Tariffs can't stop China's auto ambitions overseas

![]() 10/25 2024

10/25 2024

![]() 621

621

Lead

Introduction

China's electric vehicle (EV) companies have the intelligence and resilience to tackle this challenge.

In recent years, the EV market has risen rapidly to become a strategic industry targeted by countries around the world. As the world's largest EV producer, China's EV industry has undergone rapid development from scratch, growing from small to large and now standing at the center of the global stage.

However, with growing exports, China's EVs are also facing various challenges in the international market, particularly the issue of trade tariffs.

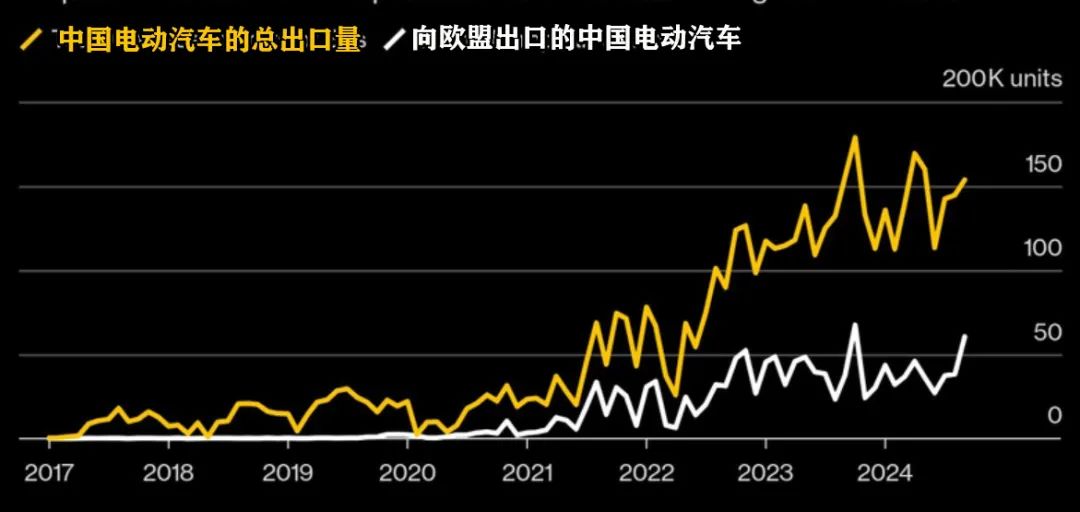

Recently, there have been some interesting figures: In September, China exported over 60,000 EVs to the European Union, surging to the second-highest level ever before the additional tariffs expected to take effect at the end of the month. Relevant data shows that Chinese automakers shipped 60,517 EVs to the 27 countries of the European Free Trade Association last month, a year-on-year increase of 61%.

The previous export peak occurred in October 2023, with 67,455 vehicles, when the EU announced an anti-subsidy investigation into EVs made in China. Despite such trade pressures, China's EV exports remain robust.

Looking back at the evolution of tariff policies, the EU introduced provisional tariffs in June and required relevant automakers to provide guarantees. However, in August, it clarified that these tariffs would not be retroactive. On October 4, the EU voted on the new tariffs, ultimately deciding to impose tariffs of up to 35%.

This measure was supported by ten countries, including France, Italy, and Poland. While China and the EU are still seeking alternative solutions, the new tariffs are expected to take effect at the end of October.

It can be seen that the surge in China's EV shipments reflects automakers' desire to increase exports before tariffs take effect. These automakers understand that the upcoming tariff measures may slow their progress in the European market but cannot completely deter their aspirations for this lucrative market.

In fact, the prices of Chinese cars in Europe are usually much higher than those in China, offering automakers higher profit margins.

Accelerating overseas production layout

To address tariff challenges and consolidate their position in the European market, Chinese EV manufacturers are actively pursuing localization production strategies. BYD has planned production bases in Hungary and Turkey, while Xpeng Motors and Geely Holding's premium brand Zeekr are also considering similar localization measures.

Recent reports suggest that Chinese automakers have the capacity to more than double their overseas full-process manufacturing capacity to circumvent EU import tariffs and meet growing demand in emerging markets.

In the past, exports and overseas CKD (Completely Knocked Down) assembly (i.e., shipping key components produced in China for assembly overseas) were common strategies for Chinese automakers to expand into international markets. However, with tariff measures implemented in regions such as the US, EU, and Turkey, investments in full-process manufacturing are gradually on the rise.

Currently, Chinese automakers have established and operationalized full-process manufacturing plants in nine countries, with an annual production capacity expected to reach 1.2 million vehicles by 2023. According to relevant agencies' predictions, if all enterprises announce relevant information in a timely manner, EV sales are expected to double in over a dozen countries by 2026, reaching 2.7 million vehicles.

Full-process manufacturing encompasses the four core processes of stamping, welding, painting, and final assembly. While it requires significant capital investment, it offers higher production capacity compared to CKD assembly. It is revealed that popular Chinese automakers such as BYD, Chery, Changan, GAC Motor, and SAIC Motor have announced plans to establish or expand ten overseas factory projects from 2023 to August 31.

Popular investment locations are mainly concentrated in Thailand, Indonesia, and Brazil. Meanwhile, Chinese automakers are also expanding into Southeast Asia, Central Asia, Latin America, and the Middle East through export and local production projects. BYD and Volvo, a subsidiary of Geely Holding, are driving capacity expansion plans in Europe, with BYD building a new plant in Hungary and planning to establish a factory in Turkey to enter the EU market.

Furthermore, Poland is increasingly favored by Chinese EV manufacturers due to cooperation with Chinese battery suppliers. Spain and Italy are also actively seeking relevant investments, with reports suggesting that Geely, Dongfeng, and Xpeng Motors are exploring suitable factory locations in these regions.

In contrast, the growth pace of overseas CKD assembly plants is relatively slow. The total commissioned production capacity of CKD assembly plants contracted and developed independently by Chinese automakers and their foreign partners is expected to increase from 2.2 million vehicles in 2023 to 2.8 million in 2026.

However, the surge in overseas automotive investments by Chinese automakers has also drawn attention. In July, China's Ministry of Commerce reportedly reminded automakers to protect EV technologies, prioritize CKD assembly methods, and exercise caution when investing in countries with geopolitical risks, such as Turkey and India.

Short-term and long-term challenges

Of course, Chinese EV manufacturers should maintain a prudent attitude when planning for the future and avoid overconfidence. To establish a foothold in the global market, technology and quality are crucial, along with a deep understanding of the market and consumers. Moreover, the establishment of localized infrastructure and partnerships is also vital.

China's EV exports surged 70% in 2023, with global sales exceeding $34 billion. This achievement owes much to price advantages. In addition to significant price advantages, technological innovation is also a highlight of Chinese EV brands.

By drawing on experience from related industries, these automakers have made significant breakthroughs in core battery technologies and vigorously built charging facilities to meet consumers' actual needs. Comprehensive control over the supply chain and a holistic development strategy have effectively controlled unit costs.

Of course, success in the domestic market cannot be directly translated into advantages in overseas markets. The prosperity of the domestic EV market is attributed to a vast energy replenishment network. However, the situation is different in overseas markets. For example, the EV markets in Norway and Sweden are highly developed due to infrastructure investments and preferential policies for purchasing vehicles, while those in Italy and Greece lag behind.

Therefore, Chinese EV manufacturers must flexibly adjust their strategies and maintain sufficient patience during global expansion. They need to combine the successful experience of the domestic market with the actual situation of overseas markets and continuously learn and adapt to truly grow into internationally renowned brands.

In this process, cooperation with local dealers is also crucial. Dealers are not only sales channels but also important windows for obtaining consumer feedback, understanding policies and regulations, and grasping local community dynamics. Close cooperation with dealers will help Chinese EV manufacturers better integrate into overseas markets and drive consumer purchasing decisions.

Regardless, based on the current situation, China's EVs have successfully established a foothold in the European and global markets, demonstrating remarkable competitiveness and influence. Behind this achievement lies not only the unremitting technological innovation and market layout of Chinese EV enterprises but also the pursuit of EVs by global consumers.

For many automakers, higher import tariffs are merely "short-term challenges." While they may increase China's EV export costs and affect pricing strategies and sales in overseas markets, these additional costs will inevitably be passed on to car buyers.

Nonetheless, we have reason to believe that Chinese EV enterprises possess the intelligence and resilience to tackle these challenges. They may reduce the impact of tariff costs on consumers by optimizing production processes, enhancing product value-added, and strengthening brand marketing, while further consolidating and enhancing their position and market share in the global market.