powered performance cars in the same price range. The third generation (2021-present) has entered the "experience revolution."

According to his statistics, in the plug-in hybrid segment, models with pure electric ranges below 100 kilometers accounted for over 70% in 2020. By the first three quarters of 2025, this proportion had dwindled to 26%. The primary development interval for models has concentrated between 100 and 200 kilometers, accounting for approximately 64%. In the extended-range vehicle segment, all models had pure electric ranges concentrated between 100 and 149 kilometers in 2020. By the first three quarters of 2025, this range had shifted to 150-299 kilometers, accounting for a substantial 86%.

The technological upgrade requirements in the new NEV purchase tax exemption policy also signify that the plug-in hybrid market will undergo a new round of "evolution." After all, for automakers, plug-in hybrid models priced below 100,000 yuan rely on thin margins and high volumes, lacking robust profitability. In 2026, under the new purchase tax exemption technical requirements, automakers face a dilemma: whether to decide on the "retention or discontinuation" of models based on market response or to swiftly complete technological upgrades and refresh the models amid the trend of cost reduction.

Besides the upgrade in pure electric range requirements, the criteria for plug-in hybrids also encompass fuel consumption under battery charge-sustaining mode needing to be below 70% or 75% of the limit for fuel vehicles in the same class. For plug-in hybrid models above 2,510 kilograms in curb weight, their electricity consumption must not exceed 1.45 times the corresponding limit for battery electric vehicles in the same class, while those below 2,510 kilograms must not exceed 1.4 times.

Currently, among plug-in hybrid models on sale weighing over 2,510 kilograms this year, 47% do not meet the standards. Even among lighter plug-in hybrid models weighing below 2,510 kilograms, 10% fail to comply with the requirements.

This indicates that under the elevation of multiple standards, plug-in hybrid models will necessitate enhancements in battery capacity, electric drive system efficiency, and engine thermal efficiency next year to continue enjoying purchase tax incentives. Clearly, the timeframe for automakers to adjust and implement is quite constrained.

With the continuous raising of policy regulatory thresholds, the NEV industry is undergoing a systemic upgrade from quantitative to qualitative change, with more technologically backward models being phased out. Companies are also navigating through this round of survival of the fittest.

This article is original to China NEVs. Feel free to share it with your peers. For media reprints, please credit the author and source at the beginning of the article. Any media or self-media creating video or audio scripts based on this article's content will be held legally responsible.