Xiaomi Group: the profitability challenge of smart car business remains unsolved

![]() 10/12 2024

10/12 2024

![]() 696

696

Recently, Lu Weibing, partner and president of Xiaomi Group (01810.HK), posted on Weibo, revealing some personnel changes in Xiaomi's mobile phone product team. Hu Xinxin, the former product manager of Xiaomi Civi, has officially rotated to the Redmi team to take on the role of Redmi product manager.

As the pillar business of Xiaomi Group, every move of Xiaomi mobile phones attracts much attention. Securities Star noticed that in Q2 this year, although the company achieved third place globally and fifth place domestically in terms of mobile phone shipments, Xiaomi's performance in the domestic market was relatively weaker. Meanwhile, Xiaomi mobile phones attract users in overseas markets primarily through cost-effective models, leading to a relatively low ASP (Average Selling Price) in these markets. As the company's overseas sales grew rapidly in the first half of the year, this further reduced Xiaomi mobile phones' overall ASP.

Additionally, since the company launched its first smart electric vehicle, the Xiaomi SU7 series, in March, Xiaomi's smart car business has garnered widespread attention. This business was fully disclosed in the interim report. Although the smart car business generated revenue of over RMB 6 billion in the first half of the year, it failed to break the 'curse' that new energy vehicle companies often struggle to achieve profitability in their early stages.

01. Hidden concerns behind revenue growth

According to the 2024 interim report, Xiaomi Group's revenue for the first half of the year was RMB 164.395 billion, an increase of 29.6% year-on-year; profit during the period was RMB 9.243 billion, an increase of 17.3% year-on-year, achieving growth in both revenue and profit.

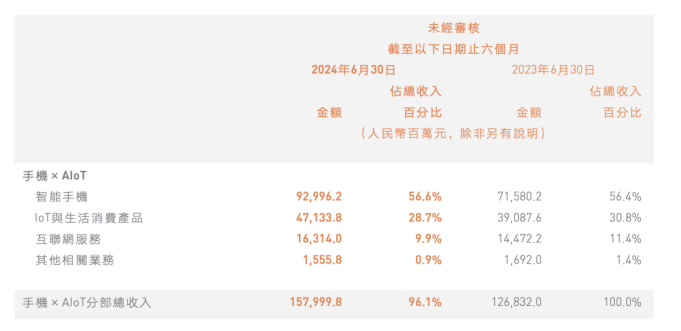

Specifically, Xiaomi Group divides its business into two segments: mobile phone x AIoT and innovative businesses such as smart electric vehicles. The mobile phone x AIoT segment (AIoT stands for Artificial Intelligence of Things) includes smartphones, IoT (Internet of Things) and consumer lifestyle products, internet services, and other related businesses; while the innovative businesses segment includes smart electric vehicles and other related businesses.

Securities Star noticed that in the first half of this year, the company's revenue from smartphones, IoT and consumer lifestyle products, and internet services all increased to varying degrees within the mobile phone x AIoT segment. Nevertheless, some hidden concerns persist behind some of these growth figures.

Currently, mobile phones remain the pillar business of Xiaomi Group, accounting for over 50% of revenue. In the first half of 2024, Xiaomi Group's smartphone business generated revenue of RMB 93 billion, with global shipments reaching 82.8 million units, both achieving varying degrees of growth.

It is worth mentioning that Xiaomi's performance in overseas markets was relatively outstanding. According to Canalys data, Xiaomi ranked third globally in smartphone shipments in Q2 2024, ranking in the top three in 58 countries and regions worldwide and ranking second in smartphone shipments in Latin America for the first time.

In contrast, the company's domestic market performance was slightly weaker. According to Counterpoint data, in Q2 this year, the top five domestic mobile phone brands were vivo, OPPO, Honor, Huawei, and Xiaomi, with Xiaomi ranking fifth and not performing outstandingly.

Securities Star noticed that the company's mobile phone business pursues different development strategies at home and abroad. In recent years, in the domestic market, Xiaomi mobile phones have been targeting the high-end market, attempting to shed the 'cost-effective' label. According to statistics, in Q2 2024, the company's market share in the price ranges of RMB 3,000-4,000, RMB 4,000-5,000, and RMB 5,000-6,000 all increased year-on-year, indicating the success of its premiumization efforts.

However, in overseas markets, Xiaomi mobile phones attract users through cost-effective models, adopting a strategy of trading price for volume. As a result, the ASP in overseas markets is relatively low. Although Xiaomi's premium strategy has achieved some success, the increase in revenue share from overseas markets with lower ASPs has led to a decline in the overall ASP of Xiaomi mobile phones in the first half of the year. In the first half of this year, Xiaomi Group's overall ASP for smartphones was RMB 1,123.7 per unit, down 0.7% year-on-year from RMB 1,131.1 in the same period last year.

In terms of IoT and consumer lifestyle products, benefiting from increased revenue from smart home appliances, tablets, and wearable products in global markets, the business segment generated revenue of RMB 47.1 billion in the first half of this year, an increase of 20.6% year-on-year.

Securities Star noticed that while the company's smart home appliance business continued to grow in the first half of this year, its growth rate slowed down. The interim report indicated that revenue from smart home appliances increased by 40.5% year-on-year, compared to over 70% growth last year. Meanwhile, the growth rate of monthly active users of the company's Mijia APP also slowed down compared to the same period last year. In June 2024, the monthly active users of the Mijia APP increased by 16.8% year-on-year to 96.9 million, compared to 17.1% growth in the same period last year.

As the only business segment within the mobile phone x AIoT segment to experience a decline in revenue, other related businesses saw their revenue decrease by 8% from RMB 1.7 billion in the first half of 2023 to RMB 1.6 billion in the first half of this year. The company attributed this decline to reduced revenue from material sales.

02. Smart car business still incurs losses

Xiaomi Group's widely watched smart car business was fully disclosed in this interim report.

In March 2024, the company officially launched its first smart electric vehicle, the Xiaomi SU7 series. In Q2 2024, the company delivered 27,400 Xiaomi SU7 series vehicles, with an ASP of RMB 228,800 for smart electric vehicles.

In the first half of this year, the company's innovative business segment, including smart electric vehicles, generated total revenue of RMB 6.4 billion, of which RMB 6.2 billion came from smart electric vehicles. However, as this segment is still in its early stages of development, its contribution to the group's overall revenue remains small, accounting for less than 4%.

In fact, in the initial stages of the smart electric vehicle industry, companies typically face high R&D and production costs, along with the risks of long investment cycles and uncertain returns. Xiaomi Group has not been able to escape the profitability challenge faced by new energy vehicle companies in their early stages. In the first half of this year, the adjusted net loss of the company's innovative businesses, including smart electric vehicles, was RMB 4 billion, with a net loss of RMB 1.8 billion in Q2.

Commenting on the reasons for the loss in the innovative business segment in Q2, Lu Weibing, partner and president of Xiaomi Group, said that the company's automotive business is still in its infancy, and one of the reasons for the loss is the relatively small scale. He believes that the automotive industry is a typical manufacturing sector that values economies of scale, which can be difficult to achieve.

It should be noted that while the penetration rate of new energy vehicles continues to increase, many automakers are accelerating their product layouts and technological upgrades, intensifying competition among enterprises. To compete for market share, automakers generally adopt pricing strategies, further compressing their profit margins.

As a result, the new energy vehicle industry faces considerable profitability pressure. In the first half of this year, among the six major listed new energy vehicle makers in China, only Li Auto achieved profitability, while the others, including Geely's Zeekr, NIO, Xpeng, Li Auto's NIO, and Xiaomi Automobile, all incurred losses.

Industry insiders pointed out: "For new entrants like Xiaomi Automobile, the key lies in whether they can provide innovative technologies, products, and services, as well as effectively manage costs and operational efficiency. The future of the new energy vehicle industry is not just about price competition but also a comprehensive competition involving technology, services, brands, and other aspects." (This article was originally published on Securities Star, written by Li Ruohan)

- End -