Who is the leader in overseas export of domestic automobiles, BYD or Chery?

![]() 11/11 2024

11/11 2024

![]() 548

548

Many things in the automotive industry actually illustrate a principle: "People will only remember the first person to land on the moon." Just like when BYD recently surpassed Tesla in revenue and export volume, people instinctively considered it the leader in overseas export. However, among domestic passenger vehicle brands, Chery leads in overall exports:

Chery Group's exports exceeded 80,000 units for the first time in September, with a cumulative export of 829,353 vehicles in the first three quarters, a 24.5% increase from the previous year, maintaining the industry's leading position. The top-selling model, Chery Tiggo 7, has been the top-exported single model among Chinese brands for three consecutive years. Chery's "international meal" is quite delicious.

There are many reasons why Chery leads in overseas exports, such as being the pioneer among domestic vehicles going overseas, its excellent "localization" strategy, and selecting markets where fuel vehicles have an advantage.

Therefore, from different perspectives, both are considered the leader among domestic brands, and Chery has its unique characteristics.

Chery, a true export giant

Exports are one of the three engines driving the economy, and the automotive industry is definitely a significant part of it. In recent years, it has injected considerable growth momentum into the domestic economy.

According to statistics from the General Administration of Customs, domestic automobile exports reached 3.991 million units in the first ten months of this year, continuing to increase by 30% year-on-year. Based on this growth rate, the China Chamber of Commerce for Import and Export of Machinery and Electronic Products predicts that breaking the 6 million mark this year is highly probable.

The continuous strengthening of independent brands is obviously a key support for domestic automobiles to continuously break through in the international market.

However, most of the time, the market focuses more on the new energy vehicle segment, where domestic industrial chains have a more significant first-mover advantage and many emerging brands have risen abruptly.

Although new energy vehicles accounted for only about 23% of China's automobile exports in 2023, their year-on-year growth rate reached 77.2%, far exceeding the overall growth rate. In terms of brands, BYD's leading position has become increasingly prominent. As of September this year, BYD's cumulative exports have exceeded the total exports for the entire year last year, reaching 302,000 units, with a year-on-year growth rate of 96.3%, firmly ranking first among peers.

Indeed, new energy vehicles represent the "future" of the domestic automotive industry to a large extent. However, what is easily overlooked is that the simultaneous strengthening of fuel vehicle brands also implies that domestic automobiles have already "caught up" in the international traditional fuel vehicle market, which has long been dominated by overseas automakers from the United States, Japan, Europe, and South Korea.

The Russian market is a typical fuel vehicle-dominated market. In 2021, imported cars in Russia were still dominated by German, Japanese, and Korean brands, with Chinese brands accounting for only 9%. However, by 2023, the penetration rate of Chinese cars in Russia reached 49%, soaring to 58% in the first half of this year.

It can be said that the roots and thriving growth of Chinese independent automobiles in this territory are the best interpretation of the performance of Chinese fuel vehicles.

According to statistics from the China Passenger Car Association, Chinese brands accounted for eight out of the top ten best-selling passenger cars in Russia from January to May this year, including five sub-brands: Haval, Geely, Changan, and Chery.

Among them, Chery Automobile has become the second largest passenger vehicle brand after the Russian local brand Lada through localized production and the CKD model, achieving sales of 210,000 units in 2023.

Those who hold reservations about this viewpoint may argue that changes in the international trade environment were the direct driving factor for "Cheries" to capture the Russian market.

What about markets like Saudi Arabia, the United Arab Emirates, Brazil, and the United Kingdom? It is reported that in the first quarter of this year, MG, Changan, and Geely ranked 8th to 10th in the Saudi automobile market, with Chinese brands accounting for 14.7% of the market share in Saudi Arabia.

The rise of domestic independent fuel vehicle brands in the international market is also an established fact. Among them, Chery, which successfully took the top spot in China's complete vehicle exports in the first half of the year, is highly likely to accelerate its presence in the public eye.

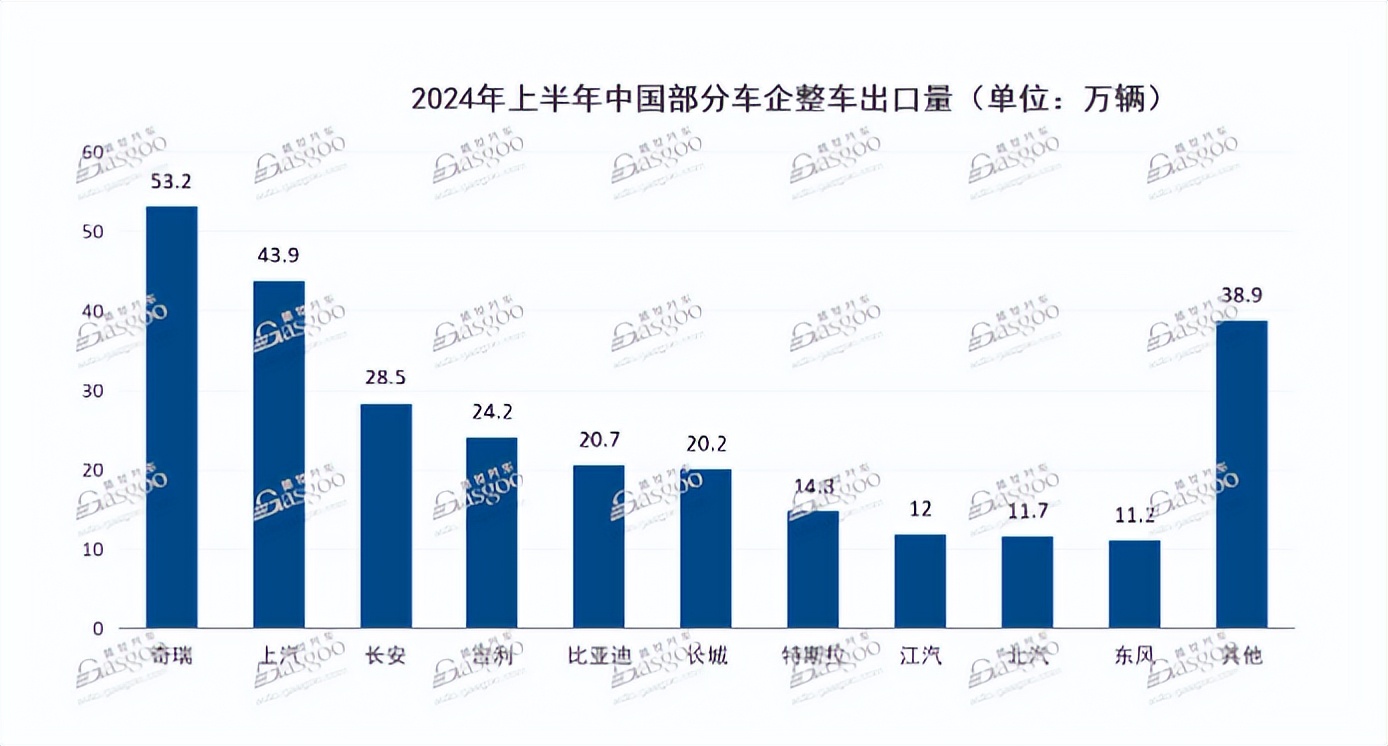

Image source: Gasgoo

In the first half of the year, Chery Automobile achieved 532,000 complete vehicle exports with a growth rate of 10.14%, surpassing SAIC and ranking first in China's complete vehicle exports.

At the same time, the achievements of accelerating overseas market expansion were also reflected in its performance. In 2024, Chery Group entered the Fortune Global 500 list for the first time, ranking 385th; the group's overseas users have exceeded 4.1 million, making it the first Chinese brand with cumulative overseas sales exceeding 4 million, with a cumulative global user base exceeding 14.9 million.

Chery Automobile's journey overseas is still ongoing. The latest official data shows that Chery Automobile's cumulative export sales from January to October were 941,275 units, a year-on-year increase of 23.8%, and it is expected that exports will exceed 1 million units in November. Among them, October exports set a new single-month record, reaching 111,922 units.

The next hit is coming

Of course, looking to the future, Chery Automobile still needs new "chips."

BYD, which is more favored by the market, will inherently have more initiative and internal growth drivers in the future from a technological perspective.

To bridge this gap, in addition to simultaneously increasing investment in the new energy sector, Chery Automobile's choice to embark on intelligent driving is in line with market trends and the times.

As early as the end of 2020, Chery Automobile signed a cooperation agreement with Huawei and successfully launched the iCar S7 and iCar R7 in November last year and September this year. Both models are positioned in the pure electric smart car market with a price range of 200,000 to 400,000 yuan.

In October this year, sales of the iCar S7 were 7,397 units, which is not prominent among the entire Hongmeng Intelligent Drive series, as sales of the AITO M9 reached 16,004 units during the same period.

However, the iCar R7 received over 30,000 orders within 33 days of its launch, with over 1,500 orders placed on November 9th and 10th alone, performing on par with AITO.

Meanwhile, the long-term late-mover advantage of the iCar series cannot be ignored.

The reason is that from AITO, iCar, BJEV's Enjoy, JAC's Zunjie, Huawei's Hongmeng Intelligent Drive has initially established a relatively complete product system in the high-end series. However, in terms of market dimensions, they are currently focused on the increasingly competitive domestic market. The core differentiated value of Chery Automobile still lies in its overseas network.

With one hand in a differentiated market and the other in differentiated technology, the export story of "Chery + Huawei" is not impossible.

Compared to AITO Automobile, which has accelerated its volume since 2023, Thalys' share price has multiplied several times, with its total market value recently reaching a new high of over 210 billion yuan; meanwhile, with the timely arrival of the million-yuan luxury car Zunjie, JAC Motors' share price has also hit a new high, with its market value successfully exceeding 100 billion yuan.

Combined with Chery Automobile's performance in overseas markets, it is reasonable to speculate that if the main body of Chery Automobile is truly about to go public, it will be an investment target combining "SAIC + Thalys."

Acceleration of Chery's IPO process

Starting as a village factory in Anhui over 20 years ago, Chery Automobile has grown into the largest domestic independent brand automobile manufacturing enterprise integrating the research, development, production, and sales of complete automobiles, powertrains, and key components. It is also the largest domestic passenger vehicle exporter, boasting a legendary journey.

However, as of now, Chery Automobile has not yet gone public and is one of the few leading domestic automobile manufacturers that have not done so.

In the asset-heavy automotive manufacturing industry, accelerated development necessitates continuous and substantial resource investment. Just as Chery Automobile has been accelerating its overseas market expansion in recent years, it has also been eager to accelerate its IPO plans.

Previously, Yin Tongyue, Chairman of Chery Holding Group, expressed the desire to go public as soon as conditions permit and clearly stated at the "Yao Guang 2025 Chery Technology DAY" conference that "we hope to complete the IPO plan by 2025."

However, in the past, investments in the automotive sector have tended to favor the new energy sector. Meanwhile, Chery Group has not been able to launch an independent new energy brand that withstands market scrutiny, and the company's equity structure is relatively complex, hindering its IPO process.

Now, a turning point has arrived. Chery Automobile's performance in exports, intelligent driving, and other areas has given investors new expectations.

In September this year, Chery Automobile "set three historical highs in its 27-year history" – monthly sales exceeded 240,000 units, monthly exports exceeded 100,000 units, and monthly new energy vehicle sales exceeded 50,000 units. Exports of automobiles continued to hit a new high in October, exceeding 110,000 units.

Perhaps based on its strong internal drive, Bloomberg recently reported that Chery Holding Group is considering an IPO for its automotive division, Chery Automobile, in Hong Kong, with a business valuation of approximately $7.1 billion.

Although it may not be listed on the A-share market, it does not mean there are no investment options. Bertel, Ruihu Mould, and Efort, three listed enterprises in the automotive supply chain, were actually incubated by Chery Group.

According to Chery Group's ambitions, at least 10 such enterprises under its umbrella will be able to go public by 2025. Another massive wealth creation movement is about to unfold under Chery's wings.

Source: Pinecone Finance