"China's electric vehicles have no core technology?" Wei Jianjun was lambasted by netizens: Is it just Great Wall that doesn't have it?

![]() 10/21 2024

10/21 2024

![]() 513

513

According to the latest data released by the China Passenger Car Association, 1.123 million new energy passenger vehicles were sold domestically in September, an increase of 50.9% year-on-year, with a new energy penetration rate of 53.3%. This is also the third consecutive month that the new energy passenger vehicle market penetration rate has exceeded 50%, making gasoline-powered vehicles once again a choice for a minority of consumers.

However, in a recent conversation with Sina Finance CEO Deng Qingxu, Wei Jianjun, Chairman of Great Wall Motor, bluntly stated, "China's electric vehicles have no core technology, only a leading industrial chain, especially in batteries and algorithms." Regarding the electrification of overseas brands, he believes that overseas brands "not only have the technology, but lack an electrification strategy."

Screenshot from the video "Can Chinese Cars Go Global?"

Dianchetong believes that only by facing up to the gap between enterprises can they catch up vigorously, but it does not agree with the view that "China's electric vehicles have no core technology."

To date, China has made significant progress and gained advantages in several key areas of pure electric vehicles. In addition to the previously recognized industrial chain, batteries, and algorithms, new energy vehicle companies are also at an advanced level in areas such as intelligent connectivity and intelligent driving. Blogger Ligang Technology Observation put forward a sharp view, "The only purpose of belittling the core technology of China's electric vehicles is to cover up one's own incompetence."

Toutiao screenshot: @Ligang Technology Observation

Judging from the official data, Great Wall Motor recorded a year-on-year increase of 24.15% in cumulative new energy sales in the first three quarters. The blogger's criticism of Great Wall Motor seems to contradict the facts, but specifically, among the brands that only launch new energy products such as Haval, Weiyue, Ora, and Tank, only the Tank brand has made sales progress, with cumulative sales of 169,810 vehicles in the first three quarters, an increase of 62.43% year-on-year. The remaining three brands have declined to varying degrees, especially the pure electric brand Ora, which saw a cumulative sales decline of 13.46% in the first three quarters.

With the rapid development of new energy, many traditional manufacturers have seen significant growth in their new energy segments, but Great Wall Motor Group seems to have missed the "ride" of the times.

Great Wall's off-road vehicles are still formidable, but its household new energy vehicles are a weakness

Judging from Great Wall Motor's current sales composition, the best-selling Tank brand has three new energy vehicles that are relatively popular: the new energy versions of Tank 500, Tank 400, and Tank 700, accounting for more than half of the brand's sales; the mainstay of Haval's new energy sales is the Haval Menglong and Haval Second Generation Dog, with monthly sales of around 8,000 vehicles each; Ora now relies solely on the Ora Good Cat model; Weiyue has completely transitioned to a new energy brand, but at this stage, only Weiyue Lanshan is doing relatively well, selling over 6,000 vehicles in September.

Image source: Weiyue Automobile

It is not difficult to see that Great Wall Motor has a significant voice in the field of new energy vehicles with a more rugged, off-road focus. Dianchetong believes that the new Hi4 and Hi4-T technologies launched by Great Wall Motor in 2023 are the key. Both technologies share the commonalities of "hybrid," "intelligent," and "four-wheel drive," emphasizing lower energy consumption to improve vehicle safety and stability.

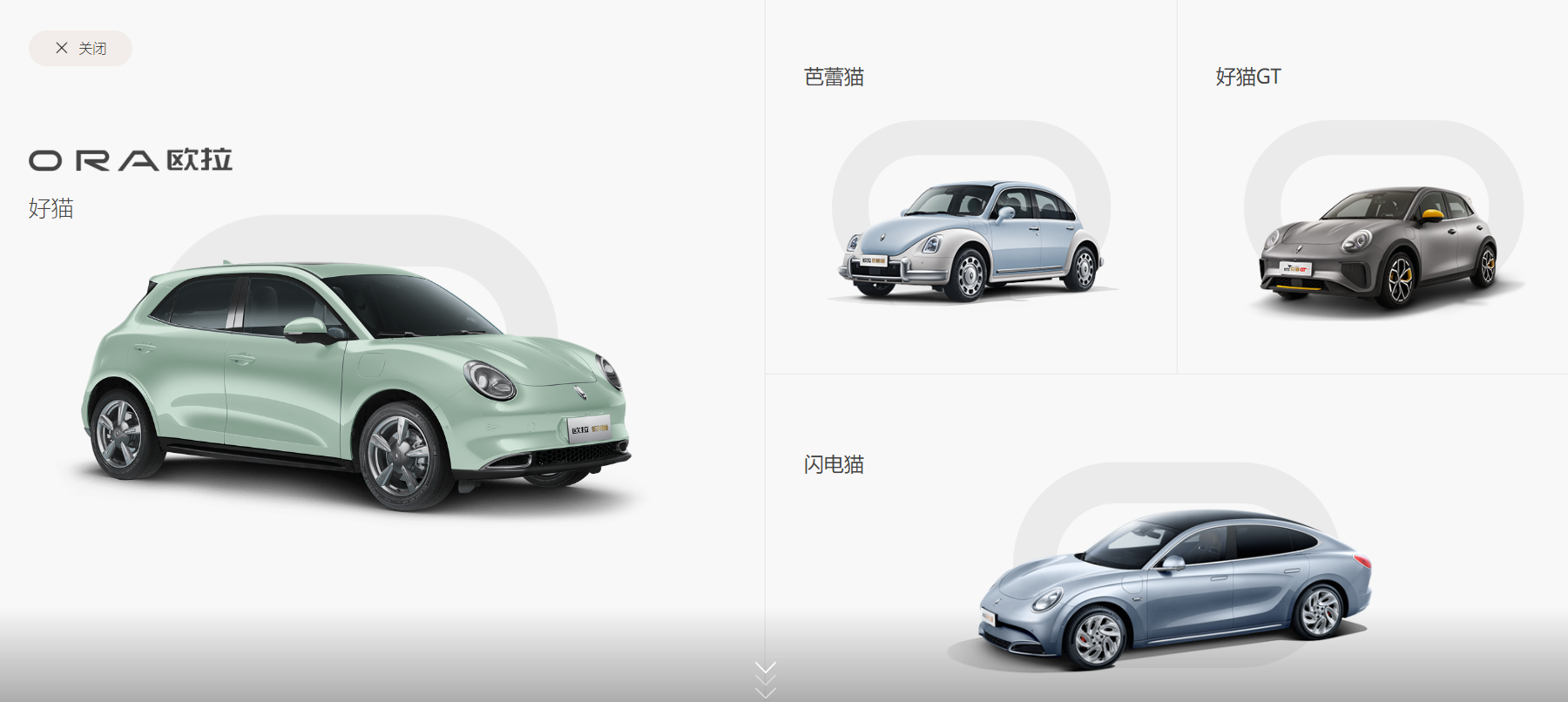

However, in the mainstream new energy market, besides the performance of Weiyue Lanshan, other new energy products targeting the household market seem to have made little contribution. Weiyue Gaoshan has not captured much of the MPV market share, and the September sales of Weiyue Mocha new energy were less than 100 vehicles. Haval H6 new energy sold only 10 vehicles in September, Ora Good Cat sold only 3,700 vehicles in September, and Ora Lightning Cat and Ora Ballet Cat showed almost no improvement.

As one of China's three established automakers, Great Wall Motor has achieved outstanding sales in the past, with its Haval H6 dominating China's SUV market for a full eight years. The gradual decline of Haval H6 coincides with the sudden popularity of BYD's Song family.

However, Great Wall Motor's entry into the new energy field was not late. As early as 2018, it launched the new energy brand Ora, and subsequently introduced Ora Black Cat and Ora White Cat, which remained at the forefront of small pure electric vehicle sales for a long time.

Image source: Ora Automobile official website

Why is Great Wall Motor not in the first tier in the mainstream segment market? Dianchetong believes that the main reason is that the company's early over-emphasis on traffic-generating marketing strategies did not create strong product memory points for consumers.

First, Great Wall Motor Group has launched several new energy vehicle brands, and under each brand, there are further sub-brands such as "Dragon Series," "Dog Category," "Coffee Series," and "Cat Series," making it difficult for consumers to quickly understand the general positioning of the products. In contrast, BYD's Dynasty Family Series, with its clear product positioning of Qin, Tang, Yuan, Song, Han, and Xia, allows consumers to roughly guess what kind of product it will be just by the car names like Qin L and Han L.

Second, the only pure electric brand Ora chooses to target the female user market exclusively. According to data released by the Ministry of Public Security, there were 160 million female drivers in China in 2022, accounting for about 30% of the total number of drivers. While many female users may be willing to pay for the products, the strategy of completely abandoning the male market is not wise.

Can Intelligence Save Great Wall from Its Predicament?

It must be said that Great Wall Motor's primary task at present is to reorganize its product line, expand the positioning of its products as much as possible, and quickly embrace the latest demands of the current new energy market.

Dianchetong has noticed that Great Wall Motor has indeed put in a lot of effort into intelligence, which is of great concern to both consumers and competitors this year.

Image source: Weiyue Automobile

For intelligent driving, which best embodies intelligence, Great Wall Motor has conducted several high-level intelligent driving broadcasts for urban NOA. One of the most direct functions is demonstrated in navigating through the complex "Panlong Interchange," where the system can quickly recognize lane lines and target ramp exits when dealing with this complex road condition, performing relatively smoothly and easily, although there are still some controversial actions, such as crossing solid lines to change lanes, in some sections.

As early as 2021, Great Wall Motor launched High-Speed NOA, and in 2022, it introduced the upgraded Coffee Pilot Pro platform that integrates driving and parking. The latest Urban NOA is based on an end-to-end intelligent driving model. To be fair, Great Wall Motor's Urban NOA is still some distance from the first tier, but it is slightly ahead of peers like Chery and Geely. Based on the end-to-end intelligent driving model, the upper limit of Great Wall Motor's Urban NOA performance can at least approach the level of "anywhere you can drive" achieved by the first tier, with time being the only remaining factor.

Image source: @Great Wall Motor

Secondly, for the intelligent cockpit, Great Wall Motor launched its new-generation cockpit system, Coffee OS 3, in June. Compared to the in-car systems of traditional brands, Great Wall Motor's cockpit system integrates AI into its development and functionality, achieving a high level of fluency and functional richness. On this basis, it also offers a rich range of desktop forms, higher customization permissions, and the built-in Coffee GPT can solve more professional user problems.

However, the latest Urban NOA and cockpit system are currently only available on the Weiyue Lanshan intelligent driving version. This explains why Weiyue Lanshan is Great Wall Motor Group's best-selling new energy product.

To further develop intelligence, Great Wall Motor has signed a "HUAWEI HiCar Integrated Development Cooperation Agreement" with Huawei, becoming one of the first automobile companies to obtain in-depth development resources such as HUAWEI HiCar source code.

Image source: Tank Automobile

While basic HiCar functions include navigation, entertainment, communication, etc., with in-depth development resources, Great Wall Motor can deeply integrate HiCar into its cockpit system to achieve a deeper level of vehicle control. Among them, the Tank 700 Hi4-T, a model under Great Wall Motor, is equipped with a deeply integrated HiCar that retains HiCar's vehicle-driver interconnection capabilities while also enabling direct control over customized UI interfaces and other functions, enhancing its intelligent attributes.

However, according to current information, Great Wall Motor does not seem to have plans to introduce Huawei's intelligent solutions such as Hongmeng cockpit or Qiankun intelligent driving. Judging from the current market situation, Huawei's intelligent solutions are relatively well-received by the market. While introducing these solutions could provide new options to the market, it may weaken Great Wall Motor's voice in the intelligent field.

Does China's Electric Vehicle Industry Really Lack Core Technology?

Finally, let's revisit Wei Jianjun's statement that "China's electric vehicles have no core technology." Dianchetong believes that the rapid development of China's electric vehicle industry and its competitiveness in the global market already demonstrate its strength in core technology.

Taking BYD as an example, aside from owning the world's most thermally efficient engine, as a globally leading new energy brand, BYD holds numerous lithium battery technology patents and has developed highly efficient permanent magnet synchronous motors and asynchronous motors. In the field of intelligence, it goes without saying that Yu Chengdong has revealed that Huawei will launch ADS 4.0 next year, bringing a commercial experience of high-speed L3 autonomous driving; Xiaomi Automobile takes the concept of "human-vehicle-home" to the extreme, further reducing the interaction cost between terminal devices and in-car systems.

Image source: Dianchetong Photography

Furthermore, Chinese new energy brands have attracted investments from many overseas brands based on their strength. For example, Volkswagen has established in-depth partnerships with XPeng, and Stellantis with NIO, both in the field of new energy. The main reason behind this is undoubtedly the recognition of Chinese electric vehicle technology by overseas brands.

It is not wrong to face up to the gap, but we should also correctly recognize China's rapid rise in the field of electric vehicles. Of course, besides the electric vehicle field, domestic brands still have much to catch up to overseas brands in other segments. It can only be said that "the revolution has not yet succeeded, and comrades must continue to strive."

(Cover image source: Screenshot from the video "Can Chinese Cars Go Global?")

Source: Leikeji