Sales of 7,600 vehicles from January to September, net loss of $4.8 billion! Lotus abandons full electrification and switches to hybrids

![]() 11/22 2024

11/22 2024

![]() 459

459

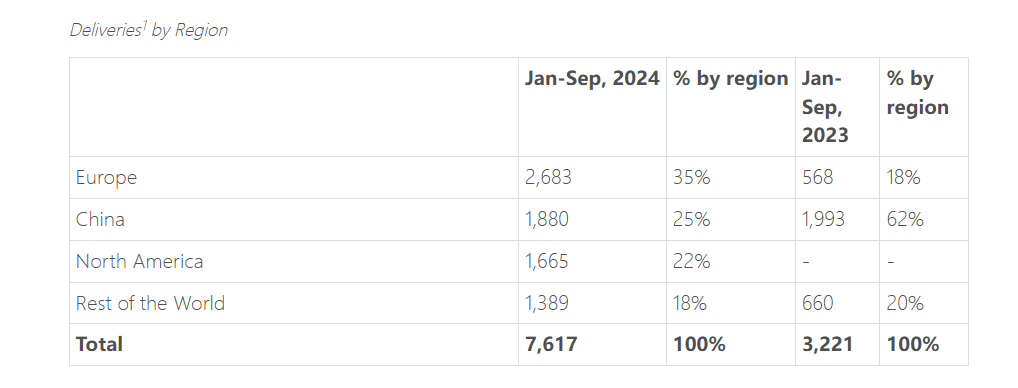

On the evening of November 21, Lotus (LOT.US), listed on Nasdaq, released its third-quarter financial report for 2024. From January to September 2024, vehicle deliveries exceeded 7,600 units, an increase of 136% year-on-year. From January to September 2024, Lotus's total revenue was $653 million, an increase of 105% year-on-year; service revenue was $29 million, an increase of 129% year-on-year. Deliveries exceeded 7,600 units, up 136% year-on-year; among them, the European market continued to expand, with deliveries in the first three quarters increasing by 372% year-on-year.

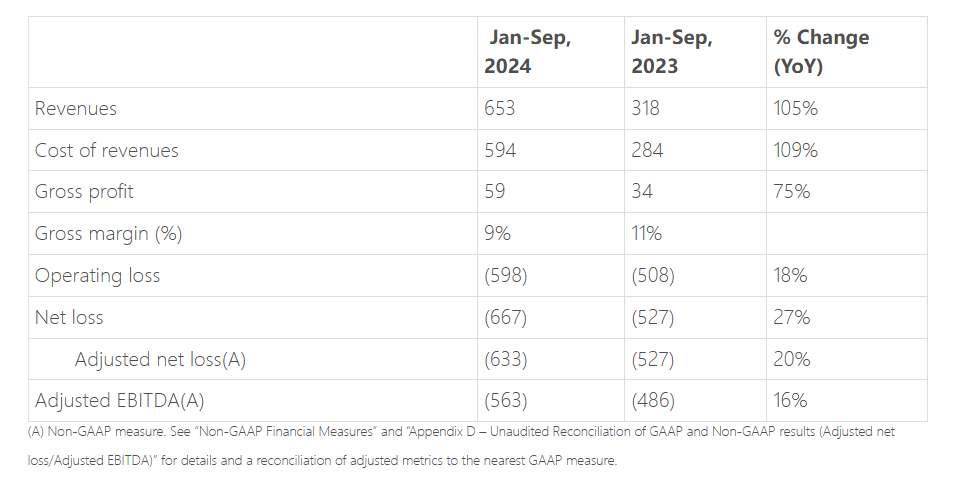

Total revenue for the first nine months of 2024 was $653 million, an increase of 105% year-on-year. Among them, vehicle sales amounted to $624 million, an increase of 104% year-on-year. Service revenue was $29 million, an increase of 129% year-on-year. Lotus's gross profit margin for the first nine months was 9%, compared to 11% in the same period in 2023. Separately, the gross profit margin for vehicle sales in the first nine months of 2024 was 7%, compared to 10% in the same period in 2023, primarily due to inventory reduction. The gross profit margin for service revenue in the first nine months of 2024 was 55%, compared to 28% in the same period in 2023, due to an increase in high-margin technology-related revenue.

As a result, Lotus's operating loss for the first nine months of 2024 was $598 million, an increase of 18% year-on-year. The net loss for the first nine months of 2024 was $667 million. Excluding share-based compensation expenses, the adjusted net loss (non-GAAP) for the first nine months of 2024 was $633 million, an increase of 20% year-on-year. The adjusted EBITDA (non-GAAP) loss for the first nine months of 2024 was $563 million, an increase of 16% year-on-year.

However, in the third quarter of 2024, Lotus accelerated its global expansion and steadily advanced new market deliveries. The Emira began deliveries in South Africa and India, while the Eletre started deliveries in Japan, South Korea, and the Philippines. The company introduced the Eletre Carbon high-performance model for the North American market, with deliveries expected to begin in the first half of 2025. High-end and limited-edition versions of the Eletre (SUV) and Emeya (GT, Sedan) also began deliveries in the third quarter. Judging from this year's financial performance, there are still no signs of improvement in Lotus's operations, prompting the company to change its previous goal of full electrification.

Recently, Lotus CEO Feng Qingfeng said in an interview with the media that "fuel vehicles still have a long life cycle." He believes that pure fuel, pure electric, hybrid, and extended-range are all forms of power expression. There is no best option, only better ones, and it is necessary to find the best solution that suits oneself.

Specifically in the luxury market where Lotus operates, Feng Qingfeng stated that traditional eight-cylinder or twelve-cylinder engines already provide powerful performance and excellent driving experiences, resulting in a low penetration rate of pure electric vehicles in the luxury car market. Based on this judgment, Lotus is developing the "Lotus Long-Range Hybrid Technology." This technology combines ultra-fast charging and turbocharged internal combustion engines, aiming to extend range to 680 miles (approximately 1,094.35 kilometers).

Feng Qingfeng believes that in the high-end market, the advantages of electrification are not obvious. "Luxury car engines are already very powerful, and the driving experience is similar, whether it's an eight-cylinder or twelve-cylinder engine, they both perform exceptionally well." He revealed that Lotus once refused to use the PHEV version due to compromises in driving feel associated with hybrid systems. PHEVs require daily charging to fully utilize the electric component, while extended-range models, while enhancing electric practicality, may experience performance degradation when the battery runs out and the internal combustion engine powers the electric motor.

Vehicles equipped with the "Lotus Long-Range Hybrid Technology" will adopt a combination of a 900V electrical architecture, turbocharged engines, and battery packs, providing a combined range of 1,094 kilometers and ultra-fast charging speeds comparable to battery swaps, thus meeting consumer demands for performance and long-distance driving. Compared to the 800V super-electric technology equipped in pure electric vehicles, the "Lotus Long-Range Hybrid Technology" will enable the coexistence of a high-performance driving experience and long range.

Currently, the "Lotus Long-Range Hybrid Technology" has entered the vehicle testing phase and is expected to be equipped on corresponding products by 2026. It is unclear whether this technology will be installed on new products or introduced as hybrid versions of existing products. Additionally, Lotus is also developing a 6D intelligent chassis to compensate for the increased vehicle weight, reduced maneuverability, and increased energy consumption caused by batteries, further enhancing measured handling performance.

As a result, Lotus has essentially abandoned its previous pure electric route. Prior to this, many brands had already abandoned their goals of full electrification. For example, Volvo, Audi, and Mercedes-Benz have postponed their previously set goals of full electrification.

In 2018, Lotus announced the "Vision80 Strategy," a ten-year brand revival plan. This strategy proposed that Lotus would fully transition to electrification and intelligence. Lotus hoped to establish itself as the world's number one pure electric luxury brand and pure electric sports car brand within ten years. Currently, Lotus has launched a total of four models: the all-terrain sports car Emira, the pure electric hypercar flagship Evija, the pure electric hypercar SUV Eletre, and the pure electric hypercar sedan Emeya, priced between RMB 600,000 and RMB 1.5 million.

From a product perspective, according to Feng Qingfeng, Lotus owners drive an average of 30,000 kilometers per year, which places higher demands on a vehicle's range and charging capabilities. The limitations of electric vehicles in terms of range and charging speed have left some consumers dissatisfied with the full-electric strategy, affecting further growth in Lotus sales.

Considering the current poor market capacity and profitability of pure electric products, as well as the better market acceptance and profitability of hybrid products, this provides a new fulcrum for Lotus to expand its market and improve its operations. The arrival of hybrid products will also make Lotus more acceptable in the international market because, from the perspective of the vehicle itself, high performance can affect the vehicle's energy consumption; from an external environment perspective, in overseas markets with inadequate charging infrastructure, plug-in hybrids and extended-range models are also more popular.