Net profit halved! The century-old German brand Mercedes-Benz, now just a facade of glory

![]() 11/06 2024

11/06 2024

![]() 648

648

The global automotive industry is undergoing tremendous changes. One glaring evidence of this is the halving of net profit for the century-old German brand Mercedes-Benz.

The root cause of this lies in the revolutionary changes taking place in the Chinese automotive industry.

1. Mercedes-Benz's net profit halved

As the inventor of the automobile, Germany's Mercedes-Benz boasts a history spanning over a century.

For over a century, Mercedes-Benz has been a world-renowned luxury automotive brand, with its iconic "three-pointed star" logo symbolizing wealth, status, and prestige.

However, amidst the seismic shifts in the automotive industry, this seasoned automaker has taken a significant hit.

Recently, Mercedes-Benz released its financial results. Data shows that in the third quarter of this year, its sales amounted to €34.53 billion (approximately RMB 266.46 billion), a year-on-year decrease of 6.7%, marking the lowest in nearly three years.

Certainly, an even greater crisis for Mercedes-Benz lies in its plummeting profitability.

In the third quarter of this year, Mercedes-Benz's earnings before interest and taxes (EBIT) were €2.52 billion (approximately RMB 19.42 billion), a staggering 48% year-on-year drop.

Over the same period, net profit stood at €1.72 billion (approximately RMB 13.25 billion), a direct 54% year-on-year halving. Even compared to the second quarter, Mercedes-Benz's net profit declined by more than 40%.

It's worth noting that Mercedes-Benz has twice revised its annual profit margin forecast downwards in the past three months.

Clearly, the enormous crisis of plummeting net profit is looming over Mercedes-Benz.

2. Chinese consumers are no longer buying it

Mercedes-Benz's poor net profit performance is directly linked to its declining sales, with the immediate trigger being the immense challenges in the Chinese market.

In the third quarter of this year, Mercedes-Benz sold 594,600 vehicles globally, a year-on-year decrease of 3%. Among them, sales in the Chinese market amounted to 170,700 vehicles, a sharp year-on-year decline of 13%, making it the market with the largest drop globally.

In contrast, Mercedes-Benz sales in the German market only declined by 7% year-on-year, while sales in the US market surged by 33% year-on-year.

In the third quarter of this year, Mercedes-Benz's revenue in the Chinese market fell by 16.6% to €5.09 billion, making it the most impacted market.

When we extend the timeline, it becomes evident that Mercedes-Benz's sales decline in China has been ongoing for some time.

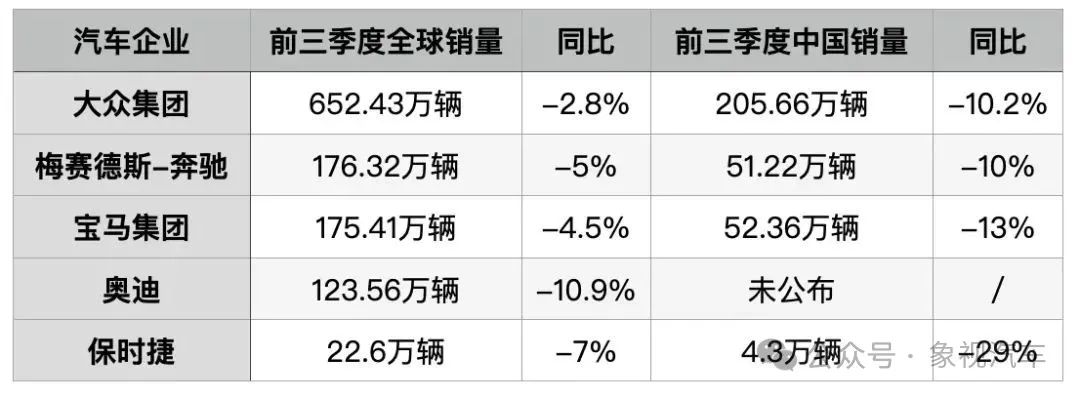

In the first three quarters of this year, Mercedes-Benz sold a total of 1,763,200 vehicles globally, a year-on-year decrease of 5%. Over the same period, sales in the Chinese market amounted to only 512,200 vehicles, a year-on-year decrease of 10%.

Obviously, the Chinese market has transitioned from being a growth engine to a major factor dragging down Mercedes-Benz's global sales performance.

For many years, the Chinese market has contributed approximately 30% of Mercedes-Benz's sales. Now that Chinese consumers are no longer buying it, with sales and revenue plummeting in the Chinese market, Mercedes-Benz is naturally facing a tough time.

3. Just a facade of glory

Declining sales are only one aspect contributing to the sharp drop in Mercedes-Benz's revenue and net profit. The other side of the coin is that Mercedes-Benz is struggling to maintain its previous brand premium and pricing system.

This is particularly true in the Chinese automotive market.

Since 2023, the price war in the Chinese automotive market has gradually spread across every niche segment. It has affected not only the mainstream market but also luxury cars like Mercedes-Benz, BMW, and Audi.

Entering 2024, the market prices of multiple Mercedes-Benz models in China have fallen significantly.

Under the dual impact of new energy vehicles and emerging players, the end-user prices of Mercedes-Benz models have continued to decrease. In the first half of this year, luxury car brands including Mercedes-Benz, BMW, and Audi were all deeply entrenched in the price war.

Some Mercedes-Benz models even offered discounts of up to 40% off their list prices. For example, the C200L, with a guide price of RMB 334,800, could be purchased for just over RMB 200,000 at some dealerships.

As for new energy vehicles, the discounts were even more drastic. For instance, the EQB's terminal price has dropped to RMB 176,000, equivalent to half of its guide price.

Even so, Mercedes-Benz's sales in China continue to decline.

With the advent of the new energy and intelligent automotive era, traditional luxury brands are under increasing pressure.

The definition of luxury automotive products is being redefined. After the in-depth baptism of new energy vehicles, Chinese consumers are no longer solely focused on brands and luxury when purchasing cars, but are increasingly paying attention to new energy and intelligence levels.

As a result, traditional luxury brands like Mercedes-Benz are naturally impacted. Moreover, Mercedes-Benz's own transition to new energy has been slow, and its electric models have been slow to gain market recognition.

If Mercedes-Benz does not accelerate its transition, even with the title of "the inventor of the automobile," it will gradually become just a facade of glory and will eventually be eliminated by the times.