"JiKe," the "Second Generation" Car Brand: Will It Be a Dark Horse in the Pure Electric Vehicle Market?

![]() 06/12 2024

06/12 2024

![]() 490

490

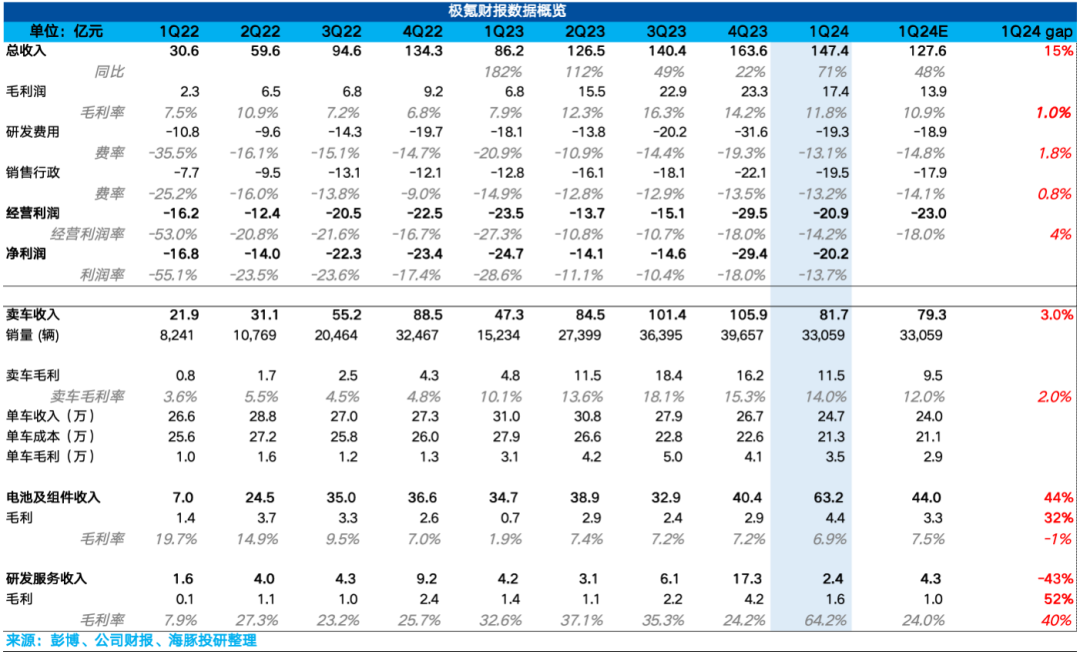

JiKe released its first-quarter financial report of 2024 before the U.S. market opening on June 11, 2024, Beijing time. Let's take a look at the key information:

1) Gross profit margin of car sales exceeded expectations: The gross profit margin of the automotive business in the first quarter was 14%, exceeding Dolphin's expectation of 12%. This is primarily due to the decline in vehicle prices being lower than Dolphin's expectation. Despite the unfavorable impact of the new JiKe 001 model's price drop of 31,000 to 57,000 yuan compared to the old model, and the decline in the proportion of high-priced JiKe 009 models, the average vehicle price only decreased by 20,000 yuan to 247,000 yuan, exceeding Dolphin's expectation of 240,000 yuan.

2) Delivery of the new JiKe 001 model drives a rapid rebound in second-quarter sales: The main model, the 24-series JiKe 001, underwent significant changes, and its listing price continued to decline compared to the old model. After the delivery of the new 001 model, second-quarter sales rebounded rapidly, and it is expected that after the completion of capacity ramp-up, second-quarter sales will increase by 59% to 69% year-on-year to 53,000 to 56,000 vehicles.

3) Significant reduction in research and development expenses drives a decline in operating expense ratio: Although sales and administrative expenses remained rigid due to store expansion and overseas marketing, the significant reduction in research and development expenses led to a 6.5% decline in the overall operating expense ratio.

4) Operating profit increased sequentially: Operating losses this quarter were -2.1 billion yuan, better than Dolphin's expected operating losses of -2.3 billion yuan. Although the gross profit margin declined sequentially, the significant reduction in research and development expenses led to an increase in both the absolute value and profit margin of operating profits this quarter compared to the previous quarter.

5) Cash flow levels remain low: JiKe's cash and cash equivalents for this quarter were only 3.8 billion yuan, continuing to decline sequentially, which is not safe compared to JiKe's first-quarter operating losses of -2.1 billion yuan.

Although JiKe has the cash flow support of its parent company Geely and does not need to be particularly concerned about JiKe's cash flow issues, Geely has many new energy brands under its umbrella and needs to bear the losses and investments of multiple new energy brands. JiKe needs to gradually reduce its reliance on Geely's financial support, reduce its own losses, and seek external financing.

Dolphin Investment Research Perspective: From the first-quarter results, our main focus on JiKe is still on its core automotive manufacturing business. This quarter's automotive manufacturing business performance exceeded Dolphin's expectations in terms of revenue and gross profit margin, primarily due to the lower-than-expected decline in ASP per vehicle.

Despite the unfavorable impact of the new JiKe 001 model's price drop of 31,000 to 57,000 yuan compared to the old model, and the decline in the proportion of high-priced JiKe 009 models, the average vehicle price only decreased by 20,000 yuan to 247,000 yuan, exceeding Dolphin's expectation of 240,000 yuan. The gross profit margin of the automotive business only declined by 1.3% sequentially to 14%, exceeding Dolphin's expectation of 12% during the trough period of vehicle manufacturing.

From the expense perspective, although sales and administrative expenses remained relatively rigid, the significant reduction in research and development expenses led to an increase in both the absolute value and profit margin of operating profits this