NVIDIA's Thor Delayed Again, Auto Manufacturers Relying on Chips Face New Setback?

![]() 11/07 2024

11/07 2024

![]() 444

444

With autonomous driving becoming mainstream, autonomous driving chips have become a core component of new energy vehicles, with significance comparable to the engine in the era of internal combustion engines. The era of autonomous driving cannot do without the support of high-performance computing platforms.

Currently, the mainstream autonomous driving computing solutions are dominated by NVIDIA's Orin-X. However, as end-to-end intelligent driving models are constantly being updated and iterated, the computational power reserve of Orin-X is gradually waning, making it insufficient to meet the software demands of OEMs with a single chip. Therefore, most models that emphasize advanced intelligent driving now come standard with dual Orin-X to expand computational power.

In fact, NVIDIA has long had a next-generation solution to address the demand for high computational power. Thor was first announced at the GTC conference in the fall of 2022 and was expected to enter mass production for vehicles by 2025, with Zeekr as the first to adopt it.

However, XPeng Motors recently revealed that due to supply delays, the latest models missed the opportunity to integrate the new platform, raising concerns about the future direction of smart cars. On the bright side, a "backstab" scenario in the short term seems unlikely, allowing consumers to purchase cars with peace of mind.

(Image from Weibo user)

The difficulty in producing the next generation of high-performance intelligent driving platforms directly affects the product layouts of OEMs. For products still in the development stage, alternative solutions such as dual Orin-X need to be considered in the selection process. Smart cars are about to enter an era of intense competition for computational power, but why are high-performance platforms slowing down?

Upstream delays pose a challenge to OEMs reliant on chips

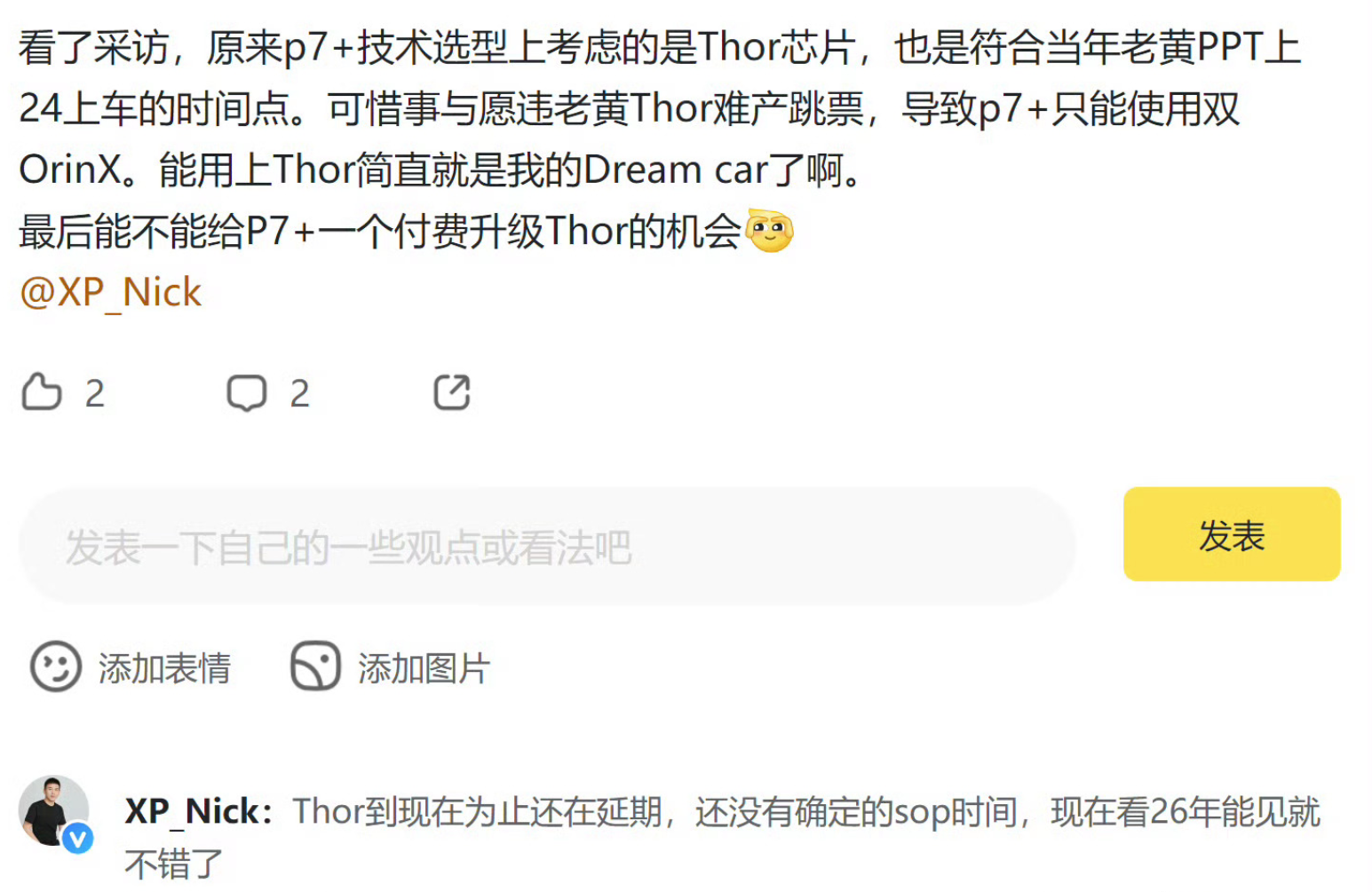

Specifically, XPeng Motors revealed that the original technical selection for the P7+ model was NVIDIA's Thor chip. However, contrary to expectations, the Thor chip was delayed, forcing the P7+ to ultimately use dual Orin-X as a substitute. Relevant sources added that the Thor chip is still delayed and there is no confirmed SOP date, with 2026 being considered optimistic.

Some hope that XPeng Motors will offer a paid upgrade from dual Orin-X to the Thor chip, giving car owners an opportunity to make up for their disappointment.

Another perspective is that Zeekr's EX1H/EX1E, as the first models to adopt Thor, are progressing normally in terms of chip integration. According to industry insights, the solution adopted by Zeekr may be the IPU14 (Thor U) version from Desay SV Automotive, which is already offline and unaffected by the integration plan.

Different automakers have varying technical selections, which to some extent affects development progress. At least those who have purchased the 25 Zeekr models can breathe a sigh of relief.

Thor has multiple derivative versions: Thor X (1000TOPS), Thor S (700TOPS), Thor U (500TOPS), and Thor Z (300TOPS), with the highest version offering up to 2000TOPS of computational power. Differences in OEM solutions may also be reflected in progress variations. Specifically, there is no information yet on which version XPeng and Zeekr will adopt.

As the next-generation processing platform for autonomous driving and cockpit integration, NVIDIA's Thor has been "snapped up" by major automakers. In addition to XPeng Motors and officially announced Zeekr, NIO, AION AOHPAI, GAC AION V Plus, Chery, and other automakers also have plans to integrate Thor.

(Image from XPeng Motors)

Among them, NIO's integration timeline is almost consistent with Thor's original mass production timeline, making it one of the earlier automakers. Meanwhile, BYD has obtained sample chips of Thor and is advancing domain controller development led by the IDC Intelligent Driving Research and Development Center under its New Technology Institute.

It is worth mentioning that BYD is currently restructuring its intelligent technology team, aiming to achieve significant breakthroughs in the core areas of intelligent driving and intelligent cockpits by next year. As a traditional automaker transitioning to new energy, BYD has strong platform capabilities but has been at a relatively basic level in terms of intelligence.

Overall, however, automakers have relatively long-term plans for Thor. For example, AOHPAI plans to adopt the DRIVE Thor chip for L4 autonomous driving vehicles, mostly targeting the L3 and L4 autonomous driving nodes and not rushing for an early first launch.

NVIDIA's DRIVE Thor, targeted at the next generation of smart cars, not only supports autonomous driving but also integrates central computing for vehicles, making it a hardware component of utmost concern to OEMs. Compared to Orin-X, a single Thor chip offers higher computational power, reducing communication issues between two chips and even replacing some chips, which is more conducive to cost control.

In other words, the delayed DRIVE Thor series will more or less directly affect OEMs reliant on chips. Currently, NVIDIA is not the only player focusing on high-performance integrated chips for driving and cockpits.

With more and more automotive chips, NVIDIA is no longer the only solution

It must be acknowledged that the end-to-end data-driven development approach has become a consensus in the smart car industry. OEMs are advancing large models for vehicles and pursuing computing platforms with higher computational power, igniting an arms race for computational power and large models.

At the recent XPeng AI Technology Day, XPeng announced its intention to lay the technical foundation for L4, incorporating steer-by-wire technology and developing the Ultra model, transitioning from human-machine co-driving to Robotaxi with a computational power of up to 3000TOPS. It is evident that the era of autonomous driving is not only about the competition of large models but also about the redundancy of computational power.

Considering the increasing performance of large models, even if high-performance chips are not needed now, they will be in the future. Redundancy is more about preparing for subsequent upgrades.

NVIDIA has a strong presence in high-performance automotive chips and collaborates with a wide range of automakers. Currently, mainstream high-end intelligent driving models largely rely on the computational power of NVIDIA's Orin-X. The upcoming DRIVE Thor chip is bound to become a hot commodity in smart cars, but high-performance computing power solutions are not easy to come by.

It seems that not only NVIDIA Thor but also Tesla's next-generation solution is encountering difficulties. The AI5 solution was announced on June 20th this year but has not yet appeared in Tesla's revised models. Elon Musk also did not mention technical details about the computing platform at the Robotaxi and Robovan launch event.

With a computational power approximately 10 times that of HW4, AI5 is sufficient to support the era of autonomous driving. The only issue is that it has not yet been implemented.

Moreover, as mentioned earlier, NVIDIA is not the only player focusing on high-performance computing chips. At the recently concluded Qualcomm Summit, the Snapdragon Cockpit Premium and Snapdragon Ride Premium platforms were officially launched to support higher computational power requirements for rendering animations and multitasking software. The Snapdragon Ride platform for autonomous driving boasts a computational power of up to 720TOPS, with increasing signs of cockpit-driving integration.

(Image from XPeng Motors)

Qualcomm is making significant strides in AI intelligence, making it impossible for NVIDIA to remain unaffected.

To quickly build a high-performance intelligent moat, domestic automakers have also embarked on the path of self-developing AI chips, such as NIO, Geely, and XPeng. NIO claims that its self-developed Shenji NX9031 chip can achieve the performance of four current industry-leading intelligent driving chips, equivalent to four times the AI computational power of Orin-X (approximately 1024TOPS).

XPeng Motors has also recently unveiled its self-developed chip, "Turing," which can locally run large models with up to 30B parameters, targeting L4 autonomous driving with an AI computational power roughly equal to three Orin-X chips. Geely's self-developed chip, Xingchen No.1, also boasts an AI computational power of up to 512TOPS.

The self-development of autonomous driving chips is gradually becoming a major trend. Domestic automakers are placing more emphasis on software and hardware matching, gaining more autonomy in computational power stacking, and having more options for standardized solutions. Thor is not the only solution. If Thor fails to enter mass production on time, it is believed that this will further drive manufacturers to self-develop or adopt a mixed supply from multiple vendors.

In intelligent driving, "computational power is king," signaling an impending price war for chips?

The new energy vehicle market is highly competitive, and upstream suppliers are also engaged in an "arms race." Leading companies like Qualcomm and MediaTek have technical reserves and experience on par with NVIDIA. Coupled with the "pincer" effect of OEM self-developed solutions, the delay of Thor is not a good sign.

In the era of end-to-end data-driven approaches, computational power is everything. The impact of high-performance chips on the user experience is actually greater than that of batteries and motors, with significance equivalent to the processing platform of smartphones. NVIDIA's Orin-X was once extremely popular and dominated the high-end intelligent driving chip market for years, but by today's standards, it clearly no longer meets the expanding demand for computational power in AI intelligent scenarios.

Back when NIO crammed four Orin-X chips into a single vehicle, today, that computational power would likely be achieved with just one Thor chip. Stacking chips to increase computational power is a stopgap measure for automakers because multiple chips inevitably increase procurement costs. Accelerating self-development and alternative solutions is also a cost consideration.

Time waits for no one. NVIDIA's Thor should not remain a "futures" product for long. It is only a matter of time before competitors catch up in terms of computational power and solution implementation. No one can guarantee that automakers will still choose NVIDIA a year from now.

Or, computational power may become cheaper, leading to a price war for intelligent driving chips, which will be the most intense competition among upstream chip suppliers.

Electric Car News does not hope that NVIDIA will lose its edge due to delays. After all, it is still a leader in the field of autonomous driving chips, with significant influence and collaboration coverage. However, faced with the increasing pressure from competitors, it is indeed time to step up the pace.

Source: LeiTech