SAIC Motor's transition pain: Feifan Auto abandons independence and returns to Roewe

![]() 11/21 2024

11/21 2024

![]() 589

589

Recently, the share price of SAIC Motor (600104.SH) has been on a "rollercoaster" ride. After two consecutive trading days of gains, the share price hit an annual high of 19 yuan per share on November 18. However, the share price quickly retreated the next day and closed at the daily lower limit. As of the lunch break on November 20, the share price was reported at 16.88 yuan per share, with a 2.18% increase. Behind the share price volatility, SAIC Motor is in a critical period of transition to new energy vehicles, but Feifan Auto's bleak return and underperformance have obviously added additional pressure to the company's transformation.

Recently, Feifan Auto, which "left" three years ago, has returned to the embrace of SAIC Passenger Cars and will merge with Roewe to assume the role of Roewe's high-end series. During the three years of independent operation, Feifan Auto's sales and performance have lagged, and it has also faced competition from internal brands, making independent development difficult.

Securities Star notes that Feifan Auto's setbacks are just a microcosm of SAIC Motor's transformation difficulties. As the market share of new energy vehicles expands, the contribution of SAIC Motor's joint venture segment gradually weakens, but new energy vehicles have not simultaneously filled the sales gap, with cumulative sales accounting for only about 30% from January to October this year. Along with declining sales, SAIC Motor is under pressure, with both revenue and net profit declining in the first three quarters, and net profit after deducting non-recurring gains and losses falling by 88.92%.

01. Feifan Auto's price reduction fails to boost sales

According to Tianyancha, Feifan Automobile Technology Co., Ltd. recently underwent industrial and commercial changes, with the original shareholder Shanghai Ruyuan Automobile Technology Partnership (Limited Partnership) withdrawing and SAIC Motor taking full control. At the same time, Wang Xiaoqiu stepped down as legal representative and chairman, and was replaced by Wang Jun.

As early as October 28, the SAIC Motor Passenger Cars official WeChat account released a poster titled "SAIC Motor Passenger Cars Roewe Feifan, Dream Integration, and Enhanced Commitment." The accompanying video revealed that 35 Roewe dealerships and 12 Feifan dealerships have been integrated into Roewe Feifan dealerships, with the goal of opening 100 dealerships by the end of the year at a rate of one new store per day. This means that after three years of independent operation, Feifan Auto has returned to SAIC Motor Passenger Cars.

It is reported that Feifan Auto, formerly known as the R brand, originated from Roewe. In 2020, Roewe announced the "dual-brand" strategy of using the "R logo" and "new lion logo," with the "R logo" positioned as the exclusive logo for mid-to-high-end new energy vehicles. In October 2021, the R brand "started anew" and officially operated as an independent company with a registered capital of 7 billion yuan, while officially changing its name to Feifan Auto. According to the plan, Feifan Auto focuses on the mid-to-high-end new energy vehicle market with prices ranging from 200,000 to 400,000 yuan, shouldering the important task of promoting SAIC Motor's brand upward and intelligent transformation.

In the three years of "going it alone," Feifan Auto only launched two models. On September 27, 2022, the pure electric SUV Feifan R7 was launched, priced at 289,900-356,900 yuan after subsidies; in March 2023, the pure electric sedan Feifan F7 was officially launched, priced between 209,900 and 301,900 yuan. According to media reports, due to the latest integration plan, the launch of Feifan RC7, originally planned for September, has been delayed.

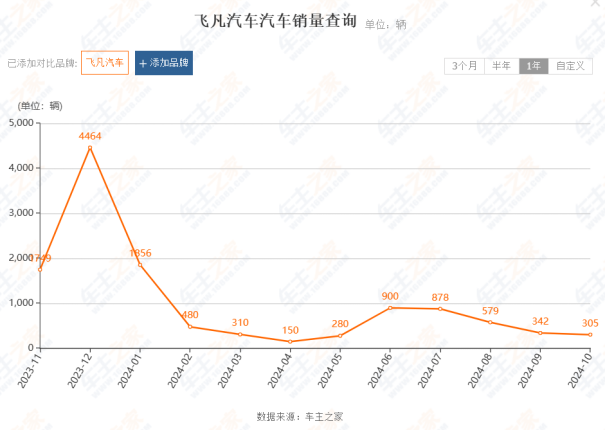

In fact, rumors about Feifan Auto returning to SAIC Motor Passenger Cars have been circulating since last September, primarily due to unfavorable market sales. Media-disclosed data shows that from 2021 to 2023, Feifan Auto's sales were approximately 18,400, 14,500, and 21,400 vehicles, respectively. Since this year, Feifan Auto's sales have accelerated to the bottom. According to Autohome data, as of the end of October, its cumulative sales were only 6,080 vehicles, and the bleak sales data has made its independent operation increasingly difficult.

To stimulate sales, Feifan Auto has also tried to increase sales volume by lowering prices. The official guide price for the 2024 Feifan R7 is 189,900-229,900 yuan, and the 2024 Feifan F7 is priced between 189,900 and 309,900 yuan, but the current situation shows that the effect is not as expected.

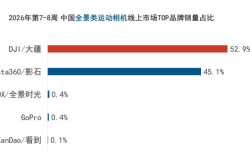

Securities Star notes that the mid-to-high-end market where Feifan Auto operates is the most competitive field, with competitors such as Zeekr (ZK.N), XPeng Inc. (09868.HK), and Li Auto Inc. (02015.HK). Within the group, Feifan Auto also faces competition from its sibling brand IM Motors.

IM Motors is positioned as a high-end smart pure electric vehicle. As competition among automakers intensifies, its product prices have gradually dropped to the 200,000 yuan range. The official prices of the IM L6 and LS6 have dropped to as low as 219,900 yuan and 239,900 yuan, respectively, overlapping with the prices of the two models currently sold by Feifan Auto, forming an internal competitive relationship to a certain extent. However, in terms of sales, Feifan Auto is hard to compete with IM Motors. In October, IM Motors reached a new milestone of "over 10,000 monthly sales," with 10,000 vehicles sold that month, representing year-on-year and month-on-month growth rates of 149% and 121%, respectively.

Under the dual pressure of low sales and internal competition, Feifan Auto had to choose to return to SAIC Motor Passenger Cars and integrate with Roewe as the current solution. He Minglei, general manager of SAIC Motor Passenger Cars Roewe Feifan Business Department, told the media that in the future, Feifan Auto's "R logo" will assume the role of Roewe's high-end series. The "R logo" will no longer be limited to the pure electric technology route and will introduce plug-in hybrid or extended-range models, but this series will not cover pure fuel vehicles.

02. New energy vehicle sales account for only 30%

Feifan Auto's unsuccessful return is just one of the setbacks faced by SAIC Motor in its current transition to new energy vehicles. In the era of fuel vehicles, SAIC Motor leveraged joint ventures to become a leading enterprise. However, it is not easy for an elephant to turn around, and the company is now somewhat sluggish in the process of transitioning to new energy vehicles.

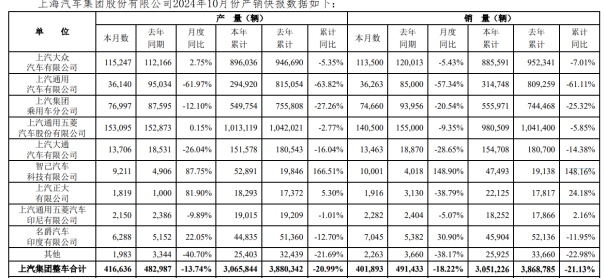

October production and sales data show that SAIC Motor's cumulative vehicle sales from January to October were 3.0512 million, a decrease of 21.13% from 3.8688 million in the same period last year. This year, only January and March saw year-on-year sales growth, and there has been a year-on-year decline for seven consecutive months since April. In October, vehicle sales were 401,900, a year-on-year decline of 18.22%.

The decline in sales is mainly due to the joint venture segment. Among them, SAIC-GM's cumulative sales from January to October declined by 61.11% year-on-year to 314,700 vehicles, the largest decline among major participating and holding companies. The cumulative sales of SAIC Volkswagen and SAIC-GM-Wuling were 885,600 and 980,500 vehicles, respectively, down 7.01% and 5.85% year-on-year.

In the independent segment, SAIC Motor Passenger Cars sold 556,000 vehicles cumulatively from January to October, a year-on-year decrease of 25.32%. IM Motors' cumulative sales increased by 148.16% year-on-year, but the achievement of 47,500 vehicles cannot reverse the downward trend in SAIC Motor's sales.

Although SAIC Motor has launched multiple new energy vehicle models, the overall market response has not been enthusiastic. Its cumulative sales of new energy vehicles from January to October were 905,100 vehicles, a year-on-year increase of 20.22%, accounting for only 29.66% of total sales.

Securities Star notes that as of 2023, SAIC Motor's sales have remained the first in China for 18 consecutive years, but this year, its sales have been surpassed by BYD (002594.SZ). From January to October, BYD sold 3.2505 million vehicles, a year-on-year increase of 36.49%, all of which were new energy vehicles.

In previous research activities, SAIC Motor stated that the automotive industry has shown characteristics of "internal competition and external pressure" this year. The penetration rate of new energy vehicles in the domestic market has further increased to over 40%, sales of fuel vehicles continue to decline, price wars continue to escalate, and the industry is highly competitive.

With sales continuously declining, SAIC Motor cannot hide its declining performance. In the first three quarters of this year, SAIC Motor achieved revenue of 430.482 billion yuan, a year-on-year decrease of 17.74%; the corresponding net profit attributable to shareholders was 6.907 billion yuan, a year-on-year decrease of 39.45%. It is worth mentioning that 5.161 billion yuan in gains and losses from the disposal of non-current assets accounted for a considerable portion of net profit. Excluding gains and losses from non-recurring items, its net profit after deducting non-recurring gains and losses fell by 88.92% year-on-year to 1.05 billion yuan.

It is worth mentioning that SAIC Motor's net profit attributable to shareholders in Q3 fell sharply. Compared to 2.714 billion yuan and 3.914 billion yuan in Q1 and Q2, respectively, its net profit attributable to shareholders in Q3 was only 280 million yuan, a month-on-month decrease of 92.85%. For the new leadership team, surviving the transition to new energy vehicles will be a necessary question for SAIC Motor. (This article was originally published on Securities Star, written by Lu Wenyan)

- End -