Meta's Multi-Billion-Dollar Purchase of Manus: After Falling Behind in Open-Source Models, Can 'Financial Clout' Bridge the Agent Divide?

![]() 12/31 2025

12/31 2025

![]() 352

352

It is widely believed that this is merely the starting point.

In recent years, it's not unusual for major corporations to acquire AI startups, with industry giants like Google, Apple, Microsoft, Alibaba, Ant Group, and OPPO all making such strategic moves.

However, after shelling out a staggering $14.3 billion to acquire nearly half of Scale AI in mid-2025, Meta went on to invest billions more by the end of the year to acquire 'Butterfly Effect,' the company behind the AI application Manus.

On December 30, 2025, Beijing Time, both entities announced the deal. Meta disclosed that Manus would be seamlessly integrated into its product lineup, offering universal AI agent capabilities for both consumer and enterprise offerings. Manus, in turn, revealed that its app and website would continue operations, with the company maintaining its headquarters in Singapore.

According to 'LatePost,' following the multi-billion-dollar acquisition, Manus's co-founder and CEO, Xiao Hong, also assumed the role of vice president at Meta.

Xiao Hong. Image source: Manus

Interestingly, shortly after Meta's acquisition of nearly half of Scale AI in mid-2025, its founder, Alexandr Wang (a Chinese-American), swiftly became Meta's Chief AI Officer, taking charge of Meta's new 'Superintelligence' team.

This trend underscores a new reality in the current AI landscape: a select few key talents have become indispensable. Case in point: Luo Fuli, who transitioned from DeepSeek to Xiaomi as the head of large models, and Yao Shunyu, who was lured away from OpenAI by Tencent to serve as chief AI scientist. While products can be duplicated and models can be caught up to, those capable of transforming models into profitable products are increasingly rare.

However, Meta's acquisition of Manus was not solely motivated by Xiao Hong's talent, nor was Manus's decision to sell driven solely by financial gain. More crucially, why did Meta, rather than a domestic powerhouse, acquire Manus?

Meta's Quest for AI Applications; Manus's Need for a Behemoth Backer

In fact, mergers and acquisitions have become a common occurrence in the AI sector over the past two years, with nearly all of the 'Magnificent Seven' tech stocks engaging in such activities.

For instance, Google spent $2.5 billion in 2024 to integrate the core team of AI unicorn Character.AI into its Gemini project and acquired the core team of AI programming startup Windsurf this year. Just days before Meta's acquisition of Manus, NVIDIA planned to spend $20 billion to acquire key executives, members, and core inference technology licenses from AI chip startup Groq.

Domestically, OPPO acquired Wave Intelligence, Ant Group acquired Biansai Technology, and Alibaba acquired part of the team from 01.AI. Even the Manus team received a $30 million acquisition offer from ByteDance in early 2024 (when it only had the Monica browser plugin).

Ultimately, Meta emerged victorious in the race for Manus.

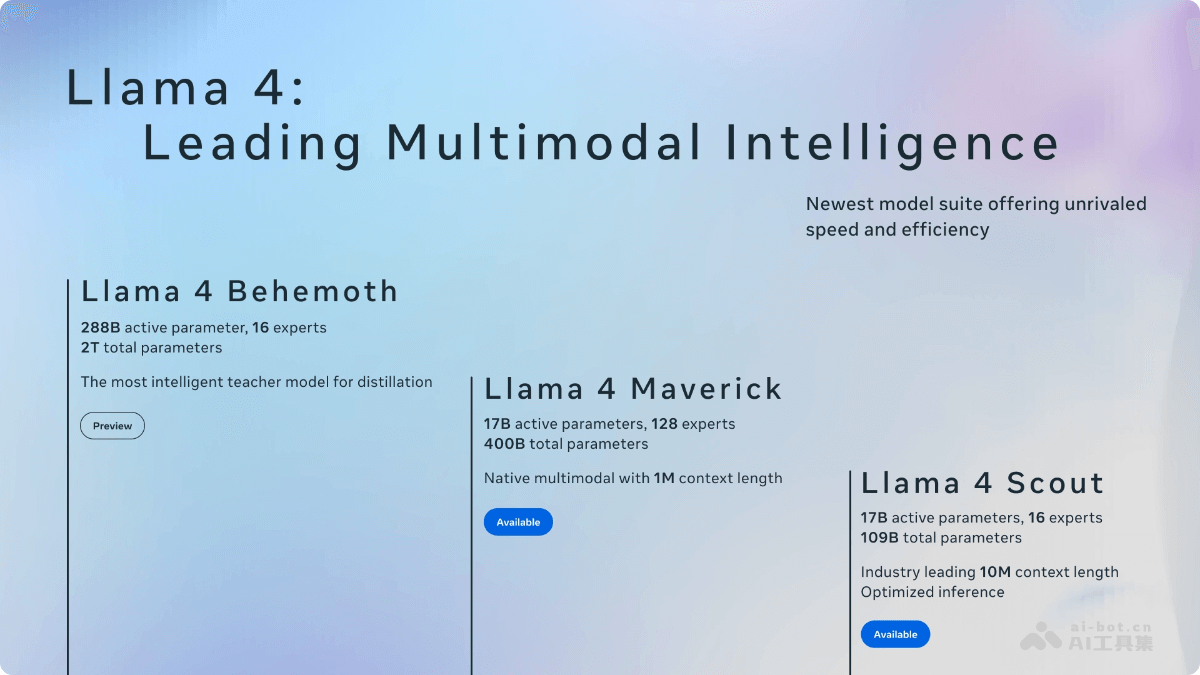

Meta's desire for Manus is understandable. Over the past two years, Meta has made substantial AI investments, continuously iterating on its Llama series with improvements in parameter scale, open-source ecosystem, and inference efficiency. However, a stark reality has emerged: Llama has fallen behind in the open-source model competition.

Image source: Meta

In terms of model performance and emergent intelligence, Llama has not only failed to keep pace with closed-source models like GPT, Claude, and Gemini but has also been eclipsed by domestic open-source models like DeepSeek and Qwen, relinquishing its 'crown' in the global open-source model ecosystem.

Consequently, Meta has made little headway in the 2025 AI agent competition. More critically, Meta has consistently struggled to launch a blockbuster AI application.

In late June, eight top OpenAI researchers left to join Meta. OpenAI's Chief Research Officer, Mark Chen, later revealed that Zuckerberg even 'personally cooked soup' to entice OpenAI members. In early July, Zuckerberg announced the formation of a 'Superintelligence' team led by Alexandr Wang.

Meta's model battle hinges on this move, but its application battle remains unresolved. Acquiring the Manus team is undoubtedly a crucial step for Meta to launch successful AI applications. When Manus relocated its headquarters and team to Singapore in July, Leitech noted in its coverage the attention Silicon Valley giants were paying to Manus.

Conversely, Manus's choice of a tech giant as a partner is unsurprising.

Manus use case 'replay' (5x speed). Image: Manus

Since sparking the 'general AI agent' trend earlier this year, Manus's growth trajectory has been clear: rapidly validating product forms, swiftly establishing paid services, and solidifying agent delivery. However, it has increasingly encountered the inevitable ceiling faced by AI application startups.

Agents inherently rely on a 'high-frequency, multi-step, long-chain' computing model, demanding far greater stability and cost control than ordinary conversational applications. While Manus can attract initial users through product strength, expanding into broader enterprise and global markets with just a startup's channels and brand is inefficient.

Moreover, when the team relocated to Singapore in mid-2025, Xiao Hong posted on Jike about 'creating great products in a globalized market.' However, relocating to Singapore is merely the starting point. The real complexity lies in building cross-regional data, payment, and enterprise client trust systems.

Looking back at the end of 2025, the agent race is undoubtedly a war of attrition, consuming both computing power and time.

Meanwhile, tech giants are increasingly encroaching on AI startups' territory. Recently, market research firm Quest Mobile released the latest weekly active user rankings for AI applications, with Doubao significantly leading DeepSeek. ByteDance and Alibaba each have three AI applications on the list, leaving only DeepSeek and Kimi (both from AI startups) with notably declined weekly active users compared to three months ago.

China's AI Application Wave: More Than Just One Manus

'We have an announcement to share: Manus is joining Meta. For us, this is not just news but recognition of Manus's work in the general AI agent field,' the Manus team stated.

However, Meta's acquisition of Manus has sparked controversy beyond the companies involved. As a major investor in Manus, ZhenFund believes 'this will be a tremendous inspiration for the new generation of young entrepreneurs in the AI era.' Meanwhile, Meta's role as the acquirer has raised discussions about the 'loss' of domestic innovation:

Why Meta and not a domestic giant? Why did Manus only gain widespread recognition after being acquired by Meta?

While Manus holds significance as a general AI agent product, showcasing the value of AI agents, there is no need to overstate its rarity.

In fact, Manus is not an isolated success story for Chinese AI applications. Over the past year, Chinese AI application startups have been quietly gaining global attention through more understated and pragmatic approaches. Their commonality lies not in model parameter size but in their keen grasp of demand and technical capabilities.

Take MasterAgent as an example, which follows a different yet noteworthy path compared to Manus. Unlike general agents targeting individual users, MasterAgent focuses on 'multi-agent collaboration,' creating AI teams that work together rather than a single all-purpose assistant. Its strength lies not in individual agent intelligence but in task decomposition, role division, and result delivery.

Image source: MasterAgent

Similarly, HeyGen, an AI video tool that enables Taylor Swift and Donald Trump to speak Chinese, allows users to upload videos and select target languages for automatic translation, voice adjustment, and lip-syncing. HeyGen does not rely on proprietary large models but, like Manus, excels in contextual engineering and tool integration above existing models.

PixVerse (video generation), Fellou AI (browser), Flowith (canvas-based AI agent)... These Chinese startup-developed AI applications better meet real-world business needs: complex workflows, clear responsibilities, and results-oriented outcomes. In these areas, Chinese AI startup teams demonstrate unique strengths in engineering and product awareness.

This advantage is no accident. On one hand, Chinese teams have honed their products in high-intensity market environments, becoming highly sensitive to efficiency, stability, and cost. On the other hand, they do not insist on 'redefining everything from scratch' but excel at rapidly building usable, marketable, and scalable products atop existing models and tools.

Manus is merely one name that has gained more visibility. Beyond it, countless other Chinese 'Manus' teams are quietly implementing solutions in specific scenarios, deserving recognition as well. Their outcomes may not all evolve into industry leaders or be acquired by giants.

In this sense, while Meta acquired one Manus, what truly deserves attention in China is not the fate of a single company but the continuous emergence of new 'Manus' teams from this ecosystem.

manusMetaAgent

Source: Leitech

Images in this article are from the 123RF licensed image library.