Is the entry of FSD into China a trump card for Tesla or a stepping stone for new forces?

![]() 10/11 2024

10/11 2024

![]() 537

537

Faced with the Chinese market, Tesla has no more cards to play.

After the bustling September and National Day holidays, almost all automakers are immersed in the sales growth brought by the consumption peak season of 'Golden September and Silver October', especially the domestic new energy brands led by many new forces, which fully demonstrate the vitality of new cars.

Many brands have received orders in just seven days that would have taken a month or even longer to accumulate before, indicating a promising situation.

Against this backdrop, Tesla, which once stirred up the domestic new energy market and is now under 'siege', seems to have been silenced, with neither sales posters nor new promotional activities, adopting a 'let others be strong' attitude.

However, Elon Musk, across the ocean, is clearly restless. On October 10, an interview with Musk expressed his eagerness, stating that 'Tesla will request regulatory approval for its Full Self-Driving (FSD) beta from regulators in Europe, China, and other countries.'

'FSD's entry into China' is like a stone weighing heavily on Musk's mind. Since his visit to China in April this year, Musk has been eager to bring FSD to the Chinese market as soon as possible, even more important than updating the Tesla Model Y.

Facing the Chinese market, FSD is likely to be Tesla's last card to play.

The final trump card

In fact, since Tesla entered the Chinese market, updates on Tesla's FSD have been frequently reported in the news. However, to this day, Tesla users in China still cannot access FSD.

Tesla began developing its Full Self-Driving (FSD) technology as early as 2016 and started rolling it out to some car owners in the United States in 2019. In the following years, Tesla's FSD gained traction in the North American market, and by the fourth quarter of 2022, Tesla's official financial report indicated that FSD subscriptions generated $324 million in revenue for the company, with over $1 billion in short-term deferred revenue related to FSD on its balance sheet.

By promoting FSD subscriptions, Tesla has transformed from a car manufacturing company in the North American market to one that can generate profits through software services.

According to data from the end of 2023, Tesla had over 2.5 million vehicles in the North American market. Based on a presumed subscription rate of 36%, this alone could generate $1 billion in annual revenue for Tesla.

This is a major factor why Tesla is eager to promote FSD in China and Europe. Affected by the price war in the new energy vehicle market, Tesla's gross margin has been declining year over year. As a publicly traded company, strong revenue performance is sometimes more important than sales volume.

At the same time, the implementation of FSD can also reverse Tesla's current awkward position in China. This year, domestic new force brands have taken surpassing Tesla as the main selling point of their new cars, making Tesla a benchmark in the domestic market, and new cars must surpass Tesla in multiple dimensions to meet the criteria for launch.

From Xiaomi's SU7 fully targeting the Model 3 at the beginning of the year to a barrage of pure electric SUVs besieging the Model Y in the second half of the year, Tesla has felt immense pressure in the domestic market. In particular, the Model Y, as a five-year-old model that has been on the market for over three years in China, can only be continuously overshadowed by competitors on paper.

As domestic new models continue to iterate, Tesla has indeed lost much of its product strength advantage in the domestic market. Helplessly, Tesla introduced a five-year interest-free offer to maintain basic sales. Although Tesla's sales are still among the top in China, its growth rate is significantly lower than that of other domestic new force brands.

In September, Tesla China delivered 72,000 vehicles, a 14% month-on-month increase and a 66% year-on-year increase, making it Tesla's best-selling month of the year.

Although sales have rebounded, Tesla's average selling price has continued to decline. As we enter the fourth quarter, ensuring revenue has become Tesla's top priority, making FSD the final trump card.

Currently, domestic new energy vehicle owners are more receptive to advanced driver assistance systems (ADAS). If FSD can successfully enter China, the subscription rate is bound to be higher than in the North American market.

Most importantly, many domestic new force brands are hyping up Tesla's FSD. Many automakers' executives and intelligent driving enterprise leaders have experienced the V12 version of FSD in the United States and have showered it with praise, giving Tesla great confidence to promote the rapid implementation of FSD in the Chinese market.

Trump card or stepping stone?

Regarding the current capabilities of FSD, domestic consumers can only obtain limited information through the internet. Few consumers can actually travel to the United States to experience Tesla's current intelligent driving capabilities, and most rely on automakers' promotions for information. For example, JiYue Automobile claims to be the first domestic automaker to adopt the same pure vision-based driving solution as Tesla.

Meanwhile, due to US government sanctions, domestic new energy vehicles cannot be sold in the United States and cannot provide corresponding high-level intelligent driving services, making it impossible to compare with Tesla's driving environment in the United States and discuss its advantages and disadvantages.

From a technical perspective, Tesla is indeed ahead of most domestic automakers. Tesla's official V12 version of FSD adopts the most popular 'end-to-end' approach in the intelligent driving field and was launched earlier than domestic automakers.

And relying on resource advantages, Tesla purchased over 100,000 H100 graphics cards from NVIDIA in 2024 alone, securing a crucial part of the end-to-end computing power. It is estimated that Tesla's total computing power now exceeds 400 exaflops, far exceeding that of its peers.

To illustrate the formidable computing power, a real-life example is Musk's launch of Grok2, a new AI model for Twitter, which defeated OpenAI's GPT-4o released in May in just a few months. This powerful computing power allows Tesla's FSD to iterate faster.

It is rumored that Tesla will roll out the FSD V13 version in October, further improving the takeover rate by six times, and will also launch its Robotaxi service on October 10 (local time) to further promote the commercial application of autonomous driving.

Judging from this information, Tesla will once again be a big disruptor for domestic intelligent driving enterprises, with its dual advantages in technology and computing power, potentially winning more orders and subscriptions for Tesla in a short period of time.

However, Tesla's current lead is based on road conditions in the North American market. There is no definitive conclusion on its ranking in the Chinese market, as various factors are at play. Firstly, domestic road conditions differ from those in the United States, with lower average speeds and more crowded roads, making it more challenging for ADAS to operate.

Secondly, domestic intelligent driving enterprises are constantly updating their technology and have models and data that are more adapted to domestic driving environments. Like new energy vehicles, intelligent driving models also benefit from economies of scale. China's vast market and numerous new energy automakers will lead to fiercer competition and technological iteration.

From the current perspective, FSD may be Tesla's trump card to regain its lead in the Chinese market, but it may soon become a stepping stone for automakers to compare at press conferences. Therefore, Tesla is eager to promote FSD in the Chinese market to preemptively capture users and deepen its user base.

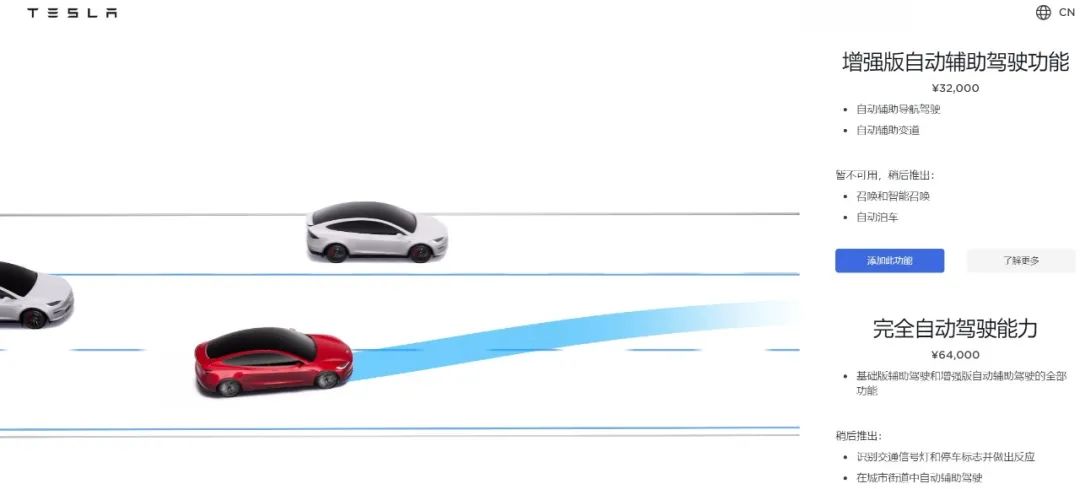

After all, compared to the almost free software usage fees in China, the current buyout price of FSD in China is still as high as 64,000 yuan, a considerable expense for users when buying a car, further deepening their bond with Tesla as car owners.

Meanwhile, in the domestic market, the first automotive intelligent safety evaluation system has recently been established, proposing a set of intelligent safety evaluation procedures for autonomous vehicles. Through more than 50 evaluations, a comprehensive safety assessment matrix for autonomous driving systems has been formed.

It can be said that the future usability of FSD in China will not only depend on users' subjective experience but also be evaluated by relevant industry standards, all of which contribute to Tesla's urgency in promoting FSD.

More importantly, the influence of domestic intelligent driving is expanding. It is rumored that Audi's new A5L will adopt a deeply customized version of Huawei's ADS 2.0. Even Audi is introducing Chinese intelligent driving software, posing an even greater challenge to Tesla.

Therefore, for Tesla, the entry of FSD into China is more like an adrenaline shot, maximizing Tesla's advantages in the short term. Once the timing drags on, the opportunity may no longer exist.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.