Geely Initiates Legal Action Against Sunwoda, Bringing New Supply Chain Disputes in the EV Sector to Light

![]() 01/07 2026

01/07 2026

![]() 415

415

Lead | Introduction

The meteoric rise of new energy vehicles (NEVs) has not only revolutionized the automotive market but also necessitated a realignment of supply chains. This shift has introduced fresh challenges to the dynamics between automakers and their component suppliers. In 2025, Geely's legal battle against Sunwoda, seeking a staggering RMB 2.3 billion in damages, emerged as a highly scrutinized event at the year's end. Why is Geely demanding such exorbitant compensation, and what repercussions will this lawsuit have on the future landscape of the domestic automotive market?

Published by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Full text: 2,413 characters

Estimated reading time: 4 minutes

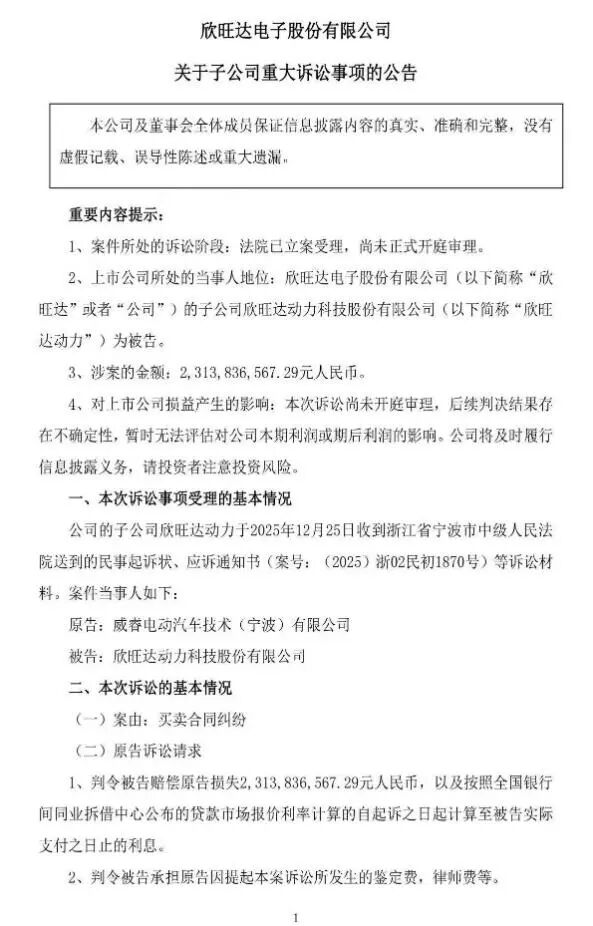

Recently, an announcement from Sunwoda sent ripples of concern throughout the domestic automotive industry.

Sunwoda Power found itself embroiled in a legal dispute with VREX Electric Vehicle Technology, a subsidiary of Geely Holding Group. The allegations centered on quality issues in battery cells supplied by Sunwoda to VREX and utilized in Zeekr vehicles from June 2021 to December 2023. How did these two prominent players in the automotive industry end up in a courtroom?

△Sunwoda Power is sued by a Geely Holding subsidiary

Geely Automobile 'Settling Scores'

For a burgeoning electric vehicle brand like Zeekr under Geely's umbrella, battery-related issues can spell disaster.

In late 2024, the Zeekr 001 WE86 model faced a barrage of complaints, including significant reductions in battery range, battery capacity degradation, slower charging speeds, unstable charging voltages, and even extreme cases of vehicle spontaneous combustion. According to VREX's claims, these issues stemmed primarily from quality problems in certain batches of battery cells supplied by Sunwoda, such as 'inconsistent voltage platforms' and 'excessive internal resistance variations.' These problems wreak havoc on a power battery pack composed of thousands of individual cells.

△In 2024, the Zeekr 001 WE86 faced a surge of battery-related complaints

At that juncture, Zeekr's decision to opt for Sunwoda's battery cells may have been a reluctant one. On one hand, Sunwoda's battery cells offered a cost advantage. According to financial reports for the first half of 2025, Sunwoda's power battery gross margin stood at a mere 9.77%, while CATL's soared to a robust 22.41%. In the fiercely competitive domestic EV market, battery costs have emerged as a pivotal factor in determining vehicle pricing. On the other hand, during the EV market's rapid expansion phase, CATL's battery cells were in short supply. Choosing Sunwoda's batteries enabled Zeekr to commence deliveries on schedule and seize market share.

However, after 'Times Geely,' a joint venture between CATL and Geely, began supplying battery cells, Zeekr swiftly transitioned to CATL's batteries, which boast a stronger brand reputation, thereby resolving the previously criticized battery issues. To placate dissatisfied customers, Zeekr launched a 'Winter Care Campaign' in late 2024, offering battery inspections for all Zeekr 001 WE86 vehicles and free battery pack replacements if abnormalities were detected. Considering the popularity of the Zeekr 001 in China and the cost of each battery pack hovering around RMB 150,000, this substantial expenditure represented a significant financial burden for a fledgling brand like Zeekr. Without the support of Geely and other shareholders, other new energy vehicle brands might not have weathered such a crisis, let alone the incalculable impact of Sunwoda's battery quality issues on the Zeekr brand.

△Zeekr invested heavily in inspecting and replacing Sunwoda's battery cells with quality issues

Why is Geely Pursuing Legal Action?

While Sunwoda's battery cells have undoubtedly cast a shadow over Zeekr and Geely's overall EV strategy, disputes between two industry titans in China are typically resolved through internal negotiations. Why has Geely opted for legal recourse this time? This decision may be attributed to the following two reasons:

1. The substantial compensation claim. According to relevant data disclosed by Sunwoda, the company's net profit attributable to shareholders for the entire year of 2024 was RMB 1.468 billion, and for the first three quarters of this year, net profit continued to surge, reaching RMB 1.405 billion. Geely's compensation claim of RMB 2.314 billion nearly equals Sunwoda's total profits for two years, rendering it an unacceptable figure for Sunwoda. Consequently, resolving the issue through private negotiations is virtually impossible.

△The compensation amount sought by Geely exceeds Sunwoda's acceptable limit

2. Vindicating Zeekr's safety reputation. During the heyday of the Zeekr 001, Sunwoda's battery cells tarnished the Zeekr brand. This lawsuit unequivocally conveys to domestic users that the previous issues were not directly attributable to Zeekr's manufacturing but rather to the supplier. Furthermore, by employing legal means to sever ties with Sunwoda, Geely is also providing a collective 'endorsement' for the battery safety of other EV models under its group in the future.

Beyond significantly impacting Geely and Sunwoda, this lawsuit will also reverberate across other domestic automakers. According to data from the China Automotive Power Battery Industry Innovation Alliance, from January to November 2025, Sunwoda ranked sixth among domestic suppliers in terms of power battery installations, with a market share of approximately 3.25%. Lawsuits like Geely's against Sunwoda typically drag on for an extended period. If related incidents continue to simmer in public opinion, it will inevitably sway consumers' purchasing decisions, directly affecting other automakers' choices of battery suppliers and the launch of new models. Some automakers relying on Sunwoda's batteries may encounter certain hurdles.

Battery Safety Must Never Be Compromised

Geely's lawsuit against Sunwoda marks a watershed moment in the domestic automotive industry.

During the EV market's rapid growth phase, automakers often found themselves at the mercy of battery manufacturers, pleading for timely deliveries. There have even been instances where the combined profits of several leading automakers in China paled in comparison to those of CATL. However, as the domestic EV/NEV market growth slows down, especially as automakers begin to stabilize their own battery supply chains, situations like Geely's 'settling scores' may become more prevalent in the future.

Battery safety is paramount for any EV/NEV brand and may even dictate a company's survival. Especially with the accelerated pace of new model launches, it poses a significant challenge to the product quality control of both automakers and battery suppliers. Therefore, both vehicle manufacturers and power battery suppliers must conduct rigorous verification and testing before introducing new products. In reality, factors such as 'refrigerators, TVs, and sofas' or intelligent cockpits and autonomous driving do not resonate with consumers as profoundly as battery safety. Hence, it is justified for automakers to be highly discerning about battery safety performance.

△It is justified for automakers to be highly selective about battery safety performance

From Sunwoda's vantage point, beyond resolving this issue with Geely, bolstering quality control is even more imperative. Currently, the domestic automotive market, whether for EVs or power batteries, is grappling with overcapacity. Both Sunwoda and other battery companies must further enhance quality control while capturing market share through low-profit, high-volume strategies to avert similar 'high-stakes lawsuits.'

Commentary

One is a leading domestic automaker, and the other is a mainstream domestic battery company. Any development can have far-reaching ramifications. From Sunwoda's perspective, learning from past experiences and continuously refining product quality will become even more critical in the future. From the automakers' vantage point, they should not be solely swayed by suppliers' low prices. Once various issues surface later, both the direct costs of recalls and the indirect impact on the brand may prove unbearable. It is worth mentioning that the Chinese automotive market should actively steer clear of a low-level, price-based internal competition. Competitions without ethical boundaries may lead companies to compromise on quality control and safety.

(This article is original to 'Heyan Yueche' and may not be reproduced without authorization.)