The European market is all but guaranteed for China's new energy vehicles

![]() 10/24 2024

10/24 2024

![]() 589

589

Breaking into the European market,

Is China's new energy vehicle industry ready?

Written by: Lao Siji

For reprinting, please contact us for authorization

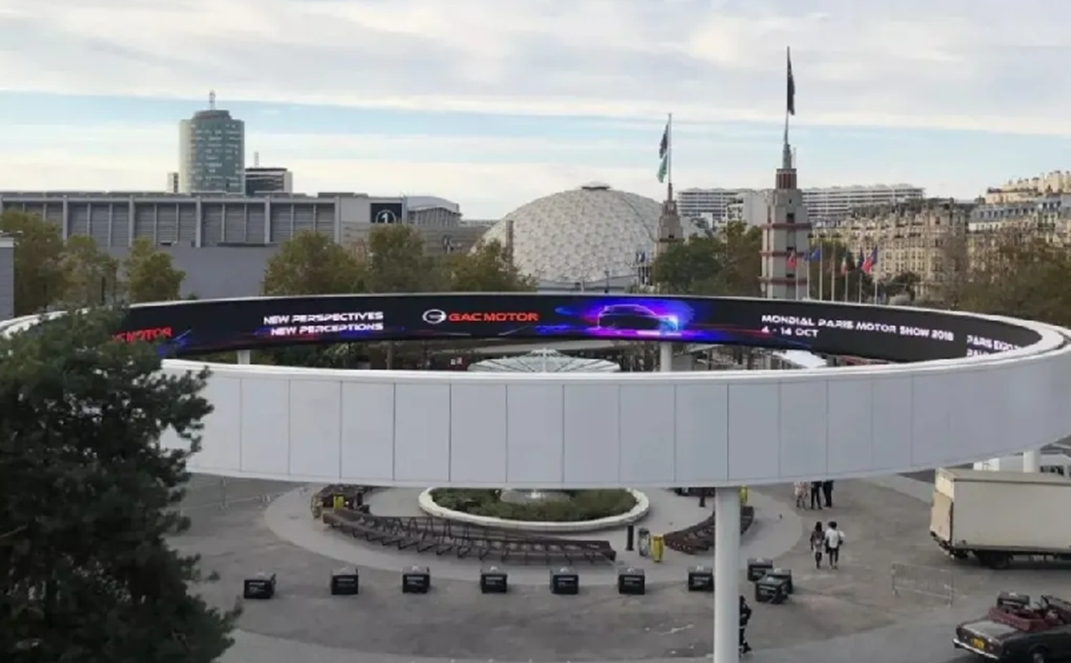

At the just-concluded Paris Motor Show, China's new energy vehicles stole the spotlight. Emmanuel Macron's visit, foreign executives taking measurements with tape measures, and the crowds of people at the exhibition seemed to make the European expansion of new energy vehicles more optimistic. In past international auto shows, it was Chinese automakers who were the ones actively seeking inspiration. The current role reversal seems to confirm the phrase, "The east rises while the west sets."

Removing the media filter, the real competitive landscape of the industry is far from simple. Wei Jianjun, the chairman of Great Wall Motor, once said, "It is the destiny of our generation of automakers to take Chinese cars to the world."

When "destiny" is mentioned, it is inevitably fraught with challenges. Although China has surpassed Japan to become the world's largest automobile exporter, and new energy vehicles are exported to more than 170 countries and regions, the influence of Chinese automakers in Europe has always been unsatisfactory. This is closely related to the uneven charging infrastructure in Europe, the constant threat of increased tariffs, and the brand strength of Chinese new energy vehicles.

Breaking into the European market, is China's new energy vehicle industry ready?

-01-

After the Paris Motor Show, the "open scheme" becomes a reality

The 2024 Paris Motor Show brought together 48 automotive brands from Europe and around the world, including nine Chinese automakers such as BYD, XPeng, WENJIE, Leapmotor, and AION, accounting for about one-fifth of all exhibitors. Each brand showcased their flagship models or new products.

These new products are not just simple "showboating" and marketing but are closely related to the subsequent overseas expansion plans of the companies.

Taking BYD as an example, the company brought the "Seal 07" to the Paris Motor Show, positioning it as a pure electric mid-size coupe SUV. The strategy is clear, targeting Tesla's Model Y, and the new car will soon enter the European market. Interestingly, wary competitors with tape measures in hand seemed to be lurking on the stand.

Moreover, the layout of the factory in Turkey will provide further support for BYD's performance in Europe. Turkey has signed free trade agreements with dozens of countries. In other words, producing cars in Turkey and exporting them directly to the European market will significantly reduce tariff costs compared to exporting from China to Europe, freeing BYD from the shackles of EU tariffs. This helps Chinese new energy vehicles compete in the same price range as European products by offering more competitive pricing.

Leapmotor, which has always been ambitious in going overseas, also has its own strategy.

Through its partnership with Stellantis, the world's fourth-largest automotive group, Leapmotor has continuously expanded into international markets. At the Paris Motor Show, Leapmotor unveiled its new B-series model, the B10, positioning it as a compact SUV with numerous highlights in materials and design. Whether it's AI-powered features, or the advanced intelligent driving suite with the 8650 smart driving chip and LiDAR, the B10 is a formidable competitor. The car has also undergone chassis tuning in collaboration with Maserati, part of the Stellantis Group, and is designed and developed to European standards.

Leapmotor's so-called "reverse joint venture" model leverages its new electric drive, battery, and electronic control systems through the B-series to empower its international expansion. Meanwhile, Stellantis' endorsement and expertise allow Leapmotor to create original designs tailored to European tastes. Coupled with their global dealer network, Leapmotor's B10 is poised to make a strong impact in the European market.

In the past, when Chinese brands appeared at overseas auto shows, it was more about "making an appearance" than anything else, with marketing taking precedence over substance. But this time, "it's really different." From BYD's Seal 07 to Leapmotor's B10, we can see that Chinese new energy vehicles are entering the European market with more rhythm and planning. Whether it's avoiding EU tariffs through overseas factories or collaborating with European automakers to create global models that meet European consumer needs, the Chinese new energy vehicle industry is making a more tangible impact, akin to a sword of Damocles, delivering a heavy blow to the birthplace of the automobile.

-02-

The "tax stick" cannot overturn China's automotive "export gateway"

On October 4, 2024, representatives of EU member states voted to approve the draft final ruling on the EU's anti-subsidy case against electric vehicles submitted by the European Commission. Among them, France voted in favor.

With a base tariff of 10%, electric vehicles produced in China face a maximum tariff of 45.3% when exported to Europe.

At the Paris Motor Show, Emmanuel Macron admitted that the European automotive market is going through a "difficult time." He said, "In such times, it is necessary to protect ourselves and establish fair rules," adding that "setting tariffs to compensate for the gap is normal."

From our perspective, Macron's words are merely a pretext for the EU's investigation into imposing tariffs on Chinese automakers.

Ultimately, the EU's indiscriminate use of the "tax stick" harms not only Chinese automakers but also European automakers themselves. Many European automakers, including Volkswagen, BMW, Audi, and PSA, have factories in China and export their products back to the world. Raising tariffs will also affect their economic benefits and sales.

This is similar to when Europe and the United States imposed chip bans on China. The actual result did not hinder China's technological development but instead forced the development of domestic chip technology. Therefore, the EU's imposition of tariffs on China is akin to a "Seven-Injured Fist," harming both the enemy and oneself.

But why are Europe and the United States doing this? The reason is simple: they currently have no viable competitors.

In the wave of electrification, European and American new energy products pale in comparison to Chinese electric vehicles, both in terms of electric drive technology and intelligent software capabilities. Once-dominant joint venture brands in the Chinese market have been continuously suppressed by Chinese new energy vehicles, with some even announcing their dissolution and withdrawal from the Chinese market. Recently, the controversy surrounding a Mercedes-Benz Maybach GLS SUV roof canopy maintenance incident sparked widespread discussion and attention. While the story began with a repair issue, it ultimately highlighted the disappointment of domestic luxury consumers towards traditional luxury brands.

In contrast, domestic automakers are redefining what true luxury means with their innovative technologies, strong R&D capabilities, and exceptional manufacturing prowess. These local brands not only demonstrate remarkable strength in their products but also excel in communicating with customers, setting service standards, and implementing marketing strategies, successfully attracting a wide range of consumers.

The Chinese automotive industry is undergoing rapid transformation. The rise of new energy vehicles and the ascendancy of Chinese brands have dealt a comprehensive blow to overseas brands. Therefore, in the face of the booming Chinese electric vehicle market, European and American countries have resorted to trade protectionism to build defensive barriers for their domestic automotive industries.

But, is this effective?

-03-

The European market is all but guaranteed for Chinese automakers

As the old Chinese saying goes, there are always more solutions than difficulties. Faced with the EU's indiscriminate use of the "tax stick," China has long had a counterstrategy: taking an alternative path and striking back.

First, adopting the CKD export model.

The CKD (Completely Knocked Down) model involves disassembling automobile parts and components for reassembly in Europe, thereby reducing tariffs and retail prices.

Leapmotor is an example of this model. According to Leapmotor, in markets without tariff restrictions, Leapmotor vehicles will be exported directly. In restricted markets such as Europe and the United States, Leapmotor will leverage Stellantis to facilitate localized production. This involves exporting auto parts to Stellantis for assembly, leveraging Stellantis' mature commercial layout in other global markets to significantly boost Leapmotor's sales in local markets.

Second, overseas investment in factories.

Overseas investment in factories for localized production is preferred by stronger independent automakers. Localized production not only circumvents tariff barriers but also further reduces costs and enables in-market R&D.

In April this year, Chery acquired an automotive factory in Spain, its first production base in Europe. It plans to produce the Omenda E5 model at the Spanish factory starting in October 2025. Meanwhile, BYD is building new factories in Hungary and Turkey and announced the acquisition of its German dealership in late August. Rumors even suggest that BYD is considering establishing a factory in France. Additionally, Geely, Great Wall Motor, SAIC Motor, and Dongfeng Motor have all announced plans to build factories in Europe.

Third, technology export.

If Europe and the United States prevent the export of Chinese new energy vehicles, China can instead export its new energy vehicle technology. Technology export is another way for Chinese automakers to go global.

On June 19 this year, Jaguar Land Rover and Chery Automobile signed a strategic cooperation letter of intent, authorizing Chery Jaguar Land Rover to launch the "Freelander" brand in electric vehicle form. The new vehicle will be produced at the Changshu factory and exported globally. This means that Jaguar Land Rover will rely on Chery's electric technology and China's mature and comprehensive new energy automotive supply chain to establish a price advantage and export to overseas markets. In return, Chery will earn technology licensing fees.

There are many similar collaborations like the one between Chery and Jaguar Land Rover.

Last year, Volkswagen and XPeng announced a partnership, with Volkswagen investing $700 million for a 4.99% stake in XPeng. The two companies will jointly develop two B-segment electric vehicles based on XPeng's G9 platform and will continue to collaborate in areas such as electric vehicle platforms, supply chains, and electric vehicle technologies. In this partnership, XPeng will reverse-engineer technology for Volkswagen and earn considerable technology service fees.

In the past, during the era of gasoline-powered vehicles, Chinese automakers partnered with overseas brands to "exchange markets for technology." Now, Chinese automakers are partnering with foreign automakers in reverse joint ventures, exporting technology to overseas brands and gaining overseas markets in return. It is expected that more such reverse joint venture models will emerge in the future.

Fourth, acquiring mature overseas brands.

The above three models are currently the mainstream ways for Chinese automakers to circumvent EU tariffs, but there is another model that provides a higher-level example for Chinese automakers going global: acquiring mature overseas brands.

When it comes to acquiring overseas brands, Geely is undoubtedly a master, with acquisitions ranging from Volvo and Lotus to Proton. Among them, the Proton acquisition is particularly noteworthy for domestic automakers to reference.

Looking back at Geely's overseas acquisitions, most of them aimed to acquire certain capabilities, such as Volvo's safety features, Lotus' performance, and their contributions to premium brand image. However, Proton, a Malaysian automaker, did not offer any technological or branding advantages to Geely.

So, what is the significance of Geely's acquisition of Proton? The answer lies in the market. By leveraging its full industrial chain, including technology, products, supply chains, and management, Geely has introduced popular models such as Boyue, Binyue, and Emgrand into Proton. With Proton's established brand image and dealer network, Geely has not only revitalized Proton but also expanded its influence throughout Southeast Asia.

In fact, this model has precedents internationally, such as General Motors' acquisition of Holden to enter the Australian market and Opel to enter the European market. Similarly, Chinese brands can acquire struggling mature overseas brands as a springboard into the European market. Recently, there have been rumors that Chery will acquire the Maserati supercar brand from the Stellantis Group.

Admittedly, Europe and the United States have arbitrarily imposed tariffs on Chinese automakers, but facing the world's third largest automobile market and the second largest new energy vehicle market after China, Chinese automakers have not given up easily. Being able to gain a foothold in the developed European market is not only a boost to brand sales for Chinese automakers, but also enhances brand reputation, conveying to the outside world that China is a powerful automobile country.

In fact, some Chinese electric vehicles that have taken the lead in entering the European market have already gained recognition from European consumers. Previously, BYD ATTO3 was selected as the Best Electric Car of 2023 in the UK by a British news company. NIO ET7 won the championship in the medium and large car group of the "Golden Steering Wheel" award from Germany's "AUTO BILD". A Munich automotive economist said that Europeans' acceptance of Chinese electric vehicles is on the rise.

In a word: the European market is a sure bet for Chinese automakers.