January's Sales Figures Released: Is Buying a Car with 7-Year Low Interest a Bad Deal?

![]() 02/02 2026

02/02 2026

![]() 477

477

Purchasing a car with 7-year low-interest financing seems to be the only solution for February's auto sales.

On February 1st, Zeekr and Ledo each introduced policies surpassing Tesla's, including Ledo's 0 penalty for early repayment and Zeekr's 5-year 0% interest within the 7-year low-interest plan.

As carmakers released their January sales figures on February 1st, the numbers shattered all expectations. With new energy vehicles transitioning from zero purchase tax to a 50% reduction, and traditional sales peaks like Golden September and October, year-end, and pre-Spring Festival periods fading, Tesla's latest policy of 7-year low-interest financing is unlikely to replicate its "miraculous turnaround" in January 2023.

Hongmeng Zhixing sold 57,915 units in January, a 65.6% YoY increase but a 35.3% MoM decrease. Xiaomi sold over 39,000 units, down over 20% MoM; Li Auto sold 27,668 units, with both YoY and MoM declines; Leapmotor delivered 32,059 units, a 27% YoY increase but a 46.9% MoM decrease.

Behind the data lies a pattern similar to the dating market: popular choices remain in demand without much stimulation.

While the results weren't replicated, the effects were. After Tesla introduced its 7-year low-interest financing policy, Xiaomi, Li Auto, Geely Galaxy, XPeng, LanTu, Dongfeng eπ, GAC Aion, and Haval followed suit.

As we know, when an individual behavior becomes collective, public perception rises exponentially. The last such case was Tesla's Model 3 and Model Y price cuts of RMB 20,000-48,000 in January 2023.

But why isn't it working this time? And it's not just young people who are unimpressed.

Is 7-year low-interest financing just an emperor's new clothes?

The limited impact of 7-year low-interest financing is a cross-verified result.

Moreover, the lower the price, the more limited the benefits of the 7-year financing policy.

The first verification comes from the January 2026 sales figures released by major carmakers. Except for a few still in accelerated production and delivery of accumulated orders, most have reached a "cash-on-delivery" rhythm. The fluctuations in numbers reveal the limited impact of 7-year low-interest financing.

The second verification comes from frontline sales experiences with similar competitors. For vehicles priced above RMB 200,000, we surveyed luxury brands like Mercedes-Benz, BMW, and Lincoln, as well as peers like NIO, Xiaomi, Li Auto, and AITO. In January, few visitors mentioned or hesitated over other brands' 7-year financing policies. Instead, 3-year 0% interest offered substantial discounts.

For vehicles under RMB 200,000, especially those under RMB 150,000, the impact of 7-year low-interest financing is even weaker. This segment is highly sensitive to price changes.

A price difference of around RMB 1,000 can alter the final purchase decision. Given the abundant choices, strong substitutability, and accelerating new car launches with higher specs and lower prices in the under RMB 200,000 market, committing to a 7-year loan is no longer worthwhile.

Furthermore, extending loan terms primarily targets consumers with "relatively insufficient budgets," tapping into potential beyond the mainstream market.

Additionally, the consumer costs vary. Take Tesla's Model Y, which previously offered a 5-year 0% interest policy to boost sales. For the entry-level Model Y priced at RMB 263,500, the new 7-year low-interest policy extends the repayment period by 24 months and reduces monthly payments from around RMB 3,000 to nearly RMB 800. However, the total cost increases by over RMB 5,000.

Among the current 7-year low-interest policies, Tesla's rate remains relatively the lowest. Purchasing other brands' models with 7-year financing would incur even higher costs.

For example, the Xiaomi YU7 Standard Edition priced at RMB 233,500 has monthly payments of around RMB 2,600; the Li Auto i6 priced at RMB 249,800 has monthly payments of nearly RMB 3,000; the XPeng P7 priced at RMB 219,800 has monthly payments of around RMB 2,500; and the Galaxy M9 priced at RMB 173,800 has monthly payments of nearly RMB 2,000.

Moreover, consumer characteristics vary across brands. For buyers with budgets exceeding RMB 200,000, relatively good education, and younger age, a 7-year commitment without 0% interest is hard to accept.

Although in 2025, Tesla's 5-year 0% interest policy led to an estimated 80% of new buyers opting for financing, other carmakers cannot easily replicate this model. For instance, Tesla started production in China in 2019 and began public deliveries in early 2020. To date, its current models have only seen significant upgrades in computing units, from HW3.0 to HW4.0.

In contrast, Chinese brands now update their products every 12-18 months. Purchasing with a 7-year loan would essentially eliminate the possibility of keeping up with the latest technology.

The most crucial factor is the contrast. While eight major brands have introduced 7-year financing policies, and more may follow, many carmakers remain hesitant.

The Pitfalls of the 90s: Post-2000s Consumers Aren't Falling for It

Although the impact of 7-year low-interest financing is limited, it still offers positive brand benefits. Many participating carmakers use this policy as an attention-grabber, focusing more on promoting terminal discounts for the vehicles themselves.

Even if consumers are uninterested in 7-year financing, discounts and price incentives can still stimulate purchases.

Returning to the topic of inaction, strong brands with positive sales cycles seem less in need of such stimulation. Examples include Huawei-affiliated models, joint ventures, and major domestic brands.

Among them, brands under Hongmeng Zhixing focus on purchase tax subsidies rather than following the 7-year low-interest trend.

Mainstream joint ventures currently offer financial policies centered on 3-year 0% interest and 5-year low-interest or subsidized rates.

Among China's top five autonomous brands, except for Great Wall's Havol, which recently adopted 7-year low-interest financing, BYD, Geely, Changan, and Chery promote financial policies of 2-3 years 0% interest and 5-year low-interest rates.

The reason for not following even the popular 5-year 0% interest policy from 2025 lies in the rational decision-making of those who have learned from past mistakes.

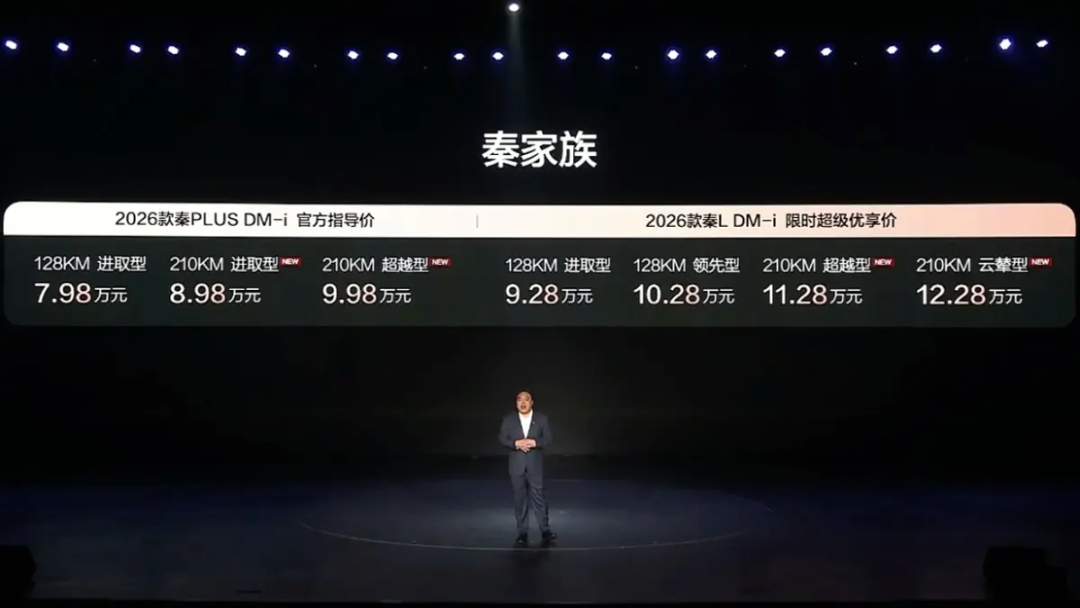

The obvious reason is that, after years of sales experience and understanding the market, for models priced between RMB 100,000-200,000, a one-time pricing strategy, like the latest 2026 BYD Qin family, suffices.

Additionally, 0% interest financing has shifted from lowering purchase barriers to becoming a discount method through manufacturer subsidies. Thus, for vehicles under RMB 200,000, increasing dealership discounts usually suffices.

A more critical reason is the potential chain reaction caused by overly aggressive financial policies. Many carmakers have learned this lesson the hard way.

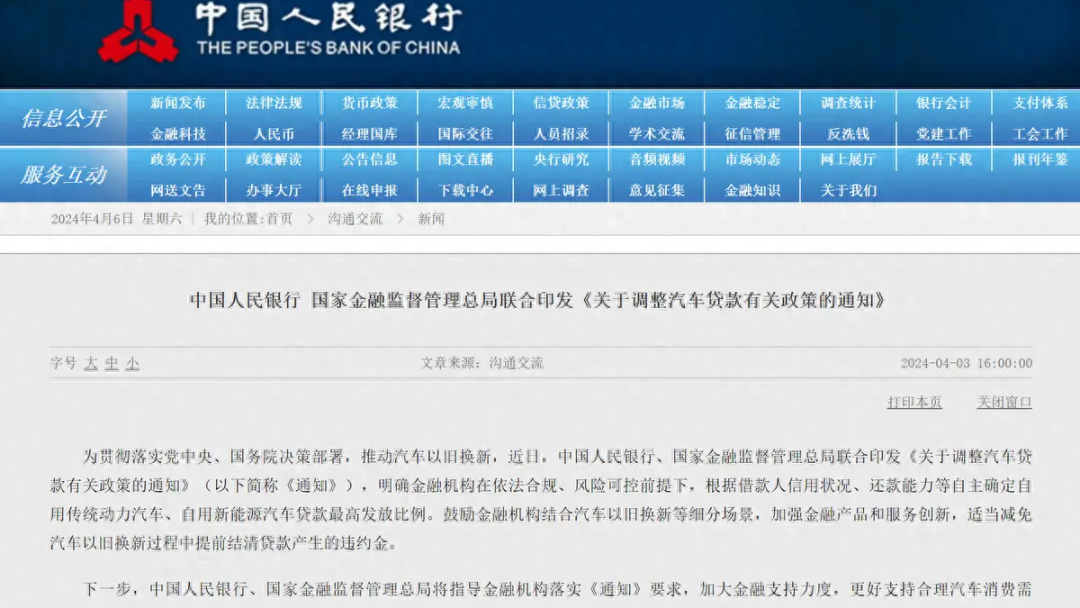

Around 2008, 0% down payment schemes migrated from real estate to the automotive industry. However, due to the 2004 "Automobile Loan Management Measures" capping auto loans at 80% (down payment ≥20%), various combinations like lease-to-own emerged but were quickly suppressed. It wasn't until April 2024 that policies relaxed, allowing financial institutions to determine auto loan ratios up to 100%, making 0% down payment financing officially compliant.

0% down payment, RMB 1 down payment, or down payments below RMB 5,000, as financing policies far exceeding 7-year low-interest in aggressiveness, caused numerous issues around 2019. For vehicles under RMB 100,000 targeting young consumers, lease-plus-financing combinations enabled 0% down payments.

The primary audience included college students and young workers seeking sporty commuter vehicles.

The outcome was that young people with limited savings faced significant financial pressure, leading to a high default rate. Although vehicles were mostly repossessed, the resulting damage to personal credit and wasted social resources was evident.

Clearly, most post-2000s consumers are unwilling to repeat the hardships faced by the post-90s generation.

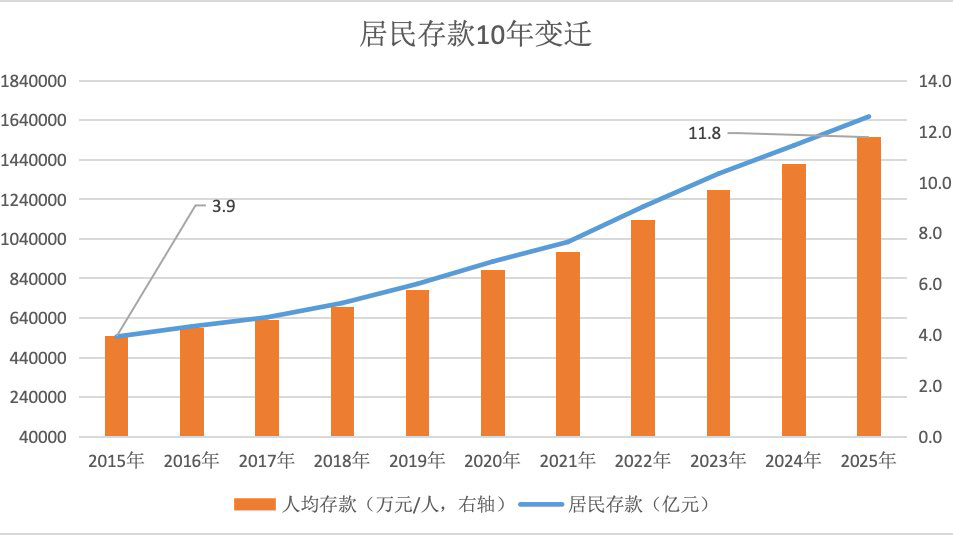

According to the 2025 Financial Statistics Report released by the People's Bank of China, household deposits reached RMB 166 trillion, a historic high. The proportion of time deposits also peaked at 73.4%. In the first half of 2025, household deposits increased by RMB 10.77 trillion, while household loans grew by only RMB 441.7 billion, the lowest since 2007.

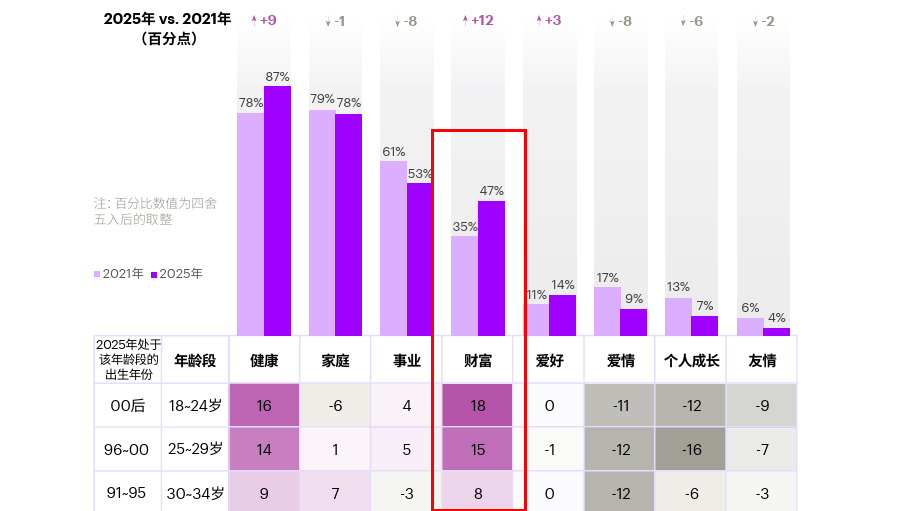

Additionally, according to a relatively authoritative survey report, Accenture's 2025 "China Consumer Insights," the post-2000 generation ranks first among all age groups in terms of their focus on wealth.

Multiple reports also support the conclusion that the post-2000 generation is more rational in their consumption. For example, the Shanghai Consumer Protection Commission's "New Insights: The Post-2000 Generation's New Consumption Trends," People.cn/China News Service's "2025 Youth Consumption Attitude Survey Report," and iResearch's "Z Generation Consumption Trends Report (2024-2025)."

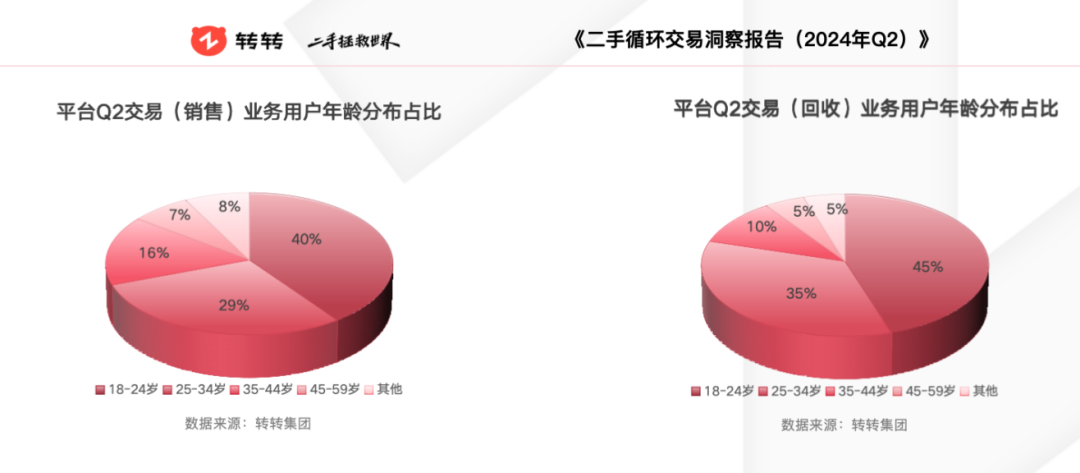

The key characteristics they exhibit are quite consistent, including not buying expensive items, being enthusiastic about second-hand goods, choosing affordable alternatives, comparing prices repeatedly, and saving wherever possible.

Therefore, precisely because of this, the current offering of 7-year low-interest rates by these leading automotive brands targeting young and trendy consumers does not possess particularly strong foundational logic.

In Conclusion

There has already been extensive discussion and analysis in the industry regarding 7-year low-interest rates. For instance, being tied down for too long, with an estimated 4-5 significant vehicle upgrades expected over 7 years, means that by the time the loan is repaid, the vehicle held will already be quite outdated.

However, this scenario is actually difficult to avoid because even if one chooses not to finance the vehicle purchase or opts for a relatively shorter-term loan, it will not hinder the rapid iteration of automotive companies. After all, buying a car is not the same as renting one, and depreciation is inevitable.

Essentially, the 7-year low-interest rate offer is limited in its stimulating (stimulative effect) compared to 0-interest rates. Instead of pursuing such innovations, it would be better to widely popularize the 5-year 0-interest rate initiative, which was a remarkable new attempt in 2025, across the industry.