What should be done with extended-range electric vehicles (EREVs) when the all-electric range of plug-in hybrid electric vehicles (PHEVs) exceeds 210 km?

![]() 01/08 2026

01/08 2026

![]() 330

330

Introduction

Ultimately, the greatest beneficiaries will be the vast number of consumers.

Undoubtedly, over the past few years, China's plug-in hybrid market has been reshaping the landscape of new energy vehicles (NEVs) at an astonishing pace. Data shows that since 2021, the annual growth rate of hybrid vehicle sales in China has been at least 50%, rising from less than 1 million units to nearly 6 million units. This means that both PHEVs and EREVs have become new choices for a broad range of consumers.

However, in the past two years, the growth rate of plug-in hybrid models has significantly slowed compared to previous years. In the first 11 months of 2025, new energy vehicle sales reached 14.78 million units, a year-on-year increase of 31.2%. Among them, plug-in hybrids (including EREVs) accounted for 5.261 million units, up 16.4% year-on-year, while battery electric vehicle (BEV) sales reached 9.515 million units, a 41.2% increase.

As a result, many believe that "electric vehicles with fuel tanks are no longer selling well." In the past, many manufacturers increased fuel tank capacity as a unified approach to enhance overall range. Later, as battery prices declined, some manufacturers began to expand battery capacity to improve overall range, typically automakers producing EREVs.

In fact, it is evident that the competitive logic and consumer base for BEVs and hybrid vehicles are different. The shrinking market share of both PHEVs and EREVs is primarily reflected in the overall market, but leading brands such as BYD, Geely, AITO, and Leapmotor continue to grow due to their product strength.

Amid uncertainties in this year's automotive market, these leading manufacturers are also contemplating how to find differentiated competitive advantages after years of intense competition. In other words, can hybrid vehicles enter the BEV track (BEV track)? This would expand the market. The way to enter the BEV track is simple: increase the all-electric range.

01 PHEVs are increasingly becoming EREV-like

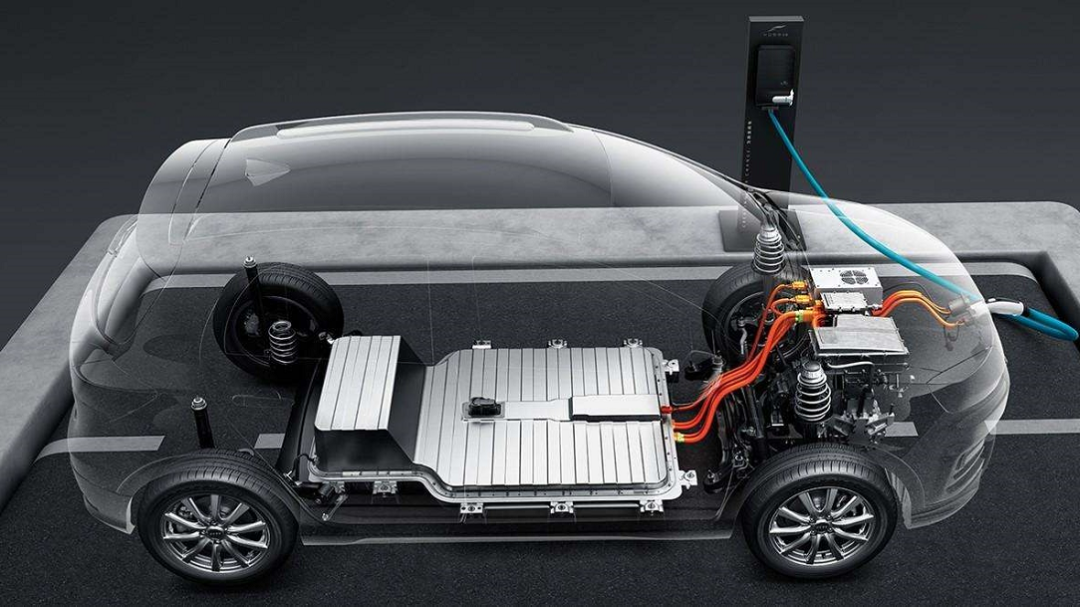

For instance, BYD recently announced long-range versions for several of its popular models, all featuring an all-electric range exceeding 210 km. It is worth noting that early EREV models typically started with a standard all-electric range of around 200 km. This implies that PHEVs may now be adopting an EREV-like approach.

From another perspective, this breakthrough is not just a number on a specification sheet but represents a fundamental shift in the vehicle's energy logic—from oil-assisted electrification to electric-assisted fuel power.

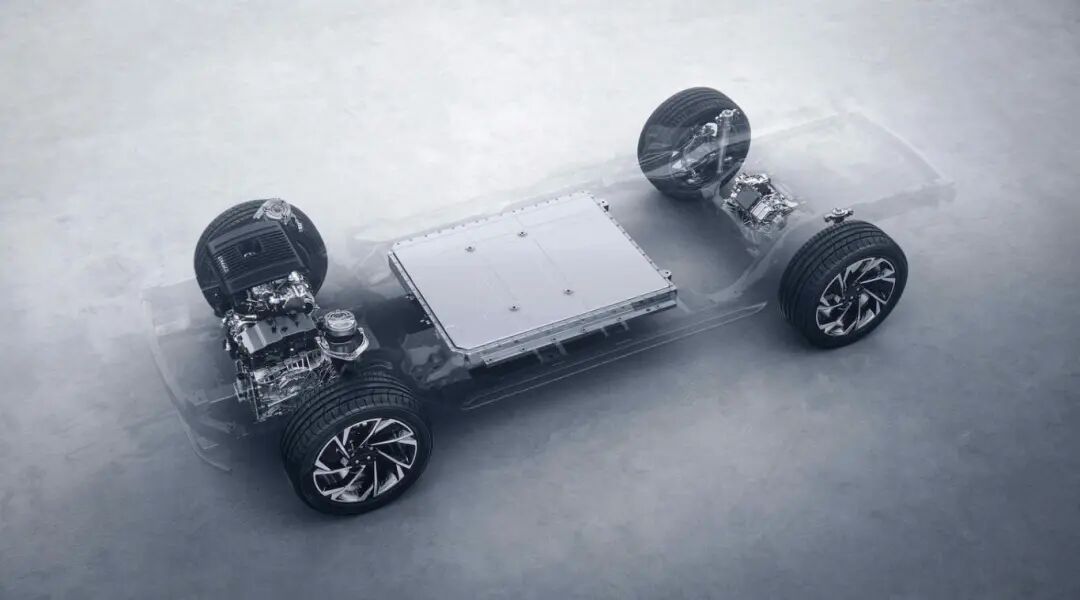

Traditional PHEVs are designed with a complementary oil-electric logic, typically offering an all-electric range of 50-100 km, primarily covering daily commuting scenarios. Once this range is exceeded, the engine frequently intervenes, making the vehicle essentially an optimized fuel-powered car. However, when the all-electric range surpasses 200 km or more, the engine's role shifts from the primary driver to emergency power supply.

Traditionally, EREVs have focused on offering a dual selling point of an electric vehicle experience without range anxiety. However, with the significant increase in the all-electric range of PHEVs, these two advantages have been notably diluted. Consumers find that choosing a PHEV with a 200 km all-electric range can provide a driving experience close to that of a BEV, while often performing better in terms of energy consumption during occasional long-distance travel.

This competitive pressure is particularly evident in the price-sensitive market. In the mainstream family car market priced between 150,000 and 250,000 yuan, consumers are highly sensitive to the total lifecycle cost. Long-range PHEVs not only offer an experience similar to EREVs but also demonstrate lower fuel consumption in highway scenarios, a traditional weakness of EREVs.

As is well known, the energy conversion path of generating electricity through a range extender and then driving is significantly less efficient during highway cruising compared to direct engine drive. New-generation PHEV technology, through intelligent energy management systems, can automatically select the optimal power flow path based on speed, road conditions, and battery status, achieving a better balance between efficiency and experience.

It can be said that the rise of long-range PHEVs has exerted multi-dimensional pressure on the EREV market. At the product value level, when the all-electric range of PHEVs is sufficient to cover 90% of daily scenarios, consumers are no longer faced with a technological route choice between "PHEV or EREV" but rather a rational comparison of which offers greater comprehensive advantages under the same usage experience.

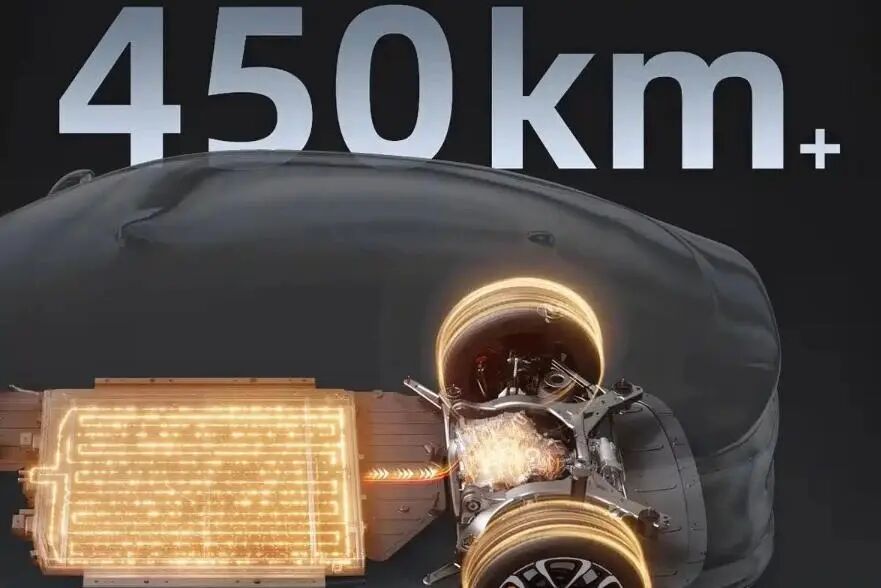

Of course, we have also seen that automakers adopting EREV technology, such as Leapmotor, AITO, Li Auto, and Shenlan, began increasing their all-electric ranges last year. For example, some EREV models from Leapmotor now offer an all-electric range exceeding 400 km, and XPENG has also released EREV models with an all-electric range over 400 km.

In fact, this is not merely a simple competition over range numbers but represents a repositioning of the value of EREV technology in response to market pressure. Automakers realize that relying solely on the promise of eliminating range anxiety is no longer sufficient to build a competitive moat. They must use longer all-electric ranges to strengthen the purity of their core selling point—the electric vehicle experience—and bridge the perception gap in energy consumption efficiency compared to traditional PHEVs.

At a deeper level, this is a struggle for definition rights. As PHEVs attempt to blur the boundaries between the two through long-range EREV-like features, the EREV camp's strategy is to push these boundaries further by increasing the all-electric range to 400 km or even higher, aiming to redefine what is considered sufficient. Their goal is to further anchor user habits in the all-electric range, thereby creating a generational gap in experience.

Therefore, the increase in range is merely a superficial manifestation. Behind it lies a strategic choice by automakers to finely understand users' real usage scenarios and maximize their technological strengths amid cross-competition between technological routes. The market is rapidly shifting from a debate over the superiority of routes to a competition over the efficiency of technological solutions based on specific scenarios.

02 To follow or not to follow?

When we revisit the issue of PHEVs surpassing the 200 km all-electric range threshold, it actually raises another fundamental question: Is this improvement driven by technological advancements in response to user needs, or is it a parameter competition driven by market forces?

Analyzing commuting scenarios, the average daily commute distance in major Chinese cities is approximately 30-40 km. Even considering additional travel, a 200 km range is sufficient to cover 95% of urban residents' needs, allowing for once-a-week charging. In this context, the marginal utility of continuing to increase battery capacity significantly diminishes. Most of the additional battery capacity remains idle most of the time, continuously increasing vehicle weight, occupying space, and driving up costs.

However, automobile consumption is never solely based on rational calculations. Behind the range numbers lies the projection of deep-seated psychological needs—the desire for range freedom, the avoidance of charging inconveniences, and the recognition of technological leadership. Just as smartphone battery capacities have increased from 3000mAh to 6000mAh, although most users do not need such capacity, the sense of battery security has become a core purchasing driver.

More strategically significant is that long-range capabilities are reshaping the market positioning of PHEVs. When the all-electric range is sufficient to support most daily scenarios, PHEVs evolve from being alternatives to fuel-powered vehicles to anxiety-free electric vehicles. This transformation not only attracts traditional fuel vehicle owners but also begins to divert some potential BEV customers, becoming a unique common denominator in the new energy vehicle market.

Faced with BYD's new benchmark of "200 km all-electric range," other automakers seem to be forced into a narrow, either-or crossroads: either follow at high cost or stick to the original position and risk marginalization. Both choices are costly and fraught with uncertainty.

Choosing to follow means entering an arms race defined by BYD. This requires automakers to possess system capabilities comparable to BYD in terms of cell cost control, battery pack integration technology, vehicle energy management, and even supply chain bargaining power. Otherwise, mere parameter following will lead to soaring product costs, extreme compression of profit margins, and ultimately a vicious cycle of losing money while gaining little market share.

Choosing not to follow is tantamount to voluntarily surrendering a core selling point in mainstream market competition. When "200 km all-electric range" becomes the new benchmark in market perception, any configuration below this may be simply categorized as technologically backward or lacking sincerity. This directly results in being excluded during consumers' initial screening, facing the huge risk (enormous risk) of rapid market share decline and brand influence marginalization.

Therefore, the essence of this binary choice is to force automakers to make a difficult balancing act between bearing the enormous costs and risks of following and bearing the risks of market loss and brand devaluation of not following. Whichever option is chosen means staking core resources and accepting a severe survival pressure test.

Of course, from a broader perspective, the continuous improvement of the all-electric range of PHEVs is essentially an inevitable manifestation of the maturation of new energy vehicle technology and market deepening. Both PHEVs and EREVs will drive the entire hybrid market toward higher levels. The diversity of technological routes is not a problem but a source of innovation.

It is foreseeable that the hybrid market in the coming years will present a richer technological landscape. This reconstruction of the hybrid market triggered by breakthroughs in battery technology will ultimately benefit the vast number of consumers.

Editor-in-chief: Yang Jing Editor: He Zengrong

THE END