ZEEKR: A "Negative" Second Generation or an Upcoming Dark Horse?

![]() 06/20 2024

06/20 2024

![]() 545

545

In the previous article on ZEEKR, through the dissection of the relationship between ZEEKR and Geely, Dolphin Tab wanted to convey the core message that the automotive manufacturing platform assets under CEVT and the R&D assets of battery, motor, and electronic control systems under Ningbo Weirui are essentially the cost units of the middle and back-end of the entire Geely family. In the automotive manufacturing industry, Dolphin Tab favors the asset value of vertical integration in the long-term race, but value without valuation, and valuation requires the front-end automotive sales business that truly generates "external" income to reflect. Car sales and the overall price that brings about these sales are the key to ZEEKR's investment value. Therefore, this article focuses on the following two questions: First, returning to the core: how are ZEEKR's capabilities and prospects in selling cars? Second, is ZEEKR, which is underestimated, truly being wronged?

Below is the main text.

I. How are ZEEKR's capabilities and prospects in selling cars?

Since mobile phone manufacturers entered the automotive market, there has been an increasing voice that cars have become "consumer electronics." And when it comes to consumer electronics, it means that each component of the product is highly standardized, with mature suppliers on the market to provide them, and the final manufacturing is handed over to assembly plants. Especially after outsourcing assembly, the brand manufacturer is essentially just attaching a label to some extent. A straightforward example is similar to the early days of PCs, when many people bought different manufacturers' motherboards, graphics cards, memory, hard drives, and other components in Zhongguancun and assembled them into desktop computers themselves. However, Dolphin Tab believes that this view is still somewhat biased, as the manufacturing processes and supply chain complexity of automobiles are not in the same league as consumer electronics, and neither is the standardization level of components.

Even for new energy vehicle manufacturing, having one's own factory capacity and independent R&D and production of battery, motor, and electronic control systems is a combination that long-term automotive manufacturers are more likely to rely on to stay in the game in the long run.

From this perspective, Dolphin Tab believes that ZEEKR has the ability to survive in the long-term competition: ① The factory capacity is technically Geely's, but ZEEKR itself is a subsidiary of Geely, so in this sense, the capacity is actually self-owned, just not reflected in ZEEKR's financial statements; ② Through Ningbo Weirui, a shared middle and back-end asset of the Geely group, ZEEKR has achieved strict independent R&D of battery, motor, and electronic control systems, and self-production of battery cells is also on the way. ③ The advanced version of the SEA automotive manufacturing platform, SEA-M, is built by CEVT, and the platform is also self-developed. Although many investments are not reflected in ZEEKR's financial statements, this kind of independent R&D and production is actually a very asset-heavy business, with high funding thresholds and significant operational risks. If terminal sales cannot be increased, these upfront capital investments in middle and back-end costs can instead become a burden on cash flow.

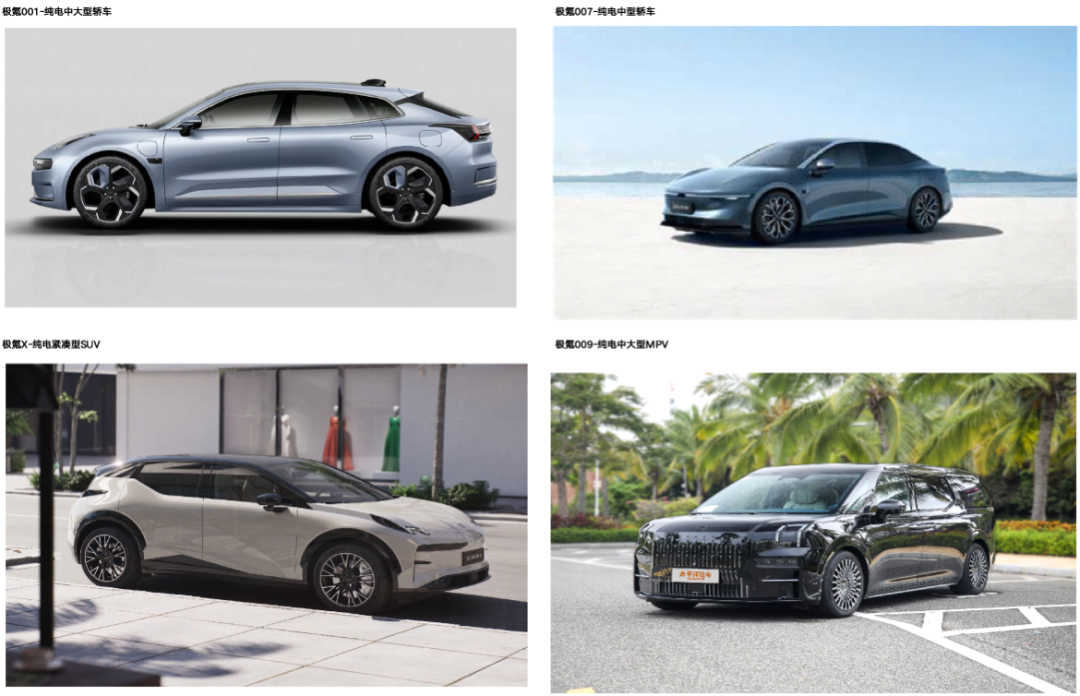

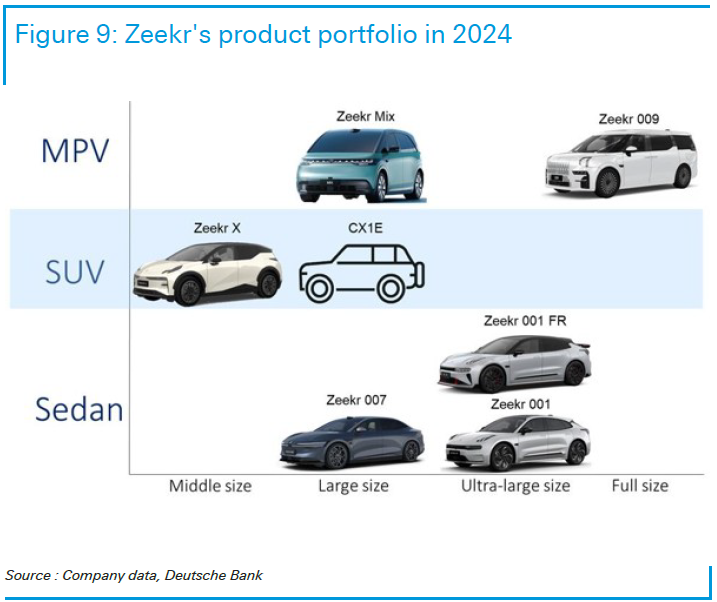

Therefore, let's focus on the products launched at the front end of these investments and layouts: 1) Led by the 001, ZEEKR has used these assets to launch 4 main sales models in three years since its inception: a. Pure electric sedans - ZEEKR 001, ZEEKR 007; b. Pure electric MPV - ZEEKR 009; c. Pure electric compact SUV - ZEEKR X.

The current ZEEKR model matrix has two very distinct characteristics: ① Creating a sense of luxury: The first model was directly priced in the luxury car market above 300,000 yuan; at the same time, it also has two rare models among pure electric cars - ZEEKR 001 FR and ZEEKR 009 Glorious Edition, both priced between 700,000 and 800,000 yuan. Note that these are not founder's limited editions with unchanged configurations similar to Xiaomi's launch, but upgraded versions with enhanced configurations and technology to highlight the sense of luxury.

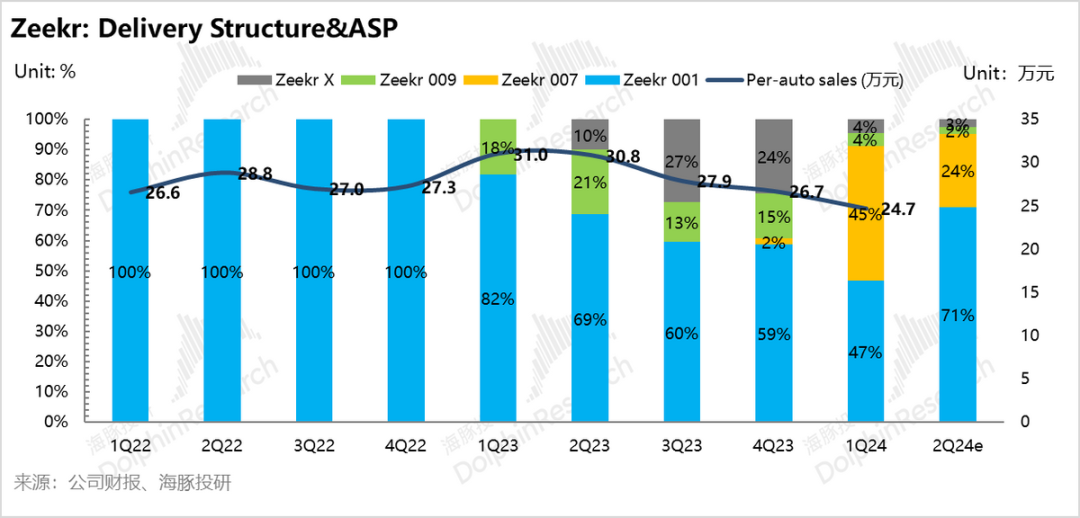

②. Over-reliance on the 001, requiring the next hit model to lock in certainty. Among the four models, ZEEKR 001, the first model built by the company, has borne the heavy responsibility of ZEEKR's sales. It was the only model offered by ZEEKR from 2021 to 2022, and in 2023, when ZEEKR's models were concentrated on launching new models, ZEEKR 001 still accounted for 64% of the total deliveries. ZEEKR basically relied solely on the ZEEKR 001 model to achieve a valuation of $13 billion in its Series A financing round in February 2023. In contrast, even among the leading new energy companies, excluding the all-round player BYD, at least two pillar models are needed to stabilize delivery volumes, as seen in Tesla's Model 3 & Y, NIO's ES6 & 7, and Xpeng's G9 & M7. That is to say, under the auspices of independent R&D and production, ZEEKR actually still needs a new hit model to increase the certainty of its performance.

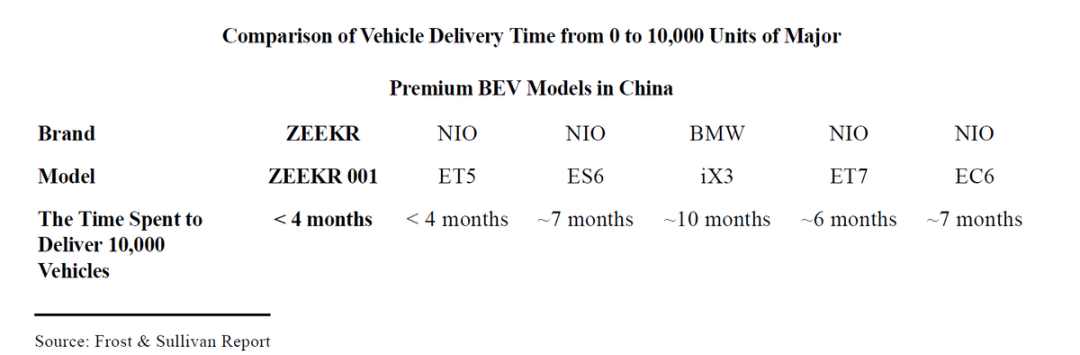

Let's take a closer look at the four models currently on sale to understand why the 001 is successful and whether the other three have the potential to become hits. 2) Exploring the four models A. The super-capable 001 ZEEKR 001 is a pure electric hunting sedan launched in April 2021 and is the first model based on the SEA platform. However, at the time of its launch, hunting sedans were still niche, and no other electric vehicle brands before ZEEKR had launched similar products. ZEEKR 001 precisely captured young audiences with its unique styling, positioning as a pure electric hunting sedan, and high cost-performance. ZEEKR 001 also achieved a cumulative total delivery volume of 10,000 units in just four months after its first delivery, making it one of the fastest-growing models in the mid-to-high-end pure electric car segment in China, comparable to the popularity of NIO ET5.

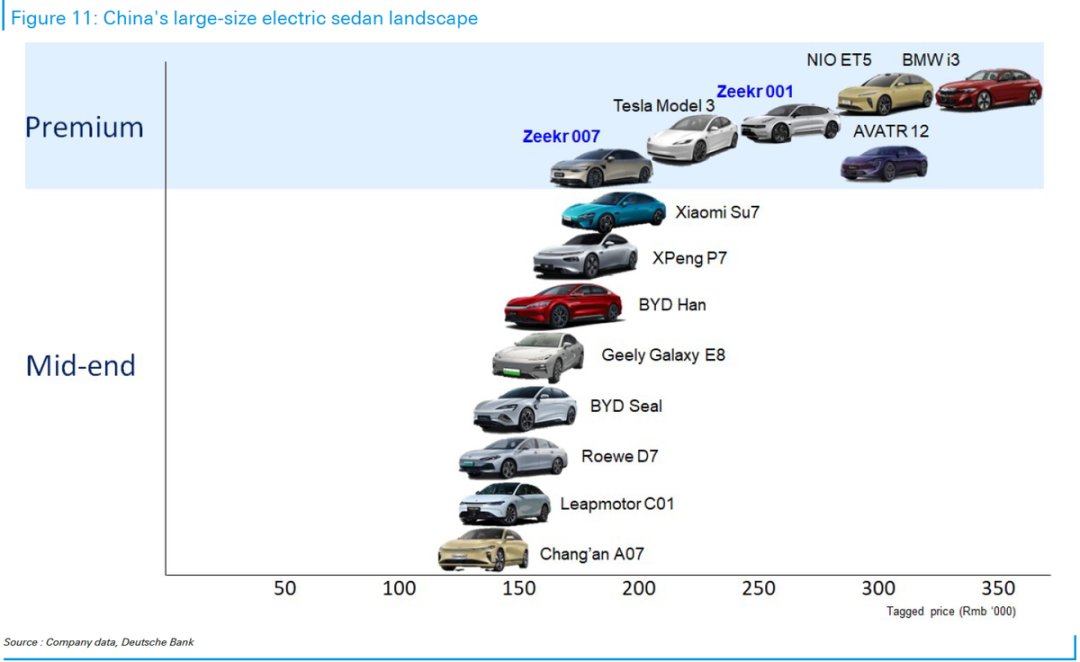

Looking at the 250,000-350,000 yuan price range where ZEEKR 001 sits, ZEEKR 001 is currently the best-selling pure electric model besides Tesla Model Y, with monthly sales continuing to exceed 10,000 units in April. It is rare for pure electric models in this price range to become hits, and only a few pure electric brands have successfully created hit models, currently only ZEEKR and NIO. However, in 2024, this track has welcomed the entry of internet players Xiaomi and Zhijie (a collaboration between Huawei and Chery).

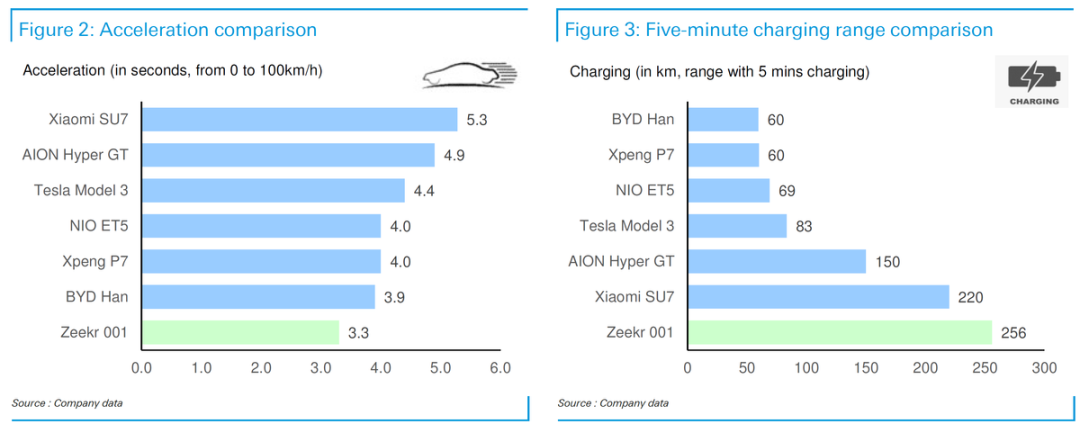

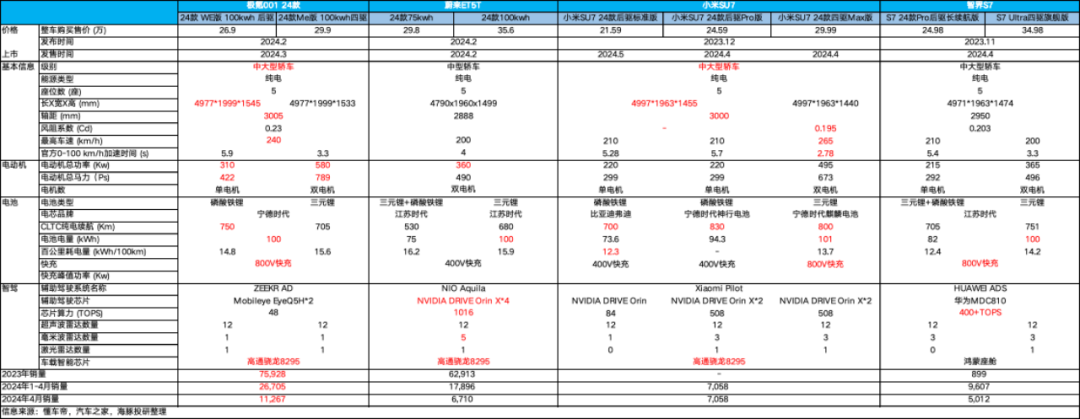

Comparing the configurations of ZEEKR 001 and its competitors, ZEEKR 001's success lies mainly in: ① Size advantage: ZEEKR 001 leads its competitors in terms of size and wheelbase, featuring a spacious interior; ② Obvious advantages in power and range: equipped with CATL's 100kwh Kylin battery, the CLTC range can reach 750km; the dual-motor version has a total power of 590KW, and the maximum horsepower of the motor can reach 789Ps; ③ Core selling point - 5 minutes of charging for 500km of range: Among electric cars in the same price range and type, ZEEKR 001 is the only one that can achieve all three of the above simultaneously.

④ Sincere upgrades: The 2024 model of ZEEKR 001 differs from minor upgrades of other competitors. Unlike NIO's 2024 model, which mainly upgrades the intelligent driving cockpit to the Qualcomm Snapdragon 8295 chip with minor adjustments to external styling and interior and maintains the same price, the 2024 model of ZEEKR 001 has significant upgrades, including upgrading to an 800V high-voltage platform across the board, upgrading the maximum total power of the motor from 400kw to 580kw, upgrading the intelligent driving system with Qualcomm's 8295 chip and standardizing one lidar, and reducing prices by 31,000-57,000 yuan compared to the older models. With sincere upgrades and super high cost-performance, ZEEKR 001 has a longer life cycle than other competitors: The first model of ZEEKR 001 began deliveries in October 2021, and its model life cycle is nearly three years. The 2024 upgrade achieved nearly 40,000 orders in about a month after its release and regained a monthly sales volume of over 10,000 units in April.

5) Serious shortcoming: intelligent driving. This is not just a problem with the 001, but also with the other three ZEEKR models except for the 007. Actually, falling behind in software speed is acceptable since OTA updates can address it, but the main issue is that its hardware is inherently weak - currently, ZEEKR 001 still uses the Mobileye solution, with chip computing power lagging behind competitors (only 48 Tops). Additionally, in terms of intelligent driving software, Mobileye's "black box delivery" prevents ZEEKR from participating in the development of core intelligent driving algorithms, affecting the long-term development of ZEEKR's intelligent driving capabilities. At the same time, in terms of city expansion speed, due to Mobileye's use of REM maps, map collection is slow. As of April this year, ZEEKR's intelligent driving NZP has been launched in 65 cities, while city NZP is still in the testing phase, lagging behind other players significantly.

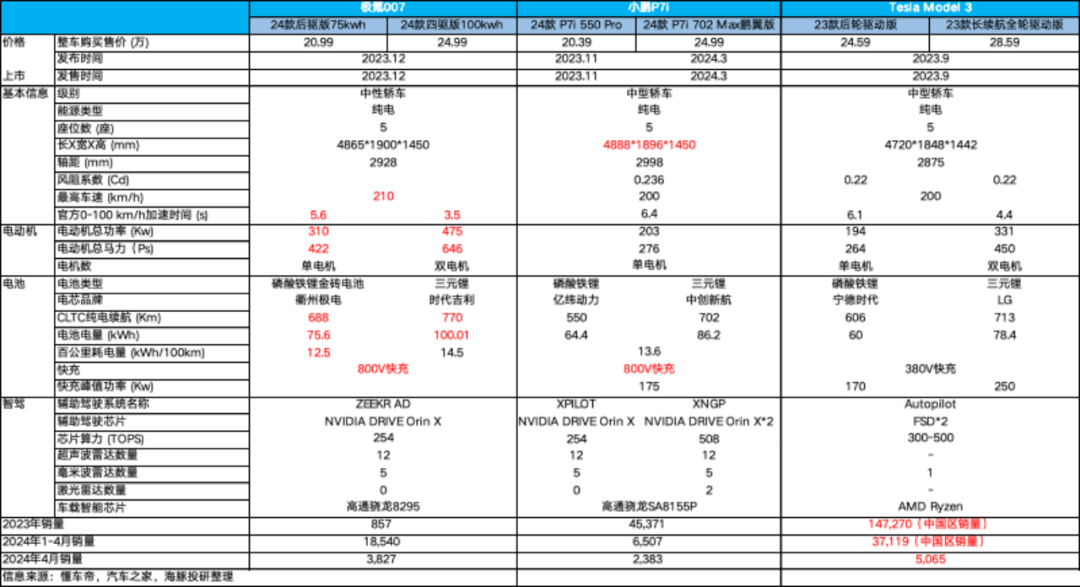

B. The barely adequate 007 ZEEKR 007 is also in the sedan market, but unlike the hunting sedan 001, the 007 is a normal family sedan, positioned as a mid-size pure electric sedan, priced between 209,900 and 299,900 yuan. Compared to competing models, ZEEKR 007's advantages also lie in its long range and leading power performance, equipped with an 800V high-voltage architecture, and using NVIDIA's Orin X chip for the first time in intelligent driving, with a maximum computing power of up to 508 Tops. Looking at the core competitors in the same price range, in terms of product configuration and pricing, unlike the 001's obvious leading edge over competitors, the 007, priced in the 200,000-250,000 yuan range, has little difference in functionality from the P7i in terms of electrification, despite the dual-motor setup giving it an advantage in acceleration. However, although the 007 uses the Orin X chip for intelligent driving, only the top-priced 270,000 yuan model comes with lidar, which seems inferior to the P7i's lidar and advanced intelligent driving capabilities available at 250,000 yuan.

Previously, the official announced that ZEEKR 007 received over 50,000 orders (details of large and small orders unclear) during its 40-day presale period, but now half a year has passed, and from the current 2-4-week delivery cycle, which is close to ready-to-deliver vehicles, it seems there is no capacity issue, with current monthly sales hovering around 4,000 units, lacking upward momentum.

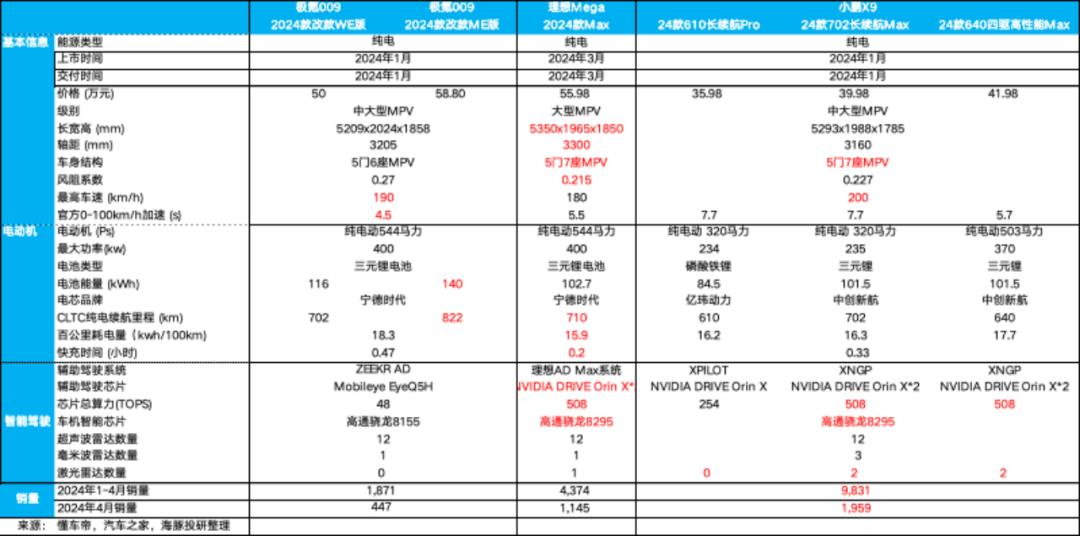

C. Still struggling with low sales, niche models 009 and X ZEEKR 009 and ZEEKR X are two models, one targeting business and family travel needs as a pure electric MPV, and the other a compact SUV. However, both models have not continued the good momentum of the 001, mainly due to: ① ZEEKR's two new models face more niche markets, such as the limited market capacity of pure electric MPVs like the 009, and the strange styling and small space of the ZEEKR X; ② Another reason is due to insufficient cost-performance. ZEEKR 009 does not have a cost-performance advantage over the Xiaopeng X9, and the compact SUV price range is concentrated between 100,000 and 150,000 yuan. The starting price of the ZEEKR X at 200,000 yuan also suffers from insufficient cost-performance. Currently, both models' weekly sales have dropped to less than 100 units, contributing limitedly to ZEEKR's sales this year.

3) Are there any promising models in the upcoming new car launch plans? In the 2024 launch plan, the revealed model is an MPV priced slightly cheaper than the 009 - ZEEKR MIX. This model will be priced in the second half of the year, and deliveries may be later. However, in the category of pure electric MPVs, the best-selling model is currently Xiaopeng's X9, with monthly sales rarely exceeding 4,000 units. It is estimated that MIX will also struggle to take on the task of volume sales. In the fourth quarter, in the SUV category, after the complete failure of ZEEKR X, ZEEKR will launch another mid-to-large SUV, but we can only hope that the next SUV will take on another leadership role. Additionally, according to the company's plans, at least two new models will be launched annually in 2025 and 2026. From some leaked spy photos and naming, it seems that next year may see