Layoffs of 70%, Compensation of N+1? Neta Auto Responds to 'Denying Large-Scale Layoffs'

![]() 11/08 2024

11/08 2024

![]() 556

556

Layoffs of 70%, compensation of N+1, only half of the September salary paid, and uncertainty about the October salary payment...

Are these rumors true?

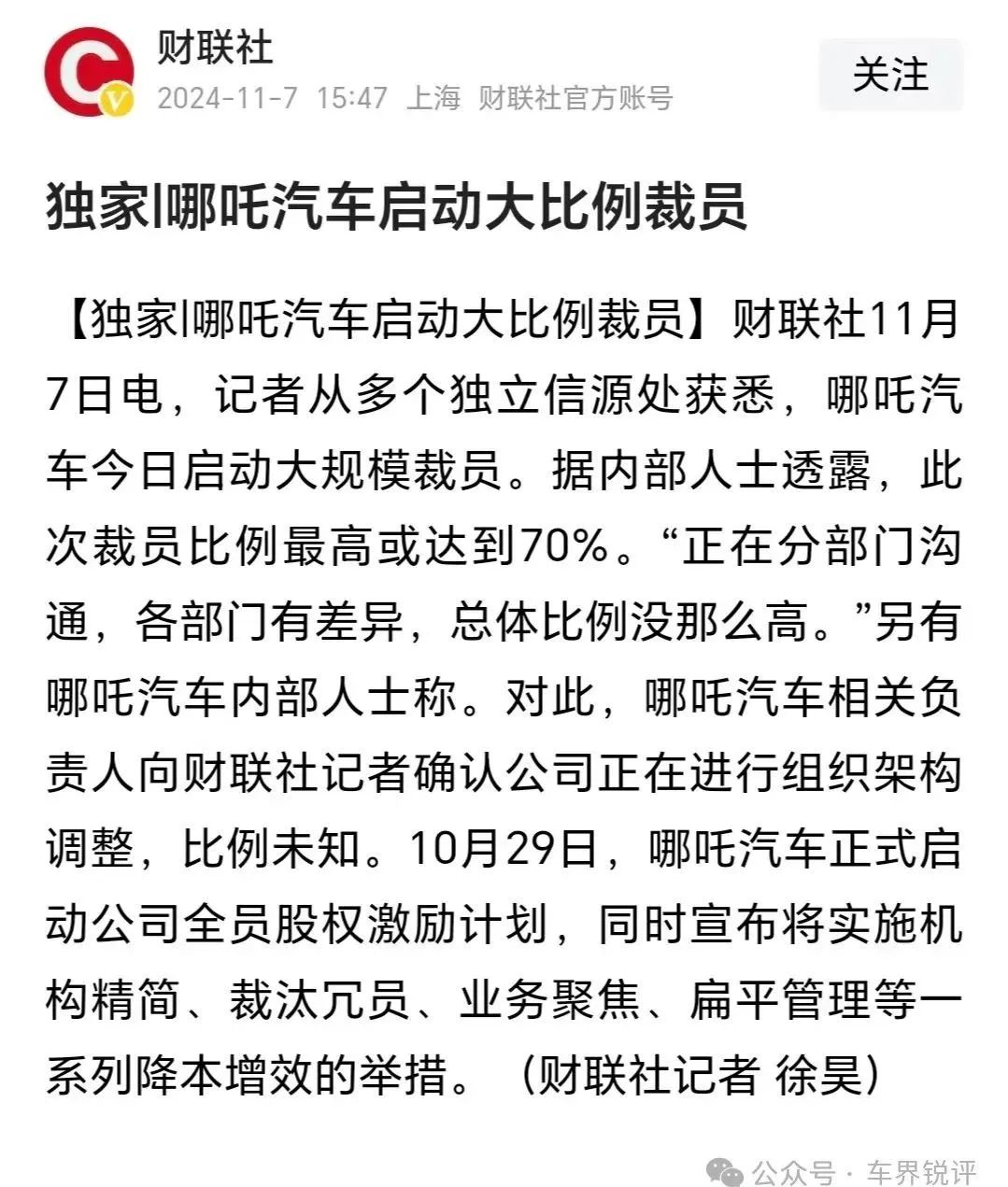

An insider from Neta Auto revealed that the layoffs at Neta Auto were indeed large-scale, with some departments experiencing layoffs of up to 70%.

This unnamed source said that the specific layoff situation in their current department is still "awaiting notice."

He said, "The compensation plan currently heard is N+1, and the payouts will be implemented within 60 working days. "Currently, only half of the September salaries have been paid across the company, and it is still uncertain whether the October salaries will be paid."

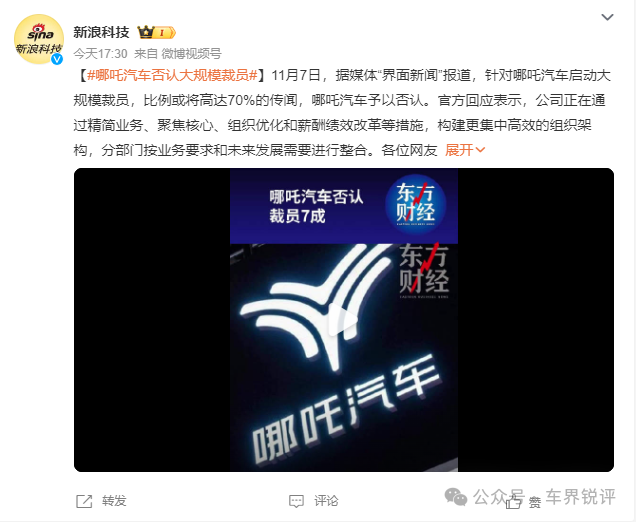

However, Neta Auto subsequently denied these rumors.

The company stated that it is currently streamlining its operations, focusing on core competencies, optimizing its organization, and reforming its compensation and performance system to build a more centralized and efficient organizational structure. Departments will be integrated based on business requirements and future development needs.

During this sensitive period, the response was still programmatic, lacking Zhang Yong's personal guidance, leading to speculation from outsiders.

Is it that Hezhong New Energy is truly facing difficulties, or is Zhang Yong really intensifying personnel changes at Neta Auto to usher in a new era?

After all, Zhang Yong's online presence has been inactive for 25 days.

His most recent Weibo post was about a driver's license issue.

Could it be that Neta Auto's current situation is truly dire, and Zhang Yong has been busy firefighting recently?

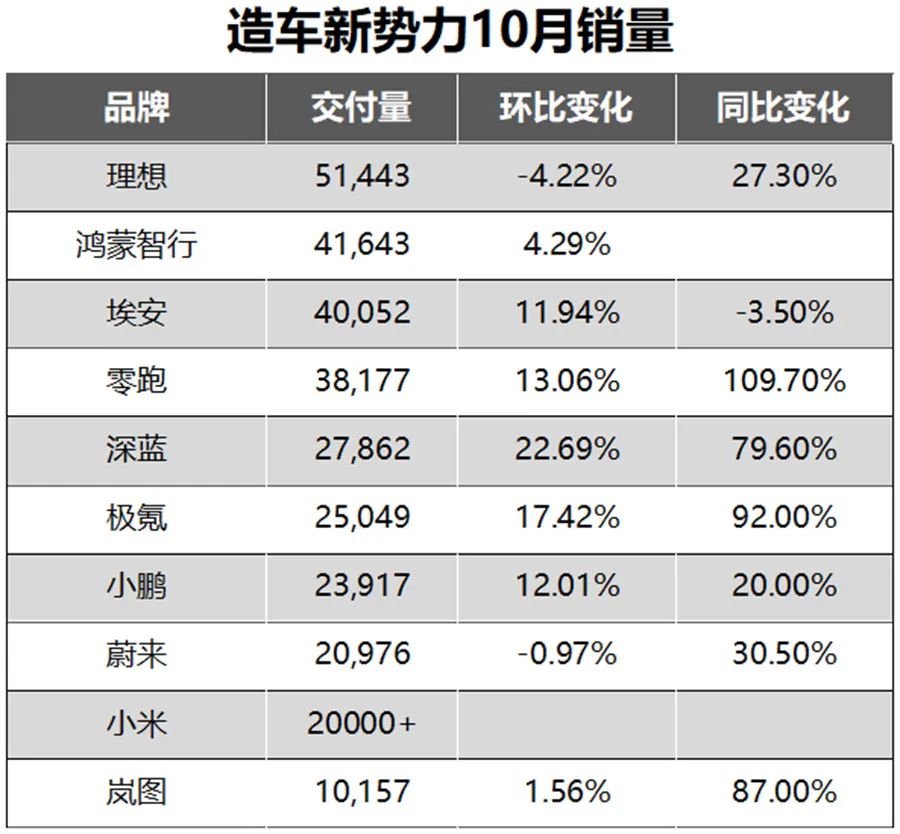

In fact, clues can be seen from the sales performance of various emerging automakers in October.

In the new energy vehicle market in October, emerging automakers showed a clear polarization trend.

On the one hand, Li Auto led the market with stable deliveries exceeding 50,000 units, maintaining high sales consistently. NIO's deliveries approached 40,000 units, with a rapid year-on-year growth rate, setting new delivery records for several consecutive months, showcasing a strong development momentum. Brands like Zeekr and XPeng also achieved new sales highs, while Xiaomi Automobile surpassed 20,000 units in monthly deliveries for the first time, marking a new breakthrough.

On the other hand, as of press time, Neta Auto had not yet announced its October sales figures.

Prior to this, its sales performance had shown no significant improvement, maintaining a level of around 10,000 units. Furthermore, in September, Neta Auto was the only emerging automaker to experience a month-on-month decline in sales. Since February this year, Neta Auto's monthly sales have declined year-on-year for eight consecutive months.

This forms a stark contrast with the positive development trends of other emerging brands, indicating that Neta Auto is indeed facing significant challenges in the market competition.

Especially earlier this year, Neta Auto CEO Zhang Yong revealed that the company's annual sales target was 300,000 units. However, the company's deliveries for the first nine months were 85,900 units, a year-on-year decrease of 12.13%.

Since 2017, Hozon Auto, the parent company of Neta Auto, has completed 10 rounds of funding, raising a total of 22.844 billion yuan. Currently, going public appears to be the company's lifeline to overcome its difficulties.

In June this year, Hozon Auto submitted an IPO application to the Hong Kong Stock Exchange.

The prospectus revealed that the company's total revenue in 2023 was 13.55 billion yuan, including 11.93 billion yuan from domestic sales, accounting for 88% of total revenue, and 1.62 billion yuan from overseas sales, accounting for 12% of total revenue. The company incurred a net loss of 6.87 billion yuan during the year. Since 2021, Hozon Auto has been incurring significant losses.

Previously, in response to rumors of salary reductions in October, Neta Auto stated that Hozon Auto's IPO was still in progress.

With the continuous negative rumors surrounding Neta Auto, is there still hope for the company to ring the bell on the Hong Kong stock market?