Big News! Alipay Rolls Out Robotaxi Autonomous Driving Travel Service Platform: How Will the Aggregated Ecosystem Transform the Unmanned Travel Landscape?

![]() 02/11 2026

02/11 2026

![]() 541

541

Introduction

Following in the footsteps of Baidu's 'Luobo Kuaipao' and Gaode's aggregated services, Alipay's Robotaxi autonomous driving travel service platform officially launched in February 2026.

This aggregated platform, which brings together autonomous driving service providers like Pony.ai, has initiated services in key urban areas such as Beijing, Guangzhou, and Shenzhen.

Alipay has opted not to tread the 'heavy asset' path of manufacturing vehicles or developing autonomous driving algorithms independently. Instead, it has embraced a more agile and potentially disruptive approach—the aggregation model.

The Driverless Car is Coming (WeChat Official Account: The Driverless Car is Coming) will delve into this topic with everyone!

(For reference, please click:

I. Platform Strategy: An 'Ecosystem Connector' Rather Than a 'Vehicle Manufacturer' with Heavy Assets

Alipay's strategy for entering the Robotaxi market is both clear and astute: it sets the stage without stepping into the spotlight.

Echoing Gaode's ride-hailing service logic, Alipay refrains from direct involvement in costly vehicle development or intricate offline operations. Instead, it acts as a super traffic portal (traffic entry point) and ecosystem connector.

Users simply input their destination on the Alipay ride-hailing page, and the system automatically matches them with the nearest autonomous driving service station.

This asset-light model enables Alipay to penetrate the market at minimal cost and maximum speed, instantly transforming its user base of over 1 billion into potential orders for driverless cars.

This model also swiftly provides partner tech companies (such as Pony.ai) with a ready pool of users and operational scenarios, expediting the commercial validation cycle of autonomous driving technology.

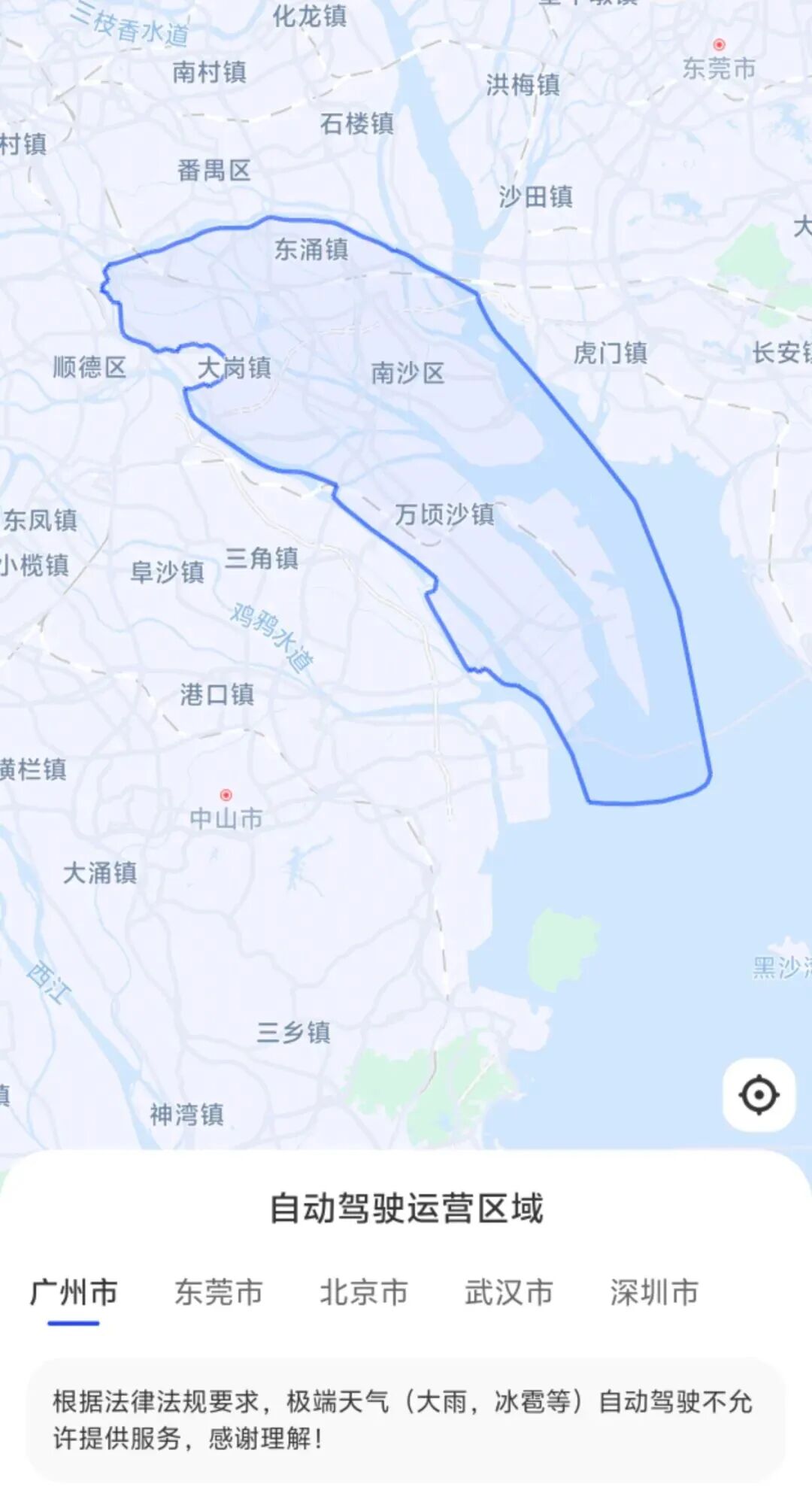

Currently, the operational scope of the Alipay Robotaxi platform is limited, covering only select areas in Beijing, Guangzhou, Shenzhen, Dongguan, Wuhan, and other cities.

It is anticipated that the platform will subsequently expand to more cities and broaden its operational market.

II. Ecological Closed Loop: The 'Iron Triangle' Alliance Forges a Deep Moat

On the surface, Alipay has merely established an aggregated platform, but beneath lies a meticulously crafted industrial 'Iron Triangle' closed loop.

The launch of this service is widely viewed as paving the way for its joint venture company, 'Zaofu Intelligence,' to develop self-branded vehicles in the future.

Previously, Ant Group, Hello Inc., and CATL jointly founded 'Zaofu Intelligence.'

In this alliance, each party assumes a distinct role: Ant contributes AI and financial-grade security technology, Hello leads in autonomous driving algorithm development and operations, and CATL supplies new energy chassis and battery technology.

(For reference, please click:

The launch of the Alipay platform completes the final piece of the puzzle, forming a comprehensive closed loop from underlying hardware (CATL) to core algorithms (Hello), to AI and security (Ant), and finally to the user portal (Alipay).

This signifies that Alipay is not merely a traffic intermediary; it will possess full-chain control from technology to operations to traffic in the future, a unique ecological advantage that competitors like Baidu and Gaode lack.

III. Market Impact: A 'Latecomer's' Dimensionality Reduction Strike and Market Transformation

Alipay's entry undoubtedly sends shockwaves through the already crowded autonomous driving taxi (Robotaxi) market.

In the current market, Baidu's 'Luobo Kuaipao' is expanding across multiple cities nationwide based on its proprietary technology, WeRide is collaborating with Uber to deeply cultivate the Middle East market, and Gaode has long been positioned with an aggregation model.

As a 'latecomer,' Alipay faces significant competitive pressure.

However, Alipay delivers a 'dimensionality reduction strike.'

Its core competitiveness lies in seamlessly integrating Robotaxi services into a super digital lifestyle app that encompasses all aspects of 'clothing, food, housing, and transportation.'

For users, all travel needs—from scanning a bike, taking a bus, hailing a ride, to booking a driverless taxi in the future—can be fulfilled within a single app, offering a seamless experience and high user retention.

This ecological synergy capability is beyond the reach of companies solely focused on ride-hailing or autonomous driving technology.

It may redefine the rules of the game: future competition will hinge not only on autonomous driving technology but also on ecological synergy and user scenario penetration capabilities.

IV. Practical Challenges: The Chasm Between High Costs, Limited Scope, and Scalability

Despite the grand vision, Alipay and the entire industry must confront harsh realities.

First is the formidable cost barrier.

Currently, the hardware costs of sensors, computing platforms, and other components for L4-level Robotaxis are exorbitant, making their operational costs significantly higher than those of ordinary ride-hailing vehicles.

For instance, in a certain western city, the starting fare for a driverless taxi is 16 yuan, with a per-kilometer rate of 2.8 yuan, surpassing that of ordinary taxis. Most companies are far from achieving profitability.

Of course, autonomous driving companies are subsidizing users in some areas, making the cost of riding a driverless car potentially cheaper than that of an ordinary ride-hailing vehicle.

Second is the confined operational scope.

Currently, all services, including those launched on Alipay, are restricted to core areas, industrial parks, and other relatively simple road conditions.

Faced with China's complex 'devilish road conditions'—such as suddenly appearing food delivery electric bikes and vehicles that disregard traffic rules—autonomous driving systems still encounter enormous challenges.

These factors collectively result in insufficient order density, making it difficult to form an efficient operational network, and the path to large-scale commercialization remains long and arduous.

V. Future Vision: From Single-Point Technology to 'Vehicle-Road-Cloud' Coordinated Evolution

Alipay's entry marks a new phase in the autonomous driving competition: transitioning from early 'single-point technological breakthroughs' to 'ecological and coordinated evolution.'

The industry's future will hinge on the triple resonance of technology, industry, and policy. The marginal benefits of single-vehicle intelligence are waning, and 'vehicle-road-cloud' integrated coordination has become an inevitable trend.

For example, Chongqing's Western Science City is already constructing smart intersections, intelligent supervision centers, and other facilities, empowering autonomous driving vehicles through roadside intelligent equipment.

This foreshadows that future driverless driving will not solely rely on vehicle intelligence but also on the intelligence of the entire transportation system.

Meanwhile, regulatory policies are accelerating.

Places like Yongchuan, Chongqing, and the Wuhan Economic Development Zone have already approved fully driverless taxis to carry passengers on the road and are attempting to formulate local regulatory rules to provide a legal basis for the industry.

With the refinement of regulations and the decline in hardware costs, the inflection point for large-scale adoption will eventually arrive.

With its ecological aggregation capabilities, Alipay has the potential to become the core node connecting tech companies, vehicle manufacturing, energy services, payment finance, and end-users, catalyzing the maturation of the entire industrial network.

Conclusion

The Driverless Car is Coming (WeChat Official Account: The Driverless Car is Coming) believes:

The launch of Alipay's autonomous driving Robotaxi is far more than just adding another option to the travel list.

It serves as a sensitive probe, testing the feasible path of integrating cutting-edge technology into a national-level application ecosystem.

Hey! What are your thoughts?

#TheDriverlessCarIsComing #DriverlessDriving #AutonomousDriving #DriverlessCar