By 2025, Some Joint Venture Automakers Stage a Comeback

![]() 02/11 2026

02/11 2026

![]() 558

558

Currently, there are no plans to re-enter the Chinese market, given the intense competition in the region.

Recently, Franck, the newly appointed CEO of Renault Group, shared his insights on the Chinese auto market during a media interview, shedding light on a stark reality.

In 2025, the Chinese auto market will be a landscape of both promise and peril. On one hand, production and sales across the entire Chinese auto market are expected to surpass 30 million units for the third consecutive year. On the other hand, the already fierce competition in the Chinese auto market will escalate further. Automakers, especially leading local Chinese manufacturers who have emerged as the dominant players, are ramping up investments, frequently introducing new products and technologies, intensifying the "price war," and continuing to reshape the auto market landscape.

In this year, BYD is set to break its own sales record once again, Geely Galaxy will achieve a 1.5-fold year-on-year growth, and Leapmotor will emerge as the new sales champion among the emerging forces. Meanwhile, first-tier brands like Honda, Nissan, and Volkswagen, as well as prestigious luxury brands such as BBA and Porsche, will all witness declines. As for the second- and third-tier brands that have already faded from the spotlight, their market presence will pale in comparison to that of the first-tier brands.

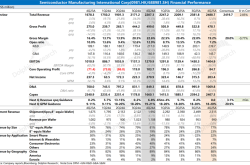

According to statistics, in 2025, the total sales in China of 18 multinational automakers will reach only 9.09 million units, marking a year-on-year decrease of nearly 700,000 units and capturing just 38.43% of the market share. Among them, Volkswagen will lead with 2.02 million units sold, followed by Toyota with 1.78 million units. These two automakers will also dominate the multinational automaker segment in China, occupying the top tier.

In the second tier, Nissan and Honda will both experience declines. Honda's sales will plummet by nearly 1 million units from its peak, while Nissan's sales will drop by nearly 900,000 units. The situation is even more dire for third-tier automakers. Dongfeng Peugeot Citroen's sales in 2025 will reach only 79,000 units, and Mazda's sales will be a mere 58,000 units.

Mass-market brands will underperform, and luxury brands will also struggle. BMW's sales will decrease by nearly 90,000 units year-on-year, while Mercedes-Benz's sales will drop by nearly 140,000 units. Among the three second-tier luxury brands, Jaguar Land Rover will sell 84,000 units in 2025, and Lincoln's cumulative sales will reach only 49,000 units.

Over the past few years, the electrification trend in the Chinese auto market has surged, with numerous local Chinese automakers capitalizing on their early advantages in electrification and intelligence to become the market's undisputed leaders, reaping substantial rewards in terms of both reputation and financial gains. In contrast, the market performance of joint venture automakers has been notably lackluster. Once consumer favorites, models such as the Honda Civic, XR-V, Vezel, Integra, Nissan X-Trail, Qashqai, and Teana have all lost their market appeal.

Although the market declines for BBA are not as severe, models such as the Audi A4L, Q3, Mercedes-Benz C-Class, and BMW X3 have also underperformed compared to their previous market standing. The performance of second-tier luxury brands has been even more lackluster. Despite offering discounts, Jaguar Land Rover has been unable to halt its decline.

Despite the overall decline, joint venture automakers in 2025 have also shown many positive signs.

First and foremost, the two South Korean joint venture automakers and SAIC-GM have all achieved growth. Data indicates that in 2025, Beijing Hyundai will sell 210,000 new vehicles throughout the year, marking a year-on-year increase of nearly 15%. Kia will sell a cumulative 254,000 units in 2025, a 2.3% increase year-on-year. In 2025, SAIC-GM's cumulative annual sales will reach 535,000 units, a 22.99% increase year-on-year, making it the joint venture automaker with the highest growth rate.

Behind the growth of the two South Korean joint venture automakers, exports have emerged as a crucial breakthrough. Statistics show that Beijing Hyundai's export volume will exceed 50,000 units in 2025. Kia has not provided full-year export data; however, other data indicates that since 2018, Kia's cumulative export volume has reached 478,000 units.

SAIC-GM's growth can be attributed to strategic adjustments. It is reported that in the past two years, SAIC-GM has overhauled its management team, shortened product development cycles, and introduced new energy technologies. In the eyes of observers, SAIC-GM's pricing strategy has also paid off. Buick's sales leader, the GL8 family, will sell a cumulative 122,373 units in 2025, a 17% increase year-on-year, with new energy vehicle sales nearly matching those of fuel-powered models. The EnvisionPlus will surge by 88.6% year-on-year, and the Lacrosse will grow by 106% year-on-year.

In comparison, although their sales are still declining, Dongfeng Nissan and Changan Mazda are actively developing new energy product lines. Currently, the Dongfeng Nissan N7 and Nissan N6 have already been launched, and the Nissan NX8 is about to enter the market, with more models in the pipeline. Changan Mazda has also introduced the EZ-6 and EZ-60, developed based on the Changan platform. While the performance of these models is not yet outstanding, they have already sent a clear signal.

It is also noteworthy that currently, overseas giants such as Mercedes-Benz, BMW, Audi, SAIC Volkswagen, Toyota, Nissan, Honda, and General Motors have all forged collaborations with Momenta, a Chinese intelligent driving solution provider. Chinese technology companies such as Huawei, Xiaomi, Baidu, AutoNavi, and Meizu have all become suppliers to these overseas giants. Moreover, multinational automakers have all formulated detailed product launch plans. This year and next, a large number of new-generation joint venture electrified products exclusively developed for the Chinese market will be introduced to Chinese consumers, including plug-in hybrids, extended-range electric vehicles, and pure electric vehicles.

Summary

Over the past few years, the decline of overseas brands in China has been the prevailing trend. First-tier automakers are already facing challenges, while the market situation for originally marginalized second-tier brands is even more daunting. However, from another perspective, after several years of market upheaval, more and more joint venture automakers are beginning to adjust their strategies, actively embracing electrification and intelligence, and accelerating the launch of new electrified products. Currently, the transformations of some automakers have yielded initial success. In the future, more joint venture automakers will also present themselves to consumers with a fresh approach. At that time, how will the competitive landscape of the domestic auto market evolve once again? Let's wait and see.

(Image source: Internet, removed if infringing)