Is WEY Poised for Another CEO Shuffle?

![]() 12/15 2025

12/15 2025

![]() 428

428

Indeed, the situation remains: 'WEY stays constant, but its CEOs come and go.'

Oh, another leadership shake-up?

On December 11th, news surfaced that WEY's CEO, Feng Fuzhi, had stepped away from his post and was on 'leave.' This suggests that WEY's top executive is set for another replacement. As of now, WEY has not issued an official response.

However, the term 'leave' is open to broad interpretation.

After all, amidst a brand elevation phase where WEY Gaoshan has clinched the national MPV sales crown for two consecutive months, the CEO taking leave is out of the ordinary. Despite this, Feng Fuzhi's Weibo account still posted WEY's promotional content on December 9th.

There are also reports indicating that Haval's General Manager, Zhao Yongpo, will take the helm, with WEY New Energy undergoing internal organizational restructuring. It's said that Zhao Yongpo's transfer will also trigger an organizational shake-up at Haval, with current Haval Deputy General Managers Zhang Fuzhi and Lv Wenbin forming a new management duo.

Feng Fuzhi has served as WEY's CEO for less than eight months. He made his debut in this role at the WEY Blue Mountain facelift launch event on May 20th and now faces 'resignation rumors,' still unable to break the 'curse' of WEY CEOs rarely lasting a full year.

Indeed, the pattern persists: 'WEY remains unchanged, but its CEOs are in constant flux.'

Unmet KPIs?

It's said that being WEY's CEO is less about 'tending horses' and more about 'riding them,' with the shortest tenure lasting just four months. Over nine years, there have been nine leadership changes, averaging one CEO change per year—a record that's hard to beat.

It is reported that Feng Fuzhi was placed on 'leave' due to unmet KPIs, a familiar excuse.

When Feng Fuzhi became WEY's current CEO, he was valued for his channel construction experience. Before joining Great Wall Motors, Feng worked for renowned consumer electronics companies like Sony, Apple, and Samsung. He later gained channel construction experience in the automotive sector at NIO and XPENG.

At this year's Guangzhou Auto Show, WEY unveiled its latest data: 'From May 2024 to November this year, we've deployed over 500 direct-sales service outlets, covering more than 130 cities nationwide.'

For any automaker, this data signifies a commendable achievement in terms of channel expansion speed. What's surprising is its operational efficiency, as WEY's channels have already reached the BEP (Break-Even Point).

However, it is reported that Chairman Wei Jianjun set a '1,000 in a year' target for him, leaving a significant gap. While the 'unmet KPIs' are set in stone, the industry feels that Chairman Wei is being overly hasty in his assessments.

In fact, Feng Fuzhi also believed that this target defied business logic. Nevertheless, Wei Jianjun reportedly responded, 'Feng Fuzhi, you need to challenge yourself; you can't retreat.'

The seeds of this development were sown early on.

In May of this year, Wei Jianjun publicly reflected on 'WEY's unstable progress' at the WEY facelift event. In essence, WEY's ability to stabilize hinged on Feng Fuzhi's performance.

However, WEY's nine-year history reveals a 'low tolerance for CEO errors.' After all, since the brand's inception, Wei Jianjun has emphasized, 'I've staked my surname on this; it can only succeed, not fail!' At WEY's launch events, Wei Jianjun is almost always present, frequently endorsing and live-streaming for WEY.

A WEY insider revealed that the chairman demands the team operate in a 'wartime state' to sprint towards high-end goals. Feng Fuzhi also mentioned, 'Every task I received after joining was urgent.' Wei Jianjun urged Feng Fuzhi to expand channels and achieve a 'rapid boost' in brand and sales.

This tolerance period indeed lasted less than a year. There are also reports that Feng Fuzhi had proposed resignation but was turned down.

From a sales perspective, Feng Fuzhi's tenure at WEY cannot be deemed a failure. During his time, WEY achieved significant growth, with cumulative sales of 89,055 vehicles in the first 11 months, a year-on-year increase of 93.94%, making it the fastest-growing brand within Great Wall Motors.

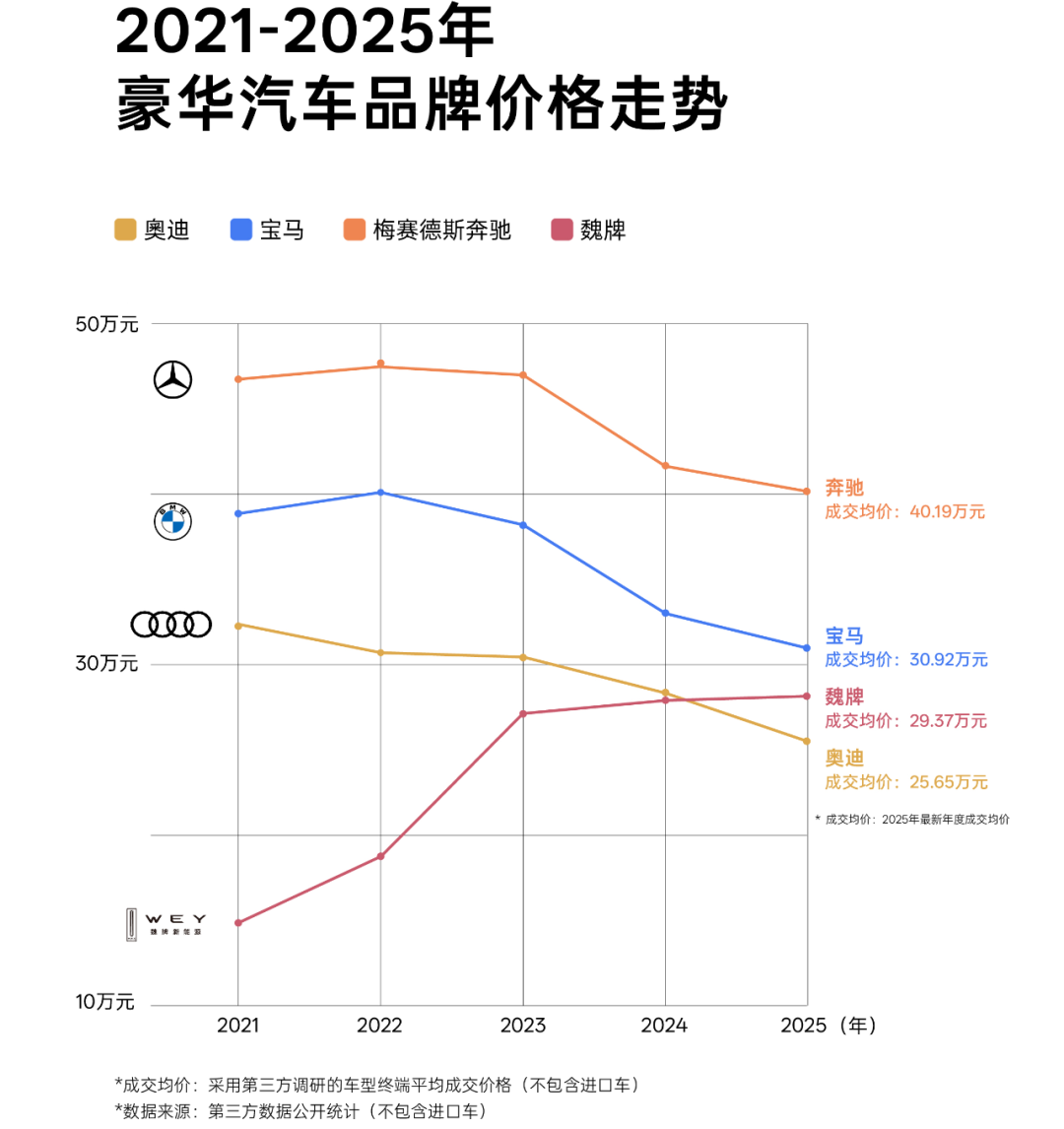

The brand's average transaction price also surged from around 150,000 yuan in 2021 to 293,700 yuan, surpassing Audi's 256,500 yuan and nearing BMW's 309,200 yuan. This indicates that WEY New Energy, after a turbulent journey, is gradually finding its rhythm in breaking into the high-end and luxury segments.

Whether in terms of sales volume or average vehicle price, WEY has shown marked improvement. Compared to its low point of 36,000 sales a few years ago, it's a 'remarkable comeback.'

It can be said that Feng Fuzhi has indeed made significant contributions.

'We're not here to win; it's just an obsession with getting the details right, a basic respect for users. Parameters don't matter; we shouldn't use user consensus as an excuse. Just do it right quietly,' Feng Fuzhi said, achieving a turnaround by simultaneously innovating sales channels and rebranding.

Therefore, replacing the CEO solely based on unmet channel KPIs when WEY is on an upward trajectory seems somewhat far-fetched.

The Technical Successor

From Zhao Yongpo's perspective, who is set to succeed, it's not just about unmet channel KPIs. After all, Zhao Yongpo's strength lies not in channels and marketing but in his technical background. He once candidly admitted, 'I don't think I'm good at marketing.'

Zhao Yongpo's forte is his 'technical mindset.' His resume shows that he became Haval's General Manager in November 2023, after serving as Deputy General Manager of Great Wall Motors' Technical Center. With over twenty years of technical and management experience, he has been deeply involved in the development of multiple Haval platforms.

More importantly, Zhao Yongpo is well-versed in Wei Jianjun's thought process and strategic preferences. Haval is Great Wall's most mature brand, and Zhao Yongpo's ability to step into this role indicates his profound understanding of Great Wall's product system, channel management, and cost control.

At Haval's launch event, Wei Jianjun didn't hesitate to express his appreciation for Zhao Yongpo. Indeed, Zhao Yongpo lived up to Wei Jianjun's expectations, achieving rapid growth at Haval.

After Zhao Yongpo took over, starting with the Menglong model, he adjusted products and optimized marketing strategies, gradually establishing Haval's rhythm. The performances of Haval Menglong, Haval Big Dog, and the second-generation Haval H9 not only showcased Great Wall Motors' 'technology-first' strategy but also completed the layout of major products in the off-road, light off-road, and urban SUV markets.

The industry speculates that Wei Jianjun's decision to transfer Zhao Yongpo to WEY aims to 'strengthen WEY's technological foundation and clarify the brand's identity.' After all, WEY has initially formed a 'three-pronged approach' for brand breakthrough with its 'Dual Mountain' product matrix, direct-sales model, and intelligent technology route.

However, the industry also wonders whether Feng Fuzhi's established direct-sales channels and built-up user reputation will undergo a strategic shift due to the replacement with a 'technology-first' CEO. After all, WEY follows a high-end route and operates through direct-sales channels, differing from Haval's mainstream mass-market approach.

Meanwhile, the key to sales growth lies in WEY's transition from an 'engineer mindset' to a 'user mindset' in brand positioning. 'We've used Great Wall's 35 years of 'deep pockets' to create a 'new look' for new energy vehicles,' Feng Fuzhi recently stated in an interview.

Feng Fuzhi also mentioned that to further promote brand high-endization, WEY is driving brand system evolution and a comprehensive rebranding. The rebranding will focus on four dimensions: value recreation, image recreation, experience recreation, and service recreation, allowing users and the market to perceive a completely different WEY.

Before 'a completely different WEY' could take shape, rumors of replacement emerged. In early December, headlines even used 'Feng Fuzhi becomes the luckiest WEY CEO' as WEY is on the verge of achieving its long-desired annual sales target of 100,000 vehicles during Feng's tenure.

However, Wei Jianjun did not grant him this opportunity.

Some say Wei Jianjun is truly impatient. However, Wei Jianjun disagrees.

'We (Great Wall Motors) are also 35 years old. Our industry is extremely competitive and challenging. We've encountered our fair share of pitfalls, detours, doubts, and cold stares along the way, but our original intention has never wavered,' Wei Jianjun said. 'At 35, it's just the beginning. Let's fuel up, charge ahead, and get to work!'

Others say this transition is not a denial of Feng Fuzhi but a strategic recalibration for Great Wall after trial and error. This time, with a technical successor, can WEY stabilize and solidify its products and brand?

After all, Wei Jianjun himself said, 'Building cars is not a 100-meter sprint but a marathon to gain user trust.'

Note: Image sources are from the internet. If there is any infringement, please contact us for deletion.

-END-