Seres Market Cap of 152.7 Billion Surpasses Lixiang: Is a Contract Manufacturer Also Worth This Much?

![]() 06/21 2024

06/21 2024

![]() 679

679

On June 20, Beijing time, Seres (601127.SH) recorded a 1.09% increase intraday, closing at a market capitalization of 152.7 billion yuan, while Hong Kong-listed Lixiang (02015.HK) recorded a 3.72% decline, with a market capitalization of 151 billion Hong Kong dollars.

Coupled with the exchange rate difference between the yuan and the Hong Kong dollar, Seres surpassed Lixiang in terms of market capitalization.

Unfortunately, this surpassing was achieved under the circumstances that Lixiang's stock price has dropped from $46 to the current $18, a drop of nearly 60%, since the release of its 2023 financial report in February 2024.

This also reflects the significant negative impact that Lixiang has had on the capital market after the release of its financial report and the failure of its first pure electric strategic model, MEGA.

For investors, the issues facing Lixiang are: 1) severe setback in its pure electric strategy; 2) whether it can maintain its basic market share in the extended-range segment.

As for Seres, the question is: What kind of valuation should be given to a car company that relies heavily on Huawei for its research, development, production, and sales?

01

What is Seres' core competitiveness?

If this question is asked to current Seres shareholders, I estimate that all shareholders would say - Huawei! Yes, the AITO brand, a collaboration between Seres and Huawei, has created a precedent in automotive history, where a car company's research, development, production, and sales are all controlled and led by suppliers.

As for He Xiaopeng's claim that XPeng Motors has created a new business model, where one OEM manufacturer conducts research and development for another OEM manufacturer.

Then, there is a significant risk for Seres - if Huawei withdraws or launches its own complete vehicle brand, what kind of competitiveness will Seres still have?

Investors might think that, even if Seres' valuation does not go to zero, it would be slashed by at least 90%. Will this happen?

That depends on whether Seres has core technologies. Let's first look at Seres' research and development investments.

According to the financial report, in Q1 2024, Seres' research and development expenses were 954 million yuan, an increase of 349 million yuan compared to the previous quarter. According to the 2023 financial report, the company's R&D expenses for that fiscal year were 4.438 billion yuan, accounting for 12.38% of revenue.

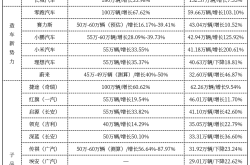

Comparing with the R&D expenses of NIO, XPeng, and Lixiang in 2023:

1) NIO's R&D expenses were 13.431 billion yuan, accounting for 24.15% of revenue; 2) XPeng's R&D expenses were 5.277 billion yuan, accounting for 17.20% of revenue; 3) Lixiang's R&D expenses were 10.586 billion yuan, accounting for 8.5% of revenue.

Compared with its direct competitor, Lixiang, Seres' R&D expenses are less than half of Lixiang's. Due to its