Japan's Three Giants Bet Hundreds of Billions on India, Pursuing Dual Tracks with Deepened China Layout

![]() 11/21 2025

11/21 2025

![]() 686

686

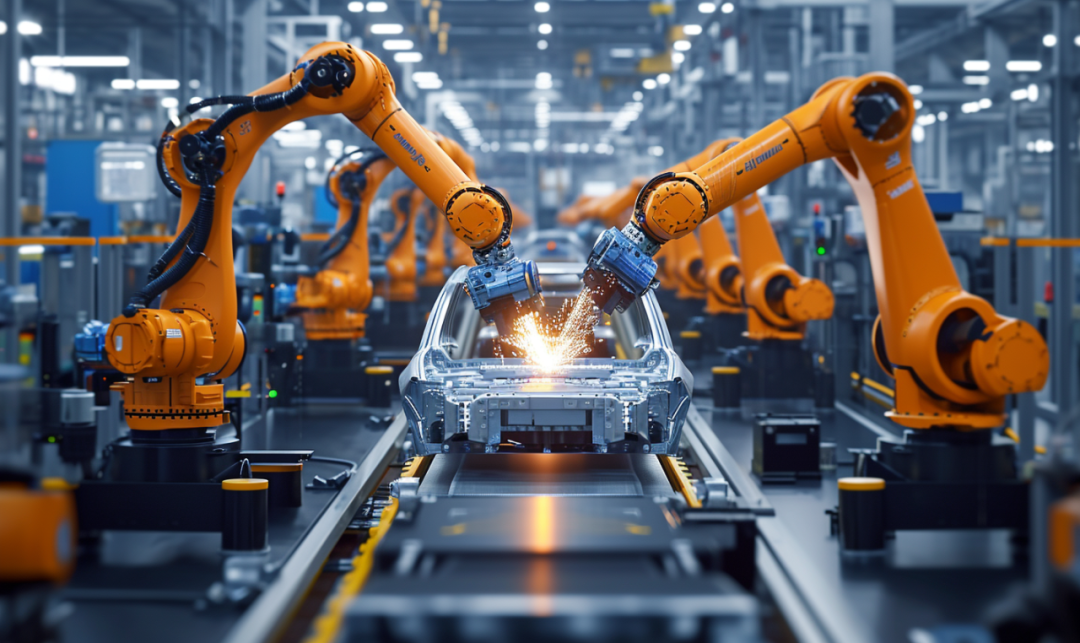

Against the backdrop of accelerating restructuring in the global automotive industry, Japan's three major automakers—Toyota, Honda, and Suzuki—are intensively redirecting funds and production capacity to India. According to Reuters, the three parties have announced investments exceeding US$10 billion in India to expand factories, boost production capacity, and position the country as a manufacturing hub for new energy and hybrid vehicles targeting the global market. This strategy is seen by the industry as a crucial step in reshaping Japan's automotive production network in Asia.

▍Japanese Automakers Increase Investments in India

In recent years, India has attracted increased investments from several multinational automakers by leveraging its low-cost labor resources, a growing domestic market, and an increasingly robust manufacturing base. As geopolitical and competitive market environments evolve, India's strategic importance in the global layouts of Japanese automakers is rapidly rising.

Toyota announced last year an investment of approximately US$3 billion in India, adding a third production line at its southern factory, bringing an additional annual capacity of 100,000 vehicles. It is also building a new factory in Maharashtra, aiming to increase local production capacity to over 1 million units by 2030 and introduce 15 new or redesigned models, striving to raise its passenger vehicle market share from the current 8% to 10%. Meanwhile, Toyota is collaborating with Indian suppliers to localize the production of core hybrid components, reducing costs and enhancing supply chain resilience. Toyota's president stated during the Japan Mobility Show that the Indian market is extremely important and will continue to grow in the future.

Suzuki, a long-term leader in the Indian market, announced an investment of approximately US$8 billion to expand its annual production capacity from 2.5 million to 4 million units. Its subsidiary, Maruti Suzuki, is not only India's best-selling automotive brand but also the country's largest automotive exporter. Suzuki's president stated during the Japan Mobility Show that it will increase exports from India and develop the country into Suzuki's global production center.

Honda, for the first time, explicitly positioned India as its global production and export base for electric vehicles under its 'Zero Series' lineup, planning to export Indian-made electric vehicles to Japan and other Asian markets starting in 2027.

▍Supply Chain Restructuring Toward 'Indian Localization'

According to statistics, direct investment by Japan in India's transportation sector surged more than sevenfold between 2021 and 2024. An executive from a core supplier to Toyota revealed that the company is shifting product standards from 'global uniformity' to 'local specifications' to accelerate the construction and integration of India's local supply chain. This deep localization strategy not only helps reduce costs but also better adapts to the demands of India and emerging markets.

▍Considerations Behind Supply Chain Restructuring

Multiple industry analysts and corporate executives point out that the strategic shift by Japanese automakers is driven by dual pressures from intensifying competition from Chinese brands and rising supply chain risks. The rise of Chinese domestic electric vehicle manufacturers, such as BYD and SAIC's MG, has increased profitability challenges for foreign brands. Meanwhile, Chinese automakers are actively expanding into traditional Japanese strongholds in Southeast Asia, impacting the overseas market share of Japanese automakers.

On the other hand, India currently imposes restrictions on Chinese electric vehicles and some manufacturing investments, providing a buffer space for Japanese brands. Gaurav Vangaal, an analyst at S&P Global Mobility, noted that India's protectionist stance toward its neighbor has become an unexpected opportunity for Japanese automakers to expand their investments in the country.

Additionally, the Indian government has introduced various manufacturing incentive policies to encourage companies to establish the country as a 'global manufacturing hub.' The domestic automotive market in India is also growing steadily, with passenger vehicle sales in October 2025 increasing by 11% year-on-year to 557,000 units. Dealers reported 'stronger foot traffic, better sentiment, and extremely high conversion rates.'

▍Challenges Remain

Despite India's vast market potential, the competitive environment is far from easy. Previously, American automakers like Ford and General Motors exited the market due to difficulties in gaining traction. Meanwhile, Indian domestic brands such as Tata Motors and Mahindra are continuously strengthening their SUV product lines, eroding the market share of traditional leaders like Suzuki.

As Japanese automakers accelerate their layout (layout) in India, they are also demonstrating a commitment to deepening localization in China. At the recent China International Import Expo in Shanghai, Toyota showcased its firm stance of transferring decision-making power to Chinese teams and having local engineers lead research and development under the theme 'Global Roots, Deeper China.' Additionally, Toyota not only brought its latest pure electric and hydrogen energy technologies but also announced deep collaborations with companies like Sinotruk and China Minmetals Corporation in hydrogen fuel cell and energy storage sectors. It plans to jointly deploy 1,000 L4-level Robotaxis with Pony.ai in 2026.

These series of moves indicate that the strategic core of Japanese giants is not a simple 'exit' or 'replacement' but rather a precise and diversified layout based on the characteristics of different markets: targeting cost and export hub advantages in India while focusing on technological integration and deep market binding in China to address fierce local competition.

From China to India, the capacity relocation by Japanese automotive giants represents not only a strategic adjustment at the corporate level but also a microcosm of changes in the global manufacturing landscape. As supply chain restructuring deepens, can India truly assume the role of the 'next world factory'? Can Japanese brands stabilize their footing amid the electric vehicle wave? All of this remains to be tested by the market.

Layout 丨 Zheng Li

Source 丨 Reuters, CNBC

Image Source 丨 Qianku Network