Huawei vs NIO: The Hidden Battle Over Battery Swapping

![]() 07/15 2024

07/15 2024

![]() 676

676

When it comes to battery swapping, NIO undoubtedly has more to say.

Main Content

Huawei and NIO, two giants of China's new energy vehicle industry, have recently clashed publicly over the issue of battery swapping, adding a strong "gunpowder" flavor to the situation.

Huawei: Battery Swapping Difficult to Replace Supercharging

NIO: You Don't Understand!

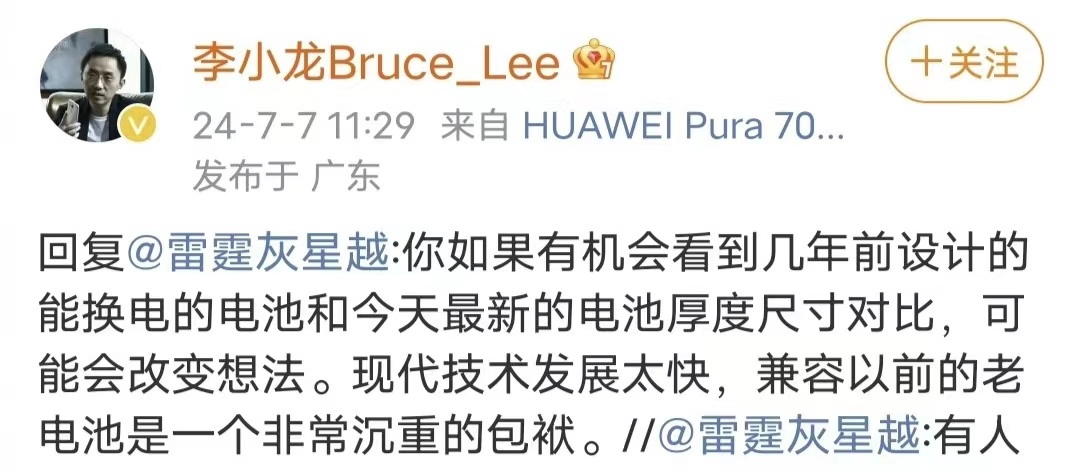

As early as July 7, Li Xiaolong, Chief Technology Officer of Huawei's Device Business Group, responded to a netizen's question on Weibo about "some people say that battery swapping will eventually replace supercharging, what do you think?" This was the first time a Huawei executive publicly addressed this topic. He said, "If you have a chance to compare the thickness and size of the replaceable batteries designed several years ago with the latest batteries today, you might change your mind. Modern technology is developing too fast, and being compatible with old batteries is a heavy burden."

From Li Xiaolong's public response, it can be seen that he holds doubts and a pessimistic attitude towards the battery swapping model for electric vehicles.

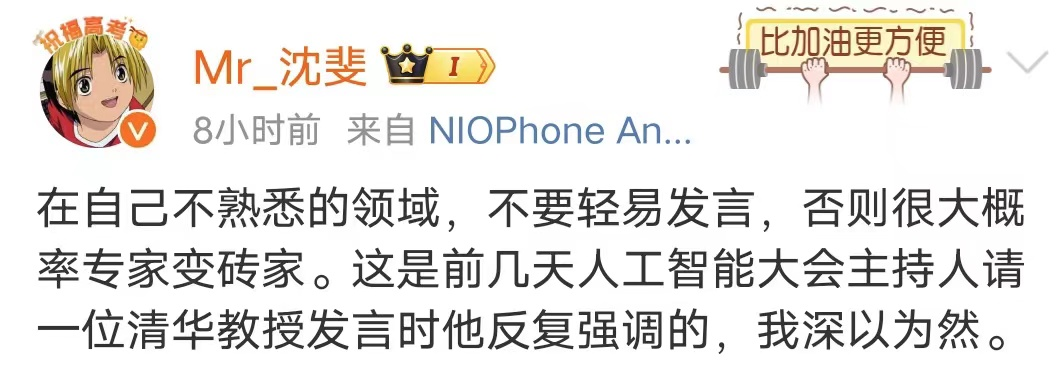

On July 10, Shen Fei, Vice President of NIO, responded to Li Xiaolong on Weibo, saying, "Don't easily speak in areas you're not familiar with, otherwise, there's a high probability that experts will become bricklayers. This is what a Tsinghua professor repeatedly emphasized when the host of the AI Conference invited him to speak a few days ago, and I deeply agree."

Relevant data shows that in May's sales ranking of 33 battery swapping vehicles, NIO topped the list, with its three most popular models even occupying the top three spots. The sales of NIO ES6 and NIO ET5 reached 8,067 and 7,647 units, respectively. Out of the top 17 models, NIO accounted for 7, with a sales share of up to 41.2%.

It is evident that NIO is far ahead of other brands in China's battery swapping passenger vehicle market, giving it a certain voice in the battery swapping field.

NIO vs Huawei: Battle Imminent

As a firm promoter and executor of the battery swapping route, NIO has indeed taken concrete actions to build battery swapping stations. According to its official website, as of July 12, 2024, NIO has 2,443 battery swapping stations, with users completing a cumulative total of 48,178,631 battery swaps. The daily average number of battery swaps exceeds 60,000, with a car fully charged and leaving a swapping station every 1.4 seconds on average. Additionally, NIO has accumulated 3,904 charging stations and 1,066,067 third-party charging piles nationwide, providing users with an energy service experience that includes charging, swapping, and upgrades. NIO continues to upgrade its products and densify its layout, offering users convenient and fast charging and swapping experiences, truly making charging more convenient than refueling. Such consideration for consumers is no wonder why NIO leads in sales.

Meanwhile, Huawei's all-liquid-cooled supercharging stations are also blooming everywhere.

According to official data, as of now, Huawei Digital Power has deployed 20,000 supercharging piles in over 200 cities nationwide. However, in the view of He Bo, Vice President of Huawei Digital Power, this is far from enough. He claims, "Product recognition is the first step. This year, we plan to cover all-liquid-cooled supercharging piles to 340 cities and 2,800 districts and counties nationwide, deploying over 100,000 supercharging piles, ultimately creating an electricity grid-friendly ultra-fast charging network connected by points, lines, and areas."

The integrated development of vehicles, piles, and networks is advancing the charging network towards comprehensive intelligence. The "dual randomness" of the power grid continues to strengthen. In the future, car owners will not only buy electricity from the grid to charge but also buy electricity at low prices and sell it back to the grid at high prices, spurring more business models and further driving the development of electric vehicles and charging networks.

NIO Battery Swapping vs Huawei Supercharging: Which Model Do You Support?

Currently, supercharging and battery swapping, as two mainstream charging methods, each have their supporters and market practitioners. NIO represents the battery swapping model, while other domestic electric vehicle brands primarily focus on the development of supercharging technology. Supercharging and battery swapping have become the focus of attention. Both methods have their advantages and disadvantages, so which one is more suitable for the future?

Battery swapping is a technology that replaces the battery pack with a pre-charged one. Its main advantages lie in efficiency and cost-effectiveness. First, battery swapping only takes a few minutes, much faster than charging. Second, as the battery pack can be used multiple times during its lifespan, it can reduce the ownership cost of the vehicle.

The lifespan of power batteries can be calculated in two ways: cycle life and calendar life. Currently, China's mandatory standard states that when the cycle life of an electric vehicle's power battery reaches 1,000 cycles, its capacity decay should not be lower than 80% of its initial capacity. In comparison, lithium iron phosphate power batteries have a slightly higher cycle life, reaching over 2,000 cycles. However, many people tend to overlook calendar life.

The calendar life of a lithium-ion battery refers to the time from its date of manufacture to the end of its service life, measured in years. This stage includes different links such as shelving, aging, high and low temperatures, cycling, and working condition simulation. Generally speaking, the calendar life of lithium batteries used in new energy vehicles is 8-10 years. The issue of "different lifespans for vehicles and batteries" and the high cost of battery replacement must be addressed urgently.

Moreover, NIO recently announced a new BaaS battery rental service system, adjusting the rental fees for standard range battery packs from RMB 980 per month to RMB 728 per month and for long-range battery packs from RMB 1,680 per month to RMB 1,128 per month. This will save car owners between RMB 3,024 and RMB 6,624 annually. With the significant reduction in the cost of power batteries today, NIO's move can significantly reduce the cost of ownership for NIO car owners and boost NIO's sales growth.

The main advantages of supercharging lie in convenience and flexibility. For most electric vehicle users, charging is the most common way to replenish energy. Simply connect the charging cable to the vehicle's charging port, and the vehicle can be charged anywhere there is a power source. Furthermore, with the continuous development of charging technology, charging speeds have improved significantly, significantly reducing charging times.

Huawei stated that it will take the lead in deploying over 100,000 Huawei all-liquid-cooled ultra-fast charging piles in more than 340 cities and major highways nationwide in 2024, aiming to provide high-quality charging wherever there are roads. In the future, new energy vehicles can use Huawei's liquid-cooled supercharging stations across the country, whether in cities or rural areas.

Of course, battery swapping also has its problems. Specifically, battery swapping requires establishing a complete battery replacement system, including battery production, storage, transportation, and replacement, which undoubtedly increases the operating costs for enterprises.

Additionally, currently, battery swapping takes 3-5 minutes, but if there are queues, it's uncertain how long it will take. The speed of battery swapping is also related to the battery stock at the swapping station. Once the fully charged batteries run out, the time for battery swapping will depend on the battery charging time. Moreover, battery swapping stations have high construction costs and can only swap batteries for one vehicle at a time. Therefore, facing Huawei's aggressive supercharging strategy, the advantages of the battery swapping model are gradually diminishing.

In conclusion, the battery swapping model has its pros and cons. If a newly purchased NIO car goes for battery swapping, getting a used battery from someone else may not be a pleasant experience. However, from another perspective, as long as NIO exists, you can get a battery with at least an acceptable performance before your car is scrapped, eliminating the high cost of battery replacement. This can be considered an advantage of NIO's battery swapping model. Nevertheless, it is still difficult to predict how widespread the battery swapping model will become. In the view of "Electric Potential," it is unrealistic for a single automaker to promote battery swapping alone. Fortunately, NIO has already cooperated with automakers such as Changan and Geely in battery swapping business, and it is hoped that NIO's battery swapping model can truly become an industry-wide standard.

NIO's battery swapping model and Huawei's supercharging technology each have their advantages, but this confrontation undoubtedly reveals their competitive stance in the electric vehicle field. The battery swapping model is fast but has high construction costs, while the supercharging model has a high penetration rate but room for improvement in charging speed. This dispute over technical routes is not only a competition between the two companies but also a game over the future development direction of the electric vehicle industry. This escalating competition demonstrates both parties' technical confidence and market ambitions, driving electric vehicle technology forward. The outcome of the debate between NIO and Huawei remains to be seen, but it will undoubtedly push the electric vehicle industry towards higher levels of development.