Cidizhi Driving IPO: The first automatic mining truck stock with a 40% discount?

![]() 11/14 2024

11/14 2024

![]() 667

667

On November 7, 2024, Cidizhi Driving submitted its prospectus to the Hong Kong Stock Exchange for the first time.

Founded in 2017, Cidizhi Driving is currently a leading provider of autonomous driving technology for commercial vehicles in China. Its business primarily consists of autonomous driving, V2X, and high-performance sensing solutions.

Cidizhi Driving may be an unfamiliar name, but one of its founders, Professor Li Zexiang, is renowned in the industry. Known as the "godfather of DJI" for his role in founding DJI (a drone company sanctioned by the United States), he is also one of the founders of GOGO, a listed A-share company.

This year, Black Sesame, Wenyuan, Horizon Robotics, and others have successively entered the capital market, with Pony.ai, Momenta, and others also gearing up. This can be considered the first year of "cash-in" for domestic intelligent and autonomous driving industry capital.

Since Cidizhi Driving does not meet the regular listing requirements of the Hong Kong Stock Exchange, it follows the example of Black Sesame and leverages the Hong Kong Stock Exchange's "Specialized Technology Company Listing Regime" (abbreviated as the "18C Charter") as a springboard to seek an IPO. If successfully listed, it will unlock the title of "the first stock of intelligent mining trucks."

In terms of performance, Cidizhi Driving is just starting out, but in the fiercely competitive field of intelligent driving, its prospects may not be as rosy.

01, Intelligent Driving Emerging from the Experimental Field

Autonomous driving (vehicles) involve a wide range of fields. In principle, any vehicle that requires human operation is the focus of this concept.

Compared to passenger vehicles, commercial vehicles have more targeted application scenarios, but this does not necessarily mean higher technical difficulty. Many end-to-end mechanized tasks are easier to program algorithmically.

Autonomous driving commercial vehicles are typically classified into closed environments, urban roads, and intercity roads based on the openness of their operating scenarios. Cidizhi is currently the only company in China that has commercialized "self-driving" solutions in all three scenarios.

Based on Professor Li's expertise in vehicle-to-everything (V2X) related technologies, Cidizhi was initially established to assist the national and local (Hunan) governments in building "smart transportation." Its classic patent is "V2X + Bus Signal Priority." Currently, the company's related products and solutions have been implemented in five of the seven national-level vehicle network pilot zones.

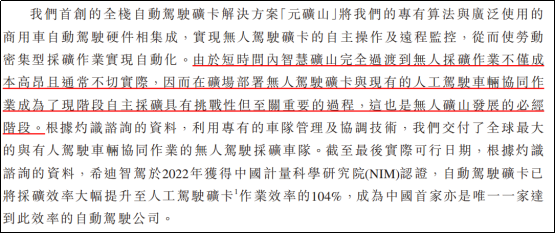

In the process of applying and iterating V2X technology, due to environmental factors, Cidizhi enriched its autonomous driving technology in closed environments in the "experimental field." Subsequently, it partnered with OEM manufacturers such as Dongfeng Liuzhou Motor to begin mass production and deployment of commercial intelligent driving solutions on mining trucks, gradually transitioning to intelligent logistics vehicles for intercity operations. However, as driverless technology in open environments has not been fully liberalized, Cidizhi's primary revenue from autonomous driving still comes from operations in closed environments, specifically in metal mines (full-stack autonomous mining truck solutions).

After experiencing a surge in 2022, as of the first half of 2024, Cidizhi had delivered a cumulative total of 56 autonomous mining trucks to domestic mines, working alongside approximately 500 manned trucks, making it the world's largest mixed-operation mining fleet. From an industry perspective, Cidizhi ranks second in domestic commercial autonomous driving solutions (8.2%, with the top spot at 12.9%) and first in the domestic autonomous mining field (36.5%, with the second spot at 34.3%) - this is also the reason why it is poised to become "the first stock of intelligent mining trucks."

In addition, leveraging its technological reuse in intelligent driving, Cidizhi further expanded its business scope to include the "Train Autonomous Perception System" (TAPS) and "Vehicle-Mounted Intelligent Safety Management Solutions" in 2022. Its TPAS is currently the only product in China that achieves independent safety perception.

02, Autonomous Mining Trucks are Good, but There are Some Awkward Aspects

Whether for passenger or commercial vehicles, the primary goal of autonomous driving is to "remove the human factor," with subsequent details serving as supplementary requirements.

On the commercial side, there is a greater emphasis on economy. The 104% efficiency of Cidizhi's autonomous mining trucks surpasses human "limits," significantly enhancing safety in mining scenarios, which aligns with its vision.

However, despite their benefits, there are two passages in the prospectus that highlight the awkward aspects of autonomous mining trucks from both positive and negative perspectives.

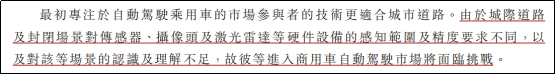

The first passage generally argues that applying autonomous driving technology from passenger vehicles to commercial scenarios is "more difficult."

It's important to note that while commercial scenarios are a branch of autonomous driving, the "uncertainty" faced in passenger scenarios is actually much higher than in commercial scenarios, especially when compared to closed and semi-closed environments.

From another perspective, if commercial solutions were indeed more difficult, why were they the first to be piloted and opened up?

Conversely, focusing on commercial applications can be considered a niche within autonomous driving. Mining trucks are a product of "relatively deterministic" scenarios, and generalizing their technology is not easy, especially when there is already significant competition.

The second passage discusses the large-scale application of mining trucks, which is honest but not exhaustive.

Heavy-duty trucks are capital-intensive assets. To reduce labor costs and improve efficiency by 4%, large-scale replacement of equipment would essentially involve paying double sunk costs, which is the first challenge in implementing large-scale updates in the existing market.

Secondly, the service life of heavy-duty trucks is generally over 10 years, and the mining life of small mines is also around 10 years. Established "small players" in the existing market generally have no update needs because it involves more than just replacing vehicles; it also requires a significant amount of infrastructure. Small-scale operations are inherently less competitive.

In other words, the market for mining trucks will inevitably see a reduction in replacements. Its growth potential is primarily targeted at equipment updates in medium and large mines and the development of new mines. However, Cidizhi is not the only player in this field... otherwise, its gross margin would not have steadily declined (from 22.5% in the small-scale period of 2021 to 16.1% in the first half of 2024), especially in 2022 when it dipped to -25.1% due to benchmark projects...

03, "Well-funded" Small-scale Financing

Since its establishment, Cidizhi Driving has conducted eight rounds of financing, raising a cumulative total of 1.5 billion yuan. Investors include Sequoia Capital, Baidu, Lenovo, and others.

However, the final round of financing in late January of this year had ulterior motives: raising 24 million yuan despite having over 250 million yuan in cash on hand. Not only was the financing amount significantly lower than the previous rounds of "real borrowing" in the hundreds of millions, but it also increased the company's post-investment valuation from 8.27 billion yuan to 9.024 billion yuan.

The sole purpose was not to raise funds but to prepare for the IPO.

The "18C Charter" stipulates that the valuation of specialized technology companies that have not yet achieved commercialization (with revenue less than HK$250 million) must not be less than HK$10 billion. Coincidentally, these 24 million yuan brought Cidizhi's post-investment valuation closer to this threshold; this may be due to pressure from the upcoming 2026 valuation adjustment period.

However, after the commercialization of autonomous mining trucks, Cidizhi received a large number of orders, and its performance also increased significantly. Revenue in the first half of the year surged 4.7 times year-on-year to 258 million yuan, with orders backlogged as of the end of September 2024 totaling approximately 500 million yuan. After crossing the commercialization threshold of the "18C Charter," the valuation requirement dropped to HK$6 billion (equivalent to a 40% discount on the threshold). This previous maneuver could become a long-term "highlight" for Cidizhi.

Conclusion

Although Cidizhi Driving meets the listing requirements, it is still in a loss-making state.

Compared to other intelligent driving companies that continue to increase R&D investment, Cidizhi's R&D expenditure in the first half of the year actually decreased by 17%, with an absolute amount of only 35 million yuan.

Regarding its intelligent driving solutions, the application scenarios are limited, and its generalization ability and competitiveness are insufficient, placing it at best in the third or fourth tier.

Most of the autonomous driving companies that went public this year experienced a high opening and low closing. The reduction in the valuation threshold from HK$10 billion to HK$6 billion is a boon for interested investors.

· END ·