The Autonomous Driving Arena: Subtle Shifts as Robobus Emerges as the Next Trillion-Dollar Opportunity

![]() 12/25 2025

12/25 2025

![]() 416

416

In 2024, Pony.ai and WeRide made their respective debuts on the U.S. stock market, a milestone widely regarded as China's "breakthrough moment" in commercializing L4 autonomous driving. Yet, the initial post-IPO enthusiasm quickly waned as financial disclosures laid bare the "four persistent challenges" facing Robotaxi services: exorbitant vehicle costs, low daily ride volumes per vehicle, heavy reliance on regulatory approvals, and a profit model that remains stubbornly unviable. By the third quarter of 2025, Pony.ai reported an average of fewer than 8 daily rides per vehicle in a single city, with operating margins still firmly in the red. Meanwhile, WeRide, despite achieving "quasi-commercialization" in select cities, continued to grapple with per-kilometer costs exceeding three times those of traditional ride-hailing services.

As capital markets transition from "tech exuberance" to sobriety, a parallel yet less visible trend is gaining momentum: autonomous buses, or Robobus. From Pingshan District in Shenzhen to Xiong'an New Area, and from Guangzhou's Huangpu District to Suzhou Industrial Park, dozens of local governments are aggressively rolling out pilot programs for the regular operation of L4 autonomous buses. Mushroom Auto, the world's sole Robobus company boasting simultaneous expertise in "L4 full-stack technology, city-level AI scheduling platforms, and commercialization on main roads in developed markets," partnered with BYD in October of this year to secure Singapore's first L4 Robobus route, marking China's foray into exporting autonomous public transit solutions.

Against this backdrop, the investment thesis for autonomous driving has evolved: post-2026, true, predictable growth will stem not from Robotaxi services—still mired in "burning cash for validation"—but from Robobus, propelled by policy support, high-frequency use cases, and a crystal-clear business model. For cities, Robobus represents a "public service upgrade"; for enterprises, a "cash cow"; and for investors, the "shortest route to monetizing intelligent transportation dividends."

Robotaxi Dilemma: Cutting-Edge Tech ≠ Commercial Success

Once hailed by capital markets as the "ultimate test" of autonomous driving technology, the IPO performances of Pony.ai and WeRide have exposed the commercial fragility of Robotaxi services. Data and real-world implementation reveal three insurmountable gaps in its business model.

First, "per-vehicle profitability" is capped by scaling-induced cost traps. Pony.ai claimed daily revenue of 299 RMB per vehicle in Guangzhou, seemingly covering costs. However, a deeper dive reveals vulnerabilities: seventh-gen Robotaxi hardware depreciation relies on a six-year amortization schedule, insurance costs are 50% higher due to early safety incidents, and remote assistance staffing (at a 1:20 vehicle ratio) remains unscalable. Expanding the fleet from 1,000 to 3,000 vehicles by 2026 would trigger exponential spikes in hardware procurement, roadside infrastructure, and remote operation costs—explaining why Pony.ai's net loss hit 381.6 million RMB in Q2 2025, and WeRide's reached 406.4 million RMB in the same period. In contrast, Robobus offers clearer cost-reduction pathways: fixed routes slash sensor calibration and algorithm iteration costs by 30–50%, while automakers like BYD have cut vehicle production costs by over 20% through economies of scale.

Second, scenario complexity clashes with policy adaptability. Robotaxi services require coverage of all urban open roads, navigating "edge cases" like jaywalking pedestrians, non-motorized vehicles, and extreme weather. Even Waymo, with 450,000 weekly rides in San Francisco, must contend with frequent regulatory tweaks by California's DMV. Chinese Robotaxi firms face policy lag: while Beijing, Shanghai, Guangzhou, and Shenzhen permit unmanned demonstration operations, core urban road access remains restricted, and accident liability and data security laws are incomplete. Robobus, however, enjoys legislative tailwinds: Shenzhen's 2022 "Smart Connected Vehicle Management Regulations" provide end-to-end legal frameworks, while Chengdu and Suzhou directly integrate Robobus into public transport plans. As scenarios expand from "park shuttles" to "urban mainlines," policies act as "enablers" rather than "gatekeepers."

Finally, demand nature differs starkly: optional luxury versus essential public service. Robotaxi is, at its core, a "premium ride-hailing" option, chosen for novelty rather than necessity, leaving it price-disadvantaged against traditional platforms like Didi and Gaode (Pony.ai's Robotaxi costs 1.5 times more than regular rides). Robobus, however, addresses rigid public transport needs: Singapore views L4 Robobus as critical to alleviating bus driver shortages, while China faced a deficit of over 100,000 bus drivers in 2024. Robobus routes in Shenzhen and Chengdu directly solve "last-mile" commuting pain points, with user willingness to pay bolstered by government or corporate subsidies, ensuring far greater cash flow stability than C-end-dependent Robotaxi.

Robobus's Four Pillars of Certainty: Policy, Scenarios, Business, Rigid Demand

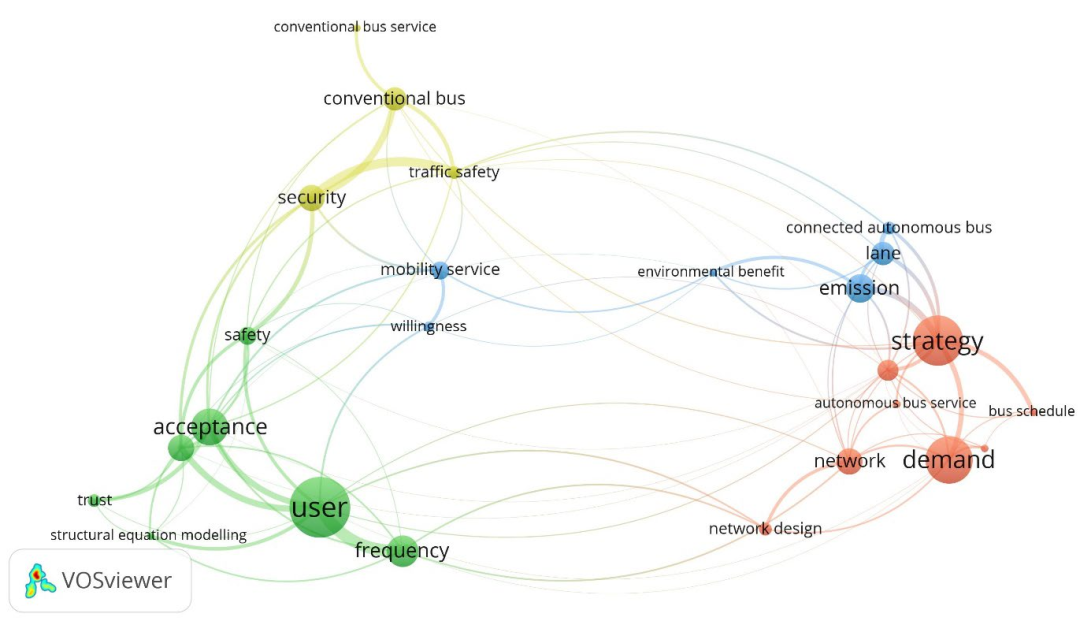

Compared to Robotaxi, autonomous buses exhibit stronger commercial certainty across multiple dimensions. A review of 46 key studies from 2018–2024 in "Implications of Autonomous Buses on Public Transit Systems" reveals:

1. Clear policy backing, driven by local governments

As a cornerstone of public transport, bus automation aligns with policies like "Smart Cities" and "Green Transport." Local governments have launched autonomous bus pilot routes with subsidies and road priority. Germany, Singapore, and China have enacted regulations and testing norms, clarifying institutional frameworks.

2. Relatively controlled scenarios, simplifying tech deployment

Buses typically operate on fixed routes, dedicated lanes, or within parks, streamlining road conditions and reducing system complexity/risk. This shortens iteration cycles and enhances safety redundancy.

3. Transparent business model: cost savings drive value

Public transit grapples with chronic issues like driver shortages, rising labor costs, and inefficiency. Studies show autonomous buses can slash operational costs by 50–60% (Bösch et al., 2018) while boosting vehicle utilization and punctuality through smart scheduling—a "calculable economic case" for governments and transit companies.

4. Strong public mandate, fostering trust

As public services, autonomous buses gain acceptance more easily. Surveys show high passenger approval for safety and environmental benefits, particularly on shuttle and microcirculation routes.

Data-Driven Future: The "Calculable" Path of Autonomous Buses

Projections and pilot data indicate:

Cost optimization: Labor costs (30–40% of total bus operations) can be slashed through automation;

Emission cuts: Electric autonomous buses reduce lifecycle emissions by 47%;

Road efficiency: Dedicated lanes and coordinated scheduling boost capacity by 10–30%.

These metrics underpin a scalable, replicable, and expandable business model.

Why Now Is the Pivotal Moment for Robobus?

Technology readiness: L4 autonomy is commercially viable in closed/semi-closed scenarios;

Policy tailwinds: Smart transport infrastructure rollouts prioritize buses;

Validated models: Cost savings are proven, with clear government procurement and operational partnerships;

Social alignment: Matches carbon neutrality, transport equity, and aging-friendly goals.

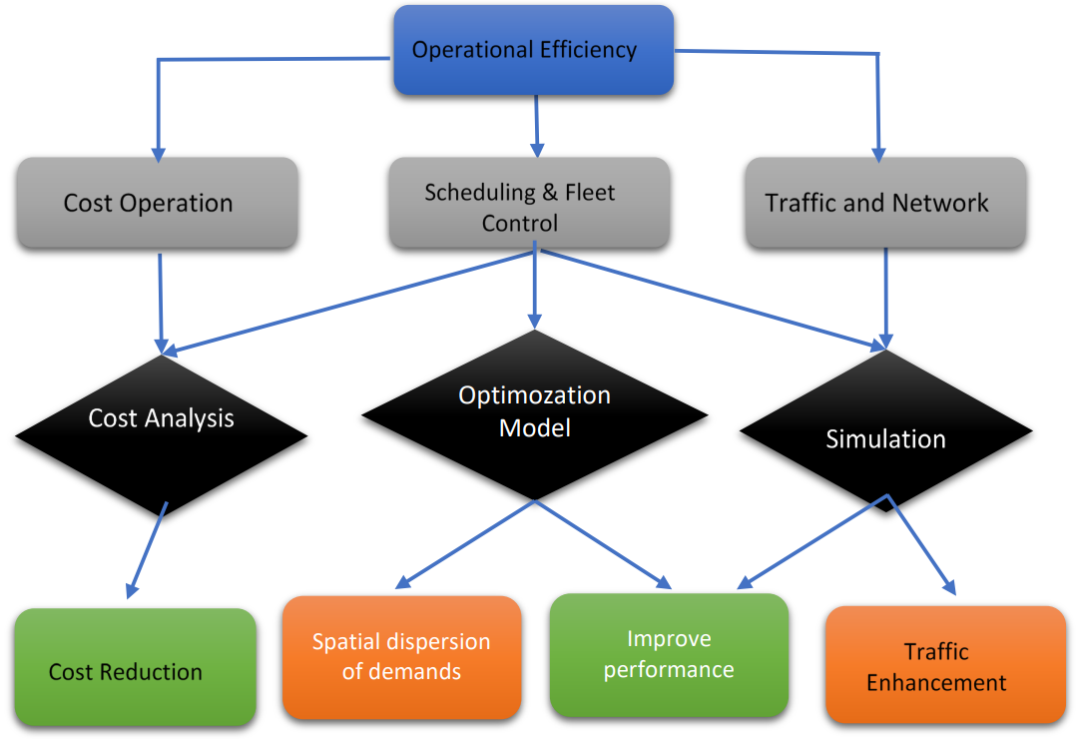

Meanwhile, operational efficiency in autonomous buses spans cost management, scheduling, fleet control, and traffic optimization. Common methods include cost models, optimization frameworks, and simulations, targeting fleet management, resource allocation, and cost reduction. While economic benefits (e.g., cost cuts) are anticipated, research conclusions vary. Cost competitiveness depends on scenarios: in specific cases, Robobus outperforms alternatives like autonomous taxis, but flexible operations face challenges like longer travel times and dispersed demand. Innovations like modular autonomous buses and demand-responsive scheduling aim to revolutionize efficiency, requiring refined management of uncertainties and cost dynamics:

Robotaxi's narrative is captivating, but Robobus's business fundamentals are rock-solid. As tech hype fades, investors are returning to basics: Who has customers? Who is profitable? Who is indispensable? While Pony.ai and WeRide struggle to scale Robotaxi profitability, Robobus has quietly achieved alignment across "policy, scenarios, business, and rigid demand." For markets, evaluating an autonomous driving firm hinges on "three matches": technical capability with scenario complexity, business model with payer alignment, and growth pace with policy rhythms—criteria Robobus firms meet more convincingly.

The future of autonomous driving may belong not to Robotaxi players fixated on open roads, but to Robobus Builders who understand policy, public transit, and operations.