"Highest Plunge of 91%! German Luxury Car Triumvirate Sees Significant Drop in Third-Quarter Net Profit: All Due to Declining Sales in China

![]() 11/07 2024

11/07 2024

![]() 443

443

On November 6, BMW released its third-quarter financial report, marking the release of all three German luxury car giants' third-quarter financial reports. In the third quarter, all three companies experienced significant declines in performance. In terms of revenue, BMW saw the steepest drop, while Audi suffered the most in terms of profit. Overall, all three companies experienced substantial profit declines, with Audi's being the largest due to additional expenses incurred from closing certain factories during its transformation. Additionally, the decline in the Chinese market was a common factor in the revenue and profit declines for all three companies, a challenge frequently mentioned in their financial reports.

In terms of deliveries, BMW delivered a total of 540,881 BMW, MINI, and Rolls-Royce branded vehicles in the third quarter, a year-on-year decrease of 13.0%. For the first nine months, BMW delivered a total of 1,754,158 BMW, MINI, and Rolls-Royce branded vehicles globally, firmly maintaining its position at the top of German luxury car sales. In the Chinese market, BMW and MINI delivered only 147,691 vehicles in the third quarter, a year-on-year decrease of 29.8%, nearly a 30% drop. From January to September this year, BMW sold a total of 524,000 vehicles in China. Among them, the Chinese market saw the largest decline of 13.1% among all markets.

Mercedes-Benz delivered a total of 1,763,200 new vehicles in the first three quarters of this year, a year-on-year decrease of 5%. In the third quarter, the group sold 594,600 vehicles, a month-on-month decrease of 1% and a year-on-year decrease of 3%. Among them, China delivered 512,200 vehicles in the first three quarters, a year-on-year decrease of 10%. In terms of sales volume, China remains the world's largest single market, accounting for 29% of Mercedes-Benz's total sales. In the third quarter of this year, Mercedes-Benz sold 170,700 vehicles in China, a year-on-year decrease of 13%, making it the market with the largest global decline.

The situation at Audi is largely similar. In the first three quarters of this year, the Audi Group delivered a total of 1.25 million vehicles, down from 1.4 million in the same period last year. In the third quarter, the Audi Group delivered a total of 407,390 vehicles, a year-on-year decrease of 16%. In the Chinese market, the Audi Group delivered a total of 479,496 vehicles from January to September, down 8.6% from the same period last year.

In terms of revenue, the BMW Group generated revenue of €32.406 billion in the third quarter, a year-on-year decrease of 15.7%. From January to September this year, BMW's revenue was €105.964 billion, a year-on-year decrease of 5.8%. Looking solely at the core automotive segment, in the third quarter of 2023, the revenue of the BMW automotive segment was €27.854 billion, a year-on-year decrease of 15.7%; from January to September, the revenue of the BMW automotive segment was €90.863 billion, a year-on-year decrease of 4.3%.

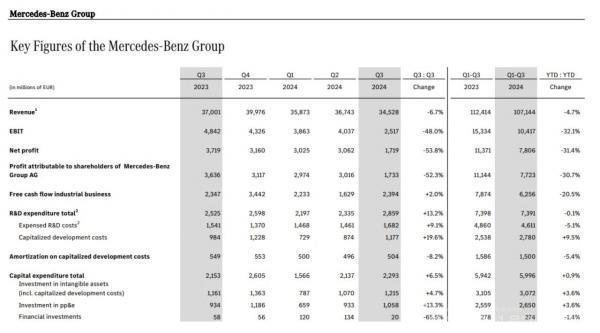

Mercedes-Benz's revenue for the third quarter was €34.528 billion, a year-on-year decrease of 6.7%. From January to September this year, Mercedes-Benz's revenue was €107.144 billion, a year-on-year decrease of 4.7%. Among them, passenger car revenue was €25.602 billion, a year-on-year decrease of 5.6%; from January to September, Mercedes-Benz passenger car revenue was €78.485 billion, a year-on-year decrease of 5.7%.

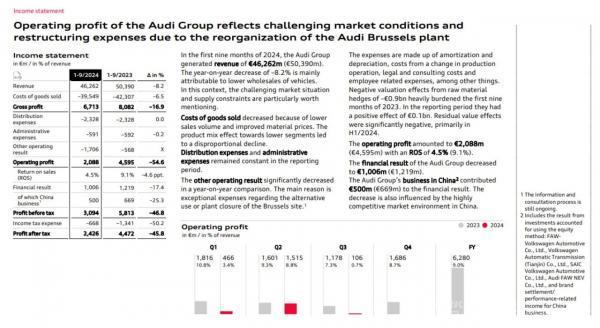

In the third quarter, the Audi Group delivered a total of 407,390 vehicles, a year-on-year decrease of 16%. Revenue was €15.322 billion, a year-on-year decrease of 5.5%. From January to September this year, Audi's revenue was €46.262 billion, a year-on-year decrease of 8.2%. The operating revenue of the Audi brand from January to September was €41.296 billion.

Looking at profits, in the third quarter of this year, the BMW Group's EBIT was €1.696 billion, compared to €4.352 billion last year, a year-on-year decrease of 61%. The BMW Group's EBIT for January to September was €9.627 billion, down 31.6% from last year's €14.07 billion.

In the third quarter, the BMW automotive segment's EBIT margin was 2.3%, compared to 8.4% in the previous quarter and 3.5% in the same period last year. The BMW Group's profit margin for the third quarter was 2.6%, compared to 10.6% in the same period last year, a significant year-on-year decrease of 75.5%.

Looking solely at the core automotive segment, the BMW automotive segment achieved an EBIT of €634 million in the third quarter, a year-on-year decrease of 79.8%; from January to September, the automotive segment achieved an EBIT of €6.028 billion, a decrease of 38.6%. Additionally, the BMW automotive division's free cash flow was -€2.48 billion, marking the first time in a decade that the BMW automotive division has had negative free cash flow. BMW explained that the increased burden on free cash flow was due to income tax payments and bonuses paid in advance to Chinese dealers.

Mercedes-Benz's profits have also taken a hit. In the third quarter of this year, Mercedes-Benz achieved an EBIT of €2.517 billion, a year-on-year decrease of 48.0%. From January to September, it achieved an EBIT of €10.417 billion, a year-on-year decrease of 32.1%. Notably, Mercedes-Benz's revenue in the Chinese market in the third quarter was €5.09 billion, a year-on-year decrease of 16.6%, and revenue from January to September was €17.227 billion, a year-on-year decrease of 6.7%.

As the core Mercedes-Benz passenger car business unit, the adjusted EBIT profit for the third quarter was €1.2 billion (approximately RMB 9.25 billion), a decrease of 64% compared to the same period last year. The adjusted return on sales decreased to 4.7%, a decrease of 7.5 percentage points from the same period last year, representing the lowest profit level recorded since the pandemic. From January to September, Mercedes-Benz passenger car sales return on sales was 8.2%, compared to 13.6% in the same period last year.

The Audi Group's operating profit plummeted 91% year-on-year to €106 million in the third quarter. The company explained that this significant decline was mainly attributed to "restructuring costs related to the reorganization of the Audi Brussels plant." From January to September this year, the Audi Group's operating profit was €2.088 billion, a decrease of 54.6% from €4.595 billion in the same period last year. The Audi Group's profit in China from January to September was €500 million, a decrease of 25.3% from €669 million in the same period last year. Audi explained that this was mainly due to increasing competition in the Chinese market.

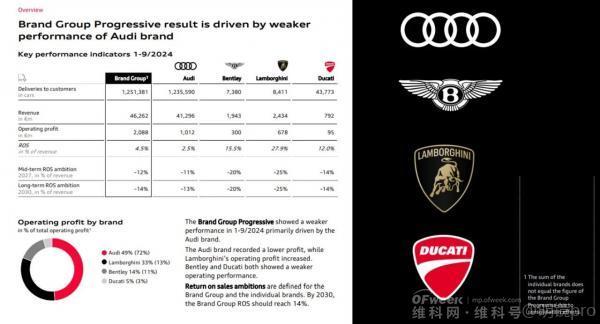

In terms of return on sales, the Audi Group was at 4.5% from January to September this year, compared to 9.1% in the same period last year, a decrease of 4.6 percentage points. As the core Audi brand, its operating revenue from January to September was €41.296 billion, with an operating profit of €1.012 billion and a return on sales of 2.5%, the lowest among the Audi Group. Bentley was at 15.5%, Lamborghini at 27.9%, and Ducati at 12% for the first three quarters of this year.

Regarding future outlook, BMW stated that due to technical issues in the third quarter, the BMW Group has adjusted its full-year performance outlook. It is expected that the Group's pre-tax profit for the full year will decrease significantly, with automotive segment deliveries slightly below last year's level. The EBIT margin is expected to be between 6% and 7%, and the return on capital employed (RoCE) will be between 11% and 13%. However, BMW still adheres to its strategic goal of a Group EBT margin of >10%.

BMW believes that the overall European market may still be slightly below last year's levels. According to current estimates, the overall markets in the United States and China will remain flat compared to last year.

Facing declining performance, Mercedes-Benz has twice lowered its full-year profit margin target this year. Mercedes-Benz stated that it will enhance cost control measures and expects fourth-quarter sales to remain flat with the third quarter, with a return on sales between 6% and 7%. The Audi Group predicts that this year's profit will be between €6.3 billion and €6.8 billion, with a return on sales of 6-8%. Notably, the Audi Group's medium-term return on sales target is 12%, with a long-term target of 14%.

With the rapid global transformation, changes in the Chinese market have forced luxury car makers to face market pressures. However, as BMW executives have stated, these major luxury automakers have a global footprint, and changes in the Chinese market are just one part of that. Undoubtedly, if they fail to keep up with these changes, the pressures they face will increase.