Can you bear selling a car and still losing money?

![]() 11/14 2024

11/14 2024

![]() 605

605

Introduction

Introduction

As the automotive industry accelerates its transformation, are dealers' good days over, both domestically and internationally?

So far, numerous events have indicated that regardless of nationality, the automotive dealers are having a tough time after the industry's turmoil over the past two years.

In China, Zhongsheng Auto, a leading auto dealer, reported a gross margin of -1.99 billion yuan for new car sales in the first half of 2024, prompting international rating agencies Moody's and Fitch to downgrade their rating outlooks from 'Stable' to 'Negative'. Internationally, a German luxury brand dealer, claiming to have not ordered cars for half a year, sent a letter directly to the senior management of the automaker, making a big deal out of the automaker's subsidy to its Chinese dealers.

Synthesizing these two scenarios leads to an awkward conclusion: auto dealers either have no money to order cars or lose money by selling them. Either way, it's a difficult situation.

Although reluctant to accept it, the winter for auto dealers has quietly arrived.

When 'Sustainability' is No Longer Sustainable

Sustainability has always been the fifth service type introduced by many luxury brand dealers beyond the traditional '4S' concepts of Sales, Spareparts, Service, and Survey. However, due to this, the issue of capital occupation has gradually become a burden for large dealers in an increasingly competitive market.

For example, a notice posted on the door of a recently closed luxury brand store in Beijing announced that due to the overall economic environment, the store is currently facing severe financial pressure. To better protect the interests of customers and employees, the group is actively seeking capital injection or other group trusteeship solutions to address the current difficulties. After the termination of brand authorization, the company has suspended new car and after-sales related businesses. To smoothly and quickly achieve capital injection or trusteeship, the company has summarized relevant data and customer rights in accordance with corresponding procedures.

And when you think this is just an isolated case, flipping through the financial reports of domestic dealer groups, you will surely find that capital issues have been plaguing each and every one of them for a long time.

Take Zhongsheng Auto mentioned earlier as an example. According to its semi-annual financial report, in the first half of 2024, Zhongsheng Group sold a total of 232,000 new cars, a year-on-year increase of 3.9%, but the gross margin for new car sales was -1.99 billion yuan, and net profit was halved by 47.5%. This means that although Zhongsheng Group sold over 230,000 new cars in the first half of the year, it actually lost nearly 2 billion yuan. On average, each new car sold resulted in a loss of over 8,500 yuan, indicating a severe 'price inversion' in the automotive industry.

In view of this, international rating agencies Moody's and Fitch successively downgraded their rating outlooks for Zhongsheng Auto from 'Stable' to 'Negative'.

These agencies also stated that with intensifying price competition in the Chinese automotive market, Zhongsheng Auto's new car sales profit margin is under pressure, and the company's profit outlook and deleveraging process over the next 12 months face challenges.

Affected by this news, Zhongsheng Auto's share price on the secondary market continued to decline, with its market value evaporating by nearly 150 billion Hong Kong dollars from its peak in July 2021.

However, the 'price inversion' in the automotive industry is not an isolated case. According to the 'Survey Report on Auto Dealer Investors' released by the China Automobile Dealers Association, the proportion of auto dealers reporting losses in the first half of 2024 reached 50.8%, with the loss surface significantly expanding compared to the previous year. Notably, new car sales incurred severe losses, with new car gross profit contributions being negative.

Even more serious than losing money on new car sales is the increasing amount of money lost. Data from the China Automobile Dealers Association shows that as of August this year, the highest inversion rate of auto dealers' purchase and sales data reached -22.8%, an increase of 10.7 percentage points compared to the same period last year. In addition, the total gross profit of the new car business has significantly decreased compared to the first half of 2023, with an average loss per store reaching 1.78 million yuan.

The Moon is Not Rounder Abroad

Of course, with the domestic auto dealership market in a downturn, do you think foreign auto dealerships are faring any better? As mentioned at the beginning of the article, compared to domestic dealers losing money on car sales, some foreign dealers simply don't have the money to order cars.

In early November, an insider revealed that a foreign Audi dealer sent a letter in German directly to the Audi board. The writer claimed to have not ordered cars for half a year, unable to redeem the vehicle registration certificate pledged at the bank due to lack of funds, and the bank no longer providing loans after mortgaging real estate. As a result, the dealer could not sleep at night.

There is nothing new under the sun, and a similar scenario occurred half a year ago. Due to declining sales and severe inventory issues, Porsche China dealers 'forced' the German headquarters in May, demanding executive changes and subsidies.

In terms of purpose, there is no difference between Porsche China dealers 'forcing' the headquarters and dealers writing to Audi headquarters; both just want to survive. However, it is evident that compared to Porsche dealers, dealers representing traditional luxury brands face a more severe survival situation. Without revealing too much information, the letter to Audi was sent to obtain more subsidies and ease financial pressure. Simply looking at the group's total sales trend can also provide some insights into its development.

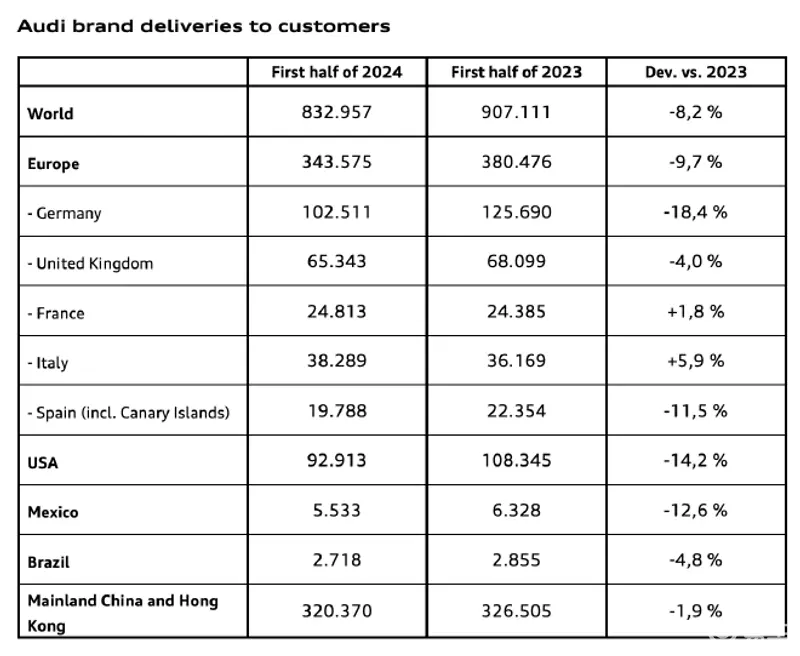

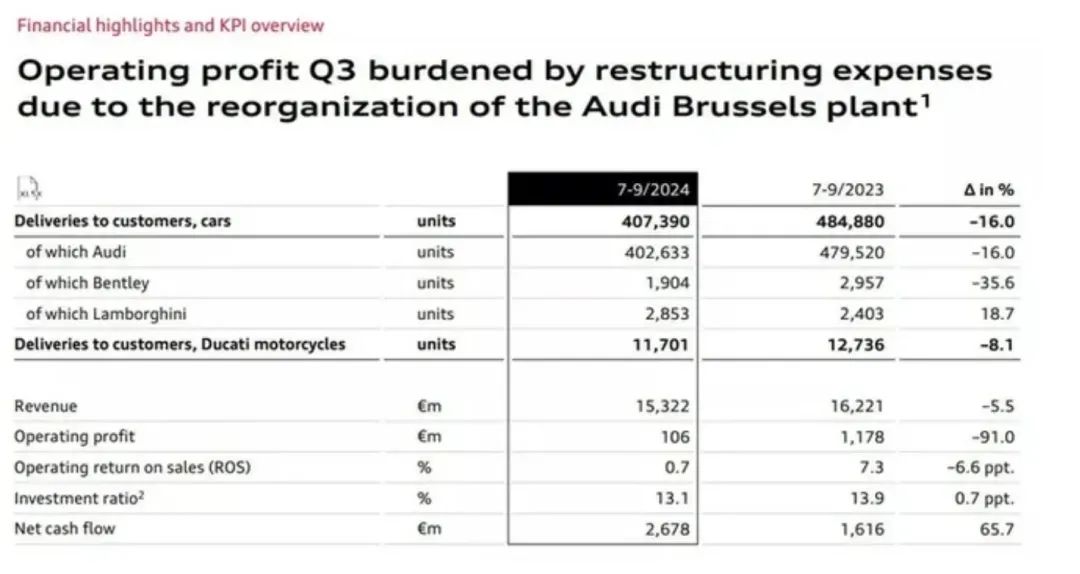

The first-half financial report shows that in terms of vehicle deliveries, the Audi Group delivered a total of 843,991 Audi and Bentley brand vehicles in the first half of the year, a decrease of 8.2% compared to the same period last year. Audi experienced sales declines in its major sales markets. In particular, sales in the European market declined by 10% (with a decline of 18.4% in Germany alone).

Furthermore, all information in the third-quarter financial report released on November 6 again pointed to the severe impact on Audi abroad. Not only did sales in the European market continue to decline, but Audi's sales in the U.S. market also declined by 16.8% year-on-year, with only 139,665 new cars sold.

Moreover, according to the German magazine 'Manager Magazin', Audi is seeking to reduce its workforce in the medium term by cutting jobs other than production. Layoffs will focus on what the company calls indirect positions, such as in the development field, where over 2,000 jobs may be cut. The company stated that its goal is to reduce the workforce by about 15%. In Germany alone, this will affect 4,500 indirect jobs.

Losing money, so what's next?

In summary, the plight of auto dealers both domestically and internationally is obvious. Losing money is not terrible; the key is to understand why and how to survive this difficult period and recoup the losses.

First, let's look at the causes, which can be attributed to three aspects: automakers, dealers, and the overall environment.

From the perspective of automakers, in such an unsatisfactory overall environment, on a smaller scale, due to the impact of price wars, most automakers' pricing in the first half of the year was somewhat chaotic. This not only weakened brand power to a certain extent but also disrupted dealers' sales rhythm. On a larger scale, severe market challenges, fierce competition, and unstable supply of components are macro factors that affect their operations.

Secondly, for dealers themselves, on the one hand, the shift in the market has turned the once advantageous large dealership system into a burden. On the other hand, the negative impact of their naturally weak position in cooperation with automakers is also expanding. In addition, dealers' own lack of transformation momentum makes it difficult for them to adapt to the current market.

In an era when auto dealers could easily make money, the automotive market experienced explosive growth. The more stores, the higher the market share and the more profits.

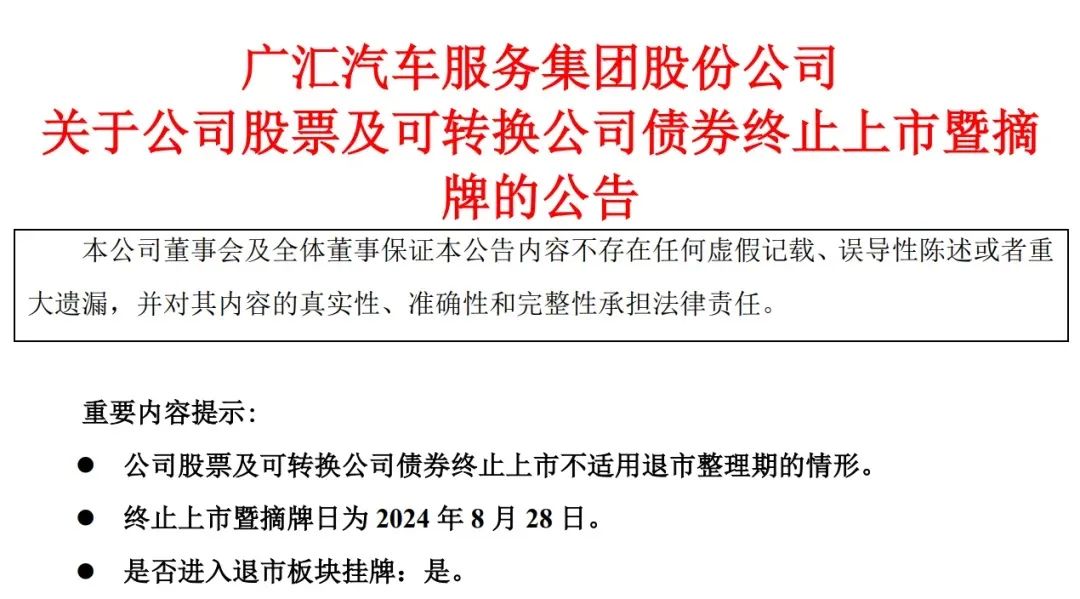

However, as the market intensifies and price wars escalate, distorted 'price inversions' have become the norm. Leveraging financial leverage to accelerate group expansion undoubtedly accelerates corporate destruction. In a downturn, once dealers have low 'blood-making' capacity and insufficient solvency, they are highly susceptible to bankruptcy or capital chain ruptures. Previously bankrupt Pangda Group and delisted Guanghui Auto both fell into this trap.

Meanwhile, in discussions with automakers, dealers are naturally in a weak position and have difficulty participating in and deciding on vehicle pricing, only having the right to adjust prices. On the other hand, facing the pressure of targets imposed by automakers, dealers have less room for maneuver, which also significantly affects their capital chain turnover.

Moreover, turning around an elephant is not only difficult but also time-consuming. After changes in the external environment, dealers may also make mistakes in market forecasting and strategic planning, such as being too slow in adjusting to new energy businesses or lacking momentum in transformation.

Compared to the reasons related to automakers and dealers, the impact of the external environment is undoubtedly significant.

Currently, auto sales have shifted from an incremental market to a stock market, with severe competition and price wars enveloping everyone in the market. Price-for-volume strategies inevitably lead to purchase-sales inversions. Meanwhile, the emergence of new energy vehicles is also impacting the existing market. Dealers who fail to adjust their strategies in a timely manner will face increasingly critical situations.

It is worth noting that the rise of domestic brands cannot be ignored. Combining sales figures from various brands, in the first three quarters of 2024, sales of the 'global top three' automotive brands Volkswagen, Toyota, and Stellantis all showed negative growth, while sales of the 'Chinese top three' automotive brands BYD, Chery, and Geely increased significantly.

In other words, with domestic brands going global, the established markets of German, American, and Japanese brands in Europe and the United States will undoubtedly face significant challenges. Although trade protection strategies represented by tariffs may temporarily slow down the pace of domestic brands, it is unlikely to curb their progress.

There are many reasons why dealers are having a hard time, but essentially, it is because the traditional dealership model is outdated and difficult to match the current market sales model. This is no different from the difficulties faced by traditional OEMs. In this context, change is the ultimate way out.

Reform should be accomplished during periods of high growth, but precisely during these periods, there is no motivation for reform. Nowadays, the entire industry is facing the same dilemma. Those who can make decisive changes and actively transform during the trough will survive the winter.

Therefore, for now, optimizing debt levels and exploring new energy vehicle sales may become two viable paths for traditional dealers.

For large dealer groups, the era when the higher the market share, the more profitable it was, is over. Optimizing industrial structure, eliminating non-performing assets, and enhancing 'blood-making' capability are crucial.

On the other hand, with the market share of new energy vehicles rising, exploring new energy vehicle sales and collaborating with new forces can also send a positive signal to the outside world and enhance market confidence.

Taking Zhongsheng Group as an example, on November 8, a blogger posted on Weibo that Zhongsheng Group would fully embrace new energy by obtaining authorizations for 50 (or some say 48) Huawei Smart Selection cars. Upon the news, Zhongsheng Auto's share price surged by over 30%. On November 10, JPMorgan upgraded its rating of Zhongsheng Group Holdings Limited to Neutral.

It is evident that keeping up with the times and actively embracing new trends can indeed bring considerable comfort during the trough of winter.