"Being Criticized" is a Compulsory Course for NIO and LeDao on Their Growth Path | Exclusive Interview

![]() 11/22 2024

11/22 2024

![]() 539

539

Introduction

Introduction

As the saying goes, honest advice may be harsh, but it is conducive to action.

Let's first set the scene back to November 1, Beijing time. The new force automakers still in the game have successively released their October sales results, with an overall trend of growth.

Throughout most of the posters, "record high" firmly occupies the center stage.

In stark contrast, NIO, which is always under scrutiny, delivered a total of 20,976 new vehicles during the same period. At first glance, it doesn't seem too bad. However, it's important to note that this figure includes 4,319 vehicles contributed by LeDao's first new model, the L60.

Instantly, NIO faced inevitable criticism from the outside world. Some criticized its marketing, some questioned its production capacity, and some attacked the internal competition between the main brand and the second brand... In short, the perspectives were diverse, but the central idea was clear: "Why did the fourth quarter perform poorly after a brief upturn in the third quarter?"

Today's article focuses on the protagonist who has once again fallen into the whirlpool of public opinion. As bystanders, we are already accustomed to this, as being criticized is inevitably a compulsory course for every new force automaker on their growth path.

Take Ideal and Xpeng, the closest "competitive teammates" in the same race, as examples.

In March this year, Ideal's highly anticipated MEGA suffered a significant setback in the pure electric market, while Xpeng faced a severe dilemma with no new cars to promote and a sharp drop in sales in the first half of the year. Neither received any positive feedback from the outside world.

However, Ideal has silenced all doubters with the emergence of the L6, while Xpeng has done the same with the combined impact of the MONA M03 and P7+.

This again reflects on NIO. Frankly, temporary misunderstandings are not dreadful; the key is to find a way to justify oneself. Last Friday, another Guangzhou Auto Show Media Day kicked off. With the above questions in mind, we sought answers from several relevant executives.

First, regarding October deliveries.

"We delivered 20,000 vehicles before LeDao, and now with LeDao, we still deliver around 20,000. The core reason is that we have proactively made some adjustments. Our three brands cover products ranging from over 100,000 to over 800,000 yuan. For the NIO brand, sales volume is certainly important, but high-quality growth is even more critical."

This viewpoint comes from Wei Jian, Senior Vice President of NIO.

He then added, "For example, we care about the quality and configuration of the ES6, ES7, and ES8, as well as user satisfaction and our average price. This is the mission of the NIO brand. As the eldest brother, we are glad that the younger brother is doing well and can shoulder much of the sales burden. We hope for overall high-quality growth."

In fact, before the Guangzhou Auto Show, there were continuous reports of NIO scaling back its terminal promotion policies. Combined with Wei Jian's spoilers, it is evident that this new force automaker is reorganizing its strategic layout. Emotionally and logically, the NIO brand should maintain its tone rather than degrade its value.

To illustrate, the relationship between NIO and LeDao should resemble that of "Porsche and Volkswagen, or Lexus and Toyota." Sufficient differentiation is the best state for their coexistence.

So, what does NIO truly value? Wei Jian also provided feedback.

"In fact, we have chosen a long-term and difficult path, but that doesn't mean we should perform poorly in the short term. Working at NIO, you'll find that the further you look, the less anxious you become. Currently, there aren't many new energy vehicle companies that persist in seriously pursuing high-end brands. In the pure electric market above 300,000 yuan, our market share is close to 50%, indicating a strong demand for high-end pure electric vehicles."

Indeed, judging NIO by this standard, it deserves a high score. This year, it was expected that with no major new launches, NIO would face a severe order crisis. However, for the NIO brand alone, its cumulative deliveries from January to October reached 165,106 vehicles, a year-on-year increase of 30.97%.

As for the reasons behind this, according to Ma Lin, Assistant Vice President of NIO and Head of Branding, Communication, and Marketing, there are several dimensions.

"First, the current second-generation product line is still very strong in the market, both in terms of computing power and software. Second, the user experience is getting better, and word-of-mouth is continuing to spread. People are increasingly recognizing the value of battery swapping, including active optimization for BssS vehicle-battery separation. Third, we held a long-life battery strategy conference, which is an active update based on our own business system."

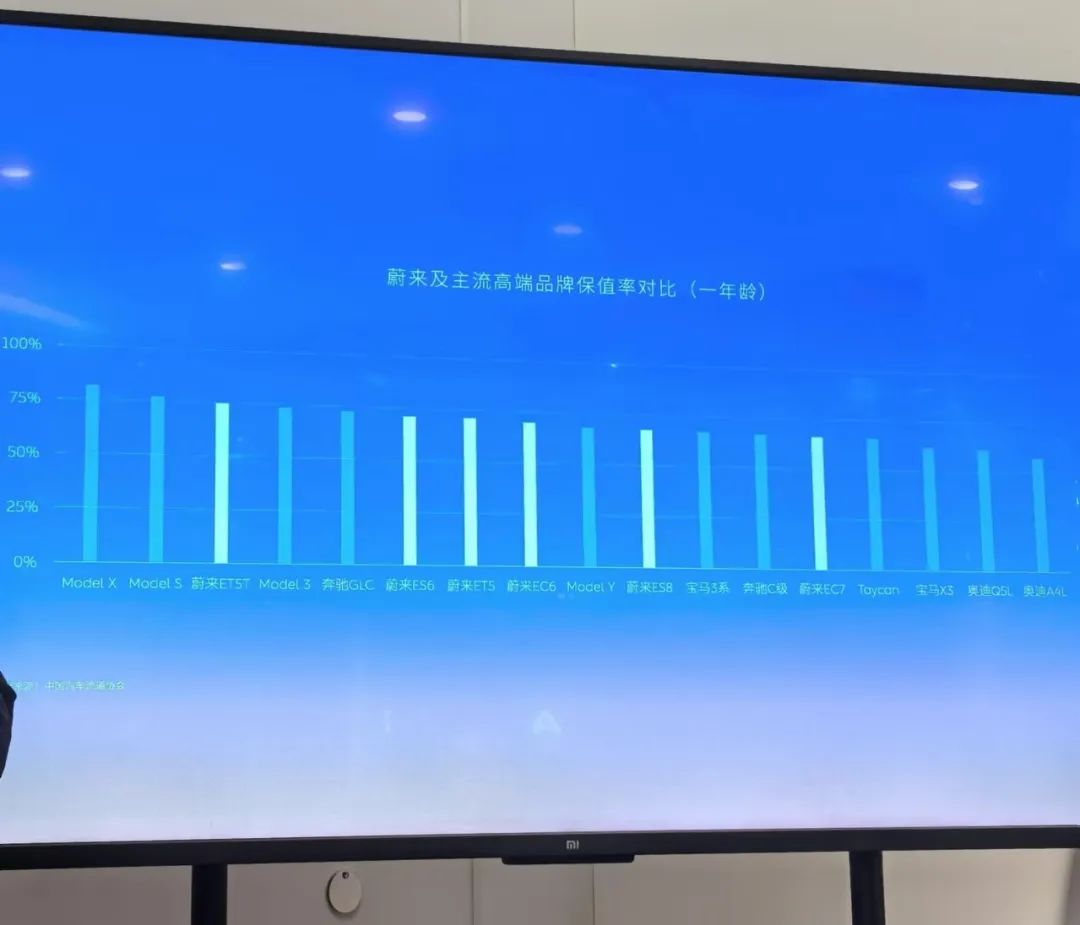

In addition, Ma Lin shared that NIO's used car preservation rate and turnover rate are improving. According to the PPT presented on-site, the one-year-old ET5T even surpassed the Tesla Model 3 and Mercedes-Benz GLC.

However, objectively speaking, based on the current development trend, this new force automaker is far from successfully escaping the quagmire. In the fiercely competitive Chinese auto market, any carelessness can lead to a fall into the abyss.

Precisely based on this background, since the NIO brand has chosen to adhere to the high-end market, the greater pressure to increase sales volume falls on the second brand, LeDao.

Unfortunately, as of the end of October, only 5,151 units of the first new model, the L60, had been delivered, which can only be described as "satisfactory but not excellent," especially considering the buzz at launch and the fierce competition from similar models like the ZEEKR 7X, IMAX R7, and Tesla Model Y. It's hard not to exclaim, "Please improve production capacity!"

No one wants to see the situation where "the cooked duck flies away."

With a mindset of "deep love leading to stern criticism," I had a conversation with Ai Tiecheng, President of LeDao and the helmsman of the brand, at this year's Guangzhou Auto Show.

Regarding manufacturing, he directly mentioned, "As of November 14, we have delivered over 7,000 vehicles. In December this year, we will deliver over 10,000 vehicles in a single month. In January and February, we will ramp up production to 15,000-20,000 vehicles, and by March next year, we will deliver over 20,000 vehicles. In fact, this has always been our plan. People have very high expectations for us, which I believe is the current challenge. The delivery schedule is similar to our previous planning."

Soon, Ai Tiecheng added, "As the first model of a brand-new brand, it is equipped with cutting-edge technology, 900V all-domain integration, and a central supercomputer. From this perspective, being the second after Xiaomi SU7 to deliver over 10,000 vehicles in a single month in just three months is a decent pace. However, for users, waiting for two to three months is indeed a long time."

Indeed, in the ever-evolving Chinese auto market, unless your brand has an absolute attraction at the brand level, making people loyal to you and choosing you exclusively, or your compensation policies are sincerely generous, the patience of most ordinary consumers for purchasing a car is quite limited.

To reiterate, "Nowadays, the quality of a product mainly determines the lower limit of sales. Correspondingly, production capacity determines the upper limit of sales."

Honestly, there is still much room for improvement in LeDao L60's performance so far. In Ai Tiecheng's view, this product will challenge Xiaomi SU7's record of delivering 100,000 vehicles in just 230 days.

Meanwhile, after reaching monthly deliveries of 20,000 vehicles in March next year, the next goal is to fully aim for 30,000 vehicles, which is expected to be achieved as early as the fourth quarter of next year.

Regarding the regret of not "stockpiling" LeDao L60 in advance of its launch, he also promised, "We mainly listen to advice, and we'll consider it carefully for the second vehicle."

Regarding new order situations, they are generally in line with expectations based on Ai Tiecheng's responses.

"The National Day holiday was a peak period, followed by a slight decline. Starting from the end of October, the week-on-week growth rate is about 10%, and the overall growth rate is very fast." Perhaps it is based on this background that the brand can steadily move forward.

Of course, what cannot be ignored are some "minor flaws" in LeDao L60 itself.

Fortunately, it is reassuring that, according to Yu Bin, Head of Product Experience Management, who was interviewed alongside Ai Tiecheng, issues such as light steering, difficult-to-close doors, and the lack of temperature display on the large in-car screen will be resolved one by one in subsequent OTA updates of various versions.

Finally, another area of significant concern for the outside world is the internal competition between LeDao and the NIO brand.

In this regard, Ai Tiecheng assured everyone, "Our overlap with NIO is very low, even much lower than expected, currently at 1%-2%. Additionally, in terms of order composition, we initially expected at least 30%-40% to be first-time purchases, but now 90% are replacement purchases. These include both gasoline and new energy vehicle users. Among gasoline vehicle users, 30% come from BBA brands such as Q5, Q3, and the 3 Series, which surprises us. Among new energy vehicle users, Tesla Model 3 owners rank first, which is within expectations."

What I feel even more is that while LeDao L60 differentiates itself from NIO products, it also leaves a deep anchor point in the hearts of potential customers at the terminal.

However, there is indeed a regret regarding current production capacity.

Regarding the future success or failure of this brand and its potential height in the Chinese auto market, it will largely determine whether the entire NIO's "chronic illness" can be solved.

Therefore, "No matter what, LeDao, you have to stand tall!"