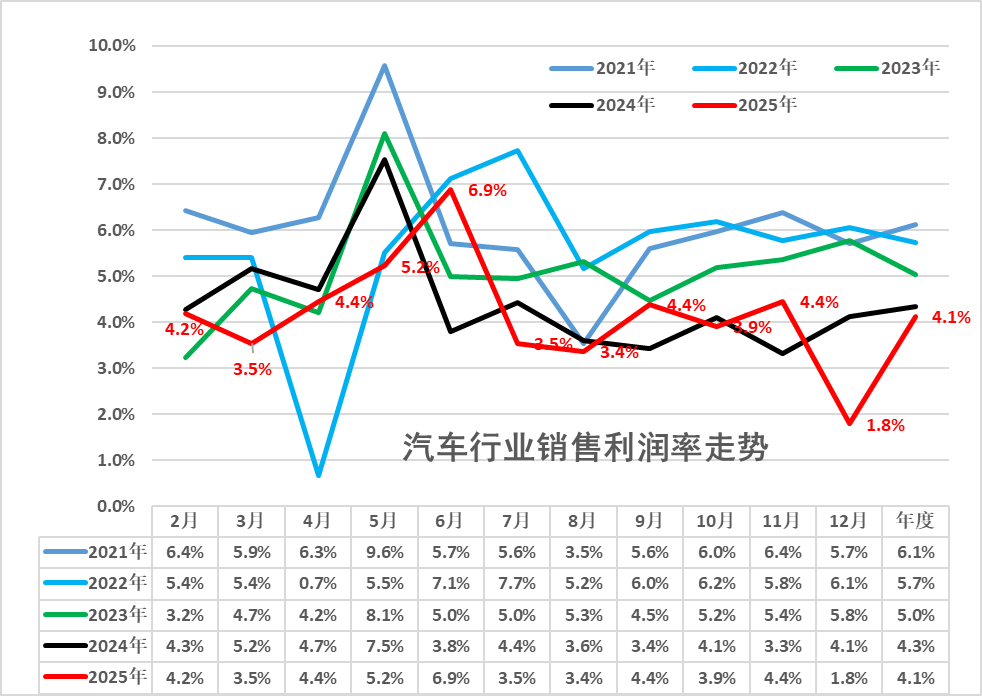

Last Year, Auto Sales Profit Margins Plummeted to a Record Low of Just 4.1%. Will Car Prices Climb This Year?

![]() 01/29 2026

01/29 2026

![]() 332

332

As 2025 drew to a close, China's auto sector reported the production of 34.78 million vehicles, marking a 10% year-on-year increase. However, the industry's overall revenue growth of 7.1% was outstripped by an 8.1% surge in costs.

Ultimately, the annual total profit reached RMB 461 billion, showing a mere 0.6% uptick, with the industry's sales profit margin settling at 4.1%. This represents a further drop from the historical low of 4.3% recorded in 2024 and lags far behind the 5.9% average for downstream industrial enterprises. Even more concerning was the data from December of the previous year: the monthly profit margin nose-dived to 1.8%, halving year-on-year, as downward profit pressure reached a near-term peak.

When Cui Dongshu, Secretary-General of the National Passenger Car Market Information Association, unveiled the aforementioned data on China's auto industry last year, it immediately sparked widespread attention and heated debates, even trending on social media.

Numerous netizens posed questions: On one hand, the industry is experiencing a booming production and sales scale, with the penetration rate of new energy vehicles nearing 50%. On the other hand, the industry's profits remain mired in the 'low-margin' zone. What is the source of this 'haze' looming over the auto industry? How will automakers break free from this predicament? Will car prices increase this year?

Where Did the Profits Disappear? A Triple-Pressure Analysis

"This isn't attributable to a single factor but rather stems from the triple pressures of costs, competition, and structural transformation," an auto industry analyst pointed out incisively.

Firstly, escalating costs are eroding profit margins. Data indicates that in 2025, the cost growth rate in the auto industry surpassed revenue growth for the second consecutive year. "The prices of key raw materials are a major culprit," revealed a procurement officer from an automaker. "The price of lithium carbonate doubled during the year, and coupled with the overall high prices of commodities, manufacturing costs were directly driven up. However, most automakers don't produce batteries and lack leverage in negotiating core component costs, making it difficult to effectively alleviate cost pressures."

Secondly, the 'involution' (cut-throat competition) style price war is intensifying. Despite ongoing national efforts to curb 'involution,' fierce market competition shows no signs of abating in the short term. To capture market share, particularly in the new energy sector, price cuts and substantial discounts have become common promotional strategies, with some even pricing products at a loss, directly suppressing per-vehicle profits. Statistics reveal that in 2025, the revenue per vehicle in the industrial chain decreased by RMB 16,000. Although costs also declined, profit margins were severely compressed.

Thirdly, structural growing pains persist during the transition period. In 2025, new energy vehicle production hit 16.52 million units, with a penetration rate of 48%. However, the industry's profitability hasn't kept pace with the scale expansion. "New energy vehicles, especially pure electric vehicles, require significant upfront investment in R&D, three-electric systems (battery, electric motor, and electronic control), and intelligence. It takes time for scale effects and mature profit models to materialize," an industry analyst stated. "Meanwhile, the gasoline vehicle market is continuously shrinking, and its originally relatively stable profit pool is also dwindling. This transition period has contributed to the overall profit margin slump."

"Breakthrough" Strategies: Financial Innovation, High-End Products, and Overseas Expansion

Faced with persistently low profit margins, automakers are acutely aware of the challenges. Three distinct adjustment paths have emerged: leveraging financial tools to stimulate the market, upgrading product structures, and accelerating overseas expansion to tap into new markets.

The recent popularity of 'ultra-long-term low-interest loans' is no accident; they serve as a financial catalyst to spur domestic demand amidst price stabilization efforts. Several mainstream automakers, in collaboration with financial institutions, have rolled out low-interest or interest-free auto financing plans lasting up to five or even seven years.

"This isn't merely a promotional gimmick," a marketing officer from a new energy vehicle brand stated. "Its core objectives are twofold: first, to lower the entry barrier for consumers and stimulate latent demand; second, to generate revenue through financial products themselves, improving automakers' cash flow and overall profits. While offering discounts for volume on the sales front, the financial end can 'compensate profits with services.'"

Promoting mid-to-high-end models is a direct approach to enhancing brand value and per-vehicle profits. Whether it's the new energy high-end sub-brands of traditional automakers or the continuously upgraded product lines of new energy vehicle startups, the number of mid-to-high-end models launched by domestic automakers reached a record high in 2025. This trend is expected to persist this year.

"We must break free from the 'cost-effectiveness' red ocean," a senior executive from a new energy vehicle company conceded. "Only by elevating the brand and enhancing product premium capabilities can we fundamentally improve gross margins. Nowadays, competition isn't just about technology but also about brand perception and user experience, which determine the profit ceiling."

Accelerating overseas market expansion is becoming a pivotal strategy for leading automakers to pursue growth and enhance profitability. "When domestic market growth hits bottlenecks and profits are thin, the vast overseas market becomes an inevitable choice," pointed out Chen Shihua, Deputy Secretary-General of the China Association of Automobile Manufacturers. "Especially in markets like Europe, Southeast Asia, and Australasia, Chinese new energy vehicles boast significant product competitiveness and industrial chain advantages, with average selling prices and profit margins generally higher than in the domestic market."

Several automakers ramped up their investments in overseas localized production in 2025, transitioning from simple product exports to brand, technology, and manufacturing exports, aiming to establish a more stable and high-value global market system. The fruits of these strategic layouts will gradually become evident in 2026.

Profit Redistribution and Policy Expectations

From a broader industrial economic standpoint, the relatively low profit margins in the auto industry are closely linked to shifts in profit distribution across the industrial chain. In 2025, the profit margin in the upstream non-ferrous metals industry soared to as high as 29.4%, with significant improvements in the steel industry's profits and historically high profits in the power industry. National measures to combat 'involution' and stabilize raw material prices have objectively facilitated a reasonable reallocation of profits towards the upstream and foundational sectors of the industrial chain.

"As a comprehensive manifestation of the manufacturing industry, the health of the auto industry necessitates collaboration across the entire industrial chain," a senior industry insider stated. "The recovery of profits in the upstream raw material sector contributes to supply chain stability. However, the manufacturing and assembly sectors in the mid-to-downstream must also maintain reasonable profit margins to sustain continuous investment in R&D and achieve transformation and upgrading. The current profit margin of 4.1% is clearly unsustainable."

The industry widely anticipates that policies such as 'equal rights for gasoline and electric vehicles,' which are set to be further implemented, will create a fairer competitive environment from the usage perspective, fostering 'co-prosperity of gasoline and electric vehicles' and stabilizing the market foundation. Meanwhile, the expansion of policies like 'trade-ins for consumer goods' is expected to continuously unleash domestic replacement demand.

Despite unprecedented pressures, positive signals have emerged. The growth rates of industry accounts receivable and finished goods inventory are lower than the overall industrial levels, indicating certain operational resilience. With the deepening of efforts to combat 'involution,' irrational price wars are expected to gradually subside. Furthermore, the intensification of overseas expansion strategies is opening a door to broader profit margins for the industry.

"2025 may mark a cyclical low point for industry profits," an industry analyst predicted. "Automakers are making comprehensive adjustments through financial innovation, product upgrades, and global expansion. When the scale effects of new energy vehicles further manifest in the global market, high-end and branding strategies start to yield results, and the profit distribution across the industrial chain becomes more balanced, the auto industry's profit margins are expected to rebound from the bottom. The future competition will not only revolve around market share in the domestic arena but also around value and efficiency in the global market."