Drowning in Gossip: The Chinese Auto Market

![]() 07/16 2024

07/16 2024

![]() 666

666

Introduction

The nearly magical public opinion environment – how can it benefit the future development of the Chinese auto market?

Editor-in-Charge: Cao Jiadong

Editor: He Zengrong

Halfway through 2024, looking back at the past six months in the Chinese auto market, besides the price war that everyone is talking about, the increasingly hostile public opinion environment is another source of frustration.

In the past, perhaps due to the lag and limitations of information transmission, the squabbles and marketing chaos in the Chinese auto market seemed to be relatively minor. Temporary disagreements between automakers were quickly resolved before the terminal market could react. Though competitors, most often, due to face-saving concerns, major conflicts were rarely made public.

But what about now?

Not to mention how the new trends in the automotive industry transformation are mobilizing consumer sentiment, with everyone actively participating in this transformation and using "public opinion attacks" as a trump card in territorial disputes.

Under its influence, the development of the Chinese auto market has deviated from its past established path. As users' understanding of "what makes a good car" has changed, the rise of emerging brands in the past six months has been mirrored by the decline of traditional automakers that once thrived in China.

Driven by public opinion, foreign brands like Volkswagen and Toyota have faced increasingly naked attacks, and the mutual sarcasm between domestic brands like Geely and Great Wall has become countless. So, who has been the biggest winner in terms of traffic during this period?

It was expected that Lixiang, hailed by traffic, would reignite with the MEGA model. Who could have imagined that Xiaomi Automobile, with Lei Jun's over a decade of experience in the mobile phone industry, would directly disrupt the entire automotive circle. Add to that the haloed "HarmonyOS Intelligent Driving," and it's fair to say that the Chinese auto market in the first half of 2024 has been truly magical.

The power of public opinion is so immense that we never imagined it before. Marketing confrontations initiated by gossip battles have not only changed the mindset of certain groups but also reshaped the landscape of an entire industry.

From the early stage where joint ventures dominated and domestic brands struggled to grow, to an era where Chinese automakers call the shots, it's worthy of great praise. However, at this critical juncture, this change inevitably leaves us with many new challenges.

Establishing industry values, evolving consumption trends, or the direction of technological advancement – all await "Chinese Autos" to provide an unequivocally correct answer.

Intensifying Public Opinion Wars

Looking back at the past six months, I believe that even before the public opinion war fully erupted, the Chinese auto market had already presented a state of anxiety for everyone involved. Despite ending 2023 with decent results, the unabashed price cuts by automakers since the beginning of the year have directly stimulated the entire industry's nerves. The "unprecedented" price war has persisted ever since.

In this war, even the suspension of HiPhi's operations has merely become a backdrop in the industry, failing to cause any sensation. What else is worth our attention and concern?

It seems that besides price, everyone in the industry is racking their brains to reduce costs and increase efficiency, preparing for the next wave of price cuts. When encountering low-priced competitors, the response is to attack with even lower prices.

How did the Chinese auto market become like this? Yes, too many practitioners have repeatedly asked themselves this question. But given the current environment, I believe no one can provide a solution.

On social platforms, the mixed nature of information has practically eliminated a fair value system within the entire industry. This extreme influence has led to competition between automakers continually deviating from the proper track of industrial development, with consumers' perceptions of certain brands becoming black-and-white.

Some say this is due to the overly simplistic market precipitation over the past 20 years. From today on, the evolution theory dominated by foreign capital should be overturned, and the Chinese auto market needs a new concept to draft its future. But does this mean any rhetoric can be used as leverage to propel the industry forward? Clearly, reality presents a different answer.

Throughout the first half of the year, under the intense public opinion clashes, even ambitious players like Lixiang failed to defend their turf, leaving weaker players pushed into a corner. Lacking consumer support, they were as powerless as losers, with neither defensive nor offensive capabilities.

A typical example is IM L6, which once viewed Xiaomi SU7 as a thorn in its side. Its own low-level mistakes at the launch event were directly fueled by public opinion, turning all efforts into nothing.

Fan culture is unacceptable. In fact, we all know that when the rules that operate in non-physical industries are applied to the automotive market, some things need to be discarded. Unfortunately, the immature Chinese auto market still can't manage that much.

Every public opinion battle encountered in the past six months, even if illogical, often convinces many people of one-sided opinions. Currently, it's puzzling that the younger generation finds it difficult to be fixated on cars or choose a model based on brand stories. But as things stand, our judgment is that the chaos is simply the result of everyone rushing in.

In other words, "uniting against the outside world" is not the direction that Chinese automakers universally agree upon. Behind the tumultuous public opinion fermentation lies the microcosm of automakers' overt and covert struggles. New forces and traditional automakers, domestic brands and joint ventures – every camp is exhausting means to fuel the restructuring of the landscape. Maintaining the healthy development of the industry is not their primary concern.

Of course, in the first six months of 2024, in terms of winners and losers, compared to Xiaomi and Huawei, which have come out on top, and traditional domestic giants that have fought back and forth in the public opinion arena, the struggles of joint ventures are always apparent. Netizens harbor deep hostility towards driving Volkswagen and Toyota out of China. The negative saying, "no matter what they do, they get scolded by consumers," is increasingly prevalent within joint venture companies.

Can we still have expectations for the next six months? Perhaps.

After all, as voices calling for an end to the price war continue to emerge, consumers who buy cars with money still fail to realize the severity of the industrial pains encountered by the Chinese auto market. The casual remark, "let those automakers that can't keep up with the competition perish," indicates that the Chinese auto market, drowning in gossip, is heading into an unknown future.

For the development of the industry, public opinion urgently needs to be loosened.

Regarding the Chinese auto market in 2024, one thing is always clear. As the penetration rate of new energy vehicles gradually reaches new highs, and the market share of Chinese brands rises above 50%, the market can no longer accommodate any automaker that does not compromise for Chinese consumers.

If consumers demand cost-effective products without brand premiums, automakers that want to survive must put aside their dignity and cater to market trends. To achieve this goal, gaining marketing advantages in public opinion will continue to be their insistence.

As an observer, we may clearly understand that after the public opinion wave in the first half of the year, changing the market's existing trajectory is difficult. However, given the repeated voices in the market, it would be unreasonable to say that the market should continue on this trajectory.

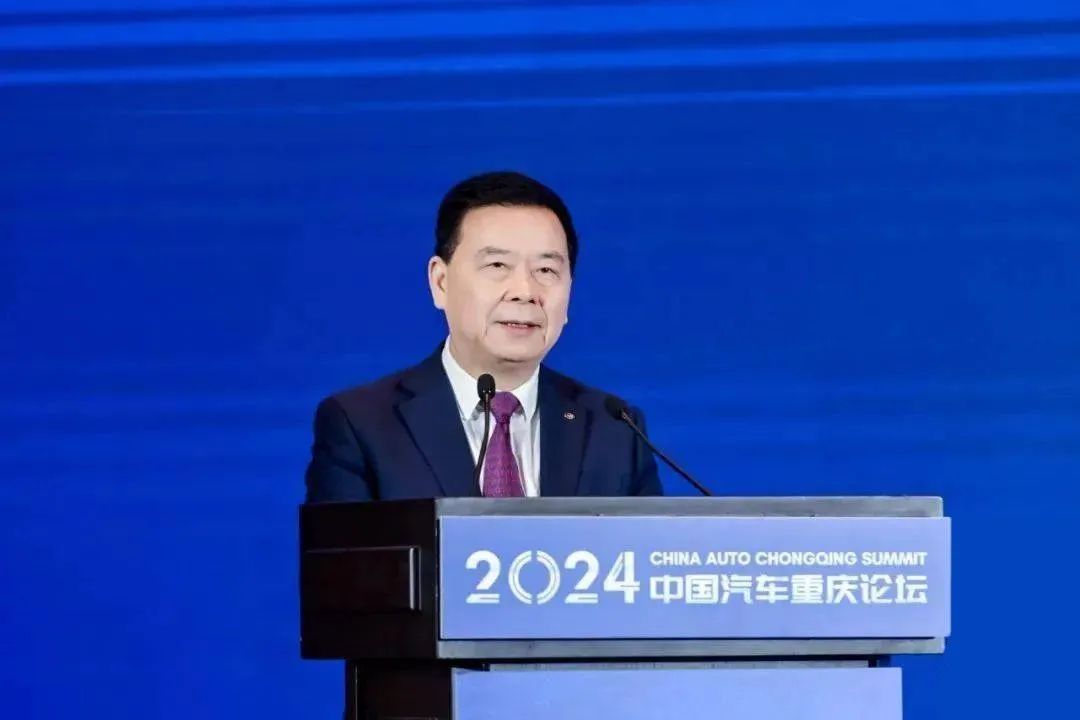

Zeng Qinghong, Chairman of GAC Group, said at the 2024 China Automotive Chongqing Forum, "Internal competition is not the solution. What is the goal of an enterprise? To make a profit. And what is the purpose of making a profit? To contribute to the country and society, pay taxes, and create job opportunities. But how many layoffs have there been in the industry? GAC Group has also laid off many employees. If this continues, what will happen to society and the country?"

At the same time, Li Shufu, Chairman of Geely Holding Group, also expressed his stance, "If the market environment is mature, regulations are perfect and strictly enforced, and competition is transparent and fair, then this internal competition can actually promote industry progress. Otherwise, it may bring negative effects."

Obviously, the subtext of these words is that even though China's new energy industry has achieved unprecedented development at this stage, with a few automakers profiting significantly, for most companies, internal competition within the industry leads to huge losses. If no adjustments are made, these losses are likely to persist. Such drastic turbulence is unacceptable for enterprises with multiple responsibilities.

Before the heat of this discussion had passed, Wang Fengying, now President of XPeng Motors, also expressed on her personal social media platform, "The Chinese auto industry is becoming increasingly competitive, from technology, configuration, and price to public opinion today. As a 30-year veteran in the auto industry, I feel particularly pained."

More recently, at the 2024 China Automotive Forum hosted in Jiading, Shanghai, Wang Lang, Deputy General Manager of Chery Automobile Co., Ltd., emphasized, "Chery Automobile firmly opposes disorderly price wars and hopes to stay away from internal competition and price wars, pursuing the path of brand upgrading. The downward space is limited, while the upward space is unlimited."

In fact, I can't remember how many automakers have publicly called for an end to this internal consumption.

Some always say that everything is market behavior, nothing more than survival of the fittest. But if that were truly the case, what are these automaker executives anxious about?

It has been said that at this stage, Chinese auto consumers no longer have a clear understanding of anything besides price. If this continues, the Chinese auto market may not see a significant decline in total volume, but the possibility of the entire chain breaking down at any time will increase exponentially. Thus, these seemingly emotionally charged comments have inadvertently become suggestions for correcting the industry's development.

In the era of information explosion, regardless of whether the advocated things are good or bad, the power of public opinion speaks for itself. Look at how many automaker officials have established online reporting centers in the past six months, vowing to combat online violence or confront water armies, and you can sense how much the Chinese auto market has been affected. Going forward, market competition will undoubtedly intensify, but for everyone in the industry, let's hope that the never-ending gossip battles don't deviate the entire industry's value orientation.