I Took 20,000 Steps at the Guangzhou Auto Show and Uncovered Automakers' Hidden Strategies

![]() 11/26 2025

11/26 2025

![]() 469

469

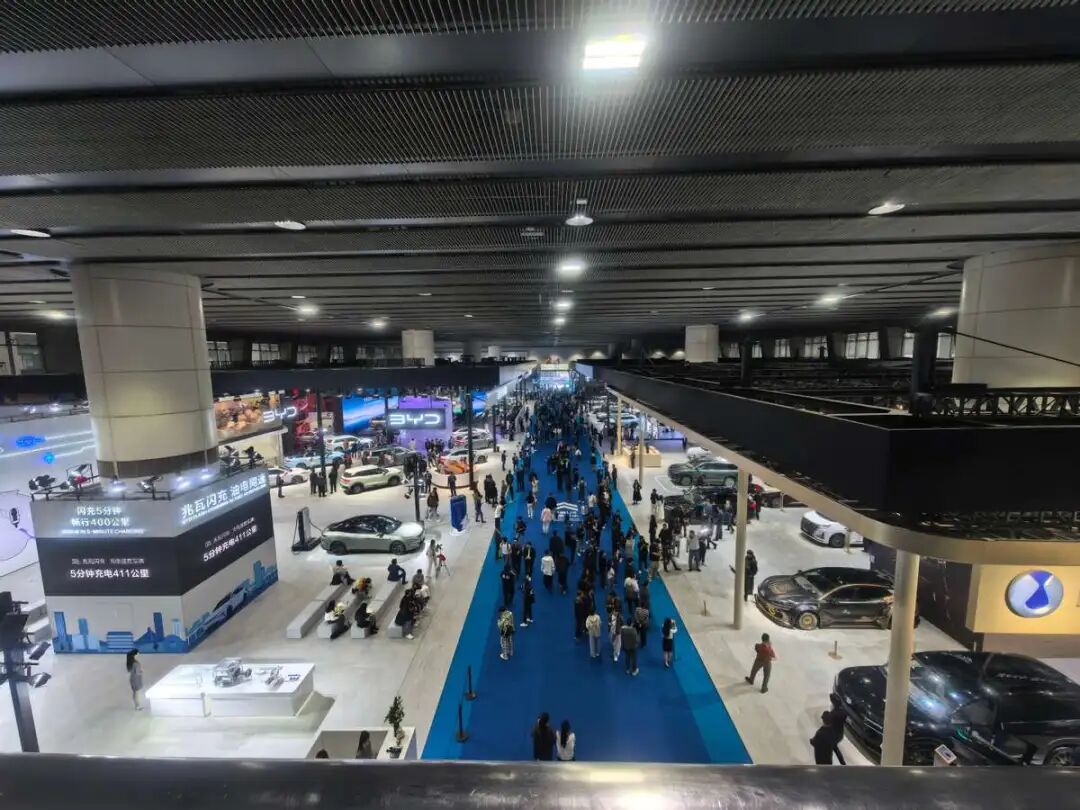

Before I set foot in the Guangzhou Auto Show, the brisk November air in the city hinted at a shift in the exhibition halls' atmosphere compared to previous years.

Of course, the booths of various automakers remained vibrant and teeming with visitors. However, the orchestrated cacophony that once defined these spaces seemed to have subsided. Instead, a sense of calm and pragmatism prevailed as the industry navigated deeper waters.

In just one day and 20,000 steps, it became clear how swiftly technology is evolving, the determination of brands to transform, and the restructuring of the entire industrial value chain.

Intelligent Driving Assistance: Becoming Mainstream

While this trend has been apparent for some time, this year's Guangzhou Auto Show made it abundantly clear that advanced intelligent driving assistance is becoming a staple for everyday consumers.

Throughout the exhibition halls, intelligent driving assistance systems were a focal point at nearly every automaker's press conference, rapidly becoming more accessible. For instance, the Leapmotor A10, a compact pure electric SUV competing with models like the Geely Starlight and BYD Yuan UP, made its debut equipped with lidar and L2+-level advanced driving assistance. This means that perception hardware previously reserved for vehicles priced above RMB 200,000-300,000 is now within reach for young consumers. A similar trend is evident in GAC Toyota's new Fenglanda Intelligent Edition, which introduces lidar and advanced intelligent driving to the sub-RMB 150,000 price range for the first time.

Moreover, the technological sophistication of intelligent driving assistance continues to deepen. Li Auto announced at the auto show that it would introduce an innovative VLA charging feature for its AD Max models, enabling vehicles to autonomously navigate charging stations, addressing the 'last 100 meters' challenge for users after locating a charging pile.

XPENG Motors unveiled its second-generation VLA model, slated for release in the first quarter of next year, representing a breakthrough in environmental understanding and decision-making capabilities.

To prepare for future higher levels of autonomous driving, many flagship models have adopted a 'hardware pre-installation' strategy. For example, the Xiangjie S9 comes standard with four lidars, providing ample perception hardware redundancy for future upgrades to L3 or even higher levels of functionality. These details indicate that the competition in intelligent driving has shifted from mere 'availability' to 'usability and continuous evolution.'

As intelligent driving assistance permeates both low-end and high-end markets, the competitive logic of the entire industry is transforming. 'Intelligent driving' is no longer a value-added feature but has become a pivotal factor in defining product value and influencing user purchasing decisions. Behind this shift lies the maturity of China's new energy vehicle supply chain and the rapid progress of Chinese tech companies in core areas such as algorithms and chips.

At the same time, it is evident that Chinese automakers are commanding the spotlight and attention. At this year's Guangzhou Auto Show, BYD occupied Hall 2.1 on the first floor of Zone A, showcasing multiple sub-brands such as Denza, Fangchengbao, and Yangwang, along with its 'Divine Eye' driving assistance system and megawatt-level flash charging technology. Additionally, an outdoor display highlighted the emergency floating capabilities of the Yangwang U8, demonstrating a comprehensive product matrix and technological depth.

GAC Group secured Hall 2.2 on the second floor of Zone A, bringing together joint ventures and independent brands such as GAC Toyota, GAC Honda, GAC Trumpchi, Aion, and Hyper, showcasing the group's collaborative effect in comprehensive electrification.

Traditional independent brands like Chery Automobile and Great Wall Motor occupied half of an exhibition hall, with several sub-brands displayed together. Geely Automobile's Lynk & Co, Zeekr, and Galaxy series exhibited independently across different halls.

So, what are overseas brands doing in this new energy-dominated environment?

Overseas Brands Playing Catch-Up: Leveraging Chinese Technology for Transformation

A notable phenomenon at this year's Guangzhou Auto Show was the absence of over twenty brands, including once-prominent names like Porsche, Bentley, and Lamborghini. Compared to the bustling crowds inside the exhibition halls, their absence was striking. Data shows that in the first three quarters of 2025, imported car sales in China reached only 360,000 units, a year-on-year decline of over 30%, with ultra-luxury brands experiencing particularly severe drops. For example, Porsche's sales in China fell by approximately 26%.

The reason for their absence from the Guangzhou Auto Show is straightforward. In the past two years of direct competition with high-end models from Chinese domestic brands, the traditional luxury brands' once-powerful brand appeal has weakened, and they have failed to establish an early foothold in the new energy wave.

We can see that the AITO M9, empowered by Huawei's intelligent technology, has successfully carved out a niche in the RMB 500,000 market, consistently ranking among the top-selling high-end SUVs. The Yangwang U8, with its unique emergency floating capability and extreme performance, has set a new benchmark in the RMB 1 million market. Chinese brands have not only broken the foreign monopoly in the high-end market but have also begun to redefine what constitutes 'luxury' in the new era.

Meanwhile, some joint ventures and independent brands, such as Beijing Hyundai and Dongfeng Peugeot Citroën, also skipped the auto show due to low market share in mainstream segments or a lack of competitive new products. The joint ventures that remained at the auto show, however, did not remain idle. This year, many of them demonstrated their greatest sincerity in transformation.

A common theme in their transformations is seeking 'technical partners' in China. At the Volkswagen booth, several models from SAIC Volkswagen and FAW-Volkswagen, such as the Passat ePro and the Talagon, featured intelligent driving assistance systems co-developed with local Chinese suppliers. The Toyota bZ4X also highlighted HarmonyOS Cockpit as a key selling point. Nissan even renamed its new Teana as the 'Teana HarmonyOS Cockpit,' promoting Huawei's intelligent cockpit technology as a core feature.

Among luxury brands, Mercedes-Benz set up a dedicated exhibition area for its new all-electric CLA built on the MMA pure electric platform, with its driving assistance system co-developed with China's Momenta. SAIC Audi, which also partnered with Momenta, adopted a driving assistance solution jointly developed with Momenta for its Audi E5 Sportback, integrating 'Audi's driving DNA' with an 'end-to-end flywheel model' to adapt to domestic road conditions and user driving habits while maintaining Audi's consistent driving experience during assisted driving.

The deepening of this 'Sino-foreign cooperation' model indicates that joint ventures are striving to compensate for their shortcomings in intelligentization and electrification responsiveness through localized innovation, aiming to preserve their market share in the fierce competition.

Merely Building Cars Is No Longer Enough: Automakers Must Diversify

Ultimately, a key takeaway from this year's Guangzhou Auto Show is that standalone vehicle manufacturing and sales are no longer sufficient to sustain an automaker's development. The core of competition has shifted from 'building a good car' to 'constructing a comprehensive technology ecosystem.'

Many automakers at the auto show showcased not just new cars but also flying cars, robots, chips, battery platforms, and even entire software systems. At Changan Automobile's booth, its three major digital and intelligent new energy brands—Deepal, Avatr, and Changan Kaiana—were all present, alongside flying cars and humanoid robots. Tianshu Intelligence also achieved a critical leap from conceptual frameworks to road capabilities.

At BYD's booth, two dedicated technology core zones were set up: one provided a detailed analysis of the perception, decision-making, and control pathways of its 'Divine Eye' driving assistance system; the other showcased its megawatt-level flash charging technology, demonstrating the capability of 'charging for five minutes, traveling 400 kilometers.' This modular technological display aimed to convey that BYD is not just an automaker but a versatile company mastering battery electric systems, intelligence, and ultra-fast charging technologies.

Meanwhile, numerous suppliers are stepping out from behind the scenes. Huawei not only provided technical support to various brands but also set up a massive independent exhibition area for its 'Intelligent Automotive Solutions,' systematically showcasing its full-stack capabilities in intelligent driving, cockpits, and electric drives. According to statistics, its Qiankun Intelligent Driving ADS has been adopted by over thirty collaborative models, with their total sales exceeding 100,000 units last month. CATL displayed its latest battery technologies and a flying car model co-developed with partners at the center of its booth. All of this indicates that competition in the automotive industry has evolved into a long-chain, systematic rivalry covering hardware, software, energy, and services. Companies lacking profound technological accumulation and ecosystem-building capabilities will struggle to survive in the next phase of competition.

Conclusion

The speed of new technology adoption has exceeded expectations, traditional brand auras need reforging in a rational market, and the focus of competition has shifted from standalone products to comprehensive ecosystems. The Guangzhou Auto Show serves as an industry examination, assessing the achievements of the past year while foreshadowing an even more ruthless culling in the future. It is foreseeable that only automakers capable of integrating cutting-edge technologies, stable supply chains, superior user experiences, and sustainable business models will truly seize the initiative in the new era of intelligent electric vehicles. And all of this has just begun.