Auction at a rock-bottom price: Who will take advantage of the bankrupt GAC Fiat Chrysler Automobiles?

![]() 10/25 2024

10/25 2024

![]() 517

517

Where will GAC Fiat Chrysler Automobiles Changsha plant go after three failed auctions?

On October 23, after three failed auctions, the administrator of GAC Fiat Chrysler Automobiles announced that the Changsha plant would start its fourth online auction with a starting price of 1.103 billion yuan, 10% lower than the previous failed auction price.

In October 2022, GAC Fiat Chrysler Automobiles filed for bankruptcy with the court and initiated the first auction of its Changsha plant on July 20, 2023. After asset appraisal, the liquidation value of the Changsha plant was assessed at approximately 1.915 billion yuan.

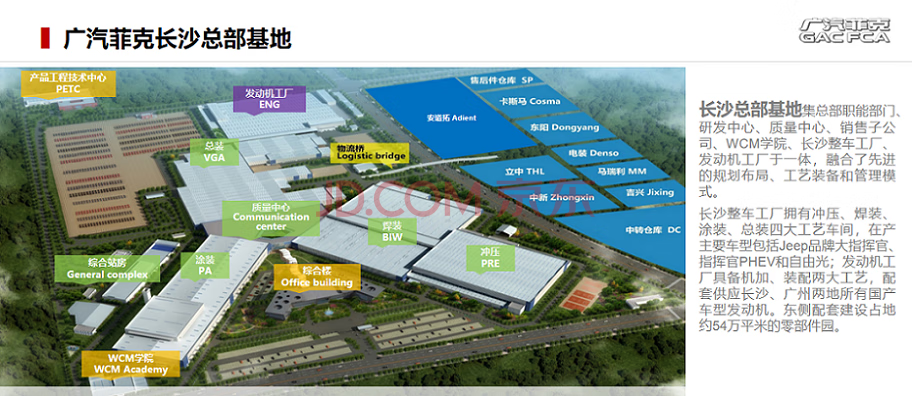

To the average person, the GAC Fiat Chrysler Automobiles plant undoubtedly represents a valuable resource, encompassing 700,000 square meters of land and a factory built with over 5 billion yuan in investment over the past decade. Now, it can be acquired for less than 2 billion yuan.

Yet, despite appearing to be a sure win, this business has attracted no buyers. After the third failed auction on September 18, 2023, the Changsha plant disappeared from the limelight until recently, when it was listed for auction again at an even lower price, nearly halved.

A hot potato

The national passenger car market is currently expanding, especially driven by the new round of trade-ins, creating a significant demand. From an investment perspective, the domestic automotive industry remains promising, but why has the GAC Fiat Chrysler Automobiles plant failed to attract buyers despite three price cuts?

There is a case similar to the GAC Fiat Chrysler Automobiles plant auction, which is the sale of the Beijing Hyundai Chongqing plant. After three auctions, it was finally acquired by a state-owned enterprise in Chongqing.

In terms of scale, the Beijing Hyundai Chongqing plant is more than double the size of the GAC Fiat Chrysler Automobiles Changsha plant. The Beijing Hyundai Chongqing plant covers 1.872 million square meters, with a total investment exceeding 7.7 billion yuan and a designed annual production capacity of 300,000 vehicles.

As Beijing Hyundai's sales continued to decline, this plant became a burden. Beijing Hyundai chose to sell the plant to cut costs. On August 11, 2023, the initial listing price was 3.68 billion yuan. After three failed auctions, it was finally acquired by Yufu Industrial Park Construction Investment Co., Ltd., a subsidiary of Chongqing Liangjiang New Area State-owned Assets Supervision and Administration Commission, for 1.62 billion yuan.

Based on the discount of the Beijing Hyundai plant sale, there is still considerable room for further price reductions in the current listing price of the GAC Fiat Chrysler Automobiles Changsha plant. There is a high likelihood that this auction will also fail.

It is also uncertain whether the Changsha Municipal Government will step in and acquire the plant. According to official data, Hunan Province's local debt at the end of 2023 was 1.82163 trillion yuan, ranking seventh nationwide, but the automotive industry is not significant, especially in passenger cars, which do not even rank in the top ten nationally.

In contrast, Chongqing's local debt is 1.2258 trillion yuan, ranking 17th nationally, but its automotive industry ranks third nationally. According to statistics, Chongqing produced 1.5401 million vehicles in the first eight months of this year, second only to Guangdong and Anhui provinces.

Under such circumstances, the Chongqing Municipal Government's acquisition of the Beijing Hyundai plant could potentially serve as capital to invest in local automotive enterprises in the future, revitalizing the land and production capacity. Chongqing boasts several powerful automotive enterprises, including Seres Group, state-owned Changan Automobile, and private enterprises like Geely.

In contrast, while Changsha once housed many automotive enterprises, only factories operated by BYD, Geely, and SAIC Volkswagen are still in production. Formerly known as GAC MITSUBISHI, the plant has been acquired by GAC AION, and the local Liebao Automobile was restructured in 2021.

It can be said that there are currently no local enterprises or industries in Changsha capable of revitalizing the GAC Fiat Chrysler Automobiles plant, which explains why it is difficult to sell.

More importantly, beyond objective factors like local pressure, the lack of interest in the GAC Fiat Chrysler Automobiles plant reflects the current overcapacity of gasoline-powered vehicles in the Chinese market.

The inevitable end of overcapacity

In 2022, when GAC Fiat Chrysler Automobiles went bankrupt, China produced 23.836 million passenger cars, including 7.058 million new energy vehicles, a growth rate of 96.9%. The popularity of new energy vehicles has to some extent reduced the market share of traditional gasoline-powered vehicles.

By 2023, China's passenger car production increased to 26.124 million, with new energy vehicle production approaching 10 million, accounting for a 31.6% market share. The gasoline-powered vehicle market shrank, and the market share of joint venture brands fell below 50%.

As a marginal joint venture brand with weak profitability, GAC Fiat Chrysler Automobiles' bankruptcy was inevitable. Even luxury joint venture brands, including Japanese and German ones, have been affected by this transformation of the market landscape.

Against the backdrop of the rise of new energy vehicles, the once massive production capacity for gasoline-powered vehicles quickly became surplus. In 2024, the penetration rate of new energy vehicles continues to climb, especially for plug-in hybrid models, dealing a second blow to the gasoline-powered vehicle market.

BYD aggressively priced its electric vehicles lower than gasoline-powered ones at the beginning of the year, continuously eroding the market share of gasoline-powered vehicles. In particular, Wang Chuanfu predicted that the monthly penetration rate of new energy vehicles would exceed 50% this year, which proved to be true. Since July, the penetration rate of new energy vehicles has been above 50% for consecutive months, marking a shift towards a new energy vehicle-dominated market in China.

If this trend continues, the annual penetration rate of new energy vehicles may exceed 50% by 2025, making gasoline-powered vehicles non-mainstream.

With annual sales declining from 20 million to 10 million units, the excess capacity of 10 million gasoline-powered vehicles needs to be converted or eliminated. In China's market environment, building new capacity may be faster than retrofitting existing ones, making it unlikely to see gasoline-powered vehicle production lines converted to new energy ones.

More importantly, the entire automotive industry is facing an elimination race. Currently, China's new energy production capacity is fully capable of meeting market demand. Competition has led automakers to become cautious with their investments this year.

We can also observe that numerous automakers have announced plant closures. On July 26, Honda China announced plans to optimize capacity and accelerate its electrification transformation. GAC Honda plans to close its fourth production line with an annual capacity of 50,000 units in October 2024, while Dongfeng Honda plans to shut down its second production line with an annual capacity of 240,000 units in November 2024.

Nissan closed its passenger car plant in Changzhou in June, with an annual capacity of approximately 130,000 units.

Beyond Japanese automakers, SAIC Volkswagen has also rumored plans to close its gasoline-powered vehicle plant in Nanjing, with an annual capacity of approximately 360,000 units. In July 2023, SAIC Volkswagen officially announced the permanent closure of its first plant in Anting, Shanghai, to be repurposed as a base for developing new models in collaboration with Audi on an intelligent digital platform.

It can be said that there is no market demand for expanding gasoline-powered vehicle capacity in the domestic market. What can be done now is to maintain normal plant operations through exports using existing capacity and gradually reduce gasoline-powered vehicle production.

From a market perspective, if passenger car sales remain unchanged, there will be a surplus of over 3 million gasoline-powered vehicles this year alone, and the currently shuttered capacity is far from sufficient. More importantly, as the penetration rate of new energy vehicles increases, so does that of domestic brands.

Under this influence, the tens of millions of gasoline-powered vehicle production capacity of joint venture brands will face even more severe overcapacity. Although many joint venture brands have begun exporting their gasoline-powered vehicles to overseas markets, it remains uncertain how much the export growth can compensate for the domestic overcapacity.

If the GAC Fiat Chrysler Automobiles plant in Changsha had been up for sale two years ago, perhaps other emerging automakers would have acquired it due to its qualifications. However, at this juncture, the risk of another failed auction remains high.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.