2024, the year the automotive industry wants to quickly turn the page

![]() 11/15 2024

11/15 2024

![]() 676

676

The pessimistic sentiment is not just wild speculation; numerous data reports have confirmed the downturn in the automotive industry.

If asked which industries have suffered the most this year?

The automotive industry is certainly one of them. After all, since the beginning of the year, pessimistic sentiment has been spreading throughout the entire automotive industry. However, this pessimistic sentiment is not just wild speculation; numerous data reports have confirmed the downturn in the automotive industry.

From January to October 2024, domestic sales of traditional fuel passenger vehicles reached 9.046 million units, a decrease of 2.332 million units from the same period last year, representing a year-on-year decline of 20.5%;

From January to October this year, the combined sales of the top three automotive enterprise groups ranked by car sales amounted to 8.749 million units, representing a year-on-year decline of 1.4%;

Several traditional automakers primarily selling fuel vehicles have released their third-quarter reports for 2024. Amid the shrinking fuel vehicle market and fierce price wars, the revenues and profits of many traditional automakers have declined, with some experiencing profit declines exceeding 90%;

……

Moreover, the 'price war' has continued unabated from last year to the end of this year, showing no signs of stopping.

Data shows that due to fierce competition and the subsequent 'price war' in recent years, the weighted average official guidance price for domestic pure electric vehicle sales has declined. In terms of transaction prices, insiders have stated that if calculated based on market discounts and average new car transaction prices in January 2023, the overall automotive market retail losses amounted to 138 billion yuan from January to August this year.

According to data from the Passenger Car Association, from January to September this year, the number of discounted passenger vehicles nationwide has reached 195 models, exceeding the 150 models in 2023 and the 95 models in 2022. The profit margins of multiple models continue to be compressed.

There is no doubt that the Chinese automotive market is undergoing a reshuffle. How to break through in a 'convoluted' market and achieve brand upgrading and high-quality development under the pressure of short-term goals has become a difficult problem facing every automaker.

Huawei and Xiaomi are in full swing

Lei Jun has become the hottest figure in the automotive circle this year, without a doubt.

In addition to inspiring CEOs of major automotive brands to imitate him and live stream this year, promoting and selling cars, Xiaomi SU7, in Lei Jun's own words, has been 'more successful than expected.'

Lei Jun candidly stated: 'From the launch of Xiaomi SU7 to today, it only took 230 days to produce 100,000 vehicles. As a newcomer to the automotive industry, this speed is already remarkable.' He also announced that a ceremony would be held shortly to celebrate the production of the 100,000th vehicle.

According to data released by Xiaomi Auto's official Weibo account on November 1, Xiaomi SU7 deliveries exceeded 20,000 units in October, marking the first time monthly deliveries surpassed 20,000 units. It is expected that the annual delivery target of 100,000 units will be achieved ahead of schedule this month.

However, in Xiaomi's second-quarter earnings report, compared to the record-breaking single-quarter revenue of 88.9 billion yuan, the automotive business-related data appearing in the financial report for the first time attracted more attention.

In the second quarter, Xiaomi's innovative business revenue, including smart electric vehicles, amounted to 6.4 billion yuan, of which smart electric vehicle revenue was 6.2 billion yuan. A total of 27,307 Xiaomi SU7 series vehicles were delivered in a single quarter, with an average selling price (ASP) of 228,600 yuan.

Regarding when profitability can be achieved, despite various doubts in the industry, Xiaomi believes that the narrowing of net losses to 1.8 billion yuan fully demonstrates Xiaomi Auto's strong product competitiveness, cost control capabilities, and robust delivery capabilities. Xiaomi Auto remains highly confident in securing new orders, delivering new orders, and continuously improving gross profit margins in the future.

Although this is also challenging, Tesla took 17 years to achieve profitability. Li Auto's first model was launched in 2019 and achieved annual profitability for the first time in 2023, despite delivering nearly 400,000 new vehicles. XPeng, NIO, and ZEEKR's annual reports indicate that they are still incurring losses.

Compared to Lei Jun's high profile, Yu Chengdong chose to 'make a fortune quietly' this year.

On November 9, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Intelligent Automobile Solution BU, posted on Weibo: 'It has been one year since the official release of Hongmeng Zhixing. Over the past year, we have delivered over 500,000 vehicles in total and achieved the double championship of new force sales and sales of models priced above 500,000 yuan.'

Yu Chengdong also firmly believes that by adhering to a user experience-centric approach and establishing rigorous quality standards far exceeding industry standards, he thanks partners including Thalys, Chery, BAIC, JAC, and others.

Data shows that in October this year, Hongmeng Zhixing delivered 41,643 new vehicles across its entire lineup, maintaining the top spot for average transaction prices in the high-end market for six consecutive months.

Among them, the Wenjie M9 delivered 16,004 units in October, with cumulative orders exceeding 160,000 units in the 10 months since its launch. The Wenjie M7 series delivered 15,836 units in October, with over 20,000 large orders in October and over 170,000 Wenjie New M7 deliveries in 2024. Since its launch, the Xiangjie S9 has maintained the top spot for sales of pure electric sedans priced above 400,000 yuan for eight consecutive weeks. The Zhijie R7 delivered 4,730 units in October, with large orders exceeding 30,000 units within 33 days of launch and over 10,000 large orders during the National Day holiday.

It is worth mentioning that under Huawei's deep empowerment, Thalys has achieved rapid turnaround in performance in recent years.

Thalys' latest financial report shows that the company achieved operating revenue of 65.04 billion yuan and net profit of 1.625 billion yuan in the first half of this year.

In contrast, Thalys' first-half performance was in net loss, with operating revenues not exceeding 13 billion yuan, in the five years from 2019 to 2023. This year, Thalys finally achieved a turnaround in its first-half performance.

It can be said that as two giants in China's technology sector, Huawei and Xiaomi are increasingly competing fiercely across multiple domains and escalating their rivalry. Besides engaging in intellectual and strategic battles in the mobile phone market, they are now locked in intense competition in the automotive market.

The popularity of Huawei and Xiaomi also reflects changes in the automotive market's logic of vehicle manufacturing. These technology giants now have absolute discourse power in the era of 'software-defined vehicles.' Meanwhile, the prosperity of the new energy vehicle market has also given birth to many new approaches.

How can joint venture brands protect themselves

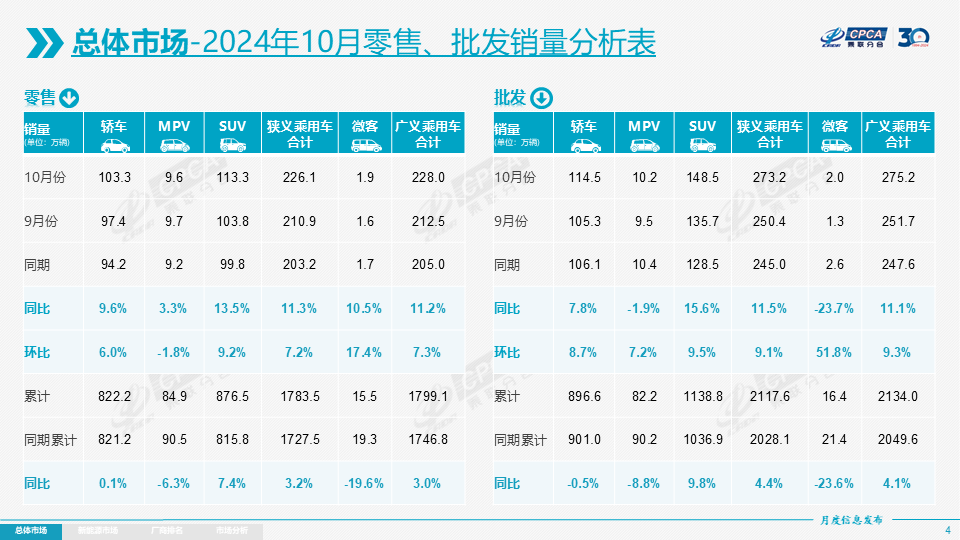

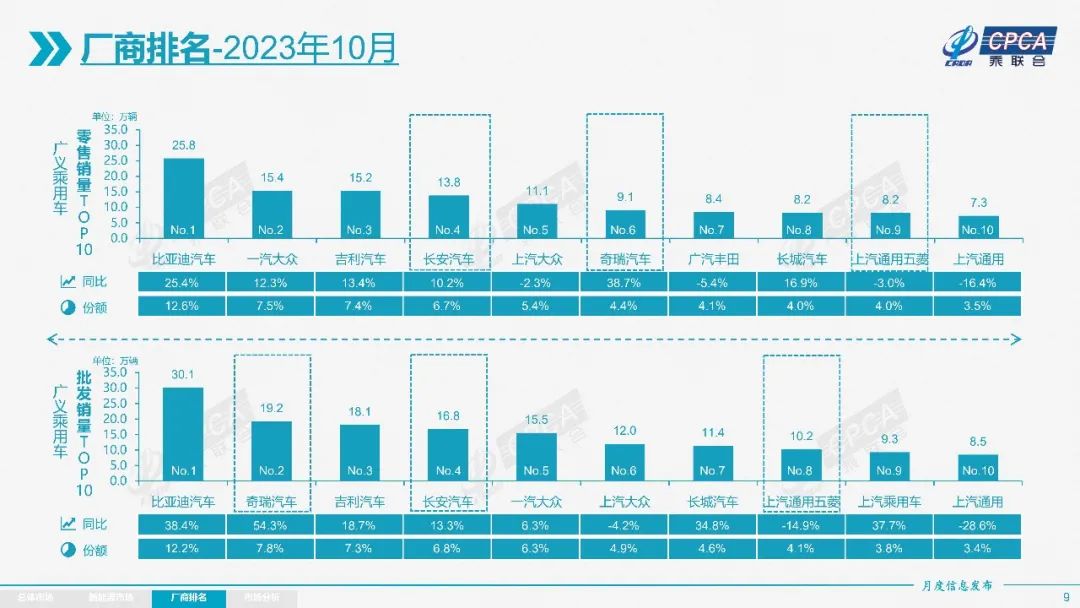

According to the latest data released by the Passenger Car Association, mainstream joint venture brand passenger vehicle retail sales declined by 17% year-on-year to 570,000 units in October. Among them, the German brand's market retail share was 15.8%, a year-on-year decrease of 2.3 percentage points; the Japanese brand's market retail share was 12.9%, a year-on-year decrease of 4.8 percentage points; and the American brand's market retail share reached 4%, a year-on-year decrease of 2.1 percentage points.

The contraction of the joint venture brand sales market has also brought significant pressure on the profitability of many automotive dealers.

According to data from the latest 'Auto Dealer Investor Survey Report' released by the China Automobile Dealers Association, the proportion of joint venture brand dealers incurring losses climbed to 27.7% among nearly 50 major automotive dealer groups nationwide in the first half of this year. Meanwhile, the proportion of dealers achieving profitability plummeted to just 11.5%.

This stark data contrast fully reflects the market challenges currently faced by joint venture brands.

Taking Volkswagen as an example, in the third quarter of this year, Volkswagen's sales in the Chinese market decreased by 160,000 units year-on-year to 638,000 units, representing a decrease of 20.1%. In the first three quarters, Volkswagen's sales in the Chinese market decreased by 247,000 units year-on-year to 1.903 million units, representing a decrease of 11.5%. Besides the Chinese market, Volkswagen's sales increased by approximately 4% in the North American market, 16% in the South American market, and decreased by approximately 1% in the Western European market in the first three quarters.

From January to September this year, SAIC Volkswagen's cumulative sales amounted to 772,000 units, representing a year-on-year decrease of 7.2%. The year-on-year decrease in the same period last year was 13.5%. Compared to the first three quarters of 2018, SAIC Volkswagen's sales this year have halved. In the first half of the year, SAIC Volkswagen's revenue was 65.01 billion yuan, half of what it was a decade ago; its net profit attributable to shareholders of the parent company was 860 million yuan, just 5.8% of what it was a decade ago.

Almost no one anticipated that joint venture automotive brands would fall into their current predicament so quickly.

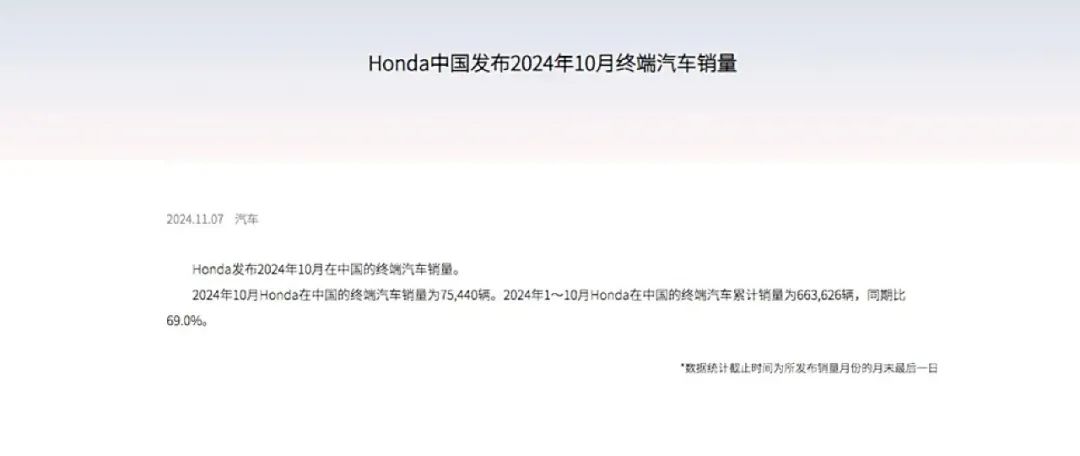

According to data released by Honda, its sales in the Chinese market amounted to 75,440 units in October, with cumulative sales of 663,626 units this year, representing a year-on-year decrease of 31.0%.

The continuous decline in sales has caused Honda's two joint ventures in China, Dongfeng Honda and Guangzhou Automobile Honda, to 'go gray overnight.' To address this difficult situation, both companies have taken measures to reduce production capacity and lay off employees.

In July, Honda China announced that the second production line at Dongfeng Honda's Wuhan plant would cease operations in November, and Guangzhou Automobile Honda planned to close the fourth production line at its Guangzhou plant in October, reducing production capacity by nearly 300,000 units. In September, it was reported that Dongfeng Honda announced layoffs of 2,000 employees, while Guangzhou Automobile Honda had already initiated large-scale layoffs in May.

Honda is not the only one facing difficulties; Toyota, Nissan, and other Japanese brands have also experienced consecutive sales declines in China and encountered challenges in their electrification transformation.

Data from the Passenger Car Association shows that from 2021 to 2023, the market share of Japanese automotive brands in China continued to decline, at 22.6%, 20%, and 17% respectively. In the first half of this year, it had already declined to 14.9%. If Japanese brands fail to adapt to changes in the Chinese market and launch products that meet the needs of Chinese consumers, they may face the risk of withdrawal from the market.

Obviously, after dominating the market for 40 years, joint venture brands are now facing significant challenges in China.

They, who once conquered China with ease, must now seriously confront a new cycle. Just as some joint venture brands have already started cooperating with some Chinese industrial chain enterprises to develop new products from the perspective of China's industrial chain and technology, aiming to win back the Chinese market.

Opposing involution, but unsuccessful?

If asked why joint venture brands are facing such a difficult time,

The main sales products of joint venture manufacturers such as SAIC Volkswagen, FAW-Volkswagen, Guangzhou Automobile Honda, and Guangzhou Automobile Toyota are highly concentrated in the price range of 80,000 to 100,000 yuan under the pressure of price wars, leaving almost no profit margins.

It's not just joint venture brands. According to data recently released by the Passenger Car Association, domestic automotive industry revenue amounted to 7.3593 trillion yuan in the first three quarters of this year, representing a slight year-on-year increase of 3%; profits amounted to 336 billion yuan, representing a year-on-year decrease of 1.2%.

When will the profit decline caused by the intense 'price war' in the automotive market end? This has also become a focus of industry attention.

Since the beginning of this year, the automotive market's 'price war' has intensified.

The 'Report' shows that due to fierce competition and the subsequent 'price war' in recent years, the weighted average official guidance price for domestic pure electric vehicle sales has declined. In terms of transaction prices, insiders have stated that if calculated based on market discounts and average new car transaction prices in January 2023, the overall automotive market retail losses amounted to 138 billion yuan from January to August this year.

Therefore, despite the increase in sales, many automakers are actually incurring losses behind significant price reductions. Many automakers' performance reports have mentioned the impact of price wars on them. The impact of price wars is not limited to this; it has also led to price chaos in the new car market, the near-collapse of the used car market, extended payment cycles for suppliers by automakers, and an impact on the entire industrial chain.

Zeng Qinghong, Chairman of GAC Group, emphasized that although price competition is a natural result of market supply and demand relationships and market laws, rationality and bottom lines must be maintained. Excessive concessions are unsustainable. Enterprises that are not profitable cannot survive, which will adversely affect taxation, employment, and the entire industrial chain.

According to the latest financial report released by GAC Group, the company's revenue and net profit both declined, with price wars being one of the main reasons for the profit decline.

According to data from the National Bureau of Statistics, the profit margins of China's automotive industry have been declining year by year over the past three years, at 6.1%, 5.7%, and 5% respectively.

Relevant responsible persons from the China Association of Automobile Manufacturers pointed out that although the revenue of China's automotive industry is increasing, profits are decreasing. Price wars have led automakers to face challenges in declining profitability, exacerbating the survival difficulties of suppliers. Amidst severe profit margin overdrafts, layoffs have become the primary means of cost reduction this year.

However, from the current perspective, the involution battle in China's automotive industry is unlikely to stop in the short term. However, the involution in the automotive industry is not simply low-level competition but a necessary stage of the transition between old and new driving forces and industrial transformation.

Therefore, facing intensified involution in the domestic market, overseas markets have become new opportunities for Chinese brands this year.

It must be mentioned that although Chinese automakers have made significant progress in 'going global,' changing external conditions have increased the difficulty of further development. Therefore, the involution pressure faced by automakers is primarily in the domestic market, and there are currently no signs of relief.

As 2024 draws to a close in less than 40 days, China's new energy vehicles officially reached 10 million units in 2024.

There is no doubt that the automotive industry is one of the hallmarks of manufacturing strength. It took nearly a decade for China's new energy vehicles to grow from the 'Ten Cities and Thousand Vehicles' initiative in 2009 to annual production and sales exceeding one million units in 2018; another four years to exceed five million units in 2022; and just about two years to surpass ten million annual production units for the first time.",

Note: Some of the images come from the internet. If there is any infringement, please contact us for deletion.