NIO's first extended-range vehicle exposed! Breaking away from the pure electric tradition, just because Middle Eastern tycoons "don't lack oil"?

![]() 11/06 2024

11/06 2024

![]() 523

523

It seems that another automaker has realized that selling pure electric vehicles is not an easy task.

Recently, sources have indicated that NIO plans to launch its first hybrid vehicle model in 2026, with the "Firefly" brand leading the way, and deliveries expected to begin in 2027.

However, the report emphasizes that NIO's hybrid models will only be sold in overseas markets such as the Middle East, North Africa, and Europe. The idea to develop hybrid models did not originate from NIO, but rather from Abu Dhabi Investment Authority (ADIA), a major shareholder in NIO, based in the Middle East.

(Image courtesy of LeDao Auto)

This news highly resembles previous rumors about NIO's sub-brand "Firefly" developing extended-range models. The official response is currently pending, but the authenticity is not low. It seems that NIO, with thousands of charging and battery swap stations, still has to make a choice on whether to "add a fuel tank" or not.

In the face of current sales and market conditions, should NIO cater to the hybrid mainstream or stick to the industry's unique swappable pure electric route?

Is NIO's "Firefly" brand's first extended-range model targeting Middle Eastern tycoons?

Regarding NIO's sub-brand "Firefly" developing extended-range models, domestic netizens have already engaged in widespread discussions.

Considering Firefly's product positioning, one opinion is that micro and compact cars do not require excessive consideration of range issues. Their usage scenarios are mainly focused on intra-city commuting, and a range of 200-300 kilometers basically does not cause anxiety. The consumer group is clear, and there is a relatively clear understanding of the range of small electric vehicles.

The track of micro and compact new energy vehicles hardly has any plug-in hybrid players. Models like AION Y, BYD Dolphin, Volkswagen ID.3, etc., are all purely electric.

From another perspective, micro and compact cars have compact bodies with limited stacking space. After installing a range extender and fuel tank, there is little space left for the battery. Additionally, converting a battery swap platform to an extended-range model will likely require sacrificing passenger and driver space.

However, those who support "Firefly" developing extended-range models believe that hybrids are the main theme in the current automotive market. Being able to run on both gasoline and electricity provides flexibility, covering consumer groups without charging or swapping infrastructure, and potentially boosting NIO's overall sales.

Regarding this issue, Li Bin and Qin Lihong have expressed their commitment to the charging and swapping route. However, considering policies and local market environments, sticking to battery swapping may not be a foolproof strategy. Taking the Middle East as an example, the local infrastructure is not well-developed, and the insufficient number of charging piles will inevitably cause inconvenience for pure electric vehicles. Moreover, new battery packs need to be adapted for the "Firefly" model, creating a significant funding gap.

Realistically speaking, the Middle East market does not lack oil resources. Establishing a battery swapping system is costly and time-consuming, so installing a fuel tank and range extender in the car seems to be a more ideal path. Therefore, it is not surprising that CYVN Holdings can make such a recommendation.

(Image courtesy of NIO)

CYVN Holdings is also a major shareholder in NIO, with a total investment of approximately $3.3 billion in two investments. Although there may not be an explicit gambling agreement, it is still hoped that NIO can achieve good results in overseas markets. Of course, it is not ruled out that CYVN Holdings will develop its own extended-range hybrid products through the electric vehicle technology licensed by NIO.

According to the content of their cooperation, NIO will jointly develop a new model with CYVN Holdings suitable for the Middle East and North African markets, further expanding NIO's product matrix in the local market and catering to consumer preferences. After all, small models like the Nissan Sunny also have significant sales.

On the other hand, the EU's new tariff policy will impose a new tariff of over 20% on NIO's electric vehicles in five years, making it difficult for NIO models to maintain a competitive advantage in the local market. However, hybrid models can still enjoy tax exemption, to some extent encouraging Chinese hybrid vehicles to go overseas.

From this perspective, the news of NIO's new sub-brand developing extended-range power is not unfounded and may even be a demand from the "financial backer." Overseas markets favor hybrid models, and the domestic market also considers hybrids as the main consumption force.

But it is certain that the "hybrid NIO" will most likely not appear in the domestic market.

The charging and swapping network remains the foundation of NIO's domestic market

News of NIO's third brand, Firefly, developing extended-range models actually came earlier. On the same day, the official refuted the rumor, stating that the third brand would continue to adopt the swappable, chargeable, and upgradable pure electric technology route.

NIO and LeDao will also adhere to the charging and swapping route in China.

Li Bin also stated in the NIO core owner group that NIO's battery swapping service has already achieved county-level coverage, making it unnecessary to explore other options. As of now, NIO has deployed a total of 2,621 battery swap stations and 23,969 charging piles nationwide.

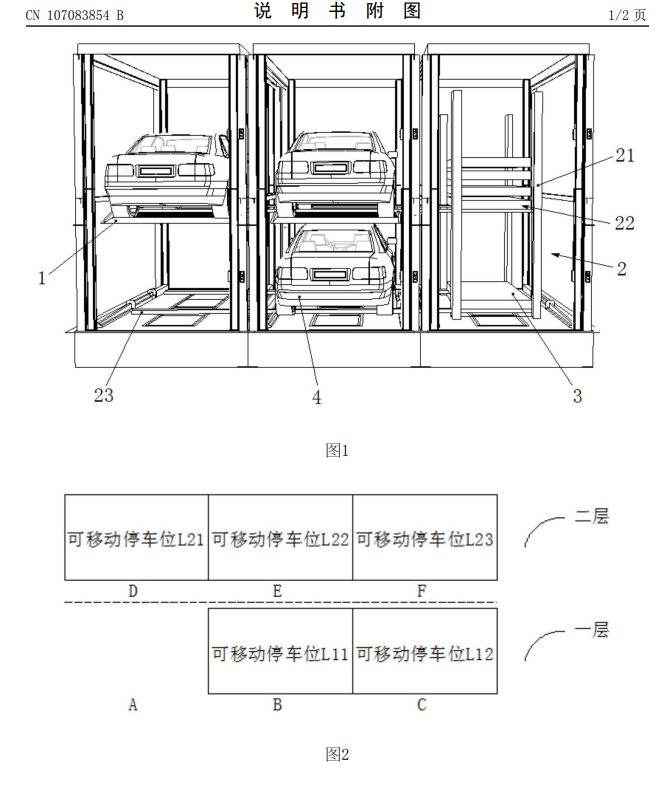

Recently, NIO also announced a patent for a "swappable 3D parking garage," which combines battery swap stations with mechanical parking garages. This allows multiple vehicles to swap batteries simultaneously, improving efficiency, and also provides temporary parking for vehicles after battery swapping, eliminating the need for users to park themselves.

(Image courtesy of China Patent Network)

It can be said that NIO has established a relatively complete charging and swapping system in China. Years of adhering to battery swapping have led to today's technological moat, realizing value expansion in areas such as chip and trinity (battery, motor, and electronic control unit) self-research and development, and high-end business ventures. The battery swapping resources of the second brand, LeDao, are also continuously being established.

If the extended-range model is launched at this time, it can indeed effectively reduce vehicle production costs and user anxiety in the short term, thereby increasing product brand sales. However, in the long run, as everyone is developing high-end extended-range electric vehicles, the substitutability will be strong, and there will be less distinctiveness.

To put it bluntly, even if an extended-range product is to be developed, considering the target audience and overall experience, medium and large SUVs such as LeDao L60 and NIO ES6 are obviously more suitable. In the price range of 250,000 to 550,000 yuan, there are many extended-range options, but only NIO offers battery swapping.

With the decreasing cost and increasing efficiency of charging station construction, as well as the addition of more partners, improving the battery swapping ecosystem is just a matter of time. Using the convenience of battery swapping to compete with the energy flexibility of extended-range models is an effective technical route.

Regarding hybrids, data from the State Information Center shows that nearly 70% of extended-range vehicle owners charge their cars 2-3 times a week, reflecting a conclusion that extended-range vehicle users prefer to drive on pure electricity, with the fuel tank serving as a "backup." Many staff at pure electric vehicle dealerships also say the same.

Domestic fuel costs are not cheap, and adding a fuel tank is only a compromise for users' range anxiety. In contrast, although foreign charging infrastructure is not well-developed, fuel resources are abundant and prices are low, making hybrid vehicles a more suitable choice.

If battery swapping can solve the two core issues of energy replenishment and battery life degradation, users' dependence on fuel tanks will decrease. According to Electech, NIO has its own considerations for sticking to the battery swapping route in China.

Whether there is a fuel tank or not is not important; the second half of the automotive game is about intelligence

Observing new energy vehicle brands this year, it can be seen that automakers that have added extended-range products have generally "won big." Zero Running has become one of the top three new forces in auto manufacturing, Lixiang One has maintained its sales crown, and AITO has also achieved monthly sales of over 10,000 units with its extended-range models.

However, Electech believes that whether there is a fuel tank or not is not the most important factor. Simply put, the new energy vehicle industry has already surpassed this stage. Each company's trinity technology is mature, and there is a clear development path. The choice of power is no longer an issue they should struggle with.

NIO, which relies on battery swapping rather than a fuel tank, has maintained sales of over 20,000 vehicles for the past six months and is not in a hurry to boost sales with a range extender.

The development difficulty for pure electric vehicle companies to add a fuel tank is not too high, and product layouts can be formed in the short term if needed.

The real test for automakers lies in automotive intelligence. Intelligent cockpits, intelligent driving, and vehicle control are all inseparable from AI. Many emerging forces have bet on the intelligent automotive track, and the level of intelligence has developed rapidly to the point where it is now highly usable. NIO has done a lot of work in intelligence but has not yet achieved impressive results, still having a certain distance to catch up with the leading players in intelligence.

Therefore, what NIO truly needs to focus on is the second half of the new energy vehicle game. 2025 will be a year of concentrated intelligence outbreak, and traditional automakers will also rely on external forces to catch up with the mainstream. Besides intelligent driving, NIO also needs more intelligent scenarios that cooperate with charging and swapping stations to strengthen its advantages in the battery swapping system.

We probably don't need to worry about NIO's "hybrid venture." Automakers going overseas definitely need to adapt to local conditions. Extended-range models are just a strategy to boost local sales. If domestic consumers want them, parallel imports are not ruled out in the future.

Source: LeTech