Lei Jun and Xiaomi: 'Autumn of Troubles' After the Hype Fades

![]() 11/26 2025

11/26 2025

![]() 474

474

Baker Street Detective

Author Bao Kemeng

Can ESG Be the 'Magic Bead' for Lei Jun and Xiaomi?

The past two years of Lei Jun's foray into car manufacturing have undoubtedly been one of the most challenging periods in his entrepreneurial career.

Before March 2024, Xiaomi relied on 'cost-effectiveness' and an 'internet mindset' to dominate the smartphone market. However, on March 28, 2024, Xiaomi expanded into car manufacturing and released its first model, the 'Xiaomi SU7.' According to Xiaomi Auto's Q3 2025 report, the company has achieved single-quarter profitability, with operating income of RMB 700 million for the quarter.

Compared to new car-making forces like NIO, XPeng, and Li Auto, Xiaomi Auto's profitability timeline has been unexpectedly short. However, business profitability has not brought Xiaomi better reputation; instead, the market views it as profit gained at the expense of reputation.

In November of this year, Lei Jun, the founder of Xiaomi Auto, posted multiple tweets on Weibo, repeatedly emphasizing that Xiaomi Auto prioritizes vehicle safety. On November 16, he posted three consecutive tweets, one of which asked netizens, 'In an interview last April, when discussing product definition, I said, 'A car's appearance is the most important.' Does this contradict 'Safety is the foundation and prerequisite'? Also in that interview, when discussing design, I said wheel rims are the hardest to design. What's wrong with that?'

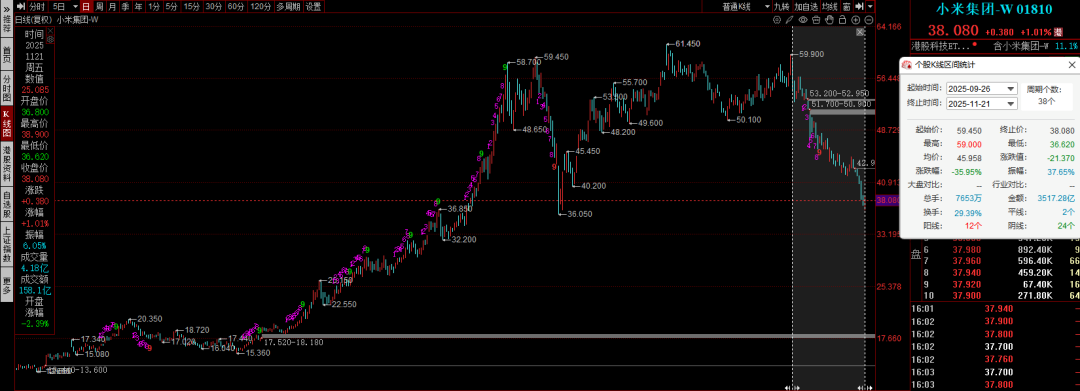

In the secondary market, despite single-quarter profitability in its automotive business, Xiaomi's stock price fell to a near six-month low. Lei Jun personally invested over HK$100 million to purchase 2.6 million shares of Xiaomi Group at an average price of approximately HK$38.58 per share, increasing his stake to 23.26%.

Focusing on corporate operations, Xiaomi recently experienced a major overhaul of its PR team. Kingsoft Software, considered Lei Jun's 'base,' not only saw a significant decline in single-quarter performance but also a stock price drop of over 60% from its 2021 peak. Most surprisingly, rumors about Xiaomi's legal team 'betraying' Lei Jun circulated widely on social media.

Unknowingly, Lei Jun and Xiaomi, once riding smoothly, seem to have entered their unique 'autumn of troubles.' Looking at Xiaomi's recent experiences, the issues may be related to the company's ESG (Environmental, Social, and Governance) management imbalance.

01

Stock Price Plunge and Capital Withdrawal: Is ESG Being Ignored?

It must be admitted that Xiaomi, under Lei Jun's leadership, excels in operations and profitability. However, the market does not favor a company that only knows how to make money, especially for companies listed on the Hong Kong Stock Exchange, which has high ESG requirements.

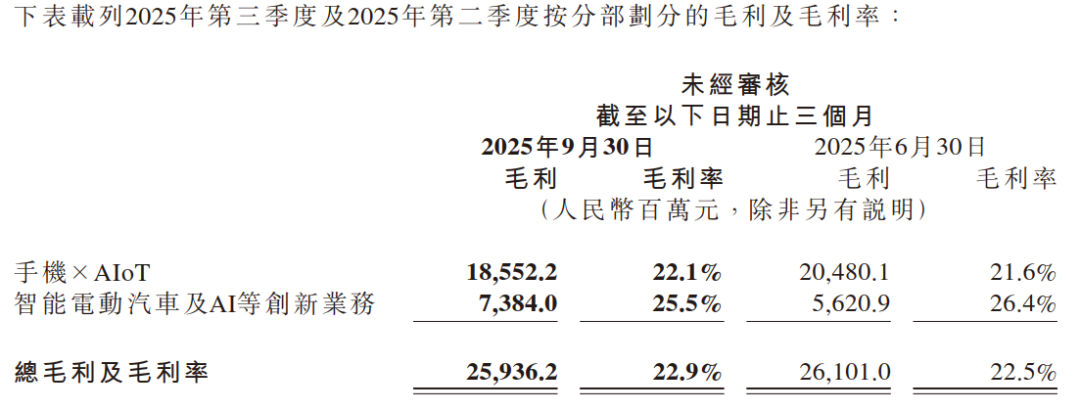

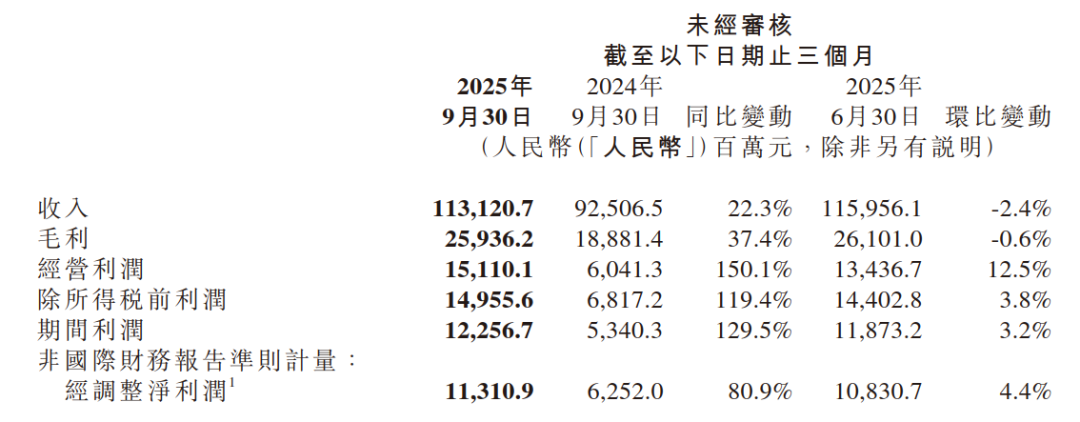

In Q3 2025, Xiaomi Group delivered an impressive financial report, achieving total revenue of RMB 113.1 billion, a 22.3% year-over-year increase. Adjusted net profit reached RMB 11.3 billion, a record high and an 80.9% year-over-year increase.

The 'Smartphone × AIoT' segment generated RMB 84.1 billion in revenue, a 1.6% year-over-year increase. The 'Smart Electric Vehicles and AI Innovation Businesses' segment achieved a record high revenue of RMB 29 billion, a 199.2% year-over-year increase.

However, the capital market reacted with unusual indifference. On the day following the Q3 report release, Xiaomi Group's stock price fell by 4.81%, closing at HK$38.82 per share. Compared to its peak in June 2025, the cumulative decline exceeded 30%.

Behind this divergence lies a collective withdrawal of capital. According to TX Investment Consulting's Q3 fund report data, Xiaomi Group not only exited the top ten holdings of active equity funds but also became the most heavily reduced stock by public funds in Q3, with a reduction in market value of RMB 10.834 billion.

Active equity funds' holdings of Xiaomi decreased by 45.9% quarter-over-quarter, and the number of funds holding Xiaomi as a top holding decreased by 216. The market value of holdings dropped by 51%. For example, funds like GF Industry Selection Three-Year Holding, China Europe Innovation Growth, and Huatai-PineBridge Digital Economy Leading Development Three-Year Holding chose varying degrees of reduction.

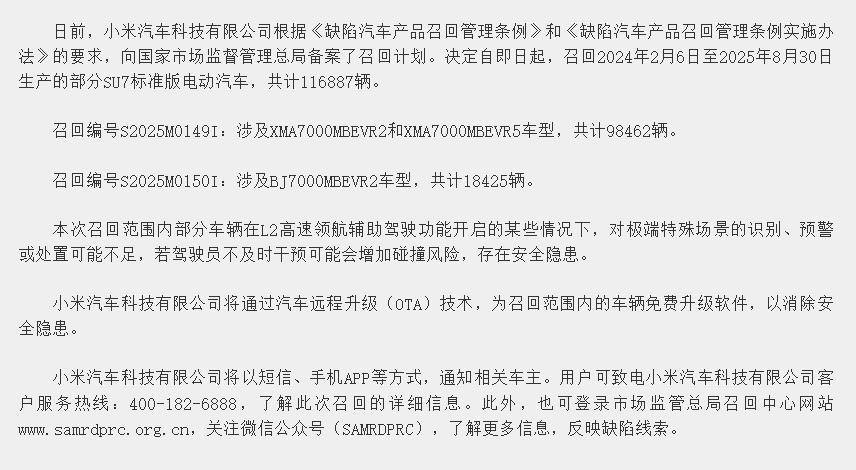

Considering the timeline of Xiaomi's stock price decline, in September 2025, negative news about Xiaomi Auto surged. First, on September 19, Xiaomi Auto Technology Co., Ltd. decided to recall certain SU7 Standard Edition electric vehicles produced between February 6, 2024, and August 30, 2025, totaling 116,887 units.

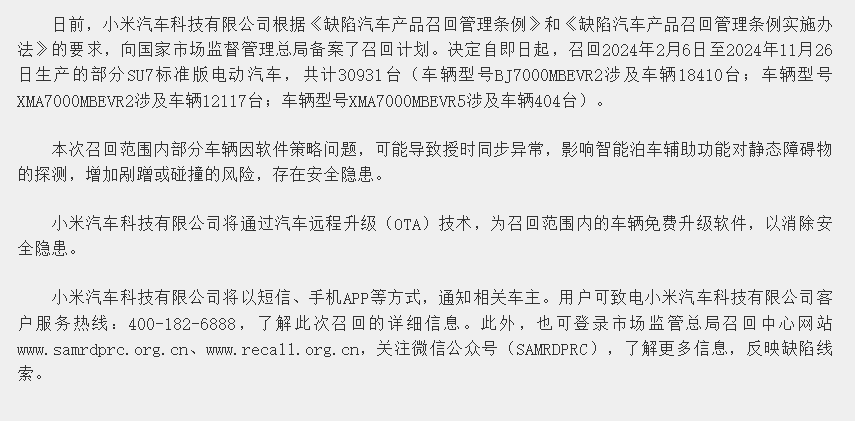

This recall was meant to demonstrate Xiaomi Auto's responsibility, but when netizens linked it to Xiaomi Auto's recall announcement on January 24, 2025, some even believed that 'there might be an issue of 'secondary recall' (some vehicles were previously recalled).'

However, Xiaomi did not promptly address the negative impact. The entire PR team has been nearly invisible since September. Netizens' first impression of Xiaomi's PR has always been founder Lei Jun himself, who is seen as the entire PR team of Xiaomi Group. For a long time, Wang Hua, the head of Xiaomi's PR, was labeled as a 'local news blogger (Chengdu)' on social media.

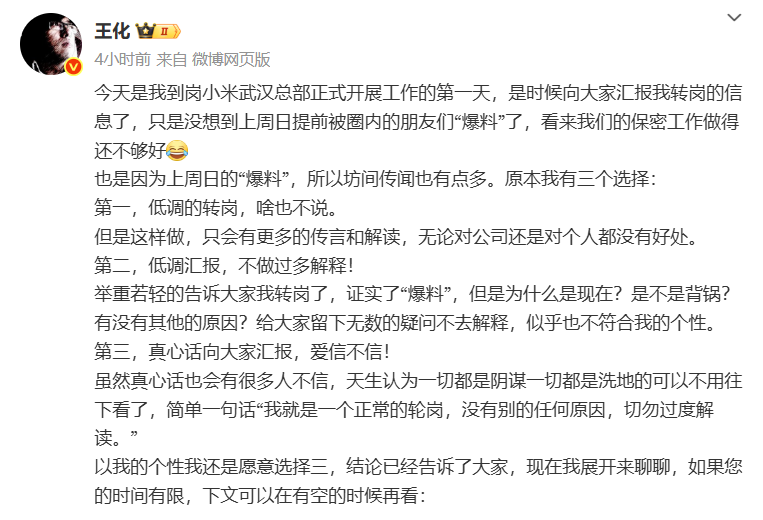

As of the article's publication, Wang Hua has posted a total of 16,817 tweets, over 3,000 fewer than Xiaomi founder Lei Jun's 19,952 tweets. His last tweet was even to quell speculation about his rotation reasons.

It seems that Xiaomi's performance in environmental responsibility, social responsibility, and corporate governance is indeed unsatisfactory. The current situation Xiaomi faces may indeed be related to its ESG governance imbalance, such as the incident where Xiaomi's legal team 'betrayed' Lei Jun.

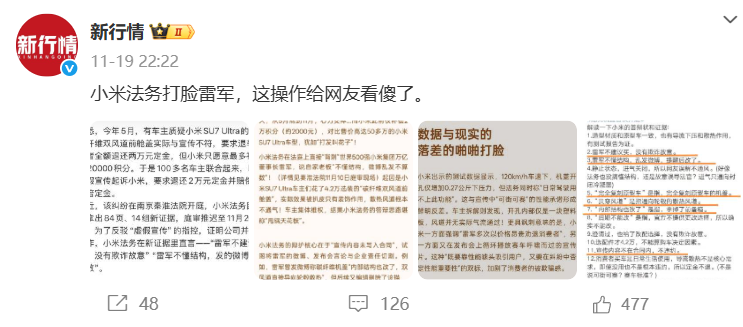

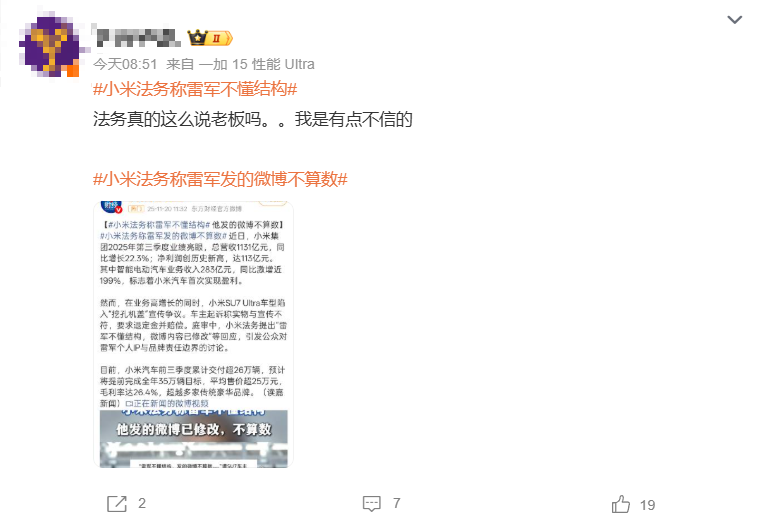

Around November 20, 2025, terms like 'Xiaomi Legal says Lei Jun's tweets don't count' and 'Xiaomi Legal says Lei Jun doesn't understand structure' appeared on social media, which netizens saw as Xiaomi Legal 'betraying' its founder, Lei Jun.

Most critically, if these terms are true, Xiaomi Auto relies on founder Lei Jun's personal charm to secure orders during sales. However, once issues arise, the company begins to dissociate Lei Jun's personal IP from the enterprise. Compared to Tesla and NIO, which focus on product explanations or corporate responsibility during crises, Xiaomi's 'divisive response' is highly likely to escalate conflicts.

Some netizens believe this reflects 'a loophole in the coordination between corporate PR and legal teams, damaging authority due to inconsistent external messaging, raising doubts about internal governance transparency, and harming the brand image.' Others jokingly said, 'Doesn't Mr. Lei's word count? Be careful, Mr. Lei might sue you through legal.'

Of course, some netizens are skeptical: 'Did the legal team really say that about their boss? I find it hard to believe.'

Regardless of whether the content behind these terms is true, the negative effects of Xiaomi's PR strategy continue to deepen.

Take Wang Hua, the former head of PR, as an example. Wang Hua joined Xiaomi in 2015 and served as the head of the PR department for four years. During Xiaomi's ten years, he was often the first to respond and handle rumors and controversies, earning him the title of Xiaomi's 'fire captain.' However, during this unprecedented crisis, Wang Hua was replaced, and the position of PR head remained vacant, leading to speculation among netizens, which even reached Wang Hua himself, forcing him to personally clarify the reasons for his rotation.

This shows that Xiaomi's personnel handling of the PR head did not promptly resolve the negative news facing the company but instead provided netizens with new talking points, which did not help the company downplay the negative news.

02

Slowing Growth in Traditional Businesses, and Little Joy in the Automotive Business

Besides the PR crisis, Xiaomi's traditional businesses also face severe challenges.

Although Xiaomi's Q3 2025 financial report was relatively impressive, focusing on its segmented businesses, the 'Smartphone × AIoT' segment generated RMB 84.1 billion in revenue, with a year-over-year growth rate of only 1.6%, far lower than the 16.8% in the same period last year.

In the smartphone business, Xiaomi Group's smartphone revenue in Q3 was RMB 46 billion, a 3.1% year-over-year decrease. This was mainly due to the decline in the average selling price of smartphones, which fell from RMB 1,102.2 per unit in Q3 2024 to RMB 1,062.8 per unit in Q3 2025.

The situation for IoT and lifestyle consumer products is equally unoptimistic. Revenue from this business was RMB 27.6 billion in Q3, a mere 5.6% year-over-year increase, in stark contrast to the consecutive growth of over 40% in the previous three quarters. Specifically, revenue from smart major appliances decreased by 15.7% year-over-year, mainly due to the impact of reduced national subsidies and increased competition in the domestic market.

Notably, revenue from IoT and lifestyle consumer products decreased by 28.8% from RMB 38.7 billion in Q2 2025 to RMB 27.6 billion in Q3 2025. Xiaomi attributed this mainly to the revenue decline in smart major appliances and certain lifestyle consumer products in mainland China, which was partially offset by increased revenue in overseas markets.

The automotive business is currently the most closely watched segment of Xiaomi, and its performance can be described as a mix of joy and worry. In Q3 2025, Xiaomi Auto achieved a record high delivery volume of 108,800 units. Lu Weibing, President of Xiaomi Group, revealed during the earnings call that Xiaomi Auto is expected to complete its annual delivery target of 350,000 units this week.

However, the market is concerned about the future sustainability of growth in the automotive business. From recent order trends, Xiaomi's weekly orders have declined to around 4,000-5,000 units, roughly corresponding to fewer than 20,000 new orders per month. This means that current order consumption is outpacing new orders (approximately 30,000 backlog orders consumed per month), and Xiaomi Auto's single-month sales in October have already been surpassed by established players like XPeng and NIO.

If Xiaomi maintains weekly orders of 4,000-5,000 units, industry estimates suggest that the company will exhaust its accumulated orders by the middle of next year and enter a demand-driven scenario of 'oversupply.'

Besides the challenges faced by Xiaomi Group, Kingsoft Software, also led by Lei Jun, is experiencing sluggish growth. In Q3 2025, Kingsoft Software's revenue was RMB 2.419 billion, a 17% year-over-year decrease. Gross profit decreased by 21% year-over-year to RMB 1.944 billion, and net profit decreased by nearly 'half,' falling by 48% year-over-year to RMB 213 million.

Specifically, the two major business segments of Kingsoft Software showed divergent performances: revenue from the office software and services segment was RMB 1.521 billion, a 26% year-over-year increase, while revenue from the online gaming and other businesses segment was RMB 898 million, a 47% year-over-year decrease. This marks the continuous decline of Kingsoft Software's gaming business for multiple quarters.

Facing the continuous decline of its gaming business, Lei Jun, Chairman of Kingsoft Software, emphasized in the earnings report that the company will continue to focus on a high-quality game strategy and deepen its IP ecosystem development.

03

The Path to Breakthrough: Challenges and Opportunities Coexist

Judging from the various challenges Xiaomi faces today, Lei Jun's 2025 will undoubtedly be a difficult battle fought on multiple fronts.

From smartphones to automobiles, and from products to public relations, Xiaomi is experiencing the growing pains of transitioning from an internet company to a comprehensive technology enterprise.

Facing numerous challenges, Xiaomi is seeking breakthroughs on multiple fronts. In its automotive business, Xiaomi is continuously expanding its sales and service network. As of September 30, 2025, it has opened 402 automotive sales stores in 119 cities across the country, with 209 service outlets covering 125 cities.

"Xiaomi's performance fluctuations are lower than in the previous cycle. The overall internal structure, composed of factors such as the premiumization of smartphones, stable gross profit margins in IoT, the growth of internet services benefiting from an increase in high-end users, and automotive delivery exceeding expectations, is the key factor supporting the company's resilience against cyclical fluctuations," said Lu Weibing, President of Xiaomi Group.

However, amid multiple challenges such as pressure from rising storage costs in the smartphone business, the impact of reduced subsidies on the IoT business, and slowing order growth in the automotive business, Xiaomi's path to breakthrough remains filled with uncertainty.

In today's capital markets, which favor compelling stories, strong performance, and ESG narratives, Xiaomi needs to demonstrate its ESG management capabilities while maintaining strategic focus. Navigating through volatile business environments, achieving steady growth across economic cycles is the foundation for all enterprises and a cornerstone of their valuations. Meanwhile, ESG management capabilities represent the final piece of the puzzle in enhancing corporate reputation and valuation.

© THE END

All materials are sourced from officially published information.

This article does not constitute any investment advice.

This article is originally created by Baker Street Detective and may not be reproduced without permission. Images are sourced from publicly available materials; please contact us for removal if any infringement is found.