2025 Automotive Market Keyword: Reverse Joint Venture

![]() 01/29 2026

01/29 2026

![]() 551

551

As the adage goes, 'Change is the only constant.'

In recent years, the joint venture landscape between Chinese and foreign automakers has witnessed a dramatic transformation. During the era dominated by traditional fuel vehicles, overseas automakers contributed products, technology, brands, and even manufacturing capabilities, while Chinese domestic automakers provided land, capital, and human resources. Today, the scenario has shifted, with some Chinese automakers now supplying technology and platforms to their overseas counterparts, giving birth to a novel collaboration model: reverse joint ventures.

At its core, the rise of new energy vehicles has presented Chinese automakers with a golden opportunity to leapfrog their rivals and take the lead in mastering technological advancements in the two pivotal areas of electrification and intelligence. In contrast, traditional multinational automakers have been sluggish in electrification and lag behind in intelligence. Given that China represents the world's largest market for both new vehicles and new energy vehicles, most multinational automakers are reluctant to concede defeat, prompting them to adopt a cooperative strategy of 'if you can't beat them, join them'.

In February of the previous year, media outlets reported that VOYAH would share its core competencies, such as three-electric powertrains and hybrid technology, with Dongfeng Nissan. Both entities engaged in technological collaboration on VOYAH's next-generation ESSA2.0 architecture and SOA electronic and electrical architecture. In April of the same year, Peugeot Citroën, a wholly-owned subsidiary of Stellantis Group in China, inked an electric drive project cooperation agreement with Lingsheng Power, a subsidiary of Leapmotor. Lingsheng Power provided services including electric drive assembly development, factory prototypes, and specialized testing. By August, XPENG Motors and Volkswagen Group had signed an expanded strategic cooperation agreement on electronic and electrical architecture technology, with the application scope of the advanced electronic and electrical architecture jointly developed by both parties extending from pure electric vehicle models to fuel vehicle and plug-in hybrid vehicle platforms.

Moreover, some overseas automakers are also turning to Chinese suppliers for intelligence solutions. It is understood that leading intelligent driving companies such as Horizon Robotics, Momenta, Huawei, and DJI have secured designated cooperation from multiple automakers, including Volkswagen, Nissan, Audi, and Toyota.

It is noteworthy that some products developed through the reverse joint venture model have already made their debut in the market.

Specifically, the NISSAN OS intelligent cockpit system, installed in the Nissan N7 and Nissan N6 models under Dongfeng Nissan, was developed with the participation of the intelligent driving team under Dongfeng Group, tailored to the usage habits of Chinese users. The two electrified models, EZ-6 and EZ-60, from Changan Mazda, were primarily developed by the Changan New Energy team, based on Changan's EPA pure electric platform. The core technologies, such as the three-electric systems and chassis architecture of BZ3X, are sourced from GAC Group. The Audi E5 Sportback, built on the ADP intelligent digital platform jointly developed by Audi and SAIC, is the first mass-produced model of the AUDI brand.

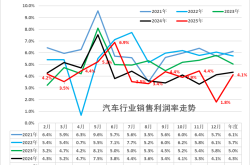

With the arrival of these models, the market performance of joint venture new energy vehicles has shown signs of a rebound. Data from the China Passenger Car Association reveals that in 2025, the retail market share of joint venture automakers in China was approximately 35%, with the year-on-year decline narrowing by 3.4%.

Analyzing by model, the BZ3X sold 70,000 units in 2025, making it the best-selling new energy vehicle among joint venture automakers. Since its launch in April, the Nissan N7 has delivered 45,000 units, ranking at the top among joint venture mid-to-large new energy sedans. The Nissan N6 also ranks among the top performers in the joint venture mid-size new energy vehicle segment. The combined sales of Changan Mazda's EZ-6 and EZ-60 reached 33,000 units, with the latter entering the top ten list less than six months after its launch, outperforming models such as the BMW iX1 and Volvo XC70.

This year, more new energy vehicles from reverse joint ventures are set to hit the market.

Among them, the Nissan NX8, equipped with Momenta's R6 intelligent driving system, will be launched in the first half of this year, featuring the NR15T 1.5T four-cylinder extended-range engine from Dongfeng Motor. The BZ7, expected to debut in March this year, not only incorporates Momenta's R6 high-level solution but also integrates Huawei's full-spec HarmonyOS cockpit and Xiaomi's ecosystem. It is worth mentioning that the vehicle's product definition and development were led by the Chinese engineer team from GAC Toyota. The first Volkswagen model adopting XPENG's electronic and electrical architecture, the ID.ERA 9X, is also scheduled for launch in March this year. Additionally, Volkswagen Group and SAIC Group will jointly develop three plug-in hybrid models and two pure electric models in China, which are expected to be launched sequentially starting this year. Similarly, FAW Group and Volkswagen Group's Volkswagen and Jetta brands will introduce 11 new models tailored for the Chinese market from 2026 onwards.

Media reports have highlighted that 2026 will be a pivotal year for the concentrated launch of joint venture new energy products. Judging from the current scenario, models such as the BZ3X and Nissan N7 have already achieved impressive sales figures, and subsequent new products are expected to maintain this hot sales momentum, further driving the overall sales growth of joint venture automakers.

However, market performance also underscores that whether it is a traditional joint venture or a reverse joint venture, the sales performance of their electrified products still lags behind the sales of fuel vehicles in the past. Currently, the challenge for joint venture automakers is to stand out amidst a sea of competitors. After all, what Chinese suppliers can offer is merely the ability to survive. As mentioned in the previous article '2025 Automotive Market Keyword: Huawei,' to truly thrive, automakers still need to demonstrate their genuine capabilities.

(Images sourced from the internet, removed if infringing)