Trump's Return Puts Auto Industry on Alert for Potential Setbacks

![]() 11/07 2024

11/07 2024

![]() 438

438

Compiled by | Yang Yuke

Edited by | Li Guozheng

Produced by | Bangning Studio (gbngzs)

On the morning of November 6, U.S. Eastern Time, Donald Trump announced his victory in the 2024 presidential election.

According to Time Magazine, Trump delivered a speech at a campaign night rally in West Palm Beach, Florida, at 3:30 AM. Trump claimed that his re-election would usher in a "golden age for America" and promised to "solve all our country's problems."

Joining him on stage were his wife, family, and Vice Presidential candidate, Ohio Senator James David Vance (J.D. Vance).

Trump also shouted out the name of billionaire tech tycoon Elon Musk, whom he called a "rising star" and "one of the most important people." Musk had gone all out to campaign for Trump in the final stages of the election.

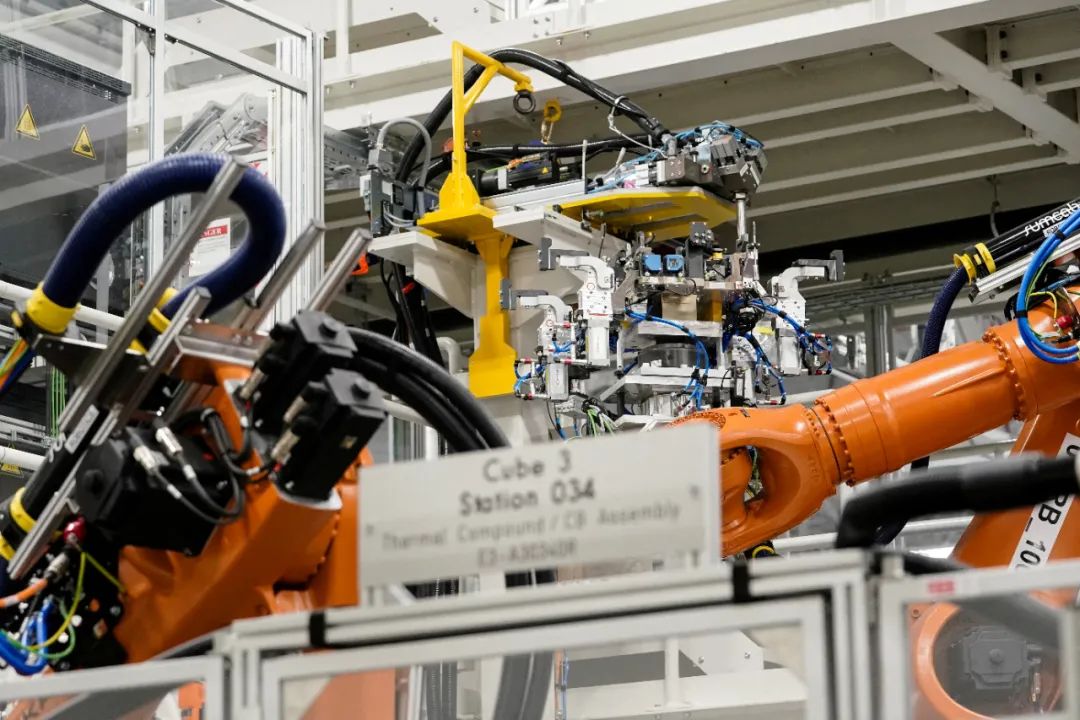

As Americans anxiously cast their votes, the auto industry was preparing for potential transformative impacts. Experts predict significant regulatory changes, particularly in electric vehicle incentives, emission standards, trade agreements, and import tariffs.

One area of concern is electric vehicle incentives and the Inflation Reduction Act.

The Inflation Reduction Act promotes the development of the U.S. electric vehicle manufacturing industry through consumer and commercial tax credits, a $7,500 electric vehicle purchase credit, and incentives for battery manufacturers.

Trump has stated that he might reduce or eliminate electric vehicle purchase subsidies, believing that they could disrupt domestic manufacturing and benefit foreign companies rather than American automakers.

Another area is emission and fuel economy standards.

If Trump wins, emission standards may be frozen at 2027 levels, affecting 2032 model year vehicles. This could reduce pressure on automakers to transition to full electrification. However, Chris Nevers, Rivian's Senior Director of Public Policy, said, "Such a rollback would be like tearing up the carpet built by all suppliers and manufacturers."

A third concern is the United States-Mexico-Canada Agreement (USMCA).

As the 2026 review of the USMCA approaches, the election results will affect trade stability in North America. The agreement allows duty-free movement of components and vehicles between the U.S., Canada, and Mexico, crucial for the U.S. auto supply chain.

Analysts agree that any disruption to the USMCA could increase costs for automakers reliant on cross-border component manufacturing.

Trump has also promised to substantially increase tariffs on Chinese auto brands produced in Mexico, saying he would impose "any necessary tariff—100%, 200%, 1000%" to keep these vehicles out of the U.S. Additionally, he has pledged to use the 6-year review of the USMCA to promote more U.S. auto production.

A fourth concern is high tariffs.

Trump has promised the lowest taxes, energy costs, and red tape for any foreign automaker choosing to increase production in the U.S. if he wins a second term. However, he has also threatened to impose "very high tariffs" on non-U.S.-made vehicles. This echoes his 2016 campaign promise to bring manufacturing back to the U.S. and make America great again.

Europe: "The Wolf is Coming"

Americans may tear up the Western alliance again, and this time it could be worse.

The outcome of the U.S. presidential election on November 6 will not only affect the pace of America's transition to electric vehicles but also determine whether foreign automakers face new tariffs—both of which will impact European auto brands like BMW, Mercedes-Benz, Volkswagen Group, and Volvo that have invested heavily in the U.S. and electrification.

Senior European officials are busy preparing for Trump's return to the White House. Europe's concern is that Trump will reignite a transatlantic trade war. He has threatened to impose tariffs of 10% to 20% on all U.S. imports to bring manufacturing jobs back to America.

Italian Socialist MEP Brando Benifei told Radio Schuman earlier on November 6 that if Trump wins and fulfills his tariff promises, the EU will need to take countermeasures to remain united.

Senior European trade officials recently told EU ambassadors that they are prepared to respond to potential trade disputes if necessary.

The UK is also concerned about the risk of another trade war. Like their European counterparts, UK officials are developing contingency plans in case Trump wins and decides to follow through on his tariff threats.

Trump has also proposed a 100% tariff on all imported vehicles, disastrous news for countries with significant automotive industries. "These tariffs will affect the U.S. economy, not just Chinese and European industries," said Aurélien Saussay, a research author at the Grantham Research Institute on Climate Change and the Environment at the London School of Economics. "If Donald Trump is elected and continues these policies, it will be terrible for the global economy."

Trump's proposed tariffs on EU goods could have a profound impact on European industries heavily reliant on U.S. exports, such as automobiles and chemicals, especially the auto and machinery industries in Germany, Italy, and Ireland.

European Commission data shows that the EU exported €502.3 billion worth of goods to the U.S. in 2023, accounting for one-fifth of all non-EU exports.

European exports to the U.S. are mainly machinery and vehicles (€207.6 billion), chemicals (€137.4 billion), and other manufactured goods (€103.7 billion), accounting for nearly 90% of the EU's transatlantic exports combined.

Bill Diviney, Head of Macro Research at ABN Amro, warned that tariffs "would lead to a sharp drop in exports to the U.S.," with trade-oriented economies like Germany and the Netherlands potentially hit hardest.

According to ABN Amro, Trump's tariffs could reduce European economic growth by about 1.5 percentage points, implying a potential €260 billion economic loss based on Europe's 2024 GDP estimate of €17.4 trillion.

If European growth stumbles under Trump's tariffs, the European Central Bank (ECB) may be forced to respond proactively, lowering interest rates to near-zero levels by 2025.

A possible outcome: a weaker euro, which could help offset some of the competitive disadvantages for European exporters but also increase import costs.

Dirk Schumacher, Head of European Macroeconomic Research at Natixis Corporate & Investment Banking Germany, said a 10% tariff increase could lower Germany's GDP by about 0.5%, France's by 0.3%, Italy's by 0.4%, and Spain's by 0.2%.

Schumacher warned that "the eurozone could fall into recession due to increased U.S. tariffs."

During Trump's first campaign in 2016, German automakers avoided a 35% tariff threat by negotiating new investments in U.S. production, including Volkswagen Group's electric vehicle expansion in Tennessee, Mercedes-Benz's $1 billion commitment in Alabama, and BMW's increased production in South Carolina.

Jacob Kirkegaard, a senior researcher at the Brussels think tank Bruegel, told Deutsche Welle that German automakers should be "very worried" as Trump's new plans could cost them even more.

"All the investments German automakers have made in the U.S. in recent years won't save them," said Kirkegaard. "Due to the level of investment and integration in recent years, they may face even greater supply chain disruptions than most other businesses."

Another threat is Trump's vow to eliminate subsidies for electric vehicles—a key pillar of U.S. President Joe Biden's green investment spree. Over the past six years, most of the funding German automakers have secured in the U.S. has been used to help increase electric vehicle production. Kirkegaard said any reversal could require a separate supply chain to continue producing internal combustion engine vehicles in the U.S.

'We've seen what happens when Germany eliminates subsidies—electric vehicle sales plummet,' said McElroy, president of Blue Sky Productions. 'I think we could see the same thing here (in the U.S.), affecting not just German brands but all companies moving into electric vehicles.'"

Meanwhile, German brands may further face Trump's ultimatum to Mexican producers. This Latin American country is a major manufacturing hub for automakers like the Volkswagen Group, BMW, and Audi, primarily targeting the U.S. market. Trump has frequently threatened automakers that shift production to lower-cost Mexico with 200% tariffs.

'Mexico is an important base for the German auto industry,' the German Association of the Automotive Industry (VDA) stated in Die Welt in October. 'German manufacturers have their own factories there and produced a record 716,000 passenger cars last year.'

Inflation Reduction Act: Back to Square One

The Inflation Reduction Act, implemented two years ago, has proven to be a milestone piece of legislation for the auto industry, stimulating billions of dollars in investments in electric vehicle assembly, battery manufacturing, and component production.

As Trump prepares to take office in January, the auto industry is urging lawmakers to retain the electric vehicle manufacturing and sales incentives in the Inflation Reduction Act, arguing that they are crucial for enhancing America's competitiveness on the global stage.

John Bozzella, CEO of the Alliance for Automotive Innovation, said the industry is once again preparing for potential drastic changes in policies and regulations between Democratic and Republican administrations.

On August 19, Trump told Reuters that if elected, he would consider eliminating the $7,500 electric vehicle tax credit.

At an Automotive Management Briefing Seminars workshop this month, Chris Nevers, Rivian's Senior Director of Public Policy, said withdrawing now would be like "fundamentally pulling out all the suppliers and manufacturers invested domestically or in some of our trading partners."

'It's really scary,' Nevers added.

A report released by Atlas Public Policy Consulting Group on August 13 revealed that U.S. companies have invested $223 billion in electric vehicle-dedicated facilities and projects in recent years, with about two-thirds of that investment occurring after the bipartisan infrastructure law passed in November 2021, accelerated by the Inflation Reduction Act passed in August 2022.

These laws, along with the CHIPS and Science Act of 2022, represent a significant shift in U.S. industrial policy. They encourage automakers, suppliers, battery manufacturers, and microchip manufacturers to develop stronger regional supply chains for electric vehicles and components and reduce dependence on auto imports, components, and materials from China.

The future of these laws and their incentives has been a thorn in the side of industry executives, especially during presidential elections.

Trump has frequently criticized government policies aimed at promoting electric vehicle sales. According to a June report by Politico, Republican congressmen have discussed repealing the clean energy and electric vehicle subsidies in the Inflation Reduction Act.

However, repealing or modifying the Inflation Reduction Act would have significant impacts on the North American auto industry.

The Natural Resources Defense Council, an environmental advocacy group, warns that if the act is repealed, the $89 billion in investments that companies have announced but not yet allocated to specific facilities could evaporate. Jordan Brinn, a clean car advocate at the Natural Resources Defense Council, said during an August 13 conference call, 'Companies have been abandoning investments left and right.'

According to Atlas data, of the announced investments in the U.S., battery manufacturing accounts for about $133 billion, with an additional $70 billion planned for electric vehicle manufacturing and $21 billion committed to electric vehicle components and critical minerals.

Ford, General Motors, and Rivian have invested the most resources in electric vehicle assembly and battery manufacturing in the U.S. to date. However, foreign automakers and battery manufacturers, including Toyota, LG, Hyundai, Volkswagen, and SK On, all plan to invest at least $10 billion in the U.S.

Under the Inflation Reduction Act and the bipartisan infrastructure law, the federal government has issued over $23 billion in loans and subsidies to promote electric vehicle assembly and battery manufacturing. These laws include manufacturing tax credits, and electric vehicles are only eligible for the $7,500 tax credit if they contain sufficient domestic components.

The battery capacity of electric vehicles in the United States is also growing rapidly. According to the U.S. Department of Energy, North America's annual production capacity for lithium-ion batteries will reach approximately 1400 GWh by 2030, sufficient to supply 14 million light electric vehicles annually. This is over ten times the planned capacity in January 2021.

Sarah Colbourn, Director of Sustainability at data provider Benchmark Mineral Intelligence, said, "We have seen growth over the past decade, but since the passage of the Inflation Reduction Act and all the measures that followed, growth has indeed been quite significant."

Discussions about the future of the Inflation Reduction Act come at a time when U.S. electric vehicle sales growth is falling short of previous expectations. Automakers are rethinking the pace of their electrification strategies, in some cases delaying investments or scaling back targets.

Analysts say the act's repeal of electric vehicle credits for consumers could exacerbate this trend. John Murphy, an analyst at Bank of America, said, "I'd bet that electric vehicle adoption in the U.S. will decline significantly."

Meanwhile, automakers and suppliers lament the lack of policy and regulatory consistency in Washington.

A more pressing issue for automakers is fuel economy and emission regulations, particularly the 2026 model year regulations in California and several states such as Washington, Oregon, and New York.

According to the current requirements of the 2022 Advanced Clean Cars II regulations, 35% of the 2026 model year vehicles to be introduced next year will be zero-emission vehicles. Pure electric, fuel cell, and to some extent plug-in hybrid vehicles meet zero-emission standards.

The California Air Resources Board reports that 12 states and Washington, D.C., have adopted these regulations; approximately half of the vehicles will start from the 2027 model year. They are part of the California Air Resources Board's Advanced Clean Cars regulations, which require 100% of new vehicle sales to be zero-emission models by 2035.

According to data from the Automotive Innovation Alliance, only 11 states and the District of Columbia had an electric vehicle market share exceeding 10% at the beginning of this year.

Officials say many automakers will push for a delay in the authorization of the California Air Resources Board. They also anticipate that Trump will repeal or freeze the Corporate Average Fuel Economy (CAFE) standards for the 2027-2031 model years.

USMCA: Uncertain Prospects

Concerned about the global expansion of China's automotive industry, Trump expressed interest in reviewing the United States-Mexico-Canada Agreement (USMCA).

The agreement, which replaced the North American Free Trade Agreement (NAFTA), was negotiated during Trump's first term and came into effect in 2020. However, Trump stated that the agreement needed improvements to better support U.S. automobile production.

Tariffs are central to Trump's automotive industry plan. He has stated his willingness to significantly increase tariffs to prevent Chinese automakers from importing cars from Mexican factories to the U.S. Trump said he would impose "any necessary tariffs - 100%, 200%, 1000%" to prevent these cars from entering the U.S.

Chinese automakers have not yet done so, but as they expand sales and establish localized production plants in Mexico, they are expected to attempt this import method in the coming years.

With the USMCA up for review in 2026, political uncertainty in the U.S. is causing concern in the automotive industry.

Under the terms of the trade agreement, the three countries must confirm in writing by July 1, 2026, whether they wish the agreement to continue. The agreement stipulates how automobiles and components can cross borders without tariffs.

Trade representatives from the three countries will meet before then to review the terms and consider proposed modifications. Their options are to accept or reject modifications, extend the agreement for 16 years, or conduct annual reviews until 2036.

Especially Trump, considering that his administration both pushed for the replacement of NAFTA and the inclusion of a mid-term review in the USMCA, he might use the review process to attempt significant changes.

Joe McCabe, CEO of AutoForecast Solutions, said Trump might view a reevaluation as a bargaining chip to prevent Mexico from allowing Chinese automakers to set up assembly plants there.

As the U.S., Canada, and Mexico prepare for the review, ensuring the agreement's continuation is a top priority for the automotive industry.

Doubts about the future of the USMCA could make the region more difficult to compete globally and attract large-scale investments, which are planned years in advance.

Since the adoption of the USMCA, the automotive industry has struggled with the pandemic and subsequent supply chain and labor shortages, prompting efforts to regionalize the manufacturing footprint.

This, in turn, has spurred investment in North American automotive manufacturing, particularly in Mexico. As more automotive plants come online, Mexican suppliers have cited tightening labor markets as a concern.

Under the agreement, a vehicle must have 75% of its components sourced from the region to cross borders tax-free, up from the previous NAFTA requirement of 62.5%.

Compared to the negotiations from 2017 to 2019, the transition to electric vehicles and China's growth in the global automotive industry will play a larger role in discussions.

The U.S. and Canada implemented tariffs this year aimed at blocking the import of electric vehicles from Chinese automakers. Both governments have expressed concerns about automakers such as BYD using Mexico as an entry point into their markets, fearing that local enterprises may not be able to compete.

Auto industry executives and analysts say there is only one certainty about this assessment. The automotive industry hopes the USMCA will survive the process and emerge better for having gone through it.

Musk and Trump: A Mesmerizing Relationship

Tesla's stock rose 12% in pre-market trading as Trump's polling lead widened.

Elon Musk, Tesla's largest shareholder, has supported Trump during his campaign. Since July, Musk has donated over $180 million to America PAC, which supports Trump.

Trump has promised to appoint Musk as the head of a government efficiency commission if elected. In a speech at a rally in Madison Square Garden in late October, the SpaceX boss said he could cut $2 trillion from the federal budget.

"Your money is being wasted, and the Government Efficiency Department will solve this problem," Trump said at the rally. "We're going to get the government off your back and out of your wallet."

Analysts believe that under the leadership of CEO Elon Musk, Tesla has "unparalleled scale and scope in the electric vehicle industry." A Trump victory could provide Tesla with a significant advantage as its domestic competitors struggle in a market without electric vehicle subsidies.

Furthermore, Trump might accelerate Musk's initiatives in autonomous driving, thereby speeding up Tesla's technological progress. Musk recently claimed that Tesla's new Cybercab robot taxi will be in production "by 2027."

Despite these potential benefits, investment analysts warn that Musk's support for Trump could negatively impact Tesla's consumer demand in the U.S.

While the direct impact on demand is limited, they warn that this political dynamic could influence some customers to steer away from Tesla in future purchase decisions.

In July this year, the Tesla CEO first supported Trump following an assassination attempt in Butler, Pennsylvania. Since then, he has frequently told people that only Trump can "save" American democracy.

However, beneath this "harmony," there lies an underlying unease. The intersection between the world's richest man - whose company holds billions of dollars in U.S. government contracts and is heavily regulated by government agencies - and a candidate known for transactional politics.

What lies ahead? Consider Trump's stance on electric vehicles.

One moment, he is praising figures like Elon Musk; the next, he is suggesting that supporters of electric vehicles should "go to hell." During his campaign, Trump has been vocal about his stance on electric vehicles.

Just last December, he said promoting electric vehicles was "electric vehicle madness." In July this year, he criticized Chinese-made electric vehicles, calling them part of a "meaningless new green scam" and vowing to ban them if he won.

"I will end the electric vehicle mandate on my first day in office, saving the auto industry from total extinction and saving American consumers thousands of dollars per vehicle," Trump said.

Just weeks ago, Trump told attendees at the Republican National Convention that electric vehicles and funding for electric vehicle infrastructure were a "new green scam." He told the audience in Atlanta, "I support electric vehicles. I have to because Elon Musk supports me a lot. So, I have no choice."

However, the question is not whether a supporter can change a candidate's stance on an issue but whether the government will fulfill its duties when a historical large donor stands on the other side of the table.

For example, the National Highway Traffic Safety Administration (NHTSA) is investigating the safety of Tesla's Full Self-Driving software following four collision reports, including one fatality. Will Trump be forced to prioritize software development over pedestrian and other safety by allowing Tesla's planned autonomous taxis to roam freely on U.S. streets?

Trump has stated that Musk has agreed to serve as his "cost-cutting minister." Will he start by drastically cutting NHTSA funding?

Reportedly, Musk's $180 million campaign pledge is just a drop in the bucket to make Tesla a $5 trillion company with autonomous taxi software.

Curiously, seven years after leaving the then-President Trump's Advisory Council over the U.S. withdrawal from the Paris Climate Agreement, Musk seems suddenly inspired to become Trump's biggest supporter.

No one knows what prompted Musk to publicly support Trump this year and commit $45 million per month to support the former president's return to power, except Musk himself.

Some observers speculate that Trump wants to return to the White House because he hopes to suppress federal prosecutions against him. But the same logic applies to Musk's support for Trump, not just in robot taxis and road safety.

Musk has had conflicts with the U.S. Securities and Exchange Commission and the Federal Communications Commission. His rocket company, SpaceX, has billions of dollars in business with NASA and the Department of Defense.

The New York Times wrote that regarding Musk leading a potential government efficiency commission, as proposed by Trump, "Essentially, this would give the world's richest person and a major government contractor the authority to oversee regulators who have influence over his company, which could create a massive conflict of interest."

"The thought of him potentially using his newly acquired power to test autonomous vehicles that have already caused deaths with software and hardware makes me uneasy - as a driver," a New York Times reporter wrote in the report. "I imagine the Trump-Musk alliance could also make competitors in the automotive industry and other competing institutions uneasy for many reasons."

However, it is clear that the relationship between Musk and Trump is transactional. Trump recently told supporters again that he "has no choice" and that electric vehicles are only suitable for a "small portion" of the population.

(This article incorporates reports from Automotive News, The Time, The Economist, CBT news, Politico, Euronews, DW, Politico, CNBC, and some images are from the internet)