Costs $0.1 per mile! Will Cybercab be Musk's Empty Promise?

![]() 10/28 2025

10/28 2025

![]() 473

473

Steering wheel-free self-driving seems even harder to implement.

In October of last year, Musk made an impressive 'promise' at the 'WE, ROBOT' launch event: two self-driving cars and robots not only showed no signs of mass production, but their commercialization also seemed distant.

No one overestimates Musk's ability to 'make promises,' but you cannot underestimate the financial resources behind him.

During Tesla's third-quarter earnings call, he officially stated, 'The biggest source of capacity expansion will be Cybercab, which will start production in the second quarter of next year.' Now, Tesla has already begun real vehicle testing and safety evaluations on the Fremont test track, accelerating project implementation with practical actions.

However, doubts have arisen: Can the current level of self-driving technology truly support the mass production and operation of Cybercab? It's important to note that this new car lacks all manual control devices such as rearview mirrors, steering wheels, joysticks, and pedals. It is a 'zero-intervention' model purely designed for self-driving.

Image source: Weibo @Tesla

Perhaps driven by the $1 trillion compensation package, Musk is starting to make moves. However, it's crucial to remain sober (the intended meaning here is likely 'sober' or 'realistic,' though ' sober ' is kept as per instruction for HTML content preservation) that Musk is not infallible. Take Tesla's electric pickup Cybertruck, for example, which only sold 20,000 units annually, far below expectations. Moreover, the later-introduced entry-level version was hastily discontinued after just five months.

This raises a profound question: Will Tesla's Cybercab lead the industry trend or become yet another 'cannon fodder'?

Steering wheel-free self-driving seems even harder to implement

Musk's vision for Tesla's Cybercab extends far beyond self-driving. In his envisioning, when people own multiple Cybercabs, they can share their idle vehicles with ride-hailing platforms to operate fleets. Through a shared model that combines 'ride-sharing and online car-hailing,' vehicles can 'earn money on their own.' Unfortunately, this beautiful vision of 'letting assets generate income automatically' has not yet been realized.

The core prerequisite for all these visions is the commercialization of Tesla's 'Fully Self-Driving (FSD) Capability.'

Ashok Elluswamy, Tesla's Vice President of AI Software, revealed that Tesla's Robotaxi fleets in Austin and San Francisco have accumulated over 250,000 miles and 1 million miles of driving, respectively. Combined with real-world FSD experience data from global private users, its intelligent driving system has amassed a vast database of real-world driving conditions.

From a data perspective, it seems to have the basic conditions to support the launch of Cybercab. However, the actual progress remains slow.

Image source: Weibo @Tesla

Currently, Tesla's Robotaxis deployed in Austin and San Francisco all require safety monitors. In Austin, the safety monitor sits in the passenger seat, while in San Francisco, they sit in the driver's seat. Their primary role is to operate the emergency shutdown device at any time to respond to unexpected situations. In contrast, Waymo and China's 'Apollo Go' have already achieved true driverless operations.

However, this situation may change soon. Recently, Musk announced that Tesla's Robotaxi is expected to commence operations in Arizona, Nevada, and Florida before the end of this year. Moreover, most areas in Austin will no longer require safety drivers for Robotaxis.

This contrast between a 'steering wheel-free design yet reliant on human supervision' highlights that FSD has not yet reached a self-sufficient level. Even with a clear implementation plan, Tesla's FSD technology faces skepticism regarding its stability and safety.

According to Forbes, Tesla's Robotaxi has been involved in multiple accidents during testing in Austin, including rear-end collisions, being rear-ended, and scrapes, exposing safety shortcomings in the existing technology.

The core logic for the safe operation of self-driving technology can be simplified into two points: First, the ability to detect the surrounding environment must be sufficiently accurate. Second, there must be a rich database of real-world driving conditions to optimize the system.

Tesla remains steadfast in adopting a 'pure vision approach,' relying solely on cameras to collect visual information. This technical path inherently limits the vehicle's environmental detection capabilities. For instance, visual recognition deviations caused by obstructions in extreme weather conditions like heavy rain or fog, as well as challenges in detecting pedestrians crossing the road or large obstacles falling onto the roadway, may lead to anticipated functional safety issues.

While Tesla's Robotaxi equipped with FSD has the 'fallback' option of human intervention, the Tesla Cybercab, which lacks any control interfaces, must possess 100% autonomous processing capabilities.

Therefore, this requires Tesla's Cybercab to continuously optimize its algorithms with massive amounts of data. In other words, its technological maturity still requires a lengthy verification period to ensure that the algorithms can make correct decisions in various complex situations.

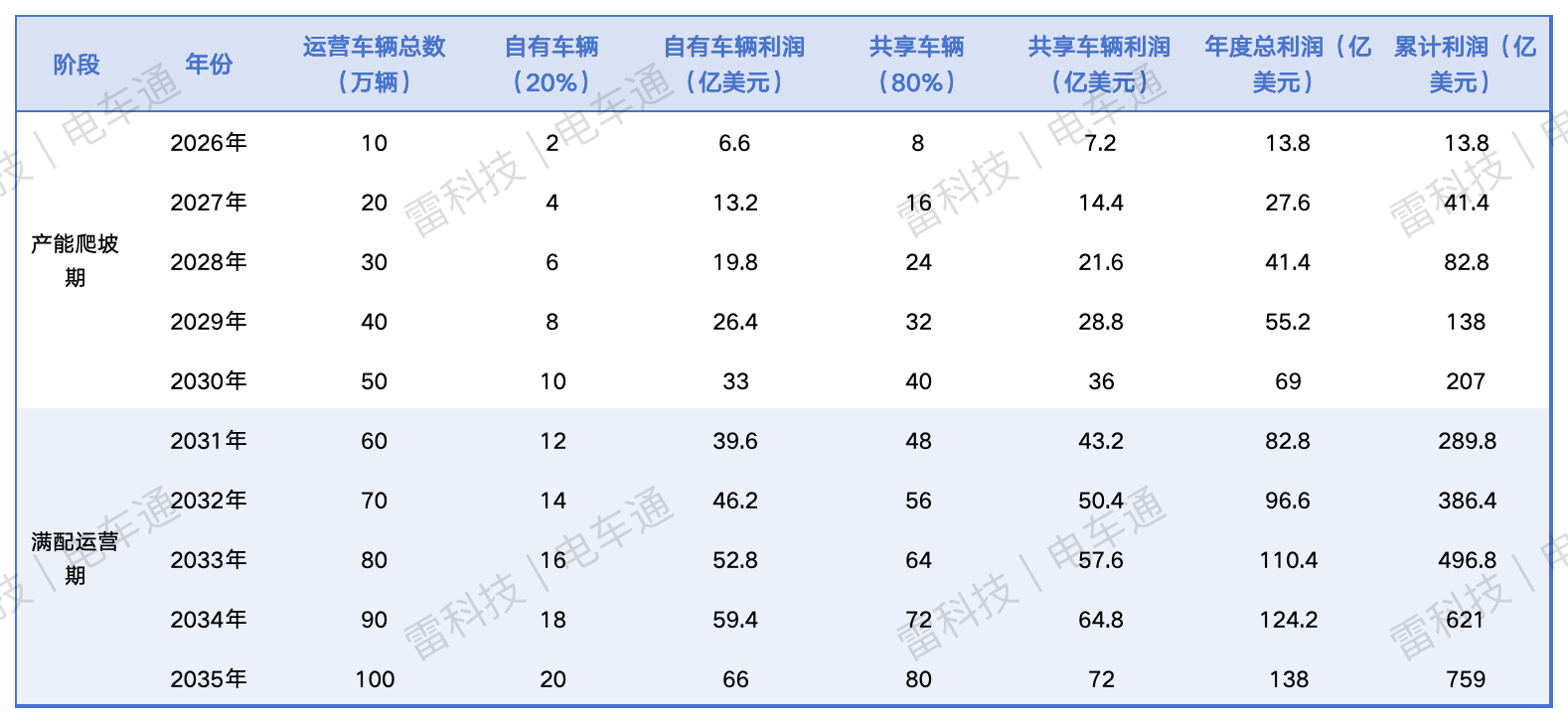

To ensure vehicles can reach their destinations smoothly, Tesla also plans to introduce virtual reality (VR) technology to support remote human intervention. The official job posting mentions that Tesla needs 'remote operators' who will use advanced VR devices to 'transport' themselves into the vehicle's environment and remotely execute complex and delicate tasks.

Image source: Tesla's official website

VR remote intervention technology serves as Tesla's fallback plan for Cybercab. However, the official has never publicly disclosed response latency data or stability performance under extreme conditions. In the field of self-driving, a millisecond of delay can mean the difference between life and death.

The absence of these core data points makes this safeguard seem more like an 'empty promise.'

Every step forward for Cybercab is a practical test of 'steering wheel-free self-driving.' The goal of 'commencing production in the second quarter of next year' merely addresses the question of 'whether it can be manufactured.' However, mass production is a systematic project that involves 'whether it can be manufactured stably and cost-effectively in large quantities.' Behind this lies multiple unresolved challenges.

Even Waymo has not dared to easily abandon control interfaces, yet Tesla has set a production timeline for Cybercab. Rather than being a 'game-changing breakthrough' for the industry, it seems more like an attention-grabbing 'technological gimmick.'

$0.1 per mile! Tesla's Cybercab Aggressively Pursues Low Costs

Of course, technological immaturity does not mean it is not a future trend. However, cost has always been a critical factor constraining industry development and service popularization.

Musk anticipates that the cost of Tesla's Cybercab self-driving taxi will be below $30,000, with costs dropping to around $0.1 per mile. In contrast, current transportation costs are approximately $1 per mile, while Waymo's costs remain as high as $3-5 per mile, 30-50 times Musk's target.

Looking at domestic players, Baidu's 'Apollo Go' pricing logic is similar to that of ride-hailing services, including a base fare, time fee, and distance fee. However, in scenarios without subsidies, its prices are about 40% higher than those of regular ride-hailing services, lacking a clear cost advantage.

Image source: Apollo Go

If Tesla can deliver on its cost advantage, it will directly create an 'affordable than buses, convenient than ride-hailing' ultimate (translated as 'ultimate' to convey the intended meaning of superiority) cost-effectiveness, fundamentally rewriting the pricing rules of the mobility market. For price-sensitive commuters, choosing Cybercab may cost only 1/20th of current ride-hailing services, providing sufficient advantage to quickly capture mainstream market share.

Clearly, the cost target of $0.1 per mile is the 'golden key' for Cybercab to unlock the commercialization of Robotaxi. To transform this ultimate (ultimate) cost advantage into actual profitability, 'scaled operations' are essential.

Based on Tesla's $1 trillion compensation package, one of Musk's core performance indicators is to 'achieve commercial operation of 1 million Robotaxis within the next decade.'

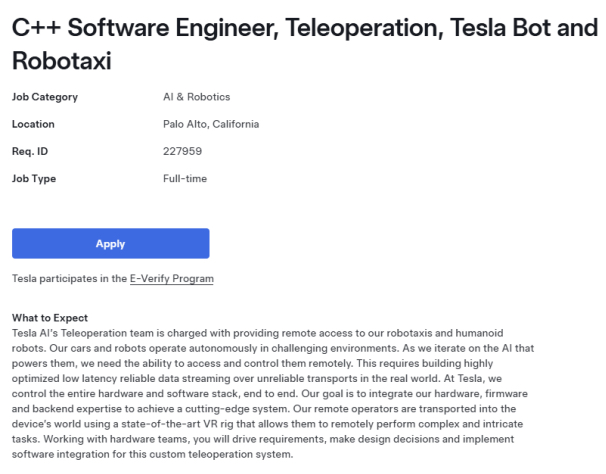

To balance scale and profitability, Tesla has planned a 'company-owned fleet + individual owner sharing' asset-light model, taking a 20%-50% commission from individual owners who connect their vehicles to the Robotaxi network. Assuming industry-neutral conditions (20% company-owned fleet, 80% individual shared fleet, 30% commission rate, 100,000 annual new vehicles), each $33,000 Cybercab can contribute approximately $9,000 in annual profit (based on a $33,000 per vehicle base profit estimate).

Based on the aforementioned parameters, Dianchetong (an AI model) estimates that 1 million Robotaxis can accumulate a total net profit of $75.9 billion over ten years.

Data source: Doubao | Chart: Dianchetong

In other words, compared to traditional automakers and self-driving companies, Tesla's valuation will rely more on stable long-term cash flows rather than short-term vehicle sales and service fees, thereby obtaining a higher valuation premium.

However, from the essence of industry development, Robotaxi is not a niche 'technological showcase' but a livelihood services (public service) that will eventually serve the general public. At this stage, this transformation has entered a 'cost race' phase: Waymo continues to reduce hardware costs by simplifying its LiDAR solutions, while Baidu dilution (dilutes) marginal costs by optimizing fleet scheduling and operational efficiency. Industry players are all sprinting full throttle on the 'cost reduction' track.

Tesla's aggressiveness lies in bringing the industry's 'implicit goals' to the forefront, materializing the 'implicit cost reduction target' pursued by all into a clear numerical value of $0.1 per mile. It directly sets the ultimate finish line for this cost competition. However, due to technological and policy constraints, a low-cost future is not easily attainable.

Will Cybercab Become Another 'Musk's Empty Promise?'

Tesla's Cybercab is breaking through the industry boundaries of taxis and ride-hailing services, reconstructing the logic of mobility through a 'company-owned + shared' model. However, whether it can avoid the fate of becoming 'cannon fodder' after a 'conceptual frenzy' depends not only on technological implementation progress and policy entry barriers but also on Musk's own 'trust assets,' which are a critical variable determining its destiny.

To date, Musk has accumulated a significant 'trust deficit' due to multiple missed technological targets, such as the FSD iteration progress falling short of expectations and prices of several products being higher than initially stated.

Repeated instances of 'empty promises' have left many consumers deeply skeptical about the technological reliability, cost target feasibility, and ultimate implementation capability of Cybercab.

Consumers, having been tested multiple times, have developed increasing immunity to 'Musk-style promises.' If Tesla's Cybercab fails to meet its targets again, market patience may be completely exhausted.

Rather than empty talk about the 'cost myth of $0.1 per mile,' Tesla should first disclose real-world test data of FSD in complex scenarios instead of using aggressive slogans to attract traffic.

(Cover image source: Weibo @Tesla)