Massive Shifts in the October Auto Market! New Energy Vehicles Soar, Yet Fuel Vehicles Stage a Comeback?

![]() 11/13 2025

11/13 2025

![]() 688

688

Authored by | Guanchejun

The auto market has witnessed a seismic transformation!

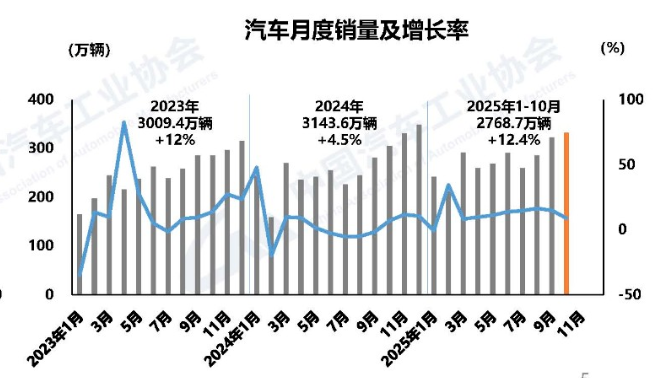

Freshly released data from the China Association of Automobile Manufacturers (CAAM) for October reveals that both automobile production and sales soared past 3.3 million units, marking an all-time high for the same period.

Even more striking is the cumulative data for the first ten months: new energy vehicle sales hit 10.929 million units, representing a 49.5% market share, nearly on par with fuel vehicles.

The sales proportion of new energy vehicles has, for the first time, approached the 50% mark! This implies that for every two cars sold in China, one is a new energy vehicle.

In Guanchejun's perspective, this transcends mere numbers; it signifies a consumption revolution.

Casting our minds back five years, new energy vehicles were mockingly dubbed 'electric daddies,' with range anxiety and inconvenient charging options deterring countless potential buyers.

Today, with battery technology breakthroughs and widespread charging infrastructure, new energy vehicles have genuinely infiltrated the households of ordinary people.

From white-collar professionals in first-tier cities to young individuals in third- and fourth-tier towns, opting for a new energy vehicle is no longer a compromise for obtaining a license plate but a genuine consumption preference.

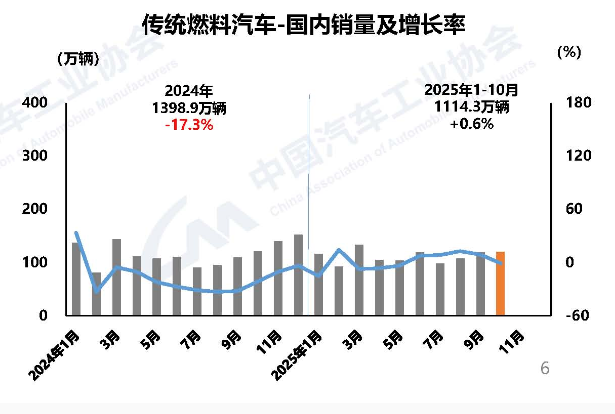

However, just as new energy vehicles surge forward, an unexpected development has emerged: fuel vehicles, long predicted to decline, are actually rebounding!

Sales of traditional fuel vehicles experienced a 0.6% growth in the first ten months. Although the increase is marginal, it successfully reverses the previous downward trend.

What does this signify? Fuel vehicles are far from bidding farewell to the historical stage. Amidst increasingly mature hybrid technology and relatively stable fuel prices, fuel vehicles still command a loyal following.

Guanchejun observed that Chen Shihua, Deputy Secretary-General of the CAAM, disclosed a crucial piece of information: 'Significant terminal price reductions persist in the domestic traditional fuel passenger vehicle market.' In simpler terms, fuel vehicles are sacrificing price for volume, making now a potentially opportune time to snag a deal.

After visiting multiple 4S stores, reporters discovered that some joint-venture brand fuel models offer discounts as high as 30%. Some models initially priced at the 200,000 yuan mark can now be purchased for 150,000 yuan. Such price reductions were unthinkable a year ago.

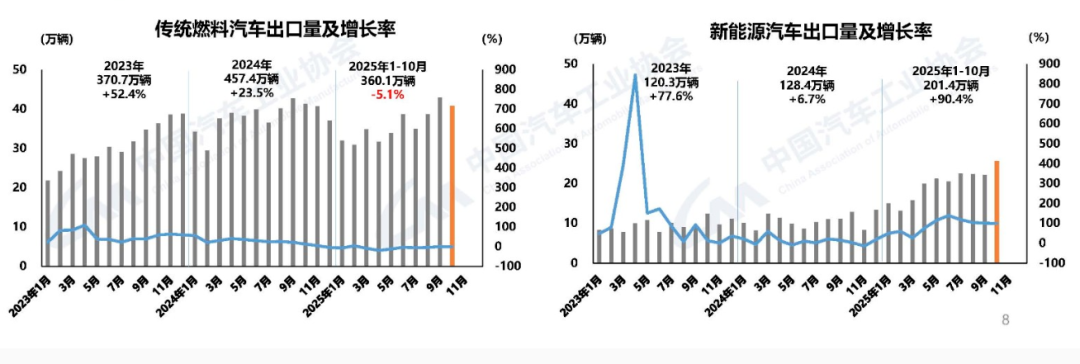

If the domestic market is characterized by 'intense competition,' then the overseas market is 'reaping rewards.'

Export data has remained above 600,000 units for three consecutive months, with a cumulative total of 5.62 million units in the first ten months, nearly matching last year's annual total. This indicates that Chinese-made cars are rapidly conquering the global market.

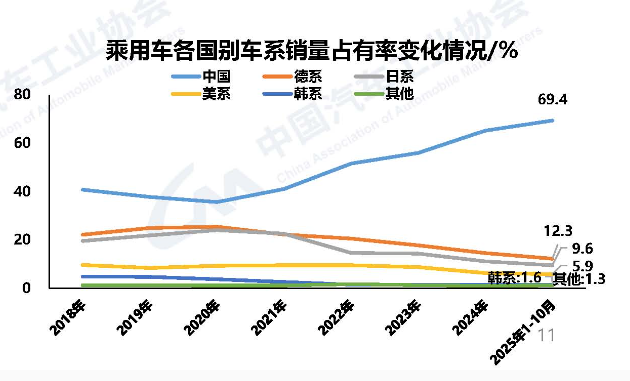

Specifically, by brand, Chery leads the export race with 1.063 million units, having established a strong reputation in markets like Russia and the Middle East over the years. BYD is also experiencing rapid growth, with exports reaching 789,000 units, a year-on-year increase of 1.4 times.

More notably, new energy vehicles have emerged as the absolute mainstay in exports, with year-on-year growth exceeding 90%. From taxi markets in Southeast Asia to middle-class families in Europe, Chinese new energy vehicles are reshaping global perceptions of 'Made in China.'

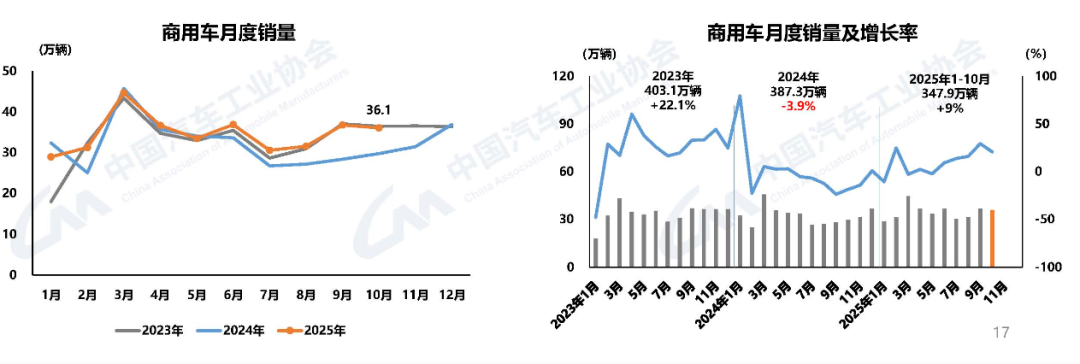

Another intriguing aspect is the commercial vehicle sector. While passenger vehicles engage in fierce competition, the commercial vehicle market is quietly undergoing a revolution.

In the first ten months, sales of new energy commercial vehicles surged to a record high, reaching 649,000 units, a year-on-year increase of over 60%. This growth rate even surpasses that of new energy passenger vehicles.

From urban logistics delivery vehicles to construction site machinery, electrification is spreading comprehensively. For young individuals in the logistics and transportation industries, this presents both opportunities and challenges. Electric commercial vehicles offer lower maintenance costs but require higher initial investments, necessitating careful consideration in the selection process.

Despite the promising data, the CAAM cautions that the industry faces significant profitability pressure, and the risk of price wars persists.

In simpler terms, the current scenario for automakers is far from rosy. While sales have increased, profits have declined. Whether this 'losing money to gain market share' strategy can be sustained remains a significant question mark.

For consumers, this situation presents both good and bad news. The good news is that cars are becoming more affordable; the bad news is to be cautious of automakers cutting corners to reduce prices. When purchasing a car, it is advisable to prioritize the quality of core vehicle components and the reputation of after-sales service.

So, here's the question: If you have a budget of 150,000 yuan now, would you opt for a new energy vehicle or a fuel vehicle?

Unless specified otherwise, the charts in this article are sourced from publicly disclosed CAAM data. Special thanks are extended for this information! The views expressed in this article are for reference only and do not constitute investment advice.

This article is an original work by Gangguan Guanche and is prohibited from being reproduced without authorization. If you wish to reproduce it, please obtain authorization. Additionally, when reproducing with authorization, please indicate the source and author at the beginning of the article. Thank you!