AI Hardware Competition Among Tech Giants: Integration of Software and Hardware is Easy, but Capturing the Ecosystem Entry Point is Tough

![]() 02/11 2026

02/11 2026

![]() 562

562

Source | Insight New Research Society

While the global tech community is still debating the capabilities of large models, the next battleground for AI has shifted from the cloud to the palm of our hands and onto our faces.

OpenAI recently announced plans to launch an AI device weighing about 15 grams, screen-free, and pod-shaped in the second half of 2026. Speculation suggests it could be a pen or a pair of earphones.

Beyond OpenAI, Google restarted its AI glasses project at the end of last year, while Meta also updated multiple AI glasses products in the latter half of the same year.

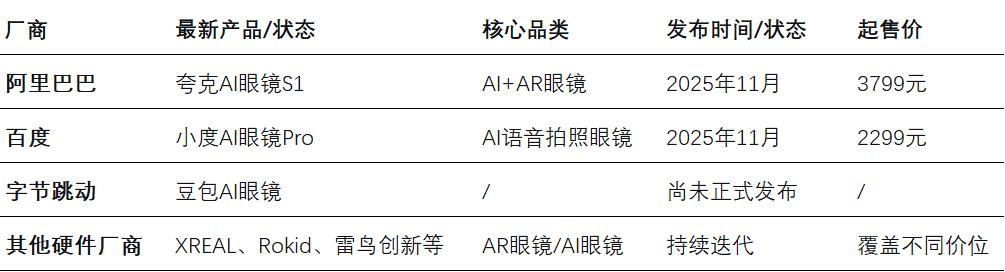

In China, ByteDance took the initiative to explore AI earphones, AI phones, and AI glasses. Alibaba's subsidiaries, Kuake and DingTalk, launched their respective AI hardware products, including AI glasses and recording cards. Baidu's Xiaodu had an earlier layout (layout) in AI phones and AI glasses.

As generative AI moves from the cloud to endpoints, tech giants are embedding large AI models into glasses, pins, and even pens, attempting to define the future of human-computer interaction. However, the mixed market feedback indicates that this competition is far from over.

01 Race on the Field

By early 2026, the AI hardware market, particularly in the smart glasses category, has entered a new phase of large-scale competition from conceptual exploration.

According to research firm Omdia, global shipments of AI glasses are expected to exceed 10 million units in 2026, with China accounting for 1.2 million units, making it the world's second-largest market. The market landscape is being rapidly reshaped by frequent new product launches and capital movements.

Meta, leveraging its first-mover advantage, has become the absolute leader in smart glasses. Its AI glasses series, developed in collaboration with Ray-Ban, forms the market's foundation. In the first half of 2025, Meta held a 73% global market share. In late 2025, it launched its first consumer-grade AR glasses with display capabilities, the Meta Ray-Ban Display (starting at $799), initiating a dual-track strategy extending from "AI voice glasses" to "visual-enhanced AR glasses."

Zuckerberg stated that AI glasses will be "our primary way to integrate superintelligence into daily life" and, at the beginning of this year, cut budgets related to the metaverse, redirecting the funds to AI glasses-related businesses.

After the setback of the first-generation Google Glass, Google chose to re-enter the market with an open platform strategy. In December 2025, it announced a collaboration with Chinese AR company XREAL to develop smart glasses, Project Aura, set for release in 2026.

This product is positioned as the "official reference hardware" for Google's Android XR operating system, aiming to deeply integrate the Gemini large model with the glasses' cameras and sensors for environmental perception and interaction. This move is seen as a key step in Google's attempt to build an open XR ecosystem similar to Android.

The competition in the Chinese market is more diverse and intense, with both internet giants and new hardware players making strides.

Alibaba's Kuake released the AI glasses S1, which topped the bestseller lists across major e-commerce platforms on its launch day. The product is powered by Alibaba's Tongyi Qianwen large model and features a lightweight design (frame thickness of just 3.3 mm) and technological innovations addressing pain points such as outdoor display, voice interaction in noisy environments, and battery life.

Baidu also entered the market around the same time, releasing the Xiaodu AI Glasses Pro through its subsidiary Xiaodu Technology. Unlike Kuake, Baidu's first product focuses specifically on the AI voice photography glasses category, lacking AR display capabilities. It relies on the "Super Xiaodu" multimodal large model, emphasizing voice interaction scenarios such as real-time translation and first-person memo recording.

Currently, ByteDance has not officially released any consumer-grade AI glasses but has products in the preparation stage for shipment, with plans for a phased launch in 2026. Given its subsidiary PICO's long-term technical accumulation in VR, ByteDance remains a potential variable in the market.

Meanwhile, besides XREAL, which collaborates deeply with Google, several Chinese manufacturers, including Rokid, Huawei, Xiaomi, and Thunderbird Innovation, also occupy a place in the global market. During CES 2026, Thunderbird Innovation showcased a glasses prototype with eSIM standalone connectivity, demonstrating further exploration of product forms.

Beyond AI glasses and AI office products, major companies are also focusing on "carving" features into smartphones. ByteDance's Doubao Phone and Google's Pixel series are prime examples.

At the end of last year, ByteDance, in collaboration with ZTE's Nubia, launched the Nubia M153, a system-level AI technology preview phone. It deeply embedded the Doubao large model into the phone's system as an AI Agent. The initial limited release of 30,000 units sold out instantly. However, its aggressive GUI (graphical user interface) approach, which involves "screen reading" through system permissions and simulating app operations, has sparked some controversy.

Google, on the other hand, has been continuously upgrading its Pixel series phones with AI enhancements in a relatively gentle (moderate) manner, leveraging its self-developed chips and on-device models to improve AI capabilities.

Overall, major companies' foray into AI hardware is creating intertwined competition with existing industry players. Each party is leveraging its technological and ecological strengths to drive the market transition from "novelty" to "common use."

02 Diverging Paths

The AI hardware strategies of major tech companies clearly reflect their different origins, resources, and ambitions, presenting three distinct paths.

The first is the "disruptive entry point" path represented by OpenAI.

As a leader in software and models, OpenAI's hardware venture is essentially an ultimate experiment in "screen-free interaction." Its upcoming AI pen abandons all screens, compressing interaction logic to the extreme. It receives commands through a highly sensitive microphone array, xMEMS ultrasonic units, and even electromyography sensors capturing laryngeal muscle activity, providing audio feedback via bone conduction technology.

It seeks to eliminate any form of "interface," allowing AI to become invisible and integrate into humanity's most natural actions—writing, speaking, or even silent thoughts.

To realize this minimalist yet challenging vision, OpenAI invested $6.5 billion in May 2025 to acquire io, a hardware company founded by Apple's former chief design officer Jony Ive, and recruited hundreds of hardware engineers from Apple and Google. This path bets on a fundamental shift in interaction paradigms, carrying the highest risk but also the greatest potential reward.

The second is the "ecosystem platform" path represented by Google and XREAL.

Unlike OpenAI's disruptive approach, Google has chosen a more familiar strategy: building an open platform to empower hardware partners. Its core is the Android XR operating system, and in collaboration with XREAL, it created "Project Aura," a system-level reference hardware.

This glasses model is equipped with XREAL's self-developed X1S spatial computing chip and an optical system with a 70-degree field of view, enabling Google's Gemini large model to truly "see" and understand the world.

Google's strategy is not to monopolize hardware but to invest in core partners like XREAL to improve (refine) the end-to-end ecosystem of Android XR, countering competition from Meta and Apple. This replicates its successful experience of integrating the smartphone industry chain through the Android system.

The third is the "full-stack collaboration" path deep cultivation (cultivated) by Chinese giants.

Companies like Alibaba, Baidu, and ByteDance focus more on achieving a closed loop of "algorithms-chips-cloud-endpoints" within their own ecosystems.

Alibaba's "Kuake AI Glasses S1," showcased at CES, deeply relies on its "Tongyi Qianwen" large model and Alibaba Cloud ecosystem. Previously, Alibaba also released its self-developed high-end AI chip, "Zhenwu 810E," demonstrating its collaborative system of "Tongyi Lab + Alibaba Cloud + Pingtouge." The advantage of this approach lies in controllability and efficiency, enabling deep optimization for specific scenarios—essentially reinforcing and extending existing ecological moats.

While the three paths appear divergent, they ultimately converge. Major companies' hardware endeavors share the same ultimate goal: defining and controlling the core entry point and ecological dominance of the next generation of human-computer interaction. The essence of this competition is to contend for (vie for) the right to set rules in the "post-smartphone era."

03 Battle of Ecosystems

Despite major companies' rapid layout (deployment) in the AI hardware field, becoming the next-generation entry point faces three obstacles. Technology is merely the first hurdle; more critical are the ecological barriers and the deep integration with user habits.

Google's Android XR system attempts to provide a unified development platform for spatial computing, addressing fragmentation in the XR industry. However, for AI hardware to truly become an entry point, it requires not just technological standardization but the establishment of a complete ecosystem encompassing content, services, and developers.

Yet, the dominance of the smartphone screen as the ecological core remains unshaken. Smartphones are not just devices but the center of user data and application services. Screen-free AI devices or AI glasses essentially challenge the "what you see is what you get" interaction paradigm. Such a fundamental shift in habits requires time and, more importantly, an ecosystem powerful enough to provide irreplaceable value.

An even greater challenge lies in transitioning from "novelty" to "common use." Currently, many AI glasses face criticism for being "gimmicky, bulky, and short-lived in battery," with some supply chain sources indicating return rate (return rates) as high as over 50%. For smart glasses to bridge the gap from "cool gadgets" to "tools," they must find an irreplaceable "killer application."

Currently, real-time translation, information prompting, navigation, and AI photography Q&A are mainstream functions. However, to achieve large-scale adoption, manufacturers need to deeply penetrate specific scenarios (e.g., education, healthcare, industry) and create reasons for users to wear them daily.

In summary, the AI hardware competition will unfold around three core dimensions in the near future.

First is the test of supply chain and mass production capabilities.

OpenAI's aggressive target of 50 million shipments directly faces constraints from high-end chip production capacity. TSMC's 2nm production capacity in 2026 is estimated at only about 100,000 wafers per month, with Apple already reserving the majority. Meanwhile, yield improvements for non-standard components like xMEMS ultrasonic units and electromyography sensors will be critical variables for cost and production capacity. The maturity and stability of the supply chain will be the first ruthless filter determining whether hardware can move from concept to widespread adoption.

Second is the global compliance challenge of privacy and ethics.

AI hardware capable of all-day environmental perception and voice collection represents power but also poses challenges to global privacy regulations. Balancing seamless intelligent services with respect for user data sovereignty will be a difficulty (challenge) all manufacturers must address.

Third is the innovation and reshape (reshaping) of business models.

As AI hardware becomes more prevalent, its value realization may shift from "selling devices" to "selling services." In the future, hardware may serve as an entry point for acquiring high-quality, real-time scenario data and reaching users, while deep AI services based on data, personalized subscriptions, and solutions deeply integrated with life and workflows will become more sustainable profit sources.

Clearly, smart hardware is a marathon track. Tech giants cannot afford to miss out on this competition about the future, but it is still too early for them to immediately become new revenue growth points or achieve disruptive innovation.