With 3.7 Billion Yuan for a 5% Stake, Is FAW's Major Investment in Leapmotor a Case of 'Squandering Money'?

![]() 12/31 2025

12/31 2025

![]() 401

401

After a prolonged period of uncertainty, FAW and Leapmotor have finally come to a definitive agreement.

On December 28th, FAW Group and Leapmotor held a signing ceremony in Hangzhou. FAW Equity Investment (Tianjin) Co., Ltd., a wholly-owned subsidiary of FAW Group, along with FAW Qixin Power (Changchun) Technology Co., Ltd., signed investment and cooperation agreements with Leapmotor respectively.

This collaboration, which has spanned several years and been rife with market speculation and strategic maneuvering, has now reached a resolution. Contrary to rumors of a 'national team' taking controlling stakes in the new energy vehicle sector, the outcome did not materialize as such. Nor did the partnership remain at a superficial level of technical collaboration.

However, the stark contrast between the 3.744 billion yuan investment and the mere 5% stake acquired has sparked widespread skepticism about FAW's move, with some questioning whether it is 'squandering money.' This makes the strategic considerations behind this seemingly 'slow-burning' collaboration even more worthy of in-depth exploration.

01

A Years-Long Negotiation and Collaborative Endeavor

In fact, the seeds of collaboration between FAW and Leapmotor were sown as early as 2019.

In that year, both parties initiated feasibility studies on the joint development of three-electric systems. Then, in April 2020, the strategic cooperation agreement between FAW Pentium and Leapmotor further laid the foundation for future collaboration. This year, both sides entered a highly anticipated 'period of negotiation' that drew significant market attention.

In March of this year, the two sides signed a Memorandum of Understanding on Strategic Cooperation, outlining collaboration in areas such as the joint development of new energy passenger vehicles, component cooperation, and capital cooperation. This open framework set the direction for subsequent cooperation but also fueled endless market speculation about the details of the capital collaboration.

By August, market rumors emerged that FAW planned to acquire approximately a 10% stake in Leapmotor. However, both parties responded with 'no knowledge' and 'no comment,' leaving the market's imagination to continue fermenting due to their ambiguous stance.

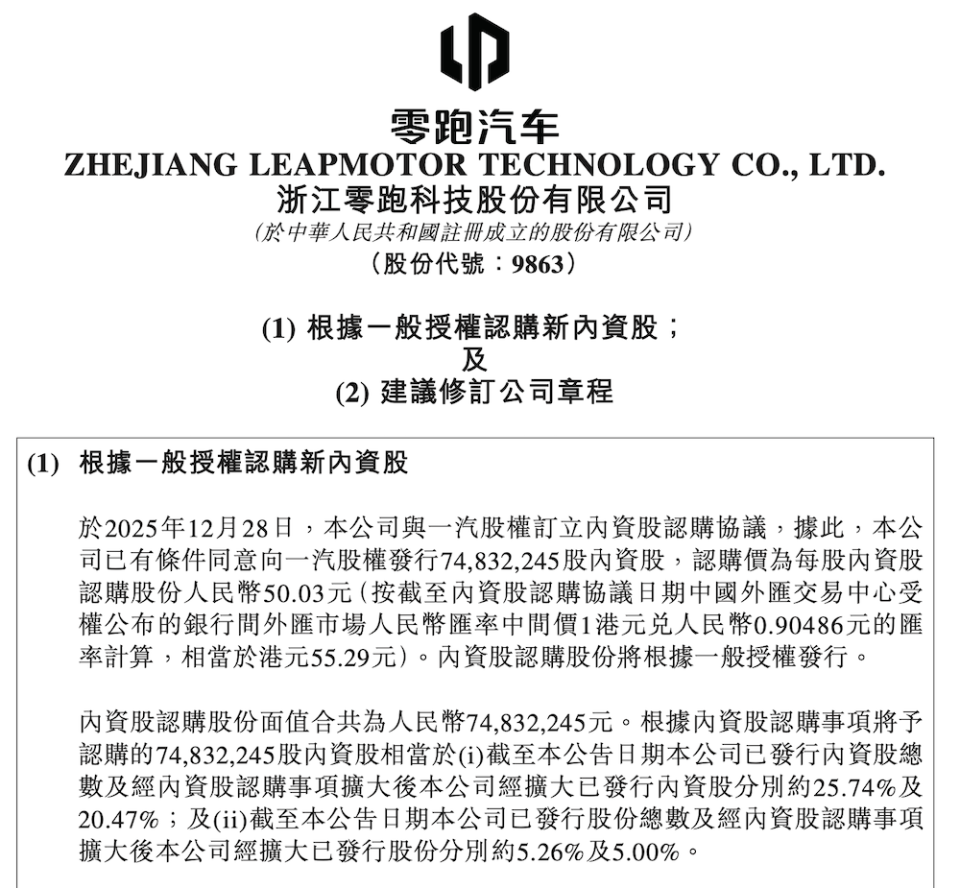

Now, after years of negotiation, the deal has finally been concluded. However, with an investment of 3.744 billion yuan, FAW has only secured a 5% stake, while Leapmotor's controlling stake remains unchanged. This raises the question: What is FAW's objective?

After all, as of December 30, 2025, Leapmotor's real-time market capitalization on the Hong Kong Stock Exchange is only 71.2 billion Hong Kong dollars. The 3.744 billion yuan investment for a 5% stake implies that FAW values Leapmotor at a staggering 74.9 billion yuan, indicating a significant premium over Leapmotor's current market price.

Currently, although Leapmotor leads in sales among new energy vehicle startups, its brand premium capability remains weak. FAW's substantial valuation concession has inevitably raised doubts.

02

3.7 Billion for a 5% Stake: A Win-Win Situation

Nevertheless, this 5% stake, which may seem like a 'symbolic' investment by FAW, is more accurately described as a mutually beneficial arrangement.

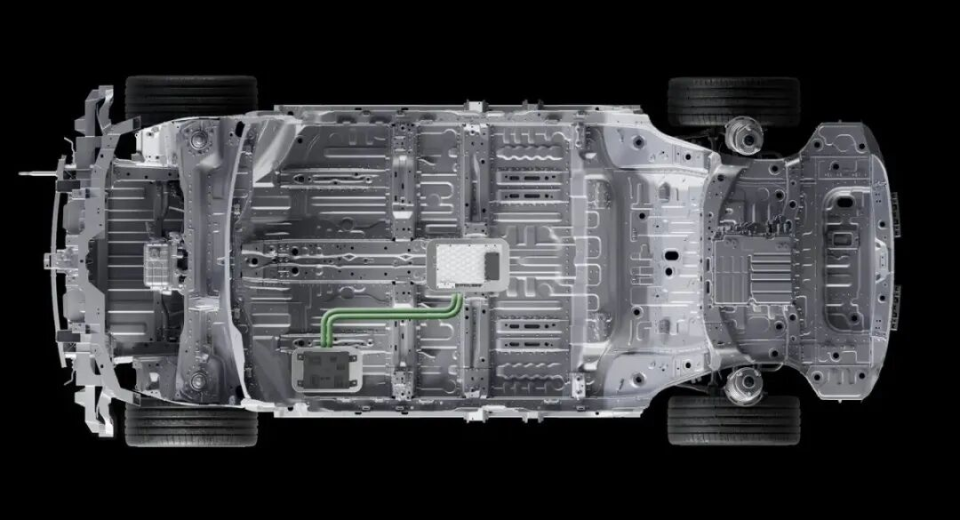

For FAW, the 3.7 billion yuan investment serves as an entry ticket. As the 'eldest son' of China's automotive industry, FAW has accumulated a rich manufacturing heritage during the internal combustion engine vehicle era. However, in the transition to electrification and intelligence, it faces the challenge of being 'too big to pivot'—lacking platform capabilities for core intelligent electric vehicle technologies and having product iteration speeds lagging behind those of new energy vehicle startups.

Leapmotor's full-stack self-developed technology system precisely serves as the 'key' for FAW to address its shortcomings. Leapmotor's market-proven technological achievements can help FAW shorten new product development cycles at a lower cost and higher efficiency, accelerating its new energy transition.

For Leapmotor, introducing FAW as a 'national team' shareholder brings value far beyond the 3.744 billion yuan capital injection. Amidst the increasingly fierce competition in the new energy vehicle industry, Leapmotor needs industrial resources and risk resistance capabilities to support its long-term development. In terms of funding, 50% of the 3.744 billion yuan investment will be used for R&D, 25% to supplement operating funds, and 25% to expand the sales and service network and brand building. More importantly, with FAW's endorsement, Leapmotor's brand credibility and supply chain bargaining power will be significantly enhanced, providing it with a more favorable competitive position in the market.

In summary, while the 3.7 billion yuan investment for a 5% stake may seem like a loss for FAW on the surface, what it has acquired is not just shares but, more crucially, access to high-quality partner resources for entering the new energy sector and essential technological support capabilities. Meanwhile, Leapmotor has gained not only 3.7 billion yuan but also strategic support for its long-term survival and development.

In fact, strategic stakeholding models similar to the 'around 5%' approach between FAW and Leapmotor have already emerged. For instance, Volkswagen's private placement investment in XPENG Motors resulted in a final stake of 4.99%, close to 5%. This indicates deep collaboration in areas such as technology while keeping corporate control and key decision-making rights in the hands of the founding team, achieving a win-win situation without interference.

03

Leapmotor's Next Decade

Coinciding with the crucial milestone of its collaboration with FAW, Leapmotor also celebrates its 10th anniversary.

Over the past decade, Leapmotor has grown from scratch to achieve cumulative deliveries exceeding 1.2 million units, expanding from a single model to a diverse product matrix covering multiple market segments. It has now moved beyond the initial exploration phase of new energy vehicle startups and stands at a critical turning point of 'shedding the new energy vehicle startup label and advancing towards maturity as an established automaker.'

As founder Zhu Jiangming stated, Leapmotor's next decade will be dedicated to brand elevation, aiming for annual sales of 4 million units. FAW's strategic stakeholding provides crucial resource support and a developmental buffer during this transformative period.

Over the years, Leapmotor has established a strong foothold in the cost-effectiveness segment and achieved continuous market share growth—with cumulative sales reaching 465,800 units from January to October 2025 and annual sales projected to approach 600,000 units, solidifying its position as a leader among new energy vehicle startups.

At its 10th-anniversary event, Leapmotor unveiled two flagship models, the D19 and D99, expressing its commitment to 'going premium.' It is evident that Leapmotor, after years of deep cultivation in the cost-effectiveness segment, is seeking transformation.

In this long-term battle for survival and advancement, whether Leapmotor can leverage external resources to break through its bottlenecks and achieve a transition from the 'king of cost-effectiveness' to a 'high-end technology brand' will not only determine its fate in the next decade but also provide a new reference for the maturation of new energy vehicle enterprises.