Down Again! Musk's 'High-Stakes Gamble' and Tesla's Future

![]() 10/28 2025

10/28 2025

![]() 485

485

Written by | Guanchejun

In the third quarter of 2025, Tesla once again dropped a 'paradoxical bombshell' on the market.

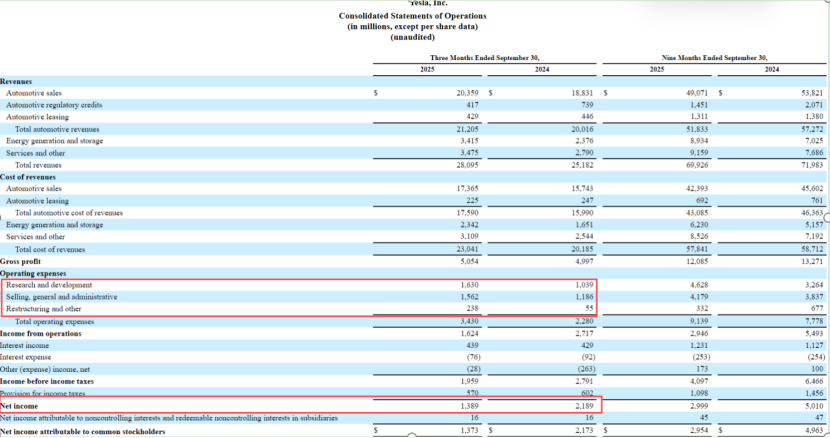

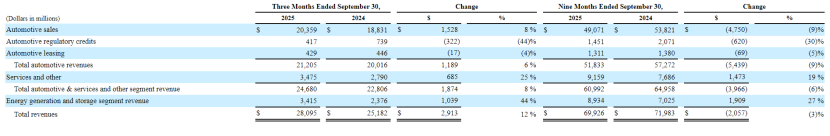

The net profit in the financial report took a nosedive, plummeting by 36.5% year-on-year. However, the total revenue, along with revenue from automotive, energy storage, and service sectors, all surpassed expectations. Moreover, the gross profit margin hit a new four-quarter high.

The stock price also began to slide, not due to poor performance but because investors were skeptical: How long can this radiance last? Isn't the profitability declining way too fast?

Upon deeper analysis, Guanchejun discovered that this seemingly contradictory financial report conceals a long-planned strategic transformation by Tesla. Musk is sacrificing short-term profits to secure long-term rights for ecological construction.

If this high-stakes gamble pays off, Tesla will break free from the automotive industry's shackles and emerge as a tech behemoth in the AI era. If it fails, however, it could become a cautionary tale of overexpansion.

01 Financial Report Breakdown: Strategic Shift Lurking Behind the Data

In the third quarter, Tesla delivered 497,000 vehicles, marking a 7% year-on-year increase. Yet, automotive revenue only rose by 6%, failing to keep pace with the delivery volume or even the total revenue growth rate.

This signal is crystal clear: the high-growth phase of the automotive business has essentially peaked, and relying solely on vehicle sales for further expansion will be challenging.

But there's a silver lining: revenue from the energy storage business soared by 44% year-on-year, while service revenue climbed by 25%, becoming Tesla's 'new growth engines'.

To put it simply, this isn't a bad scenario. Tesla no longer has to put all its eggs in the automotive basket. Its business diversity has improved, enhancing its risk resilience compared to the past.

The real worry, however, is profitability, which remains Tesla's Achilles' heel. The operating profit margin in the third quarter was 5.8%, down from 10.8% in the same period last year, nearly halving. Net profit dropped by 37%. The figures speak volumes.

Why the profit decline? There are two primary reasons:

R&D spending remains relentless. AI and humanoid robots, the 'future projects', are receiving massive investments from Musk, driving up operating expenses. Low prices are used to capture the market. The introduction of cheaper Model 3/Y Standard versions has squeezed per-vehicle profit margins.

02 Strategic Decoding: Tesla's Triple Strategy

But don't mistake Musk for being foolish. In Guanchejun's opinion, this is an open 'high-stakes gamble' with three main layers.

First: Sacrificing current profits for user base expansion. Customers acquired through affordable vehicles will become the 'fertile ground' for software services and autonomous driving in the future. He even pledged to reach an annual production capacity of 3 million vehicles within the next 24 months. How ambitious is this goal? Based on Q3's 497,000 deliveries, Tesla's current annualized capacity is around 2 million vehicles. Reaching 3 million means adding approximately 1 million in annual capacity over the next two years.

Second: The 'pillarization' of the energy business. The energy business is transitioning from a 'secondary operation' to a 'core pillar'. Tesla Energy's rise signifies the company's formal entry into the trillion-dollar energy infrastructure market.

Third: The 'futurization' of AI and robotics. Ultimately, Tesla's real 'ace in the hole' has never been electric vehicles but Musk's bet on the 'autonomous driving + humanoid robot' combination. If successful, it will be a 'profit cow'; if not, it will be a money pit.

03 Crisis or Opportunity?

Returning to the initial question: Is Tesla's current decline a 'crisis' or an 'opportunity'? Essentially, the market's divergence reflects a clash between 'short-term' and 'long-term' perspectives.

If focusing solely on quarterly profits, Tesla is indeed on a downward slope. However, if considering business structure, R&D investment, and future layout, Tesla is actually transforming from an 'automotive company' to an 'AI tech company'.

Just like in 2018, when Tesla was on the brink of bankruptcy, and its stock price plummeted to $17, few believed it could produce the Model 3 or build the Shanghai factory. But a decade later, investors who bought the dip saw their returns multiply 20-fold. Nevertheless, this is still a gamble; no one knows if Tesla can successfully transform, as it requires not just Musk and Tesla's efforts but also favorable timing, location, and human factors.

Nevertheless, Tesla's transformation represents a brand-new manufacturing paradigm:

1. From products to ecosystems

Traditional manufacturing halts at product sales; new-era manufacturing commences with user acquisition. Tesla establishes user connections through hardware and realizes sustained value creation through software and services.

2. From hardware to hardware-software integration

Pure hardware differentiation is unsustainable; hardware-software integration has become a core competitive edge. FSD is not just a feature but the 'brain' of the entire product ecosystem.

3. From enterprise to platform

Tesla is evolving from a manufacturing company into a technology platform, potentially opening its autonomous driving technology or energy solutions to other manufacturers in the future.

The outcome of this high-stakes gamble will not only determine the fate of one company but also shape the industrial landscape of the intelligent electric era.

Charts in this article without specified sources are publicly disclosed through various channels. We hereby acknowledge and express our gratitude.

This article is original to Leverage Auto Insights and is prohibited from being reprinted without authorization. For reprinting, please obtain authorization. Additionally, when reprinting with authorization, please indicate the source and author at the beginning of the article. Thank you!