When Did Porsche Start to Lose Its Allure?

![]() 10/27 2025

10/27 2025

![]() 442

442

In the wake of the new era's tide, Porsche's business model finds itself marooned on the shores of obsolescence.

A few days ago, Porsche unveiled its third-quarter financial report, revealing a stark downturn in performance that even caught the attention of CCTV.

Porsche's losses in the third quarter alone soared to a staggering €966 million (approximately RMB 8 billion), with a staggering 99% year-on-year plunge in sales profit for the first nine months of this year. From €4 billion last year, it tumbled to a mere €40 million, a decline that left many in awe.

Meanwhile, Porsche's gross profit margin per vehicle for the quarter dipped to a record low of 13.2% this year, while Tesla's soared to 15.4%, marking the first time Tesla's margin has eclipsed Porsche's.

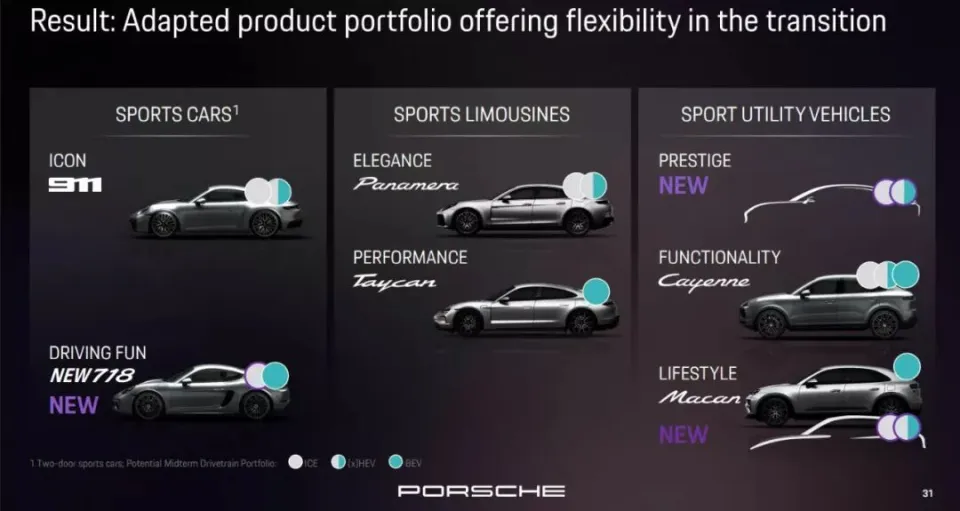

During the post-financial report conference call, Porsche announced the impending discontinuation of its fuel-powered Macan, 718 Boxster, and Cayman models. Last year, due to non-compliance with the EU's new cybersecurity regulations, Porsche halted production of the Macan and Boxster in the European market. Officials cited the prohibitively high cost of upgrading vehicle systems to meet current standards as the reason for abandoning the updates. Following the discontinuation of the fuel-powered Macan, Porsche will pivot to producing the electric Macan.

Officials stated that the Macan will remain on sale until 2026, with some markets extending availability until 2027. This seemingly gradual transition is, in reality, a strategic move to pave the way for the electric Macan.

In addition to product strategy adjustments, Porsche is also implementing a series of measures to extricate itself from its current operational quagmire.

Prior to this, Porsche had already announced a layoff plan, aiming to cut 1,900 jobs by 2029. During this financial report meeting, Porsche also disclosed that it had initiated a new round of consultations between management and employee representatives in October, with the company pledging to promptly inform the public of the discussion outcomes after the confidential talks conclude.

Porsche's current predicament can be largely attributed to its collapse in the Chinese market. From 2022 to 2024, Porsche's sales in China plummeted to 93,300, 79,300, and 56,900 units, respectively. In contrast, in 2021, Porsche sold 95,700 units in China. Even amidst a backdrop of consumption downgrade, the affluent's enthusiasm for Porsche remained undiminished.

However, since 2021, Porsche's fortunes in China have taken a nosedive. The electrification and intelligentization wave proved too formidable for even Porsche to withstand. Ironically, Xiaomi's debut car model bore several design resemblances to Porsche but was priced 75% cheaper and boasted technological features and Xiaomi's digital ecosystem.

Chinese buyers flocked to it, viewing it as an electric, intelligent, and affordable alternative to Porsche. To some extent, Xiaomi has accomplished a significant portion of Porsche's electrification transformation in the Chinese market.

Against this backdrop, Porsche's sales in China for the first nine months of this year dwindled to a mere 32,195 units, a 26% year-on-year decline. Currently, China's market share has dwindled to just 15% of its global sales. It's worth noting that China was once Porsche's largest global market, accounting for one in every three vehicles sold worldwide, with nearly a quarter of the car price being profit.

The Chinese market, which once contributed nearly 40% of Porsche's profits, witnessed a sharp 26% drop in deliveries, with a 21% decline in the third quarter alone. The German domestic market declined by 16%, while Europe also saw a slight 4% decrease.

The only silver lining in terms of terminal performance came from the North American market, with a 5% increase in deliveries. However, for Porsche, this sole growing market in North America is not as rosy as it appears.

Porsche stated that in the first nine months of this year, the new tariff policies of the Trump administration imposed an additional cost of €300 million. According to a Reuters report, Jochen Breckner, Porsche's Executive Director of Finance and Information Technology, said that the US tariff policies would result in a loss of approximately €700 million for Porsche this year, and the company plans to raise prices in the US market in the coming months.

Porsche is navigating through its most severe dark moment, both in the Chinese and global markets.

Just a few days before the release of the third-quarter financial report, the Supervisory Board of Porsche AG announced the appointment of Michael Leiters as the new CEO of Porsche, effective January 1, 2026. The current CEO, Oliver Blume, will continue to serve as the full-time CEO of the Volkswagen Group after stepping down at the end of the year.

This decision marks the end of Oliver Blume's dual role of leading both the Volkswagen Group and Porsche simultaneously.

Oliver Blume has served as Porsche's CEO since October 2015 and, after succeeding Herbert Diess as the head of the Volkswagen Group in September 2022, embarked on a "dual CEO" model, leading both automotive giants. This model has been a subject of controversy for the past three years. Investors and unions were concerned that overlapping responsibilities would divert attention and hinder Porsche's strategic decision-making efficiency.

Finally, in the face of a financial report so dismal that investors could no longer tolerate it, the CEO was replaced. Just a month before Oliver Blume was replaced, he announced a significant strategic adjustment - investing €1.8 billion to redevelop internal combustion engine products, compromising on the pure electric route.

This decision to temporarily halt the electrification transformation sparked significant controversy within the industry. Some analysts directly stated that "this step came too late and wasted a lot of time," while others believed it could potentially save Porsche from peril.

However, such new policies are not viewed favorably by the new CEO. Michael Leiters, the new CEO, is a Porsche veteran who spent 13 years in Porsche's product development department from 2000 to 2013, overseeing the development of Porsche's two main products, the Macan and Cayenne series.

After leaving Porsche, Leiters served as Ferrari's Chief Technical Officer for over eight years before becoming the CEO of McLaren Automotive. During his tenure at Ferrari, Leiters led the development of hybrid supercars such as the SF90 Stradale and 296 GTB.

For this technical CEO, "hybrid supercars" may be his forte. This once again casts uncertainty over Porsche's future technological route.

A month ago, Porsche just announced a temporary halt to electrification, only to have its CEO replaced in the blink of an eye and a technical management team specializing in hybrids take over. This forces the outside world to re-examine Porsche, as reverting to fuel power, to some extent, means abandoning the Chinese market.

The appointment of new CEO Leiters implies that Porsche may re-launch a new electrification offensive. After all, China was the earliest main battlefield to embrace electrification.

From a strategic perspective, in the eyes of traditional automotive giants worldwide, electrification is not just an environmental issue but also a technological siege to maintain their century-old monopoly.

However, on a global scale, thanks to the efforts of Tesla and Chinese new energy vehicle enterprises, electrification, to some extent, represents a shift in the supply chain and profit center.

Tesla utilizes software subscriptions to capture gross profit, while Xiaomi leverages its ecosystem to create a closed loop. Meanwhile, Porsche still relies on optional features and leather packages for its revenue. In the face of the new era's tide, Porsche's business model finds itself marooned on the shores of obsolescence.

In the past, Porsche defined luxury, driving, and the travel style of the domestic middle class. This brand hierarchy is gradually crumbling with Porsche's decline. In the new energy era, the new definition of luxury is no longer the roar of the engine but instead intelligent driving without perception, a healing cabin experience, and seamless interaction...

From 2021 to 2026, these five years have witnessed Porsche lose its initiative. The past cannot be undone, and even with a new CEO, catching up may not be so straightforward.

Note: Some images are sourced from the internet. If there is any infringement, please contact for deletion. -END-